Rising Inflation? Bombs Away!

![]() Rising Inflation? Bombs Away!

Rising Inflation? Bombs Away!

Fair warning for any snowflakes: Today’s Bullet No. 2 will be the most controversial thing I’ve expressed in 14 years of near-daily writing about the economy and the markets.

Fair warning for any snowflakes: Today’s Bullet No. 2 will be the most controversial thing I’ve expressed in 14 years of near-daily writing about the economy and the markets.

In isolation, it would seem like a foreign policy rant, irrelevant to your money or your future. So I can’t just lay it out there without setting some context first.

That’s the purpose of this Bullet No. 1…

I can’t shake the thought that there’s some connection between the hotter-than-expected inflation number yesterday and Washington’s airstrikes on Yemen less than 12 hours later.

I can’t shake the thought that there’s some connection between the hotter-than-expected inflation number yesterday and Washington’s airstrikes on Yemen less than 12 hours later.

If it wasn’t obvious already, yesterday’s number made it clear: The battle against inflation is not yet “won.” The year-over-year rate is moving in the wrong direction — from 3.1% to 3.4%. And that’s despite falling fuel prices.

With Election Day less than 10 months away, Joe Biden’s campaign advisers know well that “sticky” inflation made Jimmy Carter a one-term Democratic president.

Joe Biden’s advisers also know the Houthi attacks on global shipping could make inflation much worse.

Joe Biden’s advisers also know the Houthi attacks on global shipping could make inflation much worse.

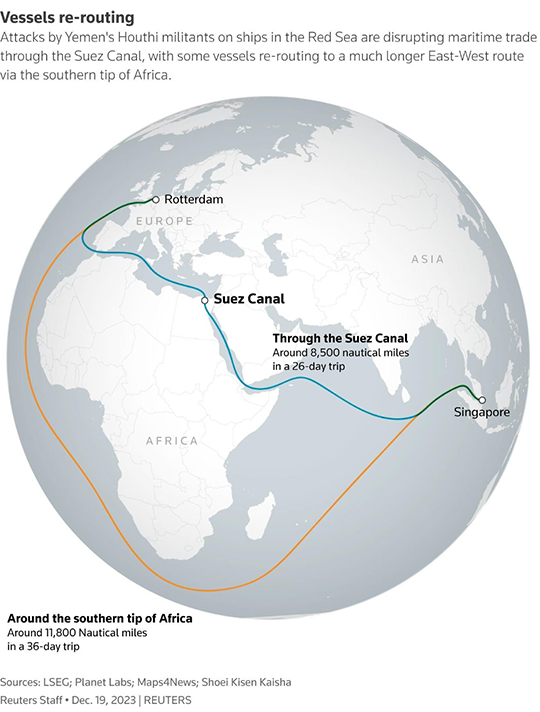

As we mentioned toward the end of last year, the Houthis’ harassment has set much of global trade back to the 1860s — before the Suez Canal was built.

Shippers are loath to ply the Red Sea as long as Yemen’s Houthi faction is targeting Israel-linked ships with drones and rockets. So they’re taking the long way to transit between Asia and Europe — all the way around Africa, as this map from the Reuters newswire helpfully illustrates...

By one estimate, this reroute adds $700 to the cost of moving a single shipping container.

“At this time when inflation is a big issue, it’s putting inflationary pressure on our costs, on our customers and ultimately on consumers in Europe and the U.S.,” says Vincent Clerc, CEO of Maersk — which carries about 20% of global ocean freight.

“At this time when inflation is a big issue, it’s putting inflationary pressure on our costs, on our customers and ultimately on consumers in Europe and the U.S.,” says Vincent Clerc, CEO of Maersk — which carries about 20% of global ocean freight.

“In the short run,” he tells the Financial Times, “it could cause significant disruptions at the end of January, February and into March.”

So far, the effects seem muted, and they seem limited to Europe — Tesla suspending most of its car production in Berlin, for instance.

But that won’t last long. If goods are taking too long to reach Europe, goods destined for the United States can be easily rerouted there — where they’d command a higher price.

Hello empty shelves again.

In short, we’re looking at a massive new snarl in the global supply chain — just as the one started by COVID lockdowns finally got straightened out.

In short, we’re looking at a massive new snarl in the global supply chain — just as the one started by COVID lockdowns finally got straightened out.

“The supply chain pressures that caused the ‘transitory’ part of inflation in 2022 may be about to return if the problems in the Red Sea and Indian Ocean continue,” says Larry Lindsey, chief of the Lindsey Group economic advisory firm. “Neither the Fed nor the European Central Bank can do anything about them,” he tells CNBC.

If you’re someone watching this all day from the West Wing of the White House, you’re mighty nervous by now about your boss’s job security. Inflation still isn’t under control… and the disruptions to global shipping threaten to make price increases even worse.

Seen in this context, there’s a twisted logic to the decision to launch airstrikes on the Houthis last night: If inflation is inevitable, might as well “wag the dog” and make sure you can blame it on foreign devils, right?

So… here we are.

Reminder: The Houthis are carrying out their attacks on shipping as an act of solidarity with the Palestinians of the Gaza Strip.

Which leads to an obvious, inescapable conclusion. That’s what Bullet No. 2 is all about. Again, I’ll issue a trigger warning. Avert your eyes if you can’t handle the following…

![]() The Phone Call Biden Refuses to Make

The Phone Call Biden Refuses to Make

Joe Biden could bring global shipping back to normal with one phone call and five words to Israel’s Prime Minister Benjamin Netanyahu: “Stop the slaughter in Gaza.”

Joe Biden could bring global shipping back to normal with one phone call and five words to Israel’s Prime Minister Benjamin Netanyahu: “Stop the slaughter in Gaza.”

It’s that simple.

Three months into Israel’s assault on Gaza, the death toll is over 23,000. That’s 1% of the population. Over two-thirds of the dead are women and children.

The United Nations estimates 85% of Gaza’s population has had to flee their homes. And many of them have had to flee again from wherever it was they’d sought refuge.

About a third of Gaza’s buildings have been destroyed. Of Gaza’s 2.3 million population, about a half million have no homes to return to.

But even if their homes are intact, they may never be allowed back. More and more Israeli leaders are making clear that their endgame is not “destroying Hamas” but rather the expulsion of Gaza’s Palestinian population.

The national security minister and the finance minister have said as much. The Times of Israel reports that senior officials are talking with leaders of African nations like the Republic of Congo as a possible place for the Gazans to go.

If you’re an American taxpayer, you’re underwriting all of this.

Apart from Ukraine since 2022, Israel is by far the biggest recipient of U.S. aid — $3.8 billion a year. Since the assault on Gaza began, Washington has delivered over 10,000 tons of military equipment to Israel, according to Israel’s Channel 12 outlet. The Intercept reports that Washington has deployed a U.S. Air Force team to Israel, which furnishes intelligence for targeting.

Biden needs to man up the way Ronald Reagan did in 1982 — when Israel was bombing the living crap out of Lebanon.

Biden needs to man up the way Ronald Reagan did in 1982 — when Israel was bombing the living crap out of Lebanon.

The ordnance had rained down on Beirut for 2½ months, killing nearly 20,000 — almost half of them civilians.

“Met with the news the Israelis delivered the most devastating bomb & artillery attack on W. Beirut lasting 14 hours,” Reagan wrote in his diary on Aug. 12. Saudi Arabia’s King Fahd “called begging me to do something.

“I told him I was calling [Israel’s prime minister Menachem] Begin immediately. And I did — I was angry. I told him it had to stop or our entire future relationship was endangered. I used the word holocaust deliberately & said the symbol of his war was becoming a picture of a 7 month old baby with it’s arms blown off.”

According to Lou Cannon’s 1991 biography President Reagan: The Role of a Lifetime, Begin called back 20 minutes later. He’d ordered a stop to the carnage.

Said Reagan to his aide Michael Deaver, “I didn’t know I had that kind of power.”

Joe Biden has that kind of power — if only he’d exercise it.

He can put an end to a humanitarian catastrophe and help global commerce return to some semblance of normal.

Seems like a win-win all around, no?

Which is exactly why it won’t happen…

![]() The Most Important Election You Haven’t Heard About

The Most Important Election You Haven’t Heard About

God help us, the Middle East isn’t the only “global flashpoint” on our minds going into this weekend.

God help us, the Middle East isn’t the only “global flashpoint” on our minds going into this weekend.

Taiwan holds an election tomorrow, one of the main issues being its future relationship with mainland China. Beijing has long expressed its determination to reunify with Taiwan — peacefully or otherwise.

In a three-way race, the front-runner appears to favor declaring independence from the mainland — the one circumstance in which Beijing has made clear it would go to war to achieve its aims.

It’s a real gasoline canister — and Joe Biden seems determined to light a match.

Biden is already the first president to repudiate the doctrine of “strategic ambiguity” that’s kept the peace in the Taiwan Strait for over 40 years — all but giving Taiwan a war guarantee.

I won’t belabor the point I made last spring — that there’s nothing about the status of Taiwan that’s worth America risking a nuclear exchange with Beijing.

But I do want to make you aware that in the present volatile moment, Biden is sending a “high-level delegation” of former U.S. officials to Taiwan.

But I do want to make you aware that in the present volatile moment, Biden is sending a “high-level delegation” of former U.S. officials to Taiwan.

It’s a bipartisan group including Stephen Hadley, who as national security adviser helped sell the disastrous “surge” in Iraq during George W. Bush’s second term. Doesn’t bode well.

There’s every likelihood Beijing will view this visit as a provocation equal to that of Nancy Pelosi’s trip to Taiwan in 2022 when she was still House speaker.

That episode prompted an unprecedented round of sorties by mainland Chinese military jets crossing the median line in the Taiwan Strait. Let’s hope that’s all that happens this time around…

![]() Oil Reacts… Earnings Season Starts… Crypto Spurned

Oil Reacts… Earnings Season Starts… Crypto Spurned

For as much as Washington has escalated the tension in the Middle East, the reaction in the oil price is muted so far.

For as much as Washington has escalated the tension in the Middle East, the reaction in the oil price is muted so far.

A barrel of West Texas Intermediate is up $1.14 at last check to $73.16. That’s squarely in the middle of its $70–76 trading range the last month or so.

Perhaps — let us hope? — oil traders are sniffing out what the military affairs analyst William Schryver is: “This was effectively a token strike,” he posts on X. “The whole thing was meant to be performance art. They know they can’t disarm Ansarullah [the Houthis]... They don’t have a plan beyond the next 24-hour news cycle.”

Meanwhile, earnings season is off to a “meh” start.

Meanwhile, earnings season is off to a “meh” start.

Three of the Big Four banks reported their numbers…

- JPMorgan Chase booked record annual profits, although fourth-quarter numbers were down. JPM is up about a third of a percent as we write

- Bank of America reported lower quarterly profits, which it blames on a regulatory charge. BAC is down 2.3%

- Citigroup booked a $1.8 billion fourth-quarter loss — the worst since the 2007–09 financial crisis — and is cutting 20,000 jobs. (Paradigm’s Jim Rickards would not be surprised by these developments.) C is down 1.3%.

With that, the major averages are all in the red — though not dramatically. The S&P 500 is down a mere six points to 4,773. A return to the early-2022 record high of 4,796 will likely have to wait for next week.

Treasury yields are backing down, the 10-year note at 3.94%.

Precious metals are ending the week on the rally tracks — spot gold up $23 to $2,051 and silver up 51 cents to $23.24.

The “buy the rumor, sell the news” phenomenon has hit Bitcoin after the Securities and Exchange Commission gave the go-ahead for spot Bitcoin ETFs on Wednesday. Bitcoin is back below $44,000 — the lowest it’s traded since Monday.

The “buy the rumor, sell the news” phenomenon has hit Bitcoin after the Securities and Exchange Commission gave the go-ahead for spot Bitcoin ETFs on Wednesday. Bitcoin is back below $44,000 — the lowest it’s traded since Monday.

So far, demand for the Bitcoin ETFs has been robust — but one investment giant refuses to make them available to customers. Vanguard believes they don’t belong in “a well-balanced, long-term investment portfolio,” says a company statement.

This for-your-own-good attitude is not new with Vanguard — which stopped offering many leveraged and inverse ETFs in 2019. But competitors are naturally seizing on the opportunity…

![]() Live at CES: One Name to Watch in ’24

Live at CES: One Name to Watch in ’24

As the week winds down, we’re reminded again of our best-of-times, worst-of-times paradox: The world is going to hell, but innovation and technology continue their ascent.

As the week winds down, we’re reminded again of our best-of-times, worst-of-times paradox: The world is going to hell, but innovation and technology continue their ascent.

“I need to get up to speed on Mobileye (MBLY). Possibly worth trading in 2024,” Paradigm’s retirement ace Zach Scheidt reports from the floor of the Consumer Electronics Show in Las Vegas.

For a couple days now, Zach and several other members of Team Paradigm have been soaking up the sights and sounds at CES 2024, on the hunt for the most investable ideas of this year and beyond.

“Mobileye is a veteran in ADAS and autonomous vehicle technologies founded in 1999,” Elektrek notes. Specifically, the company is a supplier of vision-based sensing chips, which facilitate advanced driver assistance systems (ADAS). “The company has provided over 150 million vehicles around the globe with its technology.”

And while semi- and fully autonomous driving is a trend that’s been a long time coming to market, that’s partly because, as Elon Musk pointed out in 2016: “We expect that worldwide regulatory approval [for driverless cars] will require something on the order of 6 billion miles [logged].”

To wit, Mobileye also developed a software system called Road Experience Management (REM), which collected major landmark and road information around the globe.

While Mobileye has partnered with automakers including Tesla, VW and Porsche — among others — the company announced in August that its Mobileye Chauffeur system will be included in the Polestar 4, the Chinese EV maker’s “performance SUV coupe.”

We’re sure Zach will elaborate more on his affinity for Mobileye; in the meantime, we encourage you to keep up with our team the rest of today as they cover every inch of exhibit space in search of the latest and greatest — especially in the realm of AI.

Here’s the link to our exclusive liveblog — enjoy!

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets