Xi and Joe: Who’s Got the Upper Hand?

- Xi and Joe: Who’s got the upper hand?

- The war over lidar: “National security” or protectionism?

- Shut up and buy!

- Bitcoin’s next boost

- Hallucinating over the cost of Thanksgiving

![]() Xi and Joe: Who’s Got the Upper Hand?

Xi and Joe: Who’s Got the Upper Hand?

As Joe Biden and Xi Jinping get ready to meet today in San Francisco, there’s a cocky vibe running through the corporate media’s coverage.

As Joe Biden and Xi Jinping get ready to meet today in San Francisco, there’s a cocky vibe running through the corporate media’s coverage.

“Xi needs the summit more than Biden does,” Claremont McKenna poli-sci professor Minxin Pei tells The Washington Post. “He needs to show he’s respected, that he has stature. “He’s definitely in a worse position than in November of last year.”

“China’s economy is beset by multiple challenges,” columnist Greg Ip writes on The Wall Street Journal’s front page — “from a deflating property bubble and unmanageable local government debts to slumping confidence and deflation. The U.S., meanwhile, has just recorded its strongest quarter in nearly two years while inflation subsides.”

As usual, when the mainstream zigs in unison, we look to zag.

As usual, when the mainstream zigs in unison, we look to zag.

Yesterday we mentioned Asia Times columnist David Goldman’s observation that “policy advisers close to Xi express an unprecedented kind of confidence in China’s strategic position.”

Goldman’s piece is titled “Xi Holds Four Aces as He Meets Biden.” Those four are…

- The failure of the U.S. tech war on China. We mentioned this yesterday: Chinese AI players have no problem sourcing fast semiconductors from Huawei instead of Nvidia and other U.S. producers

- The war in Ukraine, which even Ukrainian commanders now concede is a “stalemate.” Goldman says that’s “a setback for America’s strategic position and a gain for China, which has doubled its exports to Russia since the February 2022 invasion”

- The war in Gaza, which “gives China a free option to act as the de facto leader of the Global South in opposition to Israel, an American ally. China now exports more to the Muslim world than it does to the United States”

- China’s military dominance in its own backyard — with “thousands of surface-to-ship missiles and nearly 1,000 fourth- and fifth-generations warplanes,” giving China “an overwhelming home-theater advantage in firepower…

“Washington has few cards to play,” Goldman sums up, “and Biden is likely to respond to his weakened position by backpedaling on Taiwan.”

For the sake of world peace, let’s hope so. As we’ve mentioned more than once, Biden has repudiated the so-called “one China” policy that kept the peace in the Taiwan Strait for over 40 years — a reckless step that accomplishes nothing other than antagonizing Beijing.

![]() The War Over Lidar: “National Security” or Plain Ol’ Protectionism?

The War Over Lidar: “National Security” or Plain Ol’ Protectionism?

Still, Washington is likely to persist with its attempts at economic warfare — as Paradigm’s Ray Blanco reminded his Technology Profits Daily readers only yesterday.

Still, Washington is likely to persist with its attempts at economic warfare — as Paradigm’s Ray Blanco reminded his Technology Profits Daily readers only yesterday.

It’s not just AI chips that are in play — so are the metals for electric vehicle batteries, bleeding-edge “quantum computers” and space technology.

Add to that list “the niche industry of robotaxis,” Ray says. “That’s right. Self-driving taxis are at the center of America’s latest national defense measures against China.

“It’s because the same technology that is used for these robotaxis and many driver-assist features that are in many newer cars is also used in military technology such as submarines, drones and weapons with advanced targeting.”

Specifically we’re talking about lidar — light detection and ranging.

“U.S. officials claim that lidar should be looked at with the same scrutiny as any other military technology, since it can be used for battlefield mapping, autonomous targeting and possibly most concerning: spying.”

There are two major players in the lidar space — one Chinese, one American.

There are two major players in the lidar space — one Chinese, one American.

China-based Hesai Group debuted on the Nasdaq nine months ago under the ticker HSAI. CEO David Li asserts that “Hesai lidars don’t — and indeed cannot — pose a national security or privacy threat. The concerns are fictions spread by competitors.”

Hesai supplies nearly all of the lidar technology for American makers of self-driving vehicles — a fact that sticks in the craw of the American player Ouster Inc. (OUST). “Hesai has built their business on stolen IP,” says Ouster CEO Angus Pacala. Ouster has sued Hesai for allegedly stealing Ouster’s technology.

Hmmm — makes you wonder if the controversy over the military uses of lidar is a pretext for some sort of action in Washington that would give an American company a leg up.

“It’s often difficult to tell where the military tech throttling ends and the economic hamstringing begins,” Ray Blanco observes. He reminds us of the Chinese ban on chips made by Idaho-based Micron earlier this year, with Beijing’s bogus claims of “national security risk.”

In any event, we’ll stay on top of the story. “If the U.S. is willing to press the issue on lidar, there is a lot of market share up for grabs if Hesai is pushed off of our shores.”

![]() Shut up and Buy!

Shut up and Buy!

Amid the stock market’s furious November rally, Paradigm’s Greg Guenthner has six words of advice for anyone who does short-term trading: “Turn off your brain and buy.”

Amid the stock market’s furious November rally, Paradigm’s Greg Guenthner has six words of advice for anyone who does short-term trading: “Turn off your brain and buy.”

Wall Street grabbed onto a bearish narrative throughout October. And those reasons looked completely valid at the time — “poor market breadth and a near-total evaporation of new highs” amid renewed warfare in the Middle East.

And then as the month turned, “the market gave us a quick washout below key support to set up the rally that’s unfolding right now,” Greg goes on. “Sentiment tipped extremely bearish at the exact wrong time — a normal period of market weakness that perfectly aligned with seasonal trends.

“The market’s going to chew you to bits if you get too caught up in fundamental arguments during these important turning points. Sure, some stocks are falling apart after badly missing earnings estimates or lowering expectations. But most stocks are catching higher with a strong seasonal tailwind aiding their rise.

“To be clear, I’m not suggesting economic or fundamental concerns are wrong or completely useless. But you’re wasting your time trying to fight a rally during this incredible seasonal strength.”

Going into year-end, Greg anticipates the “Magnificent Seven” tech-adjacent names cooling off. “Instead of piling into stocks like NVDA and META that are already pushing to new highs, shift your trading focus to the more rate-sensitive growth names in tech.

“I’m talking about the stocks that took big hits over the past three months as the market corrected. Software stocks, biotechs and the former tech-growth darlings are ripe for huge short-covering rallies into the holidays.”

Yesterday’s big rally is carrying into today — with the S&P 500 creeping past the 4,500 level.

Yesterday’s big rally is carrying into today — with the S&P 500 creeping past the 4,500 level.

That’s a quarter-percent increase on the day. The S&P is now less than 2% below its 2023 highs set at the end of July.

Bond yields are rebounding, the 10-year Treasury back to 4.55%. Gold is flat at $1,961, silver up to $23.33. Crude has pulled back nearly a buck to $77.35.

The U.S. dollar index is dusting itself off after a huge beatdown yesterday. At 104.3, the DXY has broken below a 105–107 trading range that held going back to mid-September.

One potential drag on the market is likely no longer in play: It appears a “partial government shutdown” this weekend will be averted after the House passed another kick-the-can budget measure yesterday. After becoming House speaker on the promise of no more “continuing resolutions,” Mike Johnson has already caved. Amazing…

The day’s economic figures reinforce the new bullish narrative that inflation is cooling off.

The day’s economic figures reinforce the new bullish narrative that inflation is cooling off.

According to the Labor Department’s producer price index, wholesale prices fell 0.5% last month– in contrast with economists’ expectations for a 0.1% rise. That’s the biggest drop since the early COVID days in the spring of 2020.

Meanwhile, retail sales as reported by the Census Bureau fell 0.1% in October — the first drop since March. But the figure is skewed by falling gasoline prices. If you factor that out along with auto sales — notoriously volatile month-to-month — you end up with a 0.1% jump.

Still, we’re compelled to continue calling BS on the official consumer inflation numbers.

Still, we’re compelled to continue calling BS on the official consumer inflation numbers.

As we mentioned yesterday, year-over-year inflation of 3.2% is still higher than it was in early summer. And does anyone believe food at home is only 2.1% more costly than it was a year ago?

But it gets better. The researchers at Hedgeye Risk Management spotted a detail that stuck out like the proverbial sore thumb — health insurance allegedly falling 34% from a year earlier. By their reckoning, factoring out health insurance would have resulted in a headline inflation number of 3.4% — higher than expected.

“The U.S. government and Fed will manipulate any data necessary to make it appear consumers are doing fine,” says a tweet from Hedgeye — not usually given to such audacious language. Other finance types on Xwitter are even more impertinent…

Stand by for Bullet No. 5 for more mockery of “official” price figures…

![]() Bitcoin’s Next Boost

Bitcoin’s Next Boost

Bitcoin continues to hover near 18-month highs… and a catalyst coming within the next two months could propel it much higher.

Bitcoin continues to hover near 18-month highs… and a catalyst coming within the next two months could propel it much higher.

“Jan. 10 is when the SEC will either give the thumbs-up or the thumbs-down to a big Bitcoin ETF,” says Paradigm crypto pro Chris Campbell. “Actually, at this point, it could happen sooner than that.”

This flexible deadline goes back to a court case we told you about last summer: Grayscale Investments achieved a win in its suit against the Securities and Exchange Commission. Since then, the SEC has been acting under court order to review Grayscale’s application to issue a Bitcoin ETF.

“Of course,” Chris points out, “they could say no.’”

But that’s not the way the wind is blowing: The SEC has opened up lines of communication with Grayscale and other firms looking to issue a Bitcoin ETF, “tweaking the applications to meet their standards,” says Chris. “All signs are pointing toward a likely approval.”

And once that happens, Chris says the door will open to an Ethereum spot ETF. “A recent leak indicates that BlackRock, the world's largest asset manager, has just filed for a new iShares Ethereum trust in Delaware.

To be clear, that’s a trust — not an ETF. But Chris points out that “BlackRock did the same exact thing with Bitcoin days before filing for a spot Bitcoin ETF.

“This is not just a signal that a spot Ethereum ETF is coming… It’s also a signal that Blackrock is confident its BTC ETF is going to get approved.

“Meaning? Once the spot Bitcoin ETF is approved, the excitement and capital will look for the next big trade.

“Right now could be a big opportunity to front-run the front-runners into ETH.”

As it stands, Ethereum is back above $2,000 — on the way to something potentially much higher.

![]() Hallucinating Over the Cost of Thanksgiving

Hallucinating Over the Cost of Thanksgiving

Time for a holiday tradition of ours — dunking on the “typical” cost of a Thanksgiving dinner as calculated by the American Farm Bureau Federation.

Time for a holiday tradition of ours — dunking on the “typical” cost of a Thanksgiving dinner as calculated by the American Farm Bureau Federation.

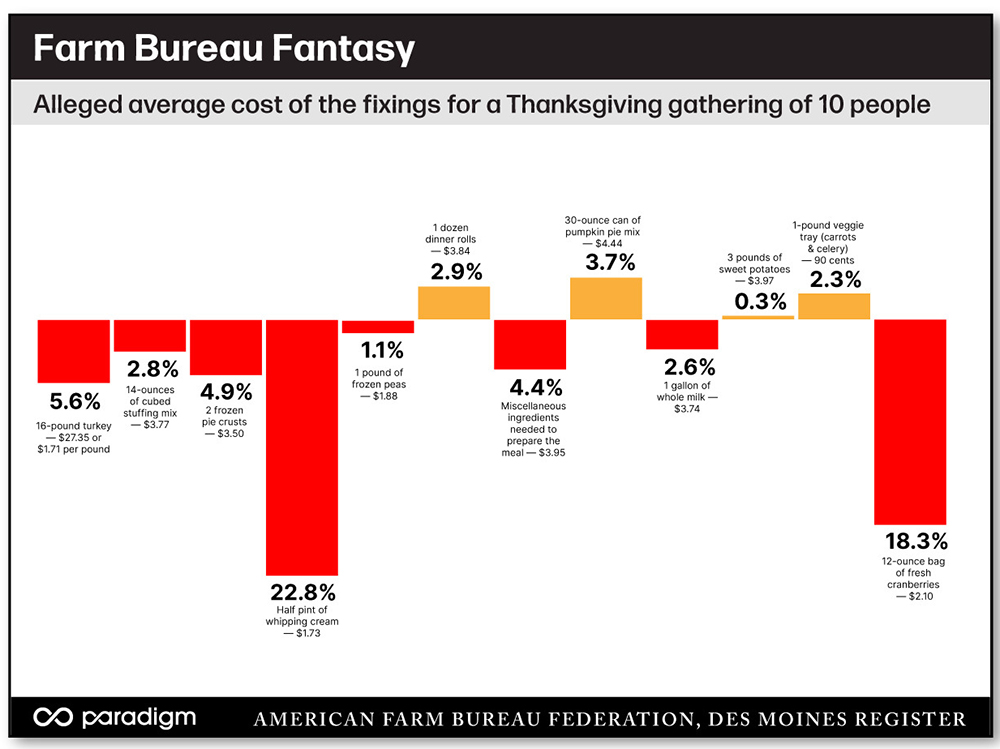

The Farm Bureau released the numbers this morning: Allegedly you can feed a gathering of 10 for $61.17 — a figure that’s down 4.5% from a year ago. (We’ll break down the specifics momentarily.)

In the Farm Bureau’s defense, the trade group does acknowledge a 25% jump compared with pre-COVID levels in 2019. And we’ll concede that turkey availability is better this year, now that an outbreak of bird flu has abated.

But all told, and as we’ve been saying for years, the figures beggar belief. Here are the Farm Bureau’s specifics…

Our beef (or our poultry in this case) with these figures is what it’s always been: The Farm Bureau lowballs these numbers to make Big Agra look good — factory-farmed turkey, store-bought pie crust, etc. As a reader told us way back in 2016, the meal amounts to “a Monsanto-laced GMO special Thanksgiving dinner that glows under a blacklight.” (Yeah, it never gets old.) And never mind the absence of the booze!

It’s been at least a couple of years since we opened the floor to the readership: Do these figures bear any relationship to your reality as you get ready for a week from tomorrow? Drop us a line: feedback@paradigmpressroom.com

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets