Where’s My *$&%#@ Flying Car?!

![]() Where’s My *$&%#@ Flying Car?!

Where’s My *$&%#@ Flying Car?!

For the first time since Thursday, we’re going to step away from politics and/or social disorder for Bullet No. 1. You’re welcome.

For the first time since Thursday, we’re going to step away from politics and/or social disorder for Bullet No. 1. You’re welcome.

That said… the best way to get into this theme today is via an 11-word comment by Donald Trump’s running mate J.D. Vance.

Two months ago, Vance sat down for an interview with New York Times columnist Ross Douthat. During a lengthy ramble about trade and immigration, Vance made this remark in passing: “We’ve had far too little innovation over the last 40 years.”

“What was Vance thinking?” asked a colleague who is passionate about digital technology and its potential to improve our quality of life.

An excellent question. It’s especially intriguing given Vance’s background in venture capital — raising and furnishing seed money for up-and-coming entrepreneurs.

We will attempt to answer it here…

“We wanted flying cars, instead we got 140 characters.”

“We wanted flying cars, instead we got 140 characters.”

So read the subtitle of a 2011 report from Founders Fund — a venture capital firm co-founded by Peter Thiel.

(Recall this was a time when Twitter was still called Twitter and tweets were limited to 140 characters.)

The report’s thesis? Computers were getting faster, cheaper, better. But in the realm of “real stuff,” human progress was nearing a standstill.

As Thiel summed it up to an audience at Stanford University in 2012, “Whether we look at transportation, energy, commodity production, food production, agro-tech, nanotechnology — that with the exception of computers, we’ve had tremendous slowdown…

“I believe we are in a world where innovation in stuff was outlawed. It was basically outlawed in the last 40 years — part of it was environmentalism, part of it was risk aversion. And all the engineering disciplines that had to do with stuff have basically been outlawed one by one.”

Key point: After walking away from a law career, J.D. Vance was a principal at another one of Thiel’s firms, Mithril Capital, around 2016–17. Presumably he’s internalized Thiel’s lament.

Nor is Thiel alone…

“I’m not denying that the changes in digital IT over the last three decades have been breathtaking,” wrote the demographer Neil Howe, also in 2012. “They have been.”

“I’m not denying that the changes in digital IT over the last three decades have been breathtaking,” wrote the demographer Neil Howe, also in 2012. “They have been.”

But progress otherwise during his boomer lifetime, he suggested, was much slower than during the life of, say, Dwight Eisenhower, born in 1890. “When he was a child... you needed to know Morse code to communicate faster than a horse could run, and (in fact) horses were the only mode of ordinary street transport. Children routinely died from bacterial infections. And Lord Kelvin, one of the greatest scientists of that age, declared that ‘aeronautical travel’ was impossible.”

By the time Ike was president in the late ’50s, “he was inside in a Boeing 707... dictating memos on the deployment of hydrogen bombs, sugar-cube vaccines for polio and plans to put a ‘man on the moon’ while flying at 35,000 feet over a nation whose vast, affluent, homeowning, car-driving, union card-holding middle-class would have been utterly inconceivable in the presidency of William McKinley.

“Meanwhile I get up every morning and drive basically the same silly internal-combustion car that people drove 50 years ago through the same suburbs on the same interstates to the same buildings powered by the same nuclear plants and hydroelectric dams that Eisenhower’s peers saw fit to build.”

Yes, electric vehicles have become more prominent in the decade since Howe wrote that. But whether EVs represent progress in improving the everyday American’s quality of life is debatable.

And isn’t an improving standard of living the whole point?

Two of my most longtime colleagues here at Paradigm Press concur…

![]() Even Our Digital Progress Is in Danger Now

Even Our Digital Progress Is in Danger Now

“On a relative development basis, the past 30 years of evolutionary improvement in the internet pales in comparison to the material science advances of, say, the 1890–1920 era,” says Dan Amoss — senior analyst for our macroeconomics authority Jim Rickards.

“On a relative development basis, the past 30 years of evolutionary improvement in the internet pales in comparison to the material science advances of, say, the 1890–1920 era,” says Dan Amoss — senior analyst for our macroeconomics authority Jim Rickards.

“And I think the two biggest causal factors are the regulatory bureaucratic nanny/NIMBY state, and a monetary system that rewards asset inflation rather than a healthy production system where profits are an output of a healthy process — rather than setting a target and then backfilling toward profits by any means necessary.”

It’s the “any means necessary” mindset with which the late Jack Welch wrecked the storied General Electric… and which rendered Boeing incapable of building airplanes that can fly reliably.

“Much of the business history of the past 40–50 years has been asset-stripping by management teams beholden to Wall Street,” elaborates Paradigm’s energy-and-mining authority Byron King.

“Much of the business history of the past 40–50 years has been asset-stripping by management teams beholden to Wall Street,” elaborates Paradigm’s energy-and-mining authority Byron King.

You can trace it back to President Richard Nixon’s decision to cut the dollar’s final link to gold in 1971. It’s been downhill — slowly, but inexorably — ever since.

Without any gold backing for the currency, it was easy-peasy for Washington to crank out all the dollars it wanted, send them overseas and get voluminous inexpensive consumer goods in return. Such a deal!

But the result was the hollowing-out of America’s industrial capacity and the “financialization” of the economy. As the union boss Frank Sobotka summed it up during Season Two of The Wire: “We used to make s*** in this country, build s***. Now we just put our hand in the next guy’s pocket.”

Byron reminds us of the many American innovations that ended up being developed overseas instead: Kodak’s pioneering work in digital photography is the prime example but there were “myriad ideas out of Xerox, IBM and more.” Meanwhile, your typical Apple product is labeled “Designed by Apple in California. Assembled in China.” Or Vietnam or some other low-cost source of labor.

“It all comes back to the fact that it's cheaper to create ‘reserve currency dollars’ than to make real things that people want to buy,” says Byron. “And this infiltrates the entire culture. With the U.S. focus on glitz and glamour, as well as sports — and then the pugnacious military-policy approach to solving problems.

“China offers its Belt and Road project to the rest of the world — while Washington threatens to shoot cruise missiles. If we had to pay for it all in ‘real’ money, we'd do things much differently.”

Here’s the takeaway today: Even the progress that’s been made in the digital realm the last 40 years is approaching a big brick wall — two of them, actually.

Here’s the takeaway today: Even the progress that’s been made in the digital realm the last 40 years is approaching a big brick wall — two of them, actually.

The first brick wall is something we’ve been harping on all year — the prodigious demands that AI is making on an electric grid whose capacity is no greater now than it was in 2011. (Our most recent in-depth treatment was a couple weeks ago; come back tomorrow as Emily passes along some new and interesting developments.)

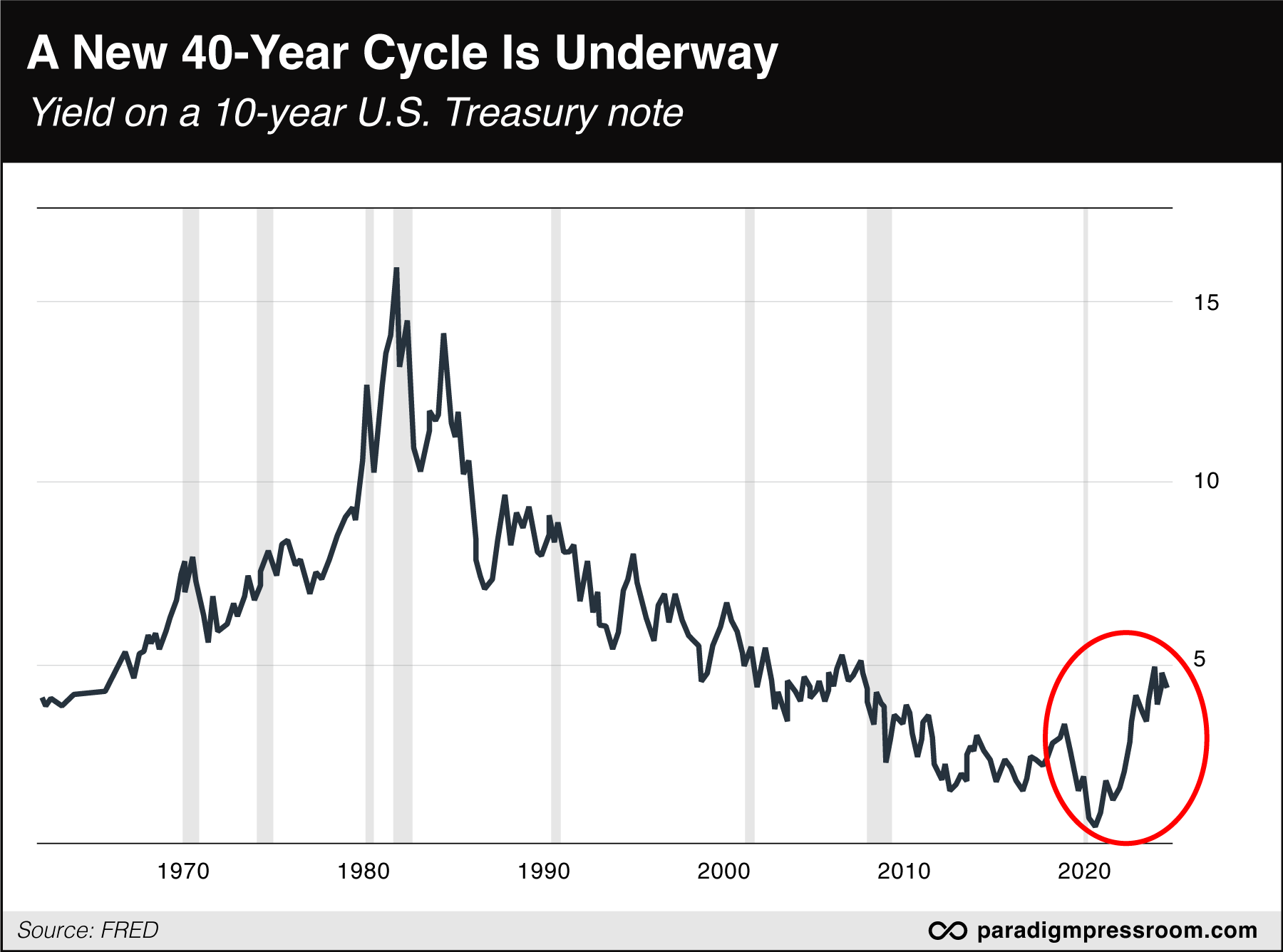

The other brick wall is the 80-year interest rate cycle — a phenomenon identified by veteran market technician Louise Yamada, among others.

It’s not exactly 40 years up and 40 years down every time — but close enough this time. You can see it on a chart of the benchmark 10-year U.S. Treasury note.

The yield peaked in September 1981 at a staggering 15.4%. It bottomed in August 2020 at a paltry 0.6%. A new 40-year cycle of generally rising rates is underway.

That’s bad news for a corporate culture that’s gotten used to steadily falling rates. Borrow money to buy a company, slash half the staff so you can service the debt, then refinance at lower rates and do it all over!

That’s been the story of the last 40 years — I saw it time and time again during my 20 years in the broadcast news biz. But those days are gone now.

Judging from that New York Times interview, J.D. Vance seems to think this state of affairs can all be fixed by slapping more tariffs on foreign goods and shutting the border to immigrants.

But as you see now, it’s far more complicated than that. If Vance doesn’t grasp it… does anyone else in Trump’s circle?

![]() Here Comes S&P 6,000

Here Comes S&P 6,000

Well — that was mighty depressing fare. You’d never guess the stock market’s at an all-time high!

Well — that was mighty depressing fare. You’d never guess the stock market’s at an all-time high!

We can’t emphasize enough that the economy and the stock market are not the same things. Maybe the economy has felt punk to you ever since the financial crisis in 2008, But at the same time, the S&P 500 has rallied from a demonic low of 666 in March 2009 to — [checking screens] — 5,593 today.

Yes, that’s a 1.3% drop from yesterday’s record close. But “I’m still looking at S&P 6,000,” Paradigm options pro Alan Knuckman told Fox Business’ Neil Cavuto yesterday. Cavuto wasn’t about to dismiss that out of hand: “You were bullish when nobody was.”

Rather than overstretched tech-adjacent names like Amazon, Alan says your best risk-reward balance can be found these days in the raw-materials sector — energy, mining, agriculture. This week alone, Alan’s Profit Wire readers bagged handsome gains from the oil-services names Schlumberger and Baker Hughes. (We’ll reopen The Profit Wire to new readers next week, so stay tuned…)

Speaking of the commodity complex, crude is rebounding hardafter the Energy Department’s weekly inventory numbers. At last check a barrel of West Texas intermediate was up $1.85 to $82.61.

Speaking of the commodity complex, crude is rebounding hardafter the Energy Department’s weekly inventory numbers. At last check a barrel of West Texas intermediate was up $1.85 to $82.61.

After flirting with all-time highs yesterday, gold is pulling back a bit — down $14 at last check to $2,453. Silver’s gotten clobbered, down more than a buck and clinging to the $30 level. The HUI gold-stock index is hanging tough, down 1.2% at 307.

Bitcoin is consolidating its recent gains at $64,370.

The economic numbers today continue to suggest “no recession yet.” The Federal Reserve reports industrial production jumped 0.6% in June, goosed by a 0.4% uptick in manufacturing. All told, 78.8% of America’s industrial capacity was in use last month — but that’s still below the long-term average going back to 1972.

Meanwhile, housing starts and permits for June rang in better than expected. But both numbers are still weak, with starts near four-year lows.

![]() Excuses, Excuses

Excuses, Excuses

OK, we can’t help but add our own cheeky take to the bribery conviction of Sen. Robert Menendez (D-New Jersey).

OK, we can’t help but add our own cheeky take to the bribery conviction of Sen. Robert Menendez (D-New Jersey).

You can read about the verdicts anywhere. But we still can’t get over the defense he tried to mount at the time of his indictment last September, when the feds said they found more than $480,000 “stuffed into envelopes and hidden in clothing, closets and a safe” at Menendez’s home.

“For 30 years,” he said, “I have withdrawn thousands of dollars in cash from my personal savings account, which I have kept for emergencies, and because of the history of my family facing confiscation in Cuba.”

Yes, of course, it’s the generational trauma every Cuban-American feels…

[U.S. Attorney photo]

As we pointed out at the time, Menendez’s family left Cuba for the United States in 1953 — six years before Castro and his commie henchmen seized control of the country.

Menendez will appeal — and while his party is abandoning him, he’s running for reelection this year as an independent. Still too soon to say good riddance to one of the Senate’s worst warmongers…

![]() Mailbag: Qualified Praise

Mailbag: Qualified Praise

“I have said this before, but it is worth repeating: Dave, you are a talented writer and purveyor of useful information!” a reader writes after yesterday’s edition.

“I have said this before, but it is worth repeating: Dave, you are a talented writer and purveyor of useful information!” a reader writes after yesterday’s edition.

[I’ve been at this long enough to anticipate the inevitable “but,” even if it doesn’t show up right away…]

“As I read your blurb about J.D. Vance I was so impressed by your recall of small, but important details that I realized two things. I offer these two insights as a cautionary compliment. First, you have a gift for finding the flaw, limitation or incongruency. As a technical writer myself, I recognize your superlative talent in this regard.

“But I believe that talent contributes to a bit of the age-old ‘forest and the trees’ conundrum. In other words, with respect to Sen. Vance, I believe you need to see the bigger picture, especially two key elements: A) no politician is going to bat a thousand on all the topics and B) the guy is 39 years old, which means many of his historic… ‘flubs’? ‘failures’? ‘flounderings’? came from when he was in his mid-30s.

“Secondly, I perceived that you fell into the trap of trying to appear ‘balanced’ by offering some positive things in contrast to your obvious criticisms. When it comes to political leaders, true balance should come from a ‘net good’ perspective, not from a quantitative assessment of individual scores.

“I think there are a ton of things to be hopeful for with Sen. Vance, but your points of concern are valid and noted. I simply would like you to criticize from more of a ‘walk in his shoes’ point of view than the critic with an impartial scorecard, like the judge of a diving competition in the Olympics.”

Dave responds: I didn’t spot this development in time for deadline yesterday… but if “fire the unvaxxed nurses” isn’t a deal-breaker (there’s evidence suggesting it was sarcasm), this should be…

“Vance’s remarks raise a few questions,” writes Daniel Larison at his Substack page called Eunomia: “why do ‘we need to do something with Iran,’ and how could it possibly be in the American interest to do more than ‘weak little bombing runs’ against them?

“If the little bombing runs are unacceptably weak, how big of a bombing campaign would Vance like to see? How many American and Iranian lives should be put at risk in the name of ‘doing something’ with Iran? Why should the U.S. be ‘punching’ Iran in the first place? What does any of this have to do with the security of the United States? I doubt Vance has good answers for any of these questions.”

And yet the front page of today’s Financial Times labels Vance an “arch-isolationist.” Amazing…