A Small Caps Resurrection

![]() The Rotation Materializes

The Rotation Materializes

There’s one compelling reason small-cap stocks should pique your interest right now…

There’s one compelling reason small-cap stocks should pique your interest right now…

The FOMC meets at the end of the month (July 30–31). Will they cut interest rates? Probably not. But traders are still betting on two rate cuts this year, with one 0.25% cut in September.

That said, Fed Chair Jerome Powell now seems to favor easing before inflation grinds down to the Fed’s 2% inflation target. Speaking this week at the Economic Club of Washington D.C., Powell said as much:

If you wait until inflation gets all the way down to 2%, you’ve probably waited too long, because the tightening that you’re doing [is] still having effects which will probably drive inflation below 2%.

And small-cap stocks generally outperform large caps when interest rates ease — a market trend that’s not lost on Paradigm’s trading pro Greg “Gunner” Guenthner.

“The illusive bull market rotation we’ve patiently waited for is finally materializing,” he says.

“The illusive bull market rotation we’ve patiently waited for is finally materializing,” he says.

“It’s also worth noting that despite this newfound rotation, the ‘biggest of the big’ stocks haven’t stalled out just yet:

- The VanEck Semiconductor ETF (SMH) is still sporting a year-to-date gain over 50%

- The NYSE FANG+ Index also remains a force to be reckoned with, as it sits on a year-to-date gain of almost 35%

- The S&P 500 Index is sitting right near its all-time highs and is up only 18% so far this year.

“While the leaders are still clinging to their gains,” Gunner says, “traders are beginning to rotate to other less-loved corners of the market.

“Which stocks could pick up the baton and start running?” Gunner posits.

“Which stocks could pick up the baton and start running?” Gunner posits.

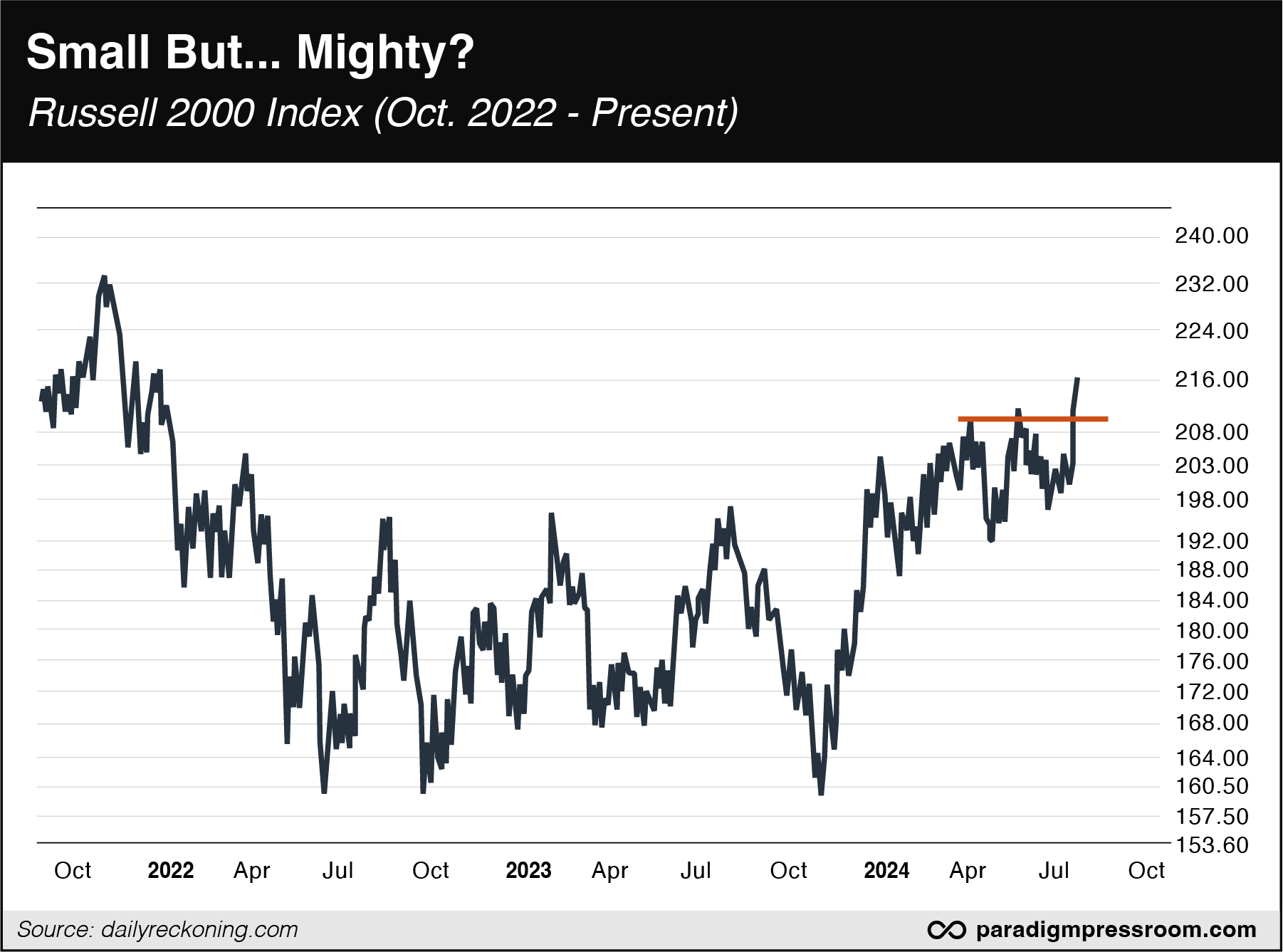

“We’re finally seeing key breakouts emerge in some forgotten corners of the market,” he says. “My favorite (and strongest!) move unfolding right now is the monster breakout in the small-cap Russell 2000.

“Frankly, small caps have been a mess for months,” he adds. “We’ve witnessed not one but two false breakouts so far this year as the Russell 2000 badly lagged the major averages.

“That all changed late last week when a midweek surge shot the iShares Russell 2000 ETF (IWM)” back above $200… and it hasn’t looked back yet.

“Remember, the Russell 2000 has grossly underperformed the major averages for nearly two years,” Gunner says.

“That’s an incredible move for these stubborn, formerly range-bound small caps!

“Now that IWM has stabilized and is approaching its 2021 highs, more traders and investors will feel comfortable buying back in,” says Gunner.

“Now that IWM has stabilized and is approaching its 2021 highs, more traders and investors will feel comfortable buying back in,” says Gunner.

“If the rotation theme continues to play out, we could see the smaller stocks outpace the big boys — even if the major averages decide to take a break.

“The move has been dramatic,” he says. “After all, no one was really expecting it. Despite the fact that some of these stocks are short-term overextended, we think they’ll soon consolidate and offer alert traders solid entry points.

“Now we’re finally seeing a powerful breakout that could take these small stocks much higher,” Gunner says.

“Are these our new market leaders as the third quarter begins in earnest?

“A funny thing happens when a down-and-out stock sector starts to break out,” Gunner says. “First, no one believes it. But as the breakouts expand, you’ll begin to hear some bullish whispers…

“That’s exactly what’s starting to happen.”

![]() The Rotation Materializes (Part 2)

The Rotation Materializes (Part 2)

“Nasdaq slides 1% as investors continue rotating out of tech,” CNBC proclaims.

“Nasdaq slides 1% as investors continue rotating out of tech,” CNBC proclaims.

“The rotation also explains why the small cap-focused Russell 2000 has jumped close to 9% in the last five trading days,” the article says. “By comparison, the Nasdaq has slipped more than 4% over the last week.”

[At the same time, I’m reminded when an index or a sector gets overstretched and then takes a tumble, the media always looks for an explanation. But sometimes the market/sector is just plain due for a tumble.

Also? “Some prudence and profit taking with the tech trade [has] been so profitable this year,” says Charlie Ripley of financial services firm Allianz.]

Meanwhile, “69 stocks within the S&P 500 [are] trading at their new 52-week highs” — including notable names like Walmart, Coca-Cola, GM, Lockheed Martin and BlackRock. But the index as a whole is in the red, down 0.70% to 5,550, while the Dow’s shed 315 points to 40,875.

Touching on commodities, oil is up 0.25% to $83 for a barrel of West Texas Intermediate. It’s a mixed bag for precious metals: Gold’s up 0.20% to $2,465 per ounce but silver is down 0.40% — still hanging out above $30.

- For the day’s economic number, the Philly Fed Manufacturing Index accelerated to 13.9 in July, trouncing economists’ consensus 2.9 and June’s 1.3 reading.

Finally, glancing at crypto, Bitcoin and Etherum are both slumping at the time of writing, to $63,825 and $3,410 respectively.

![]() Virginia Is for (AI) Lovers

Virginia Is for (AI) Lovers

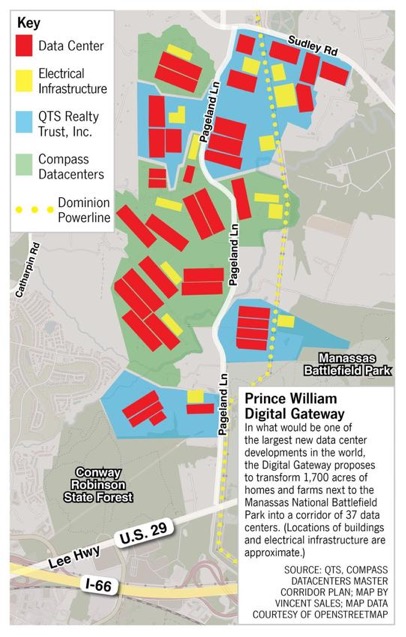

Virginia is home to the largest concentration of data centers in the world — data centers critical to the future of AI.

Virginia is home to the largest concentration of data centers in the world — data centers critical to the future of AI.

Loudoun County in northern Virginia is already home to 30 million square feet of data center locations, for instance. In December, neighboring Prince William County approved plans to build 23 million square feet of data center space…

Courtesy: Prince William Times

So Virginia might be in line to become more important to tech innovation than Silicon Valley. And considering who’s currently dominating AI, it makes sense to refer to Virginia’s concentration of data centers as “Nvidia Valley.”

Especially if Nvidia decides to buy instead of lease: Currently, Nvidia rents data center space from other companies. Nvidia could easily buy up other businesses in the cloud-computing space. And it would most likely start in Virginia.

But can the Old Dominion State’s grid support energy-intensive AI data centers, given Virginia’s power demand is projected to double over the next few decades?

“Dominion Energy says in order to keep the electric grid reliable they may need to build up to eight new natural gas plants in the next 10–15 years,” says Virginia Public Radio.

“Dominion Energy says in order to keep the electric grid reliable they may need to build up to eight new natural gas plants in the next 10–15 years,” says Virginia Public Radio.

“The plants, sometimes called peaker plants, would be designed to come on only when needed.” For that reason, Dominion has branded them “reliability centers.”

The utility company announced plans to build the first such natural-gas plant beside the James River in Chesterfield County within the next couple years.

But opponents of the plants argue that Dominion is dodging the Virginia Clean Economy Act of 2020, a legal mandate for Virginia’s grid to dump fossil fuels and become carbon-neutral by 2045 — fully relying on renewables like wind, hydro and solar power.

“There is a caveat in that law that does allow us to keep certain generation facilities on for reliability purposes,” notes Dominion Energy’s spokesman Jeremy Slayton.

Without which, he says: “On the hottest and coldest days of the year, [demand] goes up and up and up. And if we can’t meet that demand that means there will be blackouts.”

The construction of new fossil fuel power plants represents a significant shift away from state and federal initiatives aimed at promoting “green energy.”

Other states with similar carve outs in their energy policies might well adopt Virginia’s approach, particularly when faced with potential AI-driven power outages.

![]() NYC’s Revolution Is Trash

NYC’s Revolution Is Trash

“Containerization Requirement for Buildings with One to Nine Residential Units to Go Into Effect November 12, 2024.” Translation: Starting on Nov. 12, residents of NYC small apartment buildings will have to put garbage in trash cans.

“Containerization Requirement for Buildings with One to Nine Residential Units to Go Into Effect November 12, 2024.” Translation: Starting on Nov. 12, residents of NYC small apartment buildings will have to put garbage in trash cans.

I kid you not, last week, NYC Mayor Eric Adams and the city’s sanitation czar, Jessica Tisch, united to show New Yorkers how it’s done — wheeling city-approved trash and recycling cans to the curb of the mayor’s official residence, Gracie Mansion.

Courtesy: NYC.gov

“NYC Bin — Cheapest Bin of its Quality — Available for Purchase Online”

The official bins are priced around $50, shipping and handling included. And according to the mayor’s office, it’s the centerpiece of the city’s “Trash Revolution.”

“The Adams administration kicked off the Trash Revolution [when] DSNY published its Future of Trash report, the first meaningful attempt to study containerization models in New York City, and the playbook to get it done,” NYC.gov says.

Yeah, about that Future of Trash report…

Yeah, about that Future of Trash report…

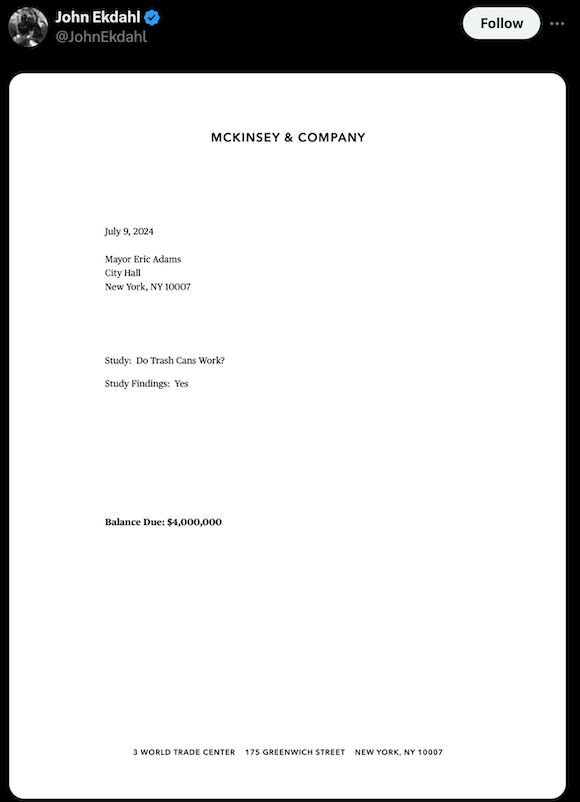

“In 2022, New York City awarded a $4 million contract to the consulting firm McKinsey to deal with the city’s trash problem,” The Daily Guardian says.

“Ending a two-year-long study, [it] has now been found that keeping the waste inside bins rather than on sidewalks is better.”

As @TrungTPhan at X put it: “I have no idea if $4m is a rip-off to learn that ‘yeah, we should put garbage in bins so rats don’t eat it’ but I would have happily done it for 10–20% of that budget (and come to a similar conclusion).”

Or, to riff on the 5 Bullets yesterday: “We wanted flying cars, instead we got [trash cans].”

![]() The People Have Spoken (Subjectgate)

The People Have Spoken (Subjectgate)

“I have held my tongue for more than a week now as I’ve tried to adapt to the new subject line for the 5 Bullets newsletter,” a longtime reader writes.

“I have held my tongue for more than a week now as I’ve tried to adapt to the new subject line for the 5 Bullets newsletter,” a longtime reader writes.

“I read the feedback you shared a few days ago, and I made an effort to be flexible, but now I am inclined to speak.

“I believe your argument in favor of the new subject line is either flawed or misfocused.

“Most of your loyal 5 Bullets readers do not choose to read the email each day based on what appears in the subject line of our inboxes.

“We read your newsletter because it is a reliable daily dose of opinions and information. Therefore, we search for those familiar words — 5 Bullets — in the small sea of text that continually churn through our inboxes each day.

“Obviously, this is not a national security issue, and I haven’t yet given serious consideration to contacting the FBI or other TLAs to report you, but I thought I should at least add my 2 cents to the conversation.”

Emily responds: Indeed, while not strictly speaking a TLA, please don’t report us to the Secret Service. (Too soon?)

At any rate, we promise to bring up “Subjectgate” at our meeting with Paradigm directors next week.

You’ll be the first to know the outcome…