“2024 Is… Beyond Recovery”

![]() Wait a Minute, He’s the President NOW

Wait a Minute, He’s the President NOW

Amid all the speculation, hand-wringing and crepe-hanging about whether Joe Biden will stick it out through Election Day… isn’t there something, uhhh, more important?

Amid all the speculation, hand-wringing and crepe-hanging about whether Joe Biden will stick it out through Election Day… isn’t there something, uhhh, more important?

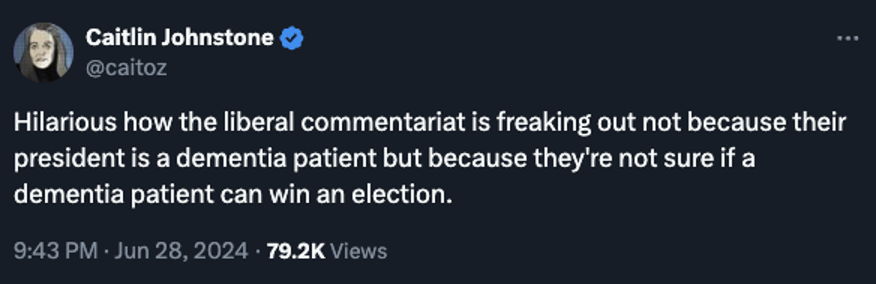

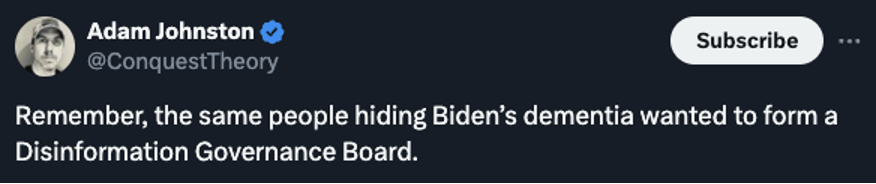

“Everyone’s talking about whether Biden can assure American voters that he has what it takes to be president,” writes the sardonic Australian commentator Caitlin Johnstone, “and nobody seems all that concerned about the fact that he is already president and will remain so for half a year.”

Right, and at a time Biden’s administration is supplying weapons for Israel’s assault on Gaza and waging a proxy war against nuclear-armed Russia. What could go wrong?

Right, and at a time Biden’s administration is supplying weapons for Israel’s assault on Gaza and waging a proxy war against nuclear-armed Russia. What could go wrong?

“Biden’s drift into blankness has been ongoing for months,” writes the veteran investigative journalist Seymour Hersh, “as he and his foreign policy aides have been urging a ceasefire that will not happen in Gaza while continuing to supply the weapons that make a ceasefire less likely. There’s a similar paradox in Ukraine, where Biden has been financing a war that cannot be won and refusing to participate in negotiations that could end the slaughter.

“The reality behind all of this, as I’ve been told for months, is that the president is simply no longer there, in terms of understanding the contradictions of the policies he and his foreign policy advisers have been carrying out.”

[Sidebar: At 86, Hersh is 5½ years Biden’s senior — and still sharp as a tack.]

With the debate debacle now more than 72 hours in the rear-view, it’s hard to imagine Biden withdrawing from the race — at least at this moment.

With the debate debacle now more than 72 hours in the rear-view, it’s hard to imagine Biden withdrawing from the race — at least at this moment.

It’s still entirely possible; Richard Nixon’s resignation 50 years ago came only hours after his aides continued to deny it would happen.

But such a step would be “fundamentally humiliating” for Biden, writes the independent political reporter Michael Tracey. “To suddenly end his campaign under duress would place him in a unique category of presidential downfalls.”

For sure: Lyndon Johnson was at severe risk of losing his party’s nomination when he quit in 1968. Biden, on the other hand, had powerful allies who made certain he would sail to the nomination unchallenged. For Biden to quit now would “inevitably invite comparisons not just to LBJ, but Nixon.”

Privately, top Democrats are already conceding the 2024 race. One of Hersh’s sources — a “longtime contributor” to the party — puts it like this: “Accept reality... 2024 is likely beyond recovery at this point. Too steep a hill to climb. Plan and execute a long-term plan to counter Mr. Orange and build a moderate platform for the recovery... and let Biden wander off to the Jersey Pine Barrens.”

“Biden is done,” says Paradigm’s macroeconomics maven Jim Rickards.

“Biden is done,” says Paradigm’s macroeconomics maven Jim Rickards.

“It remains to be seen if the Democrats will stumble to Election Day with a mentally and physically failing phantom or will move quickly to substitute a new candidate. That’s up to Democrats.”

The prediction markets have swung strongly toward Donald Trump since Thursday night.

Of course, much can happen — and almost surely will — between now and Election Day. But Jim says it’s not too soon to contemplate the investment implications of a second Trump term.

Specifically he’s thinking about something he calls Trump’s “trillion-dollar checkbook.”

“I believe it could be the catalyst to the single biggest moneymaking opportunity in decades,” he says.

Jim recently joined forces with our partners at Next Phase Media to bring this opportunity to the attention of as many people as possible. Follow this link for a strategy that could pay off big even before Election Day.

One more thought before we move on…

One more thought before we move on…

![]() Boeing: Just Like the Big Banks

Boeing: Just Like the Big Banks

Apparently the feds really do look upon Boeing as “too big to jail.”

Apparently the feds really do look upon Boeing as “too big to jail.”

Last month we bruited the possibility that the feds would come down so hard on Boeing in the wake of two fatal crashes that the company might be driven into bankruptcy.

But owing to its status as a Pentagon contractor, Boeing has the same get-out-of-jail-free card that the big banks do: Yesterday, news broke that federal prosecutors will propose a plea bargain to Boeing — a $243 million fine, three years’ probation and independent safety audits.

That would be Boeing’s punishment not for the two 737 Max crashes in 2018–19… but for violating the “deferred prosecution agreement” by which Boeing escaped criminal fraud charges linked to those crashes in 2021.

The company has until the end of the week to accept the deal or go to court.

But it’s hard to imagine Boeing turning the deal down: As often happens with the big banks, the fine amounts to a cost-of-doing-business penalty — roughly 13% of its profit during the first quarter of this year.

It’s a “sweetheart plea deal,” says Paul Cassell, a lawyer representing the victims’ families. “The memory of 346 innocents killed by Boeing demands more justice than this," Cassell tells the BBC.

Hours after the leak about the plea bargain yesterday came word that Boeing has finalized a deal to buy Spirit AeroSystems — a contractor it spun off two decades ago. It’s Spirit that made the fuselage that blew out aboard an Alaska Airlines Boeing jet in January, prompting the feds to declare that Boeing had violated the terms of its 2021 probation.

You can’t make this stuff up.

Amid all the sound and fury, BA’s share price is up 2.2% on the day. Spirit (SPR) is up 2.5%.

As for the broad stock market, it’s opening the second half of the year flat.

As for the broad stock market, it’s opening the second half of the year flat.

Among the major indexes, it’s the Nasdaq up the most — just under a third of a percent at 17,789. The S&P 500 is up less than a point at 5,461. The Dow is up a tenth of a percent at 39,154. Mr. Market seems little moved one way or another by the Supreme Court’s Trump immunity ruling.

Precious metals are also little moved, gold at $2,327 and silver at $29.23.

The big mover in the commodity complex is crude — up $1.36 and now just a dime shy of $83. That’s the highest since late April. Next target? $88 says colleague Sean Ring in his first-of-the-month outlook at the Rude Awakening.

But for maximum potential, Sean sees Bitcoin reaching $100,000 by year-end 2025. Checking our screens this morning, it’s a hair under $63,000.

The big economic number of the day is the ISM Manufacturing Index, which comes in below expectations at 48.5. Any reading under 50 suggests a shrinking factory sector; this is the third-straight sub-50 reading, and the 20th in the last 21 months. Higher interest rates continue to bite, making companies gun-shy about investing in new capacity.

![]() China Tightens Grip on Rare Earths

China Tightens Grip on Rare Earths

For the record: The Chinese government is tightening its control over rare earth elements.

For the record: The Chinese government is tightening its control over rare earth elements.

For years, Paradigm’s resident geologist Byron King has kept our readers ahead of the curve when it comes to this obscure but critical class of minerals — used in everything from your smartphone to hybrid car batteries to guided missile systems.

Over the weekend, China’s State Council rolled out a series of new rare-earth regulations — among other things, making clear that Chinese rare earths belong to the state.

“From Oct. 1, when the rules come into force, the government will operate a rare earth traceability database to ensure it can control the extraction, use and export of the metals,” reports Politico.

That’s a big deal in light of China controlling 60% of global rare-earth production — and 90% of global rare-earth processing. (Even the rare earths that are mined in the United States have to be sent to the Middle Kingdom for refining.) Supply-chain snarls for batteries and electronics production could be a real threat — to say nothing of the military’s reliance on rare earths for advanced weapons and optics.

Politico doesn’t say so, but the move sure looks like retaliation for the Biden administration’s new tariffs and restrictions targeting Chinese technology and electric vehicles.

And given Trump’s trade-warrior mentality, don’t expect that to change with a change of administration. We’ll continue to stay on top of the story…

![]() A Short History of the Barcode Scanner

A Short History of the Barcode Scanner

We’re a few days late marking the 50th anniversary of the first time a retail barcode was scanned.

We’re a few days late marking the 50th anniversary of the first time a retail barcode was scanned.

According to a Smithsonian article published nearly a decade ago, the first scan took place June 26, 1974, at Marsh Supermarket in Troy, Ohio — about 20 miles north of Dayton.

Store executive Clyde Dawson arranged a media stunt in which he reached into his shopping basket and pulled out a 10-pack of Wrigley’s Juicy Fruit gum…

The first bar-coded item to be scanned, 50 years ago this summer [Mars Wrigley photo]

“Dawson explained later that this was not a lucky dip,” said Smithsonian: “he chose it because nobody had been sure that a barcode could be printed on something as small as a pack of chewing gum, and Wrigley had found a solution to the problem. Their ample reward was a place in American history.”

Presumably the barcode was on the back of that top portion of the package?

Anyway, now you know.

Of course, no discussion of barcodes would be complete without another blast from the past. And here, we’re compelled to engage in some myth-busting…

Of course, no discussion of barcodes would be complete without another blast from the past. And here, we’re compelled to engage in some myth-busting…

As the legend goes, President George H.W. Bush was floored by the sight of a barcode scanner at a grocers’ convention in Florida. “Amazing,” he remarked.

This was early 1992; the recovery from the 1990–91 recession was moving slowly and Bush’s bid for reelection was on the ropes. The New York Times’ front-page spin — “Bush Encounters the Supermarket, Amazed” — conveyed the impression that it was the first time he’d ever seen the technology and he was sorely out of touch with everyday Americans.

But as The Associated Press acknowledges, “Reporters later learned that it was a special scanner with advanced features, including a scale to weigh produce — uncommon then — and the ability to read barcodes even if they were torn up and jumbled.”

That’s what prompted the “amazing” remark. The AP did a follow-up story a few days later, including interviews with the executive who demoed the scanner to Bush as well as White House press secretary Marlin Fitzwater.

But the narrative had taken hold. It was powerful and long-lasting. Even your editor, who was working in the news business at the time, was unaware of this backstory until now.

Consider it an object lesson in confirmation bias — a topic we had occasion to explore just two weeks ago.

Of course, Poppy was still a patrician tool — but it seems he did know what a barcode scanner was!

![]() Mailbag: Censorship, Chip Dip and Crypto

Mailbag: Censorship, Chip Dip and Crypto

On the subject of the Supreme Court’s cowardly approach to the internet censorship issue — spotlighted in last Thursday’s edition — a reader writes…

On the subject of the Supreme Court’s cowardly approach to the internet censorship issue — spotlighted in last Thursday’s edition — a reader writes…

“I think the Founders erred in not giving the third coequal branch of government sufficient powers and enforcement mechanisms.

“This notion of ‘standing’ for example seems totally out of place in my opinion for this level.

SCOTUS should be empowered to correct a clearly unconstitutional act or legislation when they notice one. Example: Biden's student loan forgiveness, opening the border without congressional approval and others.”

As for the Farm Bureau Federation’s lowball estimate for the cost of an Independence Day feast — featured on Friday — we got one hot take…

As for the Farm Bureau Federation’s lowball estimate for the cost of an Independence Day feast — featured on Friday — we got one hot take…

“The Farm Bureau forgot the chip dip! That is blasphemous!”

“Do you have any at all recommendations on buying crypto?” writes our final correspondent today. “And if so, what do you think about the Ocean/Fet merger to ASI coin?”

“Do you have any at all recommendations on buying crypto?” writes our final correspondent today. “And if so, what do you think about the Ocean/Fet merger to ASI coin?”

Dave responds: Well, you’ve come to the right place. After all, Paradigm’s James Altucher was talking up Bitcoin in 2013 when it was still $114. And our resident crypto analyst Chris Campbell has also been following the space for more than a decade.

For crypto newcomers, we recommend starting with Altucher’s Investment Network. But it sounds as if you have some familiarity with the space — and for more experienced crypto hands, Altucher’s Early-Stage Crypto Investor is the way to go. (And Chris had some ASI commentary in his regular Friday update.)

Either way, you couldn’t be in better hands — good luck!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets