Shut up About a “Soft Landing”!

- Let’s do the “soft landing” victory lap!

- But for now, it’s all good

- Big bank blues: Rickards on holiday job cuts at Citi

- They can’t kill the “kill switch”

- Phony figures: From the government and Big Ag

![]() Let’s Do the “Soft Landing” Victory Lap!

Let’s Do the “Soft Landing” Victory Lap!

By all means, break out the Champagne and let’s get the party started!

By all means, break out the Champagne and let’s get the party started!

From this morning’s Wall Street Journal, front page and above the fold: “The U.S. economy is approaching what most economists had thought either unlikely or impossible: inflation returning to its pre-pandemic norm without a recession or even much economic weakness, a so-called soft landing.

“‘What we are expecting now is a soft landing,’ said Nancy Vanden Houten, lead U.S. economist at Oxford Economics. ‘We expect the economy to weaken quite a bit, but it does look like we’ll avoid an outright contraction’ in gross domestic product.”

It’s not only the Murdoch family’s business rag, either. “The U.S. Economy Is on Its Final Descent to a Soft Landing” is the title of a report issued yesterday by Goldman Sachs.

“It was fair to wonder last year whether labor market overheating and an at times unsettling high inflation mindset could be reversed painlessly,” writes Goldman’s chief U.S. economist David Mericle. “But these problems now look largely solved, the conditions for inflation to return to target are in place and the heaviest blows from monetary and fiscal tightening are well behind us,”

We interrupt this celebration by Wall Street and the corporate media for a reality check.

We interrupt this celebration by Wall Street and the corporate media for a reality check.

Inflation is nowhere near its “pre-pandemic norm” — even if you go by the government’s own bogus figures. The latest reading of the consumer price index this week shows inflation running 3.2% year-over-year. The number frequently ran below 2% between 2010–2020 — topping the 3% level for less than a year during 2011.

Meanwhile, “core PCE” — the Federal Reserve’s preferred measure of inflation — is still 3.7%, nowhere near the Fed’s 2% target.

As for the notion that “the heaviest blows from monetary and fiscal tightening are well behind us”... we have no idea what fiscal tightening Mr. Mericle is talking about. Uncle Sam ran a $1.7 trillion deficit during fiscal year 2023 — a level never seen in pre-COVID years. But $1.7 trillion must be what counts for budgetary discipline nowadays, considering the deficits in 2020 and 2021 were substantially higher.

As for monetary tightening… it’s worth bearing in mind that there’s always a “lag effect” to the Federal Reserve’s interest-rate increases. That is, it takes a while for those rate hikes to have an impact on the economy — typically 12–24 months.

The steepest of those increases came in the summer and early fall of last year. We’re only now starting to feel the effects.

All that said, it shouldn’t be surprising to hear all this “soft landing” chatter now. We’ve been here before.

All that said, it shouldn’t be surprising to hear all this “soft landing” chatter now. We’ve been here before.

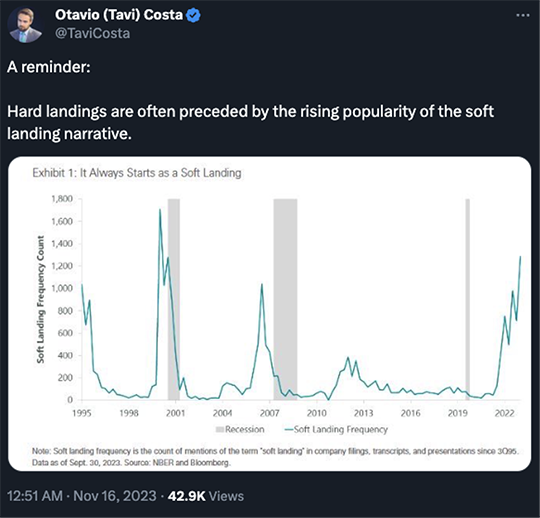

Check out the frequency with which the term shows up in company filings, presentations and earnings calls. Research by Crescat Capital shows there were huge spikes leading up to both the dot-com recession in 2001 and the “Great Recession” of 2007–09.

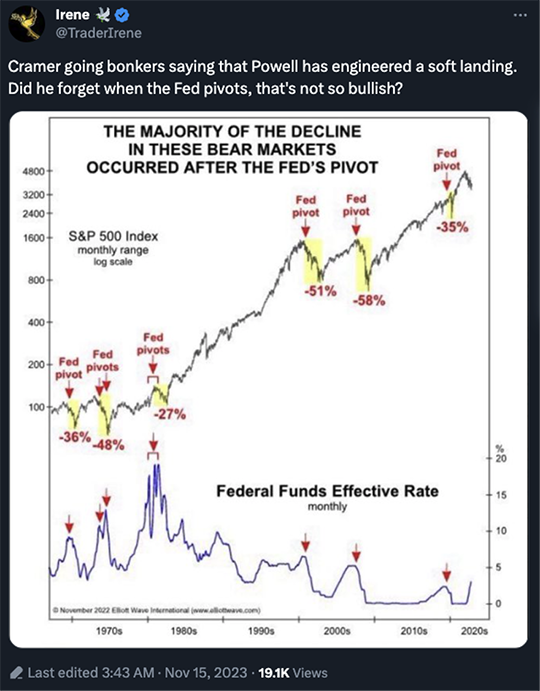

Meanwhile, Wall Street is positively giddy at the prospect of the Fed embarking on a cycle of rate cuts next year — as many as four, judging by the activity in the futures markets.

The problem is that a Fed “pivot” to rate cuts frequently precedes a steep drop in the S&P 500…

There’s an old saying that “the Fed keeps raising rates until it breaks something.” Only after the Fed pivots to rate cuts does the clue-by-four hit Mr. Market in the head: Oops, the Fed went too far.

Yes, this time could be different — but the odds aren’t good. The Fed has embarked on a dozen or so tightening cycles since World War II. Only once has it pulled off a “soft landing” — in 1994.

![]() But for Now, It’s All Good

But for Now, It’s All Good

All that said, for a third day running, the economic numbers all reinforce the “soft landing” narrative — for now. Let’s survey the landscape…

All that said, for a third day running, the economic numbers all reinforce the “soft landing” narrative — for now. Let’s survey the landscape…

- Jobless claims: First-time claims for the week gone by ring in at 231,000 — the highest in three months. Continuing claims are now the highest in nearly two years. Neither of these figures is alarming by historical standards, though

- Industrial production: Down 0.6% in October, more than expected. Manufacturing fell 0.7%, but much of that was driven by the autoworker strike. Utility output also fell, while mining and energy production grew. All told, 78.9% of America’s industrial capacity was in use during October — below the 50-year average of 79.7%

- Mid-Atlantic manufacturing: The closely watched Philly Fed index inched up this month — to minus 5.9. Readings below zero suggest contracting factory activity, and the number has been subzero almost nonstop for 18 months

- Homebuilder sentiment: Still in the dumps. The National Association of Home Builders’ Housing Market Index rings in at 34 — well below the 50 midpoint between expansion and contraction. No shock with mortgage rates at 22-year highs.

The U.S. stock market is taking a breather from the furious rally that started on Oct. 30.

The U.S. stock market is taking a breather from the furious rally that started on Oct. 30.

At last check, the S&P 500 is down less than a quarter percent — creeping back below the 4,500 level. There’s still nothing standing in the way of a continued rally to 4,600 — which is Paradigm trading pro Alan Knuckman’s near-term target.

➢ That said, inventories of diesel are still extremely tight. “S. stocks of distillate fuel (diesel and heating oil) are ending the fall season at their lowest **seasonal** level in data since 1982,” tweets Bloomberg News commodities specialist Javier Blas. “Let’s hope the U.S. economy is truly slowing down — particularly manufacturing — and that the winter is mild.”

Precious metals are rallying for no obvious reason — the bid on spot gold up to $1,984 and silver a nickel away from $24.

Speaking of gold, hedge fund legend David Einhorn is piling into shares of the SPDR Gold Trust (GLD).

Speaking of gold, hedge fund legend David Einhorn is piling into shares of the SPDR Gold Trust (GLD).

Federal filings from Einhorn’s Greenlight Capital show that the fund plowed $34.9 million into GLD during the third quarter — an 89% increase in Greenlight’s GLD holdings. The firm began building its position during gold’s COVID rally in the spring of 2020.

Einhorn made his reputation as one of the few mainstream finance types who anticipated the market meltdown of 2008; he made a mint shorting Lehman Bros.

No, there’s no connection between Einhorn’s disclosure and gold’s rally; MarketWatch posted a story early yesterday morning but gold didn’t begin jumping until about 8:30 a.m. EST today.

![]() Big Bank Blues: Rickards on Holiday Job Cuts at Citi

Big Bank Blues: Rickards on Holiday Job Cuts at Citi

Happy Thanksgiving! Starting yesterday and continuing into next week, Citigroup employees are being given their walking papers and a cardboard box for their belongings.

Happy Thanksgiving! Starting yesterday and continuing into next week, Citigroup employees are being given their walking papers and a cardboard box for their belongings.

That’s according to CNBC, which lacks firm numbers but does say in some divisions of the company as many as 10% of the workforce could be let go.

“These job cuts will not be aimed at clerks and receptionists,” says Paradigm’s macro maven Jim Rickards. “They’ll be aimed at investment bankers, senior account officers, regional managers and other senior staff positions.”

Jim says Citi CEO Jane Fraser has whiffed on all her goals since being promoted to the post in March 2021. She’s “failed to increase margins, hit profit targets or improve returns on capital… At this point, Fraser is reduced to doing what all CEOs do when everything else has failed — cut costs.

“Fraser’s goal is to get returns on capital up to 11%,” Jim continues. “That’s not a very ambitious goal considering that the cost of capital is around 10% once regulatory requirements are taken into account.

“I started my career at Citi in 1976 and retired as a senior officer in 1985. In those days, our targeted return on capital was 15% and we often did better than that. Even with the reduced expenses, Citi will have trouble hitting the 11% goal partly because the U.S. economy appears headed into recession.

“We wish Citi well,” Jim concludes — “but investors can’t be blamed for staying away from the stock.”

➢ Quirky aside: Citi’s internal code name for its cost-cutting efforts is “Project Bora Bora.” Jim tells us under the circumstances, a better name would be “Tora! Tora! Tora!” — the signal sent by Japanese pilots to their aircraft carriers during the attack on Pearl Harbor.

![]() They Can’t Kill the “Kill Switch”

They Can’t Kill the “Kill Switch”

We’re a few days late bringing this to your attention, but in case you haven’t heard yet…

We’re a few days late bringing this to your attention, but in case you haven’t heard yet…

This story begins with Joe Biden’s 2021 infrastructure bill. It includes a provision requiring cars made after 2026 to include a high-tech breathalyzer — to “passively detect” whether a driver is impaired. If the device determines he or she is unfit to drive, additional technology will disable the vehicle.

That’s intrusive enough, right? But the language of the law leaves a huge opening for regulators to make matters far worse: The objective is to “passively monitor the performance of the driver of a motor vehicle to accurately identify whether that driver may be impaired; and… prevent or limit motor vehicle operation if an impairment is detected.”

An aggressive regulator could easily seize on that to require sensors or cameras to track your movements, no? And if the embedded algorithm decides you’re impaired, you’re not going anywhere.

Anyway, Rep. Thomas Massie (R-Kentucky) offered an amendment a few days ago to defund that portion of the law. It failed 201-229. If you’re interested, here’s the roll call.

By the way, corporate media have served up several annoying “fact checks” on this story. They try to discredit genuine concerns about privacy by nitpicking over-the-top claims on social media that the law authorizes law enforcement or other government officials to disable your vehicle remotely.

It’s a sleazy trick — one we know firsthand, given how the media tried to fact-check Jim Rickards last year.

![]() Phony Figures — from the Government and From Big Agra

Phony Figures — from the Government and From Big Agra

On the subject of the government’s highly gamed inflation figures, a reader writes…

On the subject of the government’s highly gamed inflation figures, a reader writes…

“The government now lies about everything. Health insurance down 34% in the last year? Ha ha! My Aetna is going up 12% in 2024.”

LOGO — And we heard from a handful of readers about the Farm Bureau’s fanciful estimate of what Thanksgiving diner costs…

“I can't compare anything else, but I purchased a Butterball turkey at Walmart in SoCal for $2.29 per pound,” writes one.

“I feed 30,” says another, “but just the locally raised turkey was $75.00 for a 20-pound at a local farm. Last year I paid $50.00.”

“I don't use most of these items,” writes our final correspondent, “but I do know I bought heavy cream two weeks ago and it was not down at all — and the price of my spinach jumped over 10% in two weeks.

“Most everything I buy at the grocery has either gone up or stayed the same.”

Dave responds: The powers that be can fool you for only so long, though. While it’s anecdotal evidence, randos on social media know the score…

Heh. Cry harder, Paul Krugman.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets