Un-Made in China

- “Made in China” is about to blow up

- Another make-or-break moment

- Follow-up file: Carbon capture complications

- Follow-up file: Censorship goes to SCOTUS

- The Mailbag: Gazan gas… and the steal of the century

![]() “Made in China” Is About to Blow Up

“Made in China” Is About to Blow Up

I don’t usually talk about myself here. But something happened recently that 1) you might be able to relate to and 2) says nothing good about where America is going either societally or economically.

I don’t usually talk about myself here. But something happened recently that 1) you might be able to relate to and 2) says nothing good about where America is going either societally or economically.

The house my wife and I bought a few years ago has a gas fireplace in the living room. Installed shortly before we took possession of the place, it appears to have come from a big box store and cost a little under $1,000. It gave us seven years of reliable service — until a few weeks ago, just as an Upper Midwest chill was setting in.

We had a heating contractor come out who performed some repairs. But at the end of the process, he concluded the gas valve needed replacing. He could not readily locate a replacement. Because he said he was pressed for time, he asked me to poke around and see if I could locate one.

I found the manufacturer’s phone number in the manual and was told the part is no longer made. (The part about Tough s*** was merely implied). I contacted a couple of other heating-parts places, hoping something used was available; one got back to me and said the valve for this model wasn’t designed to be replaced. So I don’t know who or what to believe.

What’s happening is, for lack of a better term, a COVID cluster[expletive deleted].

What’s happening is, for lack of a better term, a COVID cluster[expletive deleted].

The contractor presumably is afflicted by the same post-lockdown labor shortage that afflicts so many other service businesses — so an effort he would ordinarily undertake himself has fallen to me, the customer, instead.

At the same time, it appears the supply-chain snags wrought by lockdown are not yet fully resolved. Presumably I’m dealing with made-in-China components — the manual is silent on this score — that no one is able to locate.

Granted, what I’m describing is the epitome of a first-world problem. But the implications go far beyond the superficial comforts of our living room. (We use the fireplace mostly for ambiance, not heat.)

Granted, what I’m describing is the epitome of a first-world problem. But the implications go far beyond the superficial comforts of our living room. (We use the fireplace mostly for ambiance, not heat.)

The time might not be far away that the manager of your nearby electric power plant or water treatment facility is going to be in the same fix that I am — reliant on experts who don’t have the bandwidth to solve a problem and on made-in-China parts whose replacements may or may not exist.

“There’s an urgent crisis brewing in America, and everything we’ve heard about China over the past 12 months is just the tip of the iceberg,” says my friend Addison Wiggin.

“There’s an urgent crisis brewing in America, and everything we’ve heard about China over the past 12 months is just the tip of the iceberg,” says my friend Addison Wiggin.

Addison is a 30-year veteran of the financial publishing biz and the author of three New York Times business bestsellers — including 2006’s Empire of Debt, co-authored with Bill Bonner, a book that’s foundational to my worldview. Addison was my colleague for 15 years and my mentor at the start of my current career. I wouldn’t be doing what I’m doing today if it weren’t for him.

For much of 2023, he’s been at work on a project that’s left him with the chilling conclusion, “I am truly scared for America.

“As our largest supplier of goods,” he says, “China has been the USA’s key to an affordable quality of life for years.

“But now, China is facing a debt crisis that could threaten our ability to enjoy an affordable, high-quality life.” he continues.

“But now, China is facing a debt crisis that could threaten our ability to enjoy an affordable, high-quality life.” he continues.

The country’s biggest property developer, Evergrande, is on the verge of liquidation. Another huge name in the space, Country Garden, is nearing default on $11 billion in dollar-denominated debt — much of it held by U.S. investors.

If you’re getting the idea that what’s happening in China won’t stay in China… you’re absolutely right. (He connects the dots for you at this link.)

“If you don’t take action ASAP,” says Addison, “the fallout could deplete your weekly grocery budget… your vacation fund… your retirement savings — everything — before you know it.”

But true to his life’s mission, Addison has devised a comprehensive solution set to protect yourself from what he calls the Great American Shell Game.

Thing is, there’s only a limited amount of time you have to get your house in order — less than three months, he reckons.

Hyperbole, you say? I don’t think so; I’ve known Addison a long time. He wouldn’t be saying it if it didn’t come from the heart.

Please take a look at his brand-new presentation… see if his message rings true for you… and decide what actions you wish to take.

![]() Another Make-or-Break Moment

Another Make-or-Break Moment

At the risk of repeating myself from Friday, the markets are at a make-or-break juncture — gold, silver, oil and Bitcoin on the verge of breaking out, the stock market on the verge of breaking down.

At the risk of repeating myself from Friday, the markets are at a make-or-break juncture — gold, silver, oil and Bitcoin on the verge of breaking out, the stock market on the verge of breaking down.

After three days of relentless whacking, the S&P 500 is up a mere five points this morning to 4,229 — still hugging its 200-day moving average. Since its year-to-date high on July 31, the index has been registering lower highs and lower lows — rarely a good sign. That said, we’ll keep an eye out this week for earnings from four of the Magnificent Seven companies.

Checking in on the IWM, the Russell 2000 small-cap ETF, it’s up 50 cents to $166.94. In today’s Rude Awakening, colleague Sean Ring says it’s still holding above the $162 level that’s been a crucial level of support since mid-2022. That’s the good news.

The bad news is that IWM has already broken below its one-year support level. “A breakdown to $162 looks likely,” he says. Reminder from last week: “We said that the small caps would dictate where the overall market goes. If that’s the case, the overall market will start to head down soon.”

Weighing on the stock market are the continued stresses in the bond market, with the 10-year Treasury yielding over 5% for the first time since 2007.

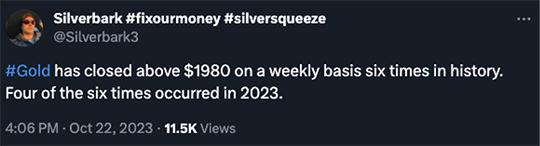

But a funny thing is starting to happen: Rising Treasury yields are not a drag on the gold price.

But a funny thing is starting to happen: Rising Treasury yields are not a drag on the gold price.

The old saying is that “Gold has no yield.” That is, when interest rates are rising, a shiny metal with no yield seems less attractive.

Not now, however. Even the mainstream is noticing: “Gold prices have rallied sharply since the Hamas-Israel conflict broke out,” says the Financial Times, “further highlighting the divergence in its long-term relationship with U.S. Treasuries as investors flee to the haven asset.”

Still, the trend was in motion long before the Middle East blew up this month: The FT acknowledges record gold buys by central banks — “as some countries aimed to reduce their reliance on the dollar after Washington weaponized its currency in sanctions against Russia.” (What have we been telling you since Russia invaded Ukraine early last year?)

For the moment, gold is holding onto most of its monster gains of the last few days, the bid in the spot market down less than four bucks to $1,977. Silver is down 23 cents, but still comfortably above $23.

➢ Meanwhile in crypto-land, Bitcoin has pulled back above $30,000 for the first time since July — $30,847 at last check. The resistance number to watch here is $31,000.

Crude has pulled back a buck this morning to $87.10 amid another huge acquisition in the oil patch.

Crude has pulled back a buck this morning to $87.10 amid another huge acquisition in the oil patch.

Chevron will acquire Hess in an all-stock deal worth $53 billion — giving the company access to parts of a huge oil find in Guyana, along with shale-oil assets in North Dakota. The deal comes only days after Exxon Mobil announced plans to buy Pioneer Natural Resources.

The Street doesn’t much care for the deal, Chevron shares down 2.3% and Hess shares flat.

![]() Follow-up File: Carbon Capture Complications

Follow-up File: Carbon Capture Complications

Maybe, just maybe, the most looney-tunes scheme in the entire climate-change hustle is nearing a well-deserved end.

Maybe, just maybe, the most looney-tunes scheme in the entire climate-change hustle is nearing a well-deserved end.

With “carbon capture” technology, the carbon dioxide generated by industry would be pumped into storage underground, where it wouldn’t contribute to the alleged greenhouse effect.

On Friday, The Wall Street Journal reported that “a pipeline company dropped ambitious plans to build a network of CO2 pipelines across the Midwest, delivering a victory for environmentalists and farmers who have opposed the project.”

Navigator CO2 Ventures had planned to build 1,300 miles of pipelines sending CO2 from ethanol plants to an underground storage site in Illinois. But even though the Biden administration is spending billions on tax credits to subsidize the industry, state regulatory hurdles proved to be too much.

Ditto for another company in the space — Summit Carbon Solutions — which has pushed back its timetable for a CO2 pipeline network by two years.

Ditto for another company in the space — Summit Carbon Solutions — which has pushed back its timetable for a CO2 pipeline network by two years.

Summit was the villain in a story we related over the summer, about a South Dakota farmer named Jared Bossly whose property stood in the way of a CO2 pipeline Summit wants to build. Summit surveyors resorted to intimidation tactics to enforce their eminent-domain authority granted by South Dakota lawmakers.

But last month, South Dakota utility regulators denied Summit a permit application, on the grounds that the application violates rules on safe distances between homes and pipelines.

South Dakota’s denial came a month after a similar denial by North Dakota regulators.

“I’ve felt like there was a tractor on my chest, and that weight has finally been removed,” Bossly told the South Dakota Searchlight site.

It’s not the end of the story — Summit can submit a revised application in the future — but the more delays the project runs into, the more likely it is the project could be scrapped altogether.

![]() Follow-up File: Censorship Goes to the Supreme Court

Follow-up File: Censorship Goes to the Supreme Court

Not a total surprise, but still worth noting: The Supreme Court will review the legitimacy of the censorship-industrial complex.

Not a total surprise, but still worth noting: The Supreme Court will review the legitimacy of the censorship-industrial complex.

On Friday, the court agreed to review Missouri v. Biden — the case brought against the Biden administration by the attorneys general of Missouri and Louisiana, as well as two epidemiologists who were censored by the social-media giants for defying the official narrative about COVID.

The order was unsigned, but the justices would seem to feel there’s ample evidence that the Biden administration leaned on Big Tech so hard with its takedown “requests” that it constitutes a violation of the First Amendment. Or at least the justices feel there’s enough evidence to take up the case.

Unfortunately, for the time being the court also stayed lower-court rulings that barred the administration from contacting the Big Tech companies. In a brief dissent, Justices Alito, Gorsuch and Thomas warned that the feds might believe they have “a green light to use heavy-handed tactics to skew the presentation of views” on social media.

Presumably a ruling will come before the court’s current term ends next June.

![]() The Mailbag: Gazan Gas… and the Steal of the Century

The Mailbag: Gazan Gas… and the Steal of the Century

“Your reader's comment that most people are unaware that Gaza is an open-air prison got me thinking that most people also probably don't know about the Gaza oil and gas reserves,” a reader points out.

“Your reader's comment that most people are unaware that Gaza is an open-air prison got me thinking that most people also probably don't know about the Gaza oil and gas reserves,” a reader points out.

“It's a powerful motivator to kick the Gaza people all out into Egypt and then not let them back in.

“This has got shades of the Iraq War-era ‘It's the oil, stupid’ vibes.

“Love the 5 — first time writing in.”

Dave responds: We figured we’d end up introducing that angle of the story sooner or later. Or re-introducing it: Back in 2014, we took note of an ongoing debate within Israel about whether the development of offshore gas would give Palestinians more economic clout and make a Palestinian nation-state more viable.

Now the debate has shifted: Israeli foreign minister Eli Cohen said last week, “At the end of this war, not only will Hamas no longer be in Gaza, but the territory of Gaza will also decrease.”

He wasn’t clear about whether Israel would annex that territory… but doing so would ensure that the revenue from offshore energy production would go into Israeli coffers.

“With regard to the floor on housing prices, what are your thoughts on the following?” a reader inquires.

“With regard to the floor on housing prices, what are your thoughts on the following?” a reader inquires.

“I had dinner with a friend last night. He suggested that the housing market shortage was a result of institutional investors purchasing residential property as investments.

“This aligned with something that I read (but didn’t recall the source) that something had changed during the 2008 housing crisis that encouraged institutional investment in residential properties.

“It also aligned with my personal experience working at a company that was providing services to investors who were buying thousands of residential properties.

“His contention was that if/when institutional investors felt they had maximized their profits, they might divest their holdings at the high prices leaving individual property owners ‘holding the bag’ when prices fell as a result of the increased supply.

“Are there statistics available about institutional holdings? Would institutional investors be able to manipulate the housing market? Are there even laws that would prevent such manipulation (not that I am a fan of more laws)?

“Keep up the great work! 5 Bullets and Sean Ring are my top daily reads.”

Dave responds: As the housing market was taking off anew in 2021, investors accounted for about one out of every five home sales nationwide.

Way back in 2012, the aforementioned Addison Wiggin and I saw the whole thing coming. We called it “the steal of the century,” although the formal name the feds gave it was “REO-to-rental.”

At that time, millions of foreclosed single-family homes were sitting on the federal government’s books in the wake of the 2008 housing bust. Under this scheme, hedge-fund and private-equity types could buy these homes at a deep discount and manage them as rentals.

These homes were available only to investors who could drop $1 billion or more on a bulk transaction.

If you as a mere peasant wanted to buy the bargain-priced foreclosure down the street to pull down a little investment income, you were out of luck. It was crony capitalism at its worst.

We anticipated, accurately, that in time the investors in these rentals would eventually turn their holdings into REITs — real estate investment trusts whose shares you could buy on the stock market.

“Alas, by then,” said Addison, “the easy money will have been made.”

So as you suggest, it’s not inconceivable that in the current tight market, the home-rental REITs might decide to sell some of their inventory at the top. Then again, as long as they can keep raising rents, why would they?

Dicey times these are. One more reason to give Addison’s newest research a look.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets