Where Are the Handcuffs? (Boeing)

![]() All Hail “Phenomenally Talented ***holes”

All Hail “Phenomenally Talented ***holes”

Upon waking, your editor was greeted by the following notification — and damn near threw the iPad across the room…

Upon waking, your editor was greeted by the following notification — and damn near threw the iPad across the room…

No, it’s not the slap-on-the-wrist punishment for two fatal crashes plus an incident that could have easily led to a third. We already knew that was coming a week ago.

Rather, it’s the nation’s leading business daily implying that Boeing’s imminent “felon” status is in some way a black eye or a stain on its reputation or — horror of horrors — a drag on the share price. It is not.

In fact, Boeing is about to join an illustrious group led by none other than JPMorgan Chase.

But we’re getting ahead of ourselves…

To no one’s surprise, Boeing accepted the “sweetheart plea deal” offered by federal prosecutors at the end of June — a $243 million fine, three years’ probation and independent safety audits.

To no one’s surprise, Boeing accepted the “sweetheart plea deal” offered by federal prosecutors at the end of June — a $243 million fine, three years’ probation and independent safety audits.

The background: In 2021, the feds were content to sign Boeing up for a “deferred prosecution agreement” — by which the firm escaped criminal fraud charges linked to the two crashes of 737 Max jets in 2018–19 that killed 346 people.

But then the fuselage blew out aboard an Alaska Airlines Boeing jet in January — not fatal at 16,000 feet, but at a higher altitude it would have been disastrous.

This spring, the feds concluded the company had violated its end of the 2021 deal. Thus, a new threat of criminal charges — which is now resolved with this plea agreement.

Assuming a federal judge signs off on the agreement, Boeing’s monetary penalty will amount to about 13% of its profit during the first quarter of this year.

The words “sweetheart plea deal” are those of the lawyer representing the families of the people who died in those two crashes.

As you’ve surely noticed from what you just read, no one is going to federal “PMITA” prison for what happened.

As you’ve surely noticed from what you just read, no one is going to federal “PMITA” prison for what happened.

We suspected as much in 2019 — a few months after those fatal crashes — when the aforementioned Wall Street Journal published a story saying the feds had a steep climb pursuing a criminal case against Boeing.

“A corporate indictment and potentially huge sanctions,” said the paper, “must be balanced against the economic and national-security risks of incapacitating the country’s second-biggest defense contractor behind Lockheed Martin Corp.”

We’ll come back to this “too big to jail” notion in a moment…

But first, it’s worth noting that the military side of Boeing’s business shoulders much of the blame for the company’s troubles with commercial aircraft.

But first, it’s worth noting that the military side of Boeing’s business shoulders much of the blame for the company’s troubles with commercial aircraft.

There was a time when Boeing strictly segregated the military and civilian sides of the company.

As Andrew Cockburn wrote for Harper’s in 2019, “Senior management reportedly enforced an unwritten rule that managers from the defense side should never be transferred to the civilian arm, lest they infect it with their culture of cost overruns, schedule slippage and risky or unfeasible technical initiatives.”

That division was swept away when Boeing merged with McDonnell Douglas in 1997 and McDonnell’s CEO later took over the combined company.

By 2005, the board handed the CEO job to James McNerney. McNerney came over from 3M, where he purged veteran managers who “overvalued experience and undervalued leadership.”

Ah yes, leadership. McNerney was a protege of General Electric’s Jack Welch. It was under Welch’s leadership that GE was transformed from an industrial powerhouse into a company driven mostly by “financial engineering.” (Now Welch is dead and GE is a shadow of its former self.)

In a bootlicking biography published in 2008, McNerney made no secret of his contempt for the Boeing engineers and machinists who cared more about the soundness of their aircraft than about the share price of their employer.

“Phenomenally talented ***holes,” he called them — and his lackeys made their lives hard enough that many of them quit in disgust. (I knew a handful of such folks over 30 years ago who worked for Boeing. Wonder what happened to them…)

![]() Boeing and the Big Banks

Boeing and the Big Banks

As I suspected five years ago, Boeing’s defense contractor status puts it in the same position as the big banks — “too big to jail.”

As I suspected five years ago, Boeing’s defense contractor status puts it in the same position as the big banks — “too big to jail.”

The big banks were so huge and systemically important that during the 2008 financial crisis, the government insisted they must get a taxpayer bailout. “Too big to fail,” was the expression back then.

“Too big to jail“ came into the picture a few years later, when Barack Obama’s attorney general Eric Holder was asked why no criminal cases were brought against the banks for obvious fraud.

"I am concerned,” he replied, “that the size of some of these institutions becomes so large that it does become difficult for us to prosecute them when we are hit with indications that if you do prosecute, if you do bring a criminal charge, it will have a negative impact on the national economy, perhaps even the world economy."

That was in 2013 — by which time JPMorgan Chase had been fined $8 billion in the previous three years. Money manager and blogger Barry Ritholtz labeled JPM CEO Jamie Dimon as "Fortress Dimon" — playing off Dimon's infamous assertion that JPM possessed a "fortress balance sheet."

"Its walls are made of lawyers, and its moat is made of burning money,” said Ritholtz. “Something is wrong with a board of directors that tolerates this sort of egregious incompetency and/or rampant illegality."

And those were just civil fines. The following year, 2014, JPM began to rack up five felony convictions.

And those were just civil fines. The following year, 2014, JPM began to rack up five felony convictions.

That’s right, JPM admitted to five felony counts between 2014–2020 — everything from manipulating the price of precious metals to JPM’s shady dealings with the notorious fraudster Bernie Madoff.

As Pam Martens and Russ Martens pointed out at Wall Street On Parade, those five felonies were five more than the bank pleaded guilty to in the preceding 100 years.

But Dimon, now 68, is still on the job and appears likely to stick it out at least a couple more years.

Damn, it feels good to be a bankster…

For all the fines and felony pleas, the board is happy to keep him around as long as he wants — and why not? JPM’s share price is up 270% since the first of those felony pleas a decade ago, spanking the S&P 500’s 185% gain and crushing the KBW Bank Index’s rise of only 50%.

And Boeing’s CEO, you wonder?

And Boeing’s CEO, you wonder?

Dave Calhoun took the job in early 2020, on the heels of the two fatal crashes. But after the Alaska Airlines near-disaster in January, his credibility was shot. In March, he said he’d be stepping down. Remarkably, the board is A-OK with him staying on through the end of this year. Accountability.

Perhaps Calhoun’s fate would be different if Boeing’s share price had fared better than JPM’s. But BA trades this morning for $188 — no better than it did in 2017.

Two more thoughts before we move on to the markets and the mailbag…

Two more thoughts before we move on to the markets and the mailbag…

First, here’s what’s probably an incomplete Wikipedia list of companies convicted of felony offenses in the United States.

Second, when a culture of corruption is as deeply rooted as this — how much difference does it make, really, who sits in the White House come January 2025?

![]() Earnings Season: Watch for an Impending Market Shift

Earnings Season: Watch for an Impending Market Shift

As if to add insult to injury, Dimon’s mug turned up when I opened the Financial Times’ iPad app this morning.

As if to add insult to injury, Dimon’s mug turned up when I opened the Financial Times’ iPad app this morning.

“Analysts expect investment banking revenues at JPMorgan Chase, Goldman Sachs, Morgan Stanley, Bank of America and Citigroup will on average rise more than 30% from a year earlier during the second quarter,” says the salmon-colored rag, citing Bloomberg estimates.

That said, “rising defaults are expected to contribute to muted earnings growth for many of the largest U.S. lenders this quarter.”

JPM will start a new earnings season on Friday — an earnings season that could trigger a market shift for the second half of the year.

JPM will start a new earnings season on Friday — an earnings season that could trigger a market shift for the second half of the year.

“The biggest story of the year has been the dominance of mega-cap tech stocks, particularly Nvidia, in driving gains in the broad market,” Paradigm income-investing pro Zach Scheidt reminds us.

“While the S&P 500 has hit new highs in the first half of the year, there's a significant disconnect between these top performers and the rest of the market. Consider this: Of the Russell 1000 stocks, representing the thousand largest U.S. companies, only 35% were up last quarter…

“A top-heavy market like the one we have now presents both risks and opportunities.

If anything happens to shake confidence in these leading stocks, we could see the overall market trade lower. But for disciplined and diversified traders, there's a chance to sidestep this risk while staying invested in resilient areas of the market.”

If the biggest tech-adjacent names issue a cautious outlook for the second half — most of them report late this month or early next — Zach says you should expect a rotation elsewhere.

“Specifically, I’m looking at opportunities in energy,” he tells Lifetime Income Report readers. “Crude oil prices have been constructive recently, and energy stocks appear undervalued compared to the commodity's price advance.

“Another area I’m watching is utilities. Once considered ‘orphan and widow’ stocks for their stability, utilities now offer both safety and growth potential” — in large part because of AI’s prodigious electricity demand. (More about that tomorrow…)

Speaking of energy, oil prices are pulling back this morning from multimonth highs — a barrel of West Texas Intermediate now $82.47.

Speaking of energy, oil prices are pulling back this morning from multimonth highs — a barrel of West Texas Intermediate now $82.47.

Precious metals are getting pounded for no obvious reason — gold down nearly $35 to $2,353 and silver down 49 cents to $30.57. Bitcoin can’t catch a break, now under $56,000.

As for stocks, the major indexes are nearly ruler-flat. At 5,566, the S&P 500 is down one slender point from Friday’s record close.

![]() Jobs: Less Than Meets the Eye

Jobs: Less Than Meets the Eye

Because we were in holiday mode on Friday, let’s quickly catch up on some of the interesting nuggets buried in the June job numbers.

Because we were in holiday mode on Friday, let’s quickly catch up on some of the interesting nuggets buried in the June job numbers.

The headline number — 206,000 new jobs, allegedly — is doing nothing to alter Mr. Market’s calculus about the prospect of interest rate cuts at the Federal Reserve. If current trading in the futures market is any indication, the first cut will come in mid-September.

The official unemployment rate crept up to 4.1%. Don’t look now, but it’s been creeping higher from 3.4% over the last 15 months.

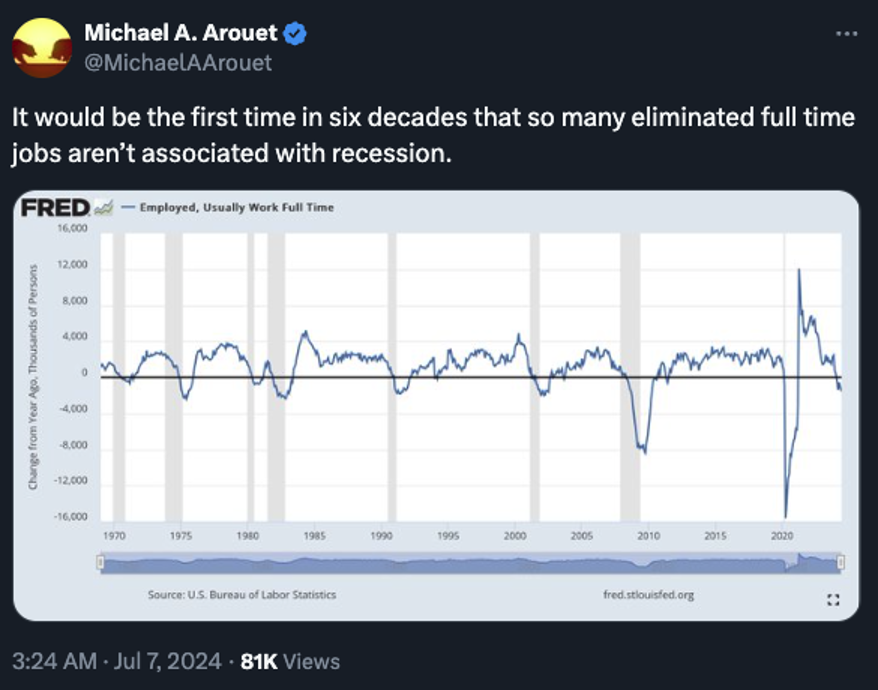

And if you’re looking for signs of an impending recession, they can be found in the number of full-time positions that are being cut…

For sure, the labor market is cooling, judging by how the May and April estimates of new jobs were revised downward.

Fully 110,000 jobs the statisticians thought were created in those two months? Well, that was just their statistical inference at the time, and now more data has come in. So there.

![]() Mailbag: Brickbats and Bouquets

Mailbag: Brickbats and Bouquets

Also, while we’re in catch-up mode from a holiday break, we heard from a semiregular critic…

Also, while we’re in catch-up mode from a holiday break, we heard from a semiregular critic…

“And, as if on cue, you once again chose your leadoff story to be a political hack job,” he replies to last Monday’s edition. “ I guess you couldn't pass up the opportunity to jump on the right-wing bandwagon to chew up Biden and the Democrats.

“No mention of Trump's nonstop lies during the debate. No mention of Trump's history of two impeachments, felony convictions and multiple unforgivable crimes against our country. Your claim to fairness falls flat to any educated reader, no matter left or right. We all recognize a hack job when we read it.

“Lucky for us, you were able to transition into the economic news that makes your newsletter worthwhile to read. Most of us are capable of recognizing biased reporting when we see it. Those who don't already belong to the cult and are hopeless anyway.”

Dave responds: It’s undeniable that Biden’s decrepitude overshadowed Trump’s loose acquaintance with the truth.

But c’mon — which is the bigger story? Even the mainstream could no longer overlook it after doing so for close to five years.

Of course, the mainstream focus is on “Should he run for another term?” and not on “Is he qualified to be in office now?” That was my point last week, and remains so now.

In any event, I don’t get either the hostility or the hero worship accorded to Trump. I truly don’t. After all, the guy has a track record in the office on which he can be evaluated.

And the record is — pretty much what you would have gotten from a more conventional Republican. A ginormous tax cut with no spending cuts to offset it… a mixed bag of Supreme Court justices… COVID lockdowns and a jab that failed to deliver on its major promises (and for which he still takes credit!).

How would any of this have been different if the GOP donor class got their wish in 2016 and Jeb Bush became president?

Jeb!

Jeb!

Meanwhile, some praise came in over the transom after our video edition on Friday…

Meanwhile, some praise came in over the transom after our video edition on Friday…

“Dave, really great to see you in that interview, to get more of a sense of you as a human being.

Thoughtful and informed as always, I wouldn't have expected otherwise.

“In re this post-debate brouhaha, Taibbi used a wrestling term that was new to me: kayfabe. One can't help but wonder to what extent that is going on.

“I think you could make a real contribution on podcasts, and there may be a need for an informed libertarian journalist perspective in that milieu.”

And one other email from a reader who watched: “DAVE GONIGAM FOR PRESIDENT.”

Dave: Puh-leez…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets