Wall Street’s AI Blindspot

![]() Wall Street’s AI Blind Spot

Wall Street’s AI Blind Spot

According to Paradigm’s crypto-and-AI expert James Altucher: “China is quietly creating an AI empire that could soon rival Big Tech’s dominance. And almost nobody is talking about it.”

According to Paradigm’s crypto-and-AI expert James Altucher: “China is quietly creating an AI empire that could soon rival Big Tech’s dominance. And almost nobody is talking about it.”

Earlier this year, a small Chinese startup named DeepSeek stunned the tech world by unveiling an AI model matching OpenAI’s capabilities — at a fraction of the cost.

For a brief moment, headlines buzzed with concern about China’s AI progress. But then, “everyone went back to ignoring it,” says James. “Big mistake.”

Chinese AI development is advancing at an incredibly rapid pace, but one company stands out…

Over the past decade, the e-commerce giant Alibaba (BABA) has transformed into an AI powerhouse, developing some of the most advanced AI models in the world.

In April, Alibaba released its Qwen3 model family, which “matched or beat offerings from OpenAI and Google on several key benchmarks,” James says.

“Last week, a new version of Qwen3 surpassed both OpenAI’s o4-mini and Google’s Gemini-2.5 Pro on major reasoning tests.”

Plus, Alibaba plans to pour $53 billion into AI and cloud infrastructure over the next three years. And the company is “backing Moonshot AI, whose Kimi K2 model is beating ChatGPT and Claude in coding tasks.”

What distinguishes Alibaba as a leader at the forefront of AI innovation?

What distinguishes Alibaba as a leader at the forefront of AI innovation?

Unlike American tech giants struggling with high labor costs — including Nvidia, Google and Microsoft — Alibaba benefits from “China’s vast pool of AI talent at a fraction of Silicon Valley salaries,” James notes.

The company is embedding AI throughout its massive e-commerce ecosystem, which serves millions of customers daily. Its cloud business is rapidly growing and becoming the “Amazon Web Services of Asia” with AI built into its core.

In February, Alibaba struck a deal with Apple to provide the AI brains for Siri in China. Recently, they announced that their AI assistant, Quark, will soon power smart glasses — potentially rivaling Meta’s Ray-Ban offerings.

The company is making breakthroughs in healthcare too: its Damo Panda AI model received FDA breakthrough device designation for detecting pancreatic cancer with 34.1% greater accuracy than radiologists.

Despite this innovation, Alibaba is undervalued compared to its American peers.

Despite this innovation, Alibaba is undervalued compared to its American peers.

Its market cap is about one-tenth of Amazon’s, and it trades at just 13 times earnings — a fraction of what U.S. peers command. This valuation gap exists largely due to lingering investor wariness about Chinese stocks stemming from “past accounting scandals and fears of government interference.” But James argues this fear may be overblown regarding Alibaba.

He further highlights that Alibaba has a “strong balance sheet with more cash than debt, operates in sectors the Chinese government wants to develop (AI, cloud computing, e-commerce, etc.) and is actively buying back shares, showing confidence in its own future.

“The geopolitical risks are real,” James concedes, “but they're likely priced into the stock already. China knows that harming foreign investors would trigger retaliation, potentially threatening companies like TikTok in Western markets.

“Meanwhile, US-China chip tensions are thawing, with Trump reversing Biden's ban on shipping Nvidia H20 chips to China. This opens the door for even faster AI development at Alibaba.

“For investors, this creates a rare opportunity,” he concludes. “While everyone else chases the same handful of American AI stocks at premium prices, you could be positioning yourself in what might be the most overlooked AI opportunity on the market.

“The AI revolution represents a once-in-a-generation wealth creation opportunity,” James says. “And Chinese AI — specifically Alibaba — might be the most overlooked part of that opportunity.”

[Urgent: This afternoon, all eyes are trained on American tech giant Apple, awaiting a game-changing announcement from CEO Tim Cook. That’s why it’s absolutely crucial you act FAST — before Apple’s big reveal 4 pm EST. Or you risk missing out on a prime opportunity.

Click here to view James Altucher’s down-to-the-wire briefing, including simple steps in order to take immediate action.]

![]() A Fed Rate Cut Incoming?

A Fed Rate Cut Incoming?

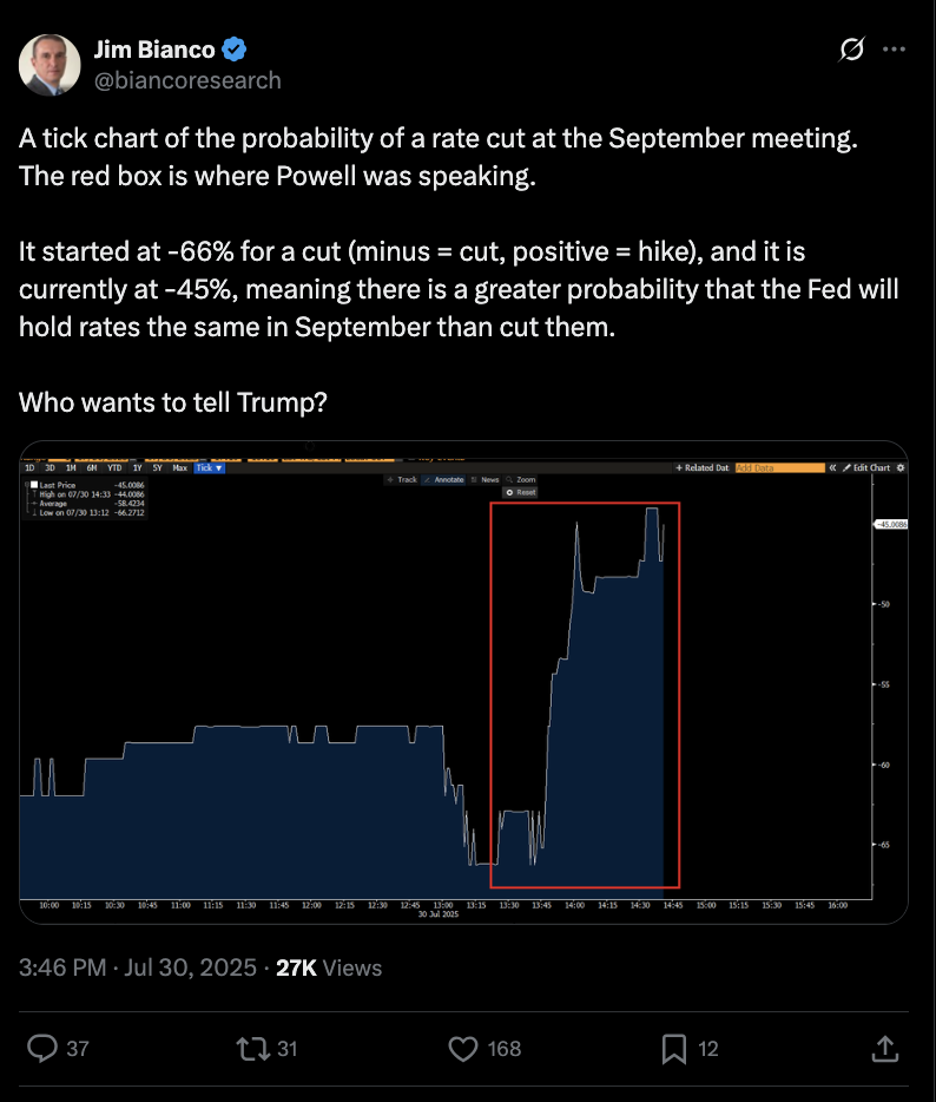

“The Fed did continue the pause in its Fed funds rate as we predicted. This kept the Fed’s target rate unchanged at 4.50%,” says Paradigm’s macro expert Jim Rickards, kicking off his post-FOMC meeting roundup.

“The Fed did continue the pause in its Fed funds rate as we predicted. This kept the Fed’s target rate unchanged at 4.50%,” says Paradigm’s macro expert Jim Rickards, kicking off his post-FOMC meeting roundup.

Notably, two FOMC members disagreed with the decision to pause rate cuts. These two “no” votes are important because they don't happen often; dissent suggests there is some disagreement and debate at the Fed about the best path forward.

Jim underscores the significance of this division: “Counting board member votes only, the vote to pause on policy changes was 5-2, which is an uncomfortably small majority in a world where collegiality and consensus are everything.”

Division at the Fed hints at potential shift in policy or leadership ahead — especially as Chair Jerome Powell’s term nears its end in 2026.

The meeting’s focus, meanwhile, Jim notes, centered on the Fed’s “dual mandate”: controlling inflation and fostering employment.

“For now, the Fed’s action on Wednesday clearly shows it is less concerned about unemployment and more interested in fighting inflation by keeping rates at a relatively high level,” Jim says.

“For now, the Fed’s action on Wednesday clearly shows it is less concerned about unemployment and more interested in fighting inflation by keeping rates at a relatively high level,” Jim says.

Recent inflation data show a troubling upward trend — we’ll have more to say about inflation in a moment — while unemployment rates have remained stable.

Powell acknowledged the delicate balance in his post-meeting remarks: “Recent indicators suggest that growth of economic activity has moderated... The moderation in growth largely reflects a slowdown in consumer spending.”

Jim interprets these comments as a possible signal: “A rate cut is a near certainty,” given that inflation data can be interpreted to justify easing. (Jim’s forecast, by the way, bucks popular opinion.)

Jim suggests that if consensus at the Fed erodes further, decisive policy moves — including a strong rate cut at the September meeting — could very well be on the horizon.

Ultimately, Jim warns the Fed appears to be “following markets and not leading them. That’s bad news for investors because, if the Fed were leading the economy, they would get ahead of the coming recession.

“They’re not,” he concludes, “doing either.”

![]() Market Miscellany

Market Miscellany

The Core Personal Consumption Expenditures (Core PCE) index, the Federal Reserve’s preferred measure of inflation, rose 0.3% in June 2025, matching economist expectations but surpassing May’s revised 0.2% increase.

The Core Personal Consumption Expenditures (Core PCE) index, the Federal Reserve’s preferred measure of inflation, rose 0.3% in June 2025, matching economist expectations but surpassing May’s revised 0.2% increase.

On a yearly basis, core PCE inflation — which strips out food and energy prices — rose 2.8%, slightly above forecasts but ruler-flat from May’s revised reading.

Once again, June’s number signals persistent inflation, firmly entrenched above the Fed’s 2% inflation target.

Meta (META) and Microsoft (MSFT) both reported strong earnings on Wednesday afternoon, exceeding analysts' expectations and boosting share prices.

Meta (META) and Microsoft (MSFT) both reported strong earnings on Wednesday afternoon, exceeding analysts' expectations and boosting share prices.

Meta posted Q2 revenue of $47.52 billion — a 22% increase year-over-year — with net income rising 36% to $18.34 billion, or $7.14 per share.

Its core advertising revenue grew 21%, and Meta expects third-quarter revenue between $47.5 billion and $50.5 billion, beating forecasts. The company also raised its full-year capital expenditure forecast to between $66 billion and $72 billion, reflecting heavy investments in AI infrastructure.

Microsoft reported fiscal fourth-quarter revenue of $76.44 billion, up 18%, with net income increasing to $27.23 billion, or $3.65 per share. Like Meta, Microsoft plans substantial capital expenditures, with over $30 billion anticipated in the first fiscal quarter, driven by AI investments.

Plus, Microsoft surpassed the $4 trillion market cap milestone.

At the time of writing, META shares are up 11.5% while MSFT is up 4.5%.

At the time of writing, META shares are up 11.5% while MSFT is up 4.5%.

As for the broader stock indexes, the Nasdaq’s leading the way, up 0.60% to 21,260, and the S&P 500 is up 0.25% to 6,380. The Big Board, however, is down about 0.30% to 44,335.

Commodities are hitting the skids today. The price of crude is down 1.85% to $68.75 for a barrel of WTI. Meanwhile, gold is down 0.10% to $3,349.20 per ounce, but silver’s getting kicked in the teeth: down almost 3% to $36.65.

The crypto market? Both Bitcoin and Ethereum are up about 1% to $118K and $3,780 respectively.

![]() Overbought Doesn’t Mean OVER

Overbought Doesn’t Mean OVER

“While stocks are getting a little overbought here, it’s not set in stone that we’ll see a broad pullback soon or even at all!” emphasizes Paradigm’s retirement-and-income specialist Zach Scheidt.

“While stocks are getting a little overbought here, it’s not set in stone that we’ll see a broad pullback soon or even at all!” emphasizes Paradigm’s retirement-and-income specialist Zach Scheidt.

Zach defines overbought as a scenario wherein stocks have “moved up too far, too fast,” often detected by technical indicators like the Relative Strength Index (RSI). However, Zach says this condition can resolve in multiple ways, not just through sharp declines.

One common but overlooked resolution is consolidation, when prices “trade sideways within a range for weeks or even months.” This process “resets valuations, cools off sentiment, and allows earnings or economic data to catch up to price levels,” though it may frustrate momentum traders.

Another way is through a shift in leadership among sectors. Zach notes: “If tech stocks led the rally and are now overbought, money may rotate into energy, industrials, or financials,” easing pressure under the surface without dragging the whole market down.

“Prices may fall 3–5% or more as investors lock in profits and wait for better entry points,” he continues. “This is the most obvious resolution and what many expect when they hear the term overbought.

“The key point, though, is that not every dip signals the start of a deeper bear market. It's often just the market resetting expectations and absorbing gains.

“Understanding these dynamics is crucial for both short-term traders and long-term investors,” Zach concludes. “Instead of exiting positions prematurely or without a plan, it may be more prudent to tighten stop-losses, reduce risk in extended names, or look for relative strength in under-owned sectors.

“Overbought signals are just that: signals. They suggest caution, not panic.”

![]() Summer’s Budget-Friendly Buzz

Summer’s Budget-Friendly Buzz

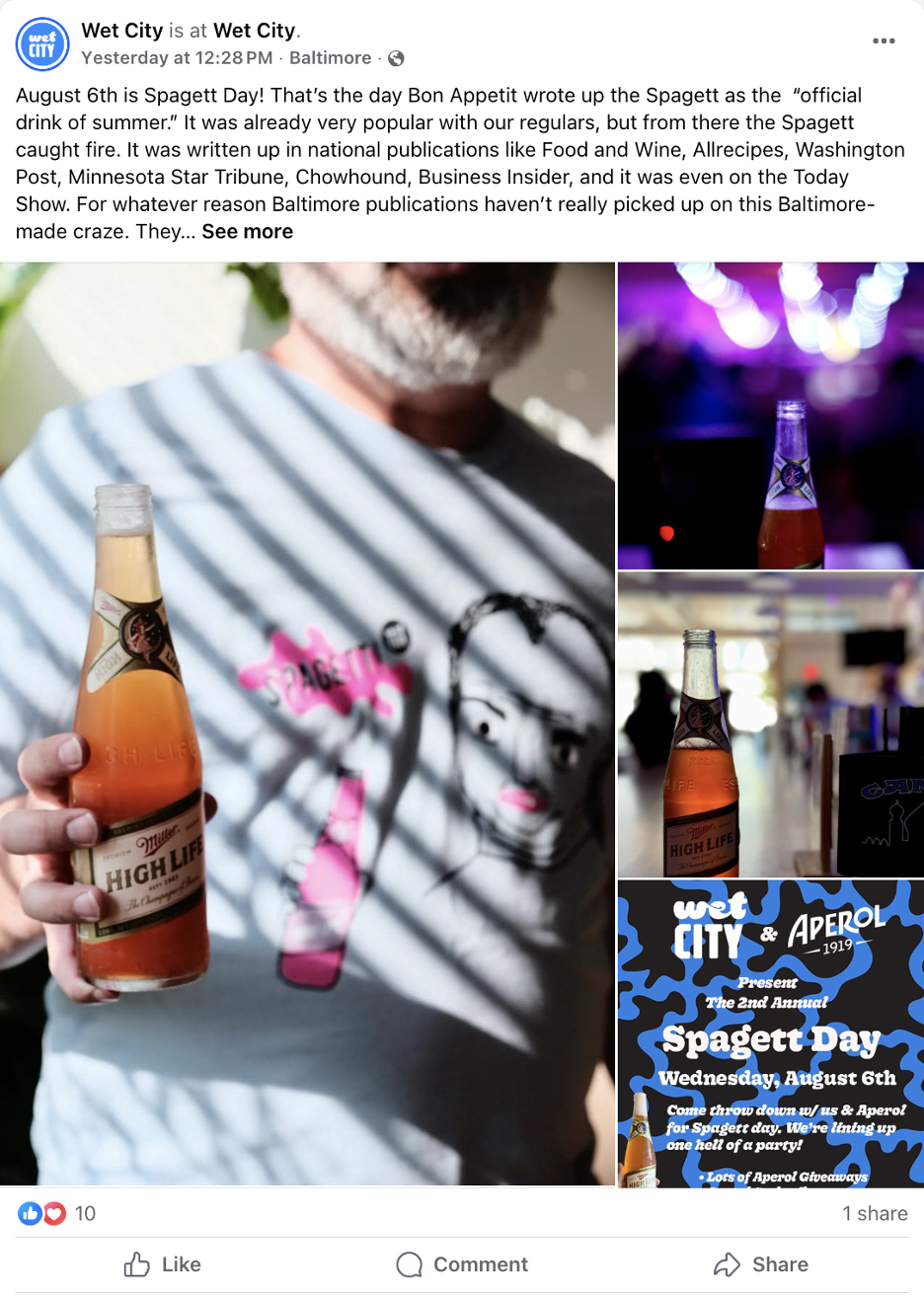

This summer, if you’re scanning bar menus and spot a cocktail — the “Spaghett” — you don’t have heatstroke.

This summer, if you’re scanning bar menus and spot a cocktail — the “Spaghett” — you don’t have heatstroke.

This fizzy concoction — Miller High Life plus a splash of Italian aperitif Aperol and maybe a dash of lemon — has bubbled up from bartender secret to reigning champ of budget-friendly coolers.

The switch to Spaghetts isn’t just about refreshment; it’s a wallet-driven decision. Nicknamed the “hobo Negroni” and the “trailer park spritz,” it’s the Aperol spritz’s thrifty cousin.

The Spaghett first appeared on menus at Wet City Brewery in Baltimore, Maryland — shoutout to Paradigm’s HQ! — where it was created by bartender Reed Cahill in 2016. It’s been on their cocktail menu from the brewery's opening, and has gained a cult following since.

Source: Facebook

But is the Spaghett a recession omen? The numbers are telling: Spaghett orders soared 65% in the first half of 2025 — up 1,000% since 2022 — according to Square.

So while it may taste like summer, the Spaghett’s explosive popularity says just as much about the economic weather; it’s a bittersweet signal that even happy hour isn’t immune to recession vibes.

Cheers?

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets