The $2,500 Gold Forecast

![]() “The Ultimate Trade: Second Half of 2024”

“The Ultimate Trade: Second Half of 2024”

This year, Gold’s been a standout performer in the global asset market, consistently breaking price records and attracting headline attention.

This year, Gold’s been a standout performer in the global asset market, consistently breaking price records and attracting headline attention.

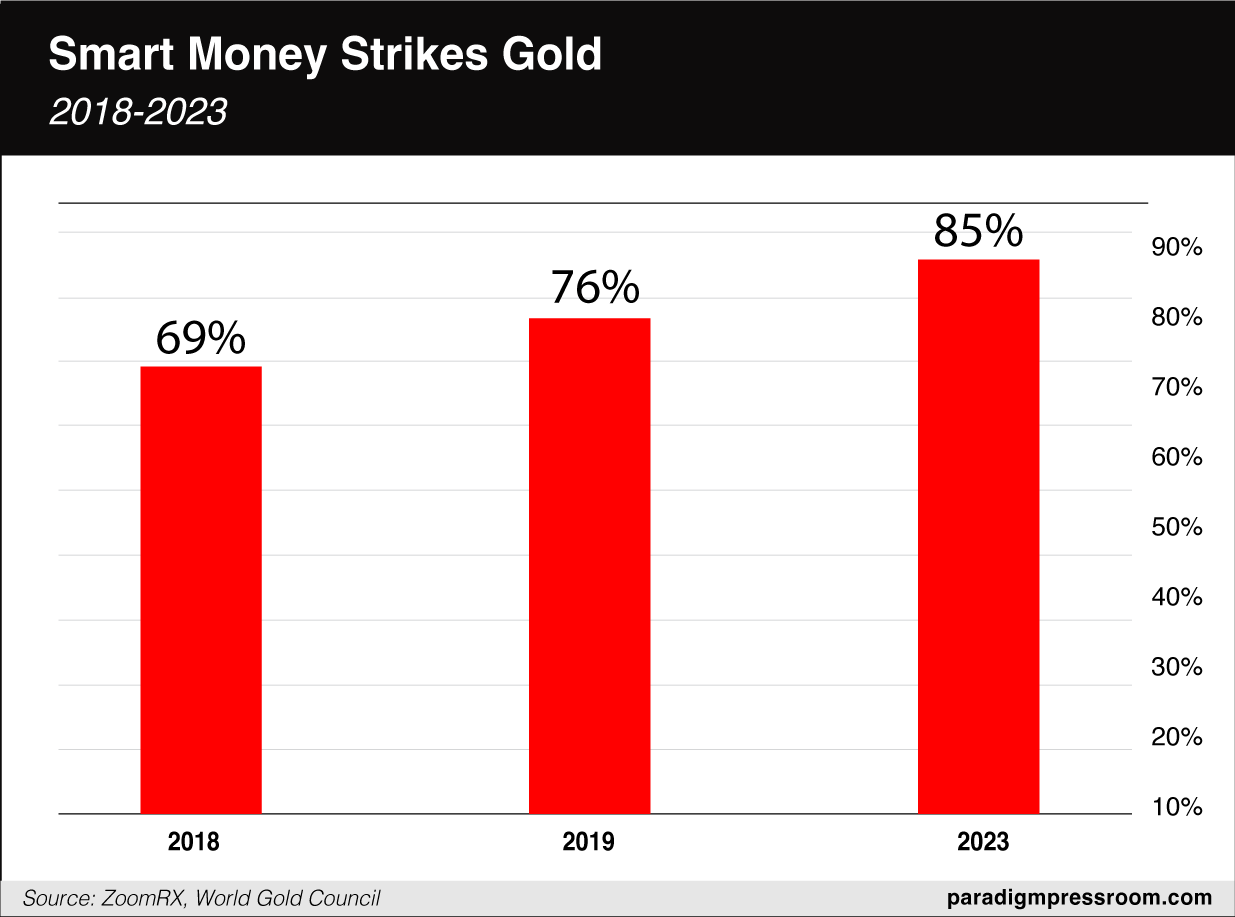

A recent World Gold Council survey of 525 North American professional investors — “a mix of large institutions, consultants and financial advisers” — confirms their clients’ gold-related investments have increased over five years.

“A staggering 85% reported an allocation to some type of gold investment, up from 69% in 2018 and 76% in 2019,” says a World Gold Council article.

“At face value this may seem a surprisingly high percentage. [Delving] deeper into the data reveals that just over a quarter of respondents hold only very small (<1% AUM) gold allocations,” the article continues.

“But it was particularly interesting to see that more than half held at least 1% of AUM in gold, with 24% having an allocation of 3% or more.”

(Of course, this allocation still misses the mark: Paradigm’s macro expert Jim Rickards has long advocated for 10% of a healthy portfolio allocated to precious metals.)

When asked what motivates professional investors to invest — or increase their current gold holdings — respondents cited gold's long-standing history as an effective tool against inflation. To wit?

When asked what motivates professional investors to invest — or increase their current gold holdings — respondents cited gold's long-standing history as an effective tool against inflation. To wit?

“While investors waited for U.S. inflation data for fresh clues on the Federal Reserve's interest rate stance, gold prices edged up on Friday and were poised for a third-straight quarterly rise,” Reuters says today. (More on May’s PCE inflation report in a moment.)

The price of gold, in fact, increased 4% during Q2 this year.

“Gold has so far managed to hold firm with the current consolidating phase being so shallow that hedge funds who bought into the rally back in February and March have yet to be challenged,” says Saxo Bank’s commodity strategist Ole Hansen.

“As long as the metal holds above $2,200, I see no major risk of a forced long-liquidation phase emerging. Incoming data will be key,” he adds.

“Overall I see no reason why gold cannot reach $2,500 before year end.”

“Which brings me to what I call The Ultimate Gold Trade,” says Paradigm’s commodities pro Alan Knuckman.

“Which brings me to what I call The Ultimate Gold Trade,” says Paradigm’s commodities pro Alan Knuckman.

“As you know, gold recently broke out of the $2,000 level for the first time ever this year, and recently traded for as high as $2,450 per ounce.

“Despite gold’s all-time highs, gold mining stocks are nowhere CLOSE to their all-time highs.

“In fact, gold miners are trading at their cheapest levels relative to the price of gold in 25 years.

“Miners simply can’t mine enough gold to keep up with demand,” says Alan.

“But one miner has been performing remarkably well over the last year:

- It’s made key acquisitions and is investing in production

- Its free cash flow nearly doubled

- All around, it’s an extremely well-run company.

“This is setting up,” Alan says, “for the ultimate trade for the second half of 2024 — and beyond.”

As you’ve just read, Alan is very focused on a single lucrative gold trade… that has 5,000% upside over the next six–nine months. Click here now for THE gold story of 2024 — as told by Paradigm’s macro expert Jim Rickards. Please note: This offer closes at midnight.

![]() Recession Has Been Canceled?

Recession Has Been Canceled?

The Federal Reserve’s preferred inflation measure shows the annual inflation rate is the lowest since March 2021.

The Federal Reserve’s preferred inflation measure shows the annual inflation rate is the lowest since March 2021.

The Commerce Department issued its read on “core PCE” this morning. By this yardstick, consumer prices rose 0.1% in May — compared with 0.2% in April — which aligns with economists’ expectations.

While inflation, by the Fed’s estimation, is moving in the right direction, we’ll see if a couple months constitute a real downward trend. This Twitter/X satirist… thinks so?

Meanwhile, year-over-year core PCE is running 2.6% — still more than the Fed’s 2% inflation target.

“Did the DNC and CNN plan on making Biden look awful, and maybe they even alert Trump about it?” asks our colleague Sean Ring at The Rude Awakening this morning.

“Did the DNC and CNN plan on making Biden look awful, and maybe they even alert Trump about it?” asks our colleague Sean Ring at The Rude Awakening this morning.

Suffice it to say, the presidential debate last night was the fecal storm we all expected; if you want the highlights (er, lowlights), Sean does a more than credible job.

The markets, however, are holding up today — mostly. As for stocks, all three major U.S. indexes are in the green, with the S&P and DJIA gaining about 0.10% to 5,485 and 39,200 respectively. Meanwhile the tech-heavy Nasdaq has gained a fraction of a percent to 17,865.

Turning to the commodities complex, crude is down 0.30% to $81.50 for a barrel of West Texas Intermediate. At the same time, precious metals are rallying: Gold is up 0.25% to $2,342.70 per ounce while silver is up 1.10%, about 50 cents under $30.

Crypto, on the other hand, is getting taken to the woodshed. Bitcoin’s down 0.85%, under $61,000, and Ethereum’s flagging 1.45% to $3,395.

For more on the crypto, read on…

![]() From FEAR to FOMO

From FEAR to FOMO

“Despite all the bullish catalysts, crypto traders have been scratching their heads since early June, watching three things happen,” notes Paradigm’s crypto expert Chris Campbell.

“Despite all the bullish catalysts, crypto traders have been scratching their heads since early June, watching three things happen,” notes Paradigm’s crypto expert Chris Campbell.

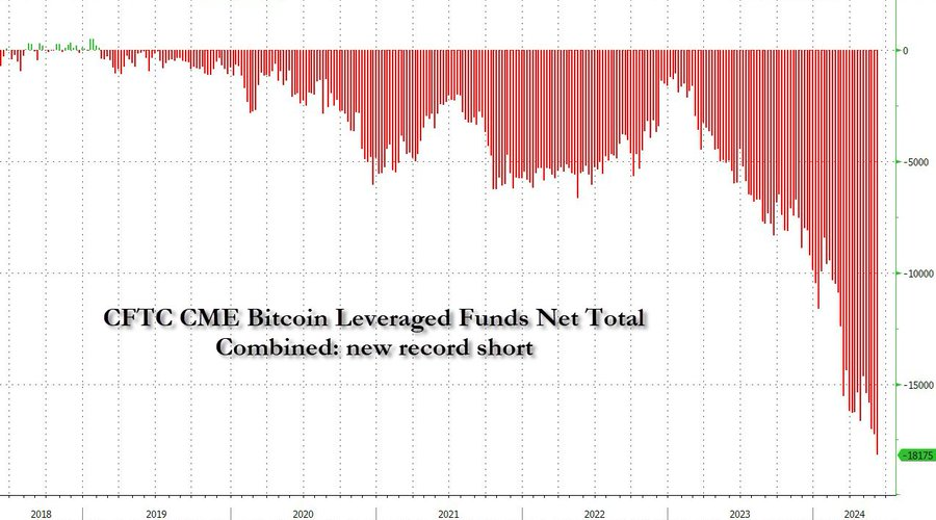

- Reports of record short positions in Bitcoin futures

- Reports of record outflows of Bitcoin

- Bitcoin’s downsloping chop, despite all of the seemingly bullish catalysts.

“Earlier this month, for example, Zero Hedge posted this chart, revealing Bitcoin hedge fund net shorts…

Source: Zero Hedge

“Many interpreted this as institutions being mega-bearish on Bitcoin,” says Chris.

“Wrong,” he says. “Institutions were just taking both sides.

“The ‘cash and carry trade’ is a common practice in futures and more recently crypto markets. It involves buying Bitcoin in the spot market (buying the actual Bitcoin now) and selling futures contracts (agreeing to sell Bitcoin at a future date for a set price).

“It's like buying apples today for $1 each and agreeing to sell them in six months for $1.10 each, guaranteeing a profit of $0.10 per apple.

“It's as close to a riskless profit as one can get in crypto (barring any unforeseen counterparty risks, of course),” Chris says.

“By being long on the spot market and short on futures, traders are not affected by Bitcoin price changes.

“In theory, this trade is supposed to be neutral. In practice, it can cause downward pressure,” Chris notes.

“In theory, this trade is supposed to be neutral. In practice, it can cause downward pressure,” Chris notes.

“When traders want to unwind this trade, they must sell the spot ETFs and long the futures. Spot and ETF markets are much smaller than futures markets, and are more sensitive.

“This can then lead to a chain reaction where the basis (price difference) collapses, leading to more selling.

“This can also cause FEAR,” says Chris.

“It seems we’re starting to see a bit of that. Funding rates are down, making this ‘cash and carry trade’ less attractive. Also, ETF volumes are low, making it harder for the market to absorb large sell orders.”

Chris’ takeaway: “Don’t panic… The overall trend remains bullish… A storm is swelling to the upside…

“Bitcoin fell from $72,000 to [checks price] a little over $60,000,” he says. “Can it go lower? Of course.

“But it can also go higher — a lot higher,” he says. “And if it repeats past post-halving runs, we’re looking at prices that will shock even ardent critics into FOMO.”

![]() Not Just for Hollywood (GLP-1s)

Not Just for Hollywood (GLP-1s)

“What areas of biotech do you see the most opportunity in right now?” a reader asks Paradigm’s science-and-technology expert Ray Blanco.

“What areas of biotech do you see the most opportunity in right now?” a reader asks Paradigm’s science-and-technology expert Ray Blanco.

“Biotech is one of my favorite areas of the market, so there’s plenty to talk about,” Ray responds.

“For one thing, the obesity space is booming right now. You've got companies like Novo Nordisk and Eli Lilly leading the way with drugs like semaglutide (Wegovy) and tirzepatide.

“These GLP-1 drugs for metabolic conditions and obesity are in such high demand that there are shortages because they can't make enough of them,” says Ray. “And we're just scratching the surface.

“Goldman Sachs estimates getting more people on these drugs could boost GDP by a trillion dollars from increased productivity.

“While the GLP-1s have been successful, it's not just about weight loss either…

- The cardiovascular benefits of these drugs are stunning, showing a 20–25% reduction in major adverse cardiac events

- They may even have applications in Alzheimer's and cancer down the road from their anti-inflammatory effects.

“The opportunities are endless when it comes to targeting metabolism,” he says.

“Just last week we added two companies to our Technology Profits Confidential portfolio that are revolutionizing the way we treat metabolic disorders,” Ray says.

At present, Ray’s paid service isn’t open to new subscribers, but we’ll let you know when it reopens…

![]() The Stingiest BBQ Ever

The Stingiest BBQ Ever

This will probably come as no surprise, but the cost of your Fourth of July cookout will break records this year.

This will probably come as no surprise, but the cost of your Fourth of July cookout will break records this year.

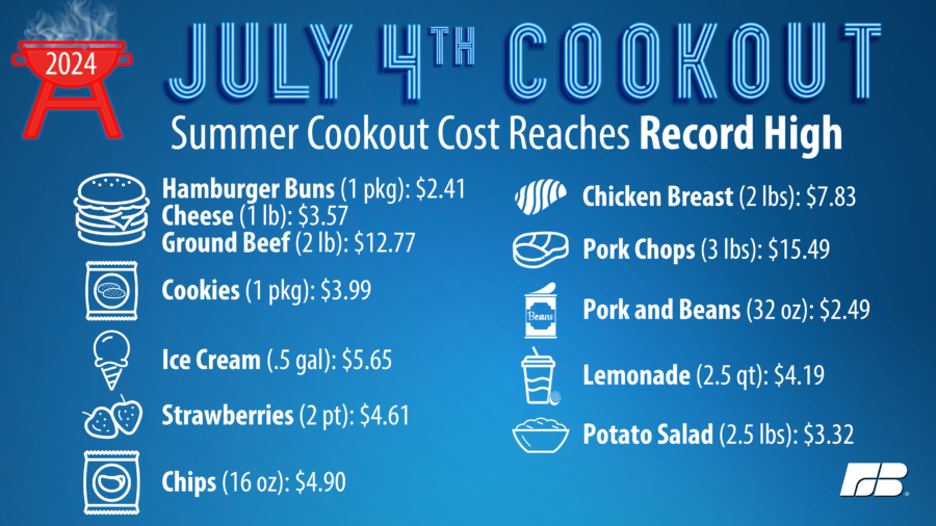

“Volunteers from across the United States contributed to this year’s American Farm Bureau Fourth of July market basket survey to determine the average cost of summer cookout staples,” the Farm Bureau says.

On the menu? Volunteers shopped for all the ingredients to make a “homemade cookout consisting of cheeseburgers, chicken breasts, pork chops, potato chips, pork and beans, fresh strawberries, homemade potato salad, fresh-squeezed lemonade, chocolate chip cookies and ice cream.

“With plenty of options to feed a hungry crowd, a group of 10 this year can expect to pay…

“… $71.22 for their celebration,” the survey concludes, “up 5% from last year and up 30% from five years ago.” In fact, only the cost of two menu items — chicken and potato salad — will decrease this year.

“Depending on where you live, your grocery prices may differ from these national averages,” the Farm Bureau says.

(We live on planet EARTH, Farm Bureau. Where exactly do you live?)

“Those in the Northeast will feed a hungry crowd of 10 for the low of $63.54. Southerners and Midwesterners will spend an average of $68.33 and $68.26, respectively. Unfortunately for those in the Western U.S., your grocery bill will be nearly $1 per person higher than the national average — $80.88 for a party of 10.”

Your editor today cries foul (fowl?) on the Farm Bureau. First, the portions, my goodness, are skimpy.

And second… Where's the booze?

Have a wonderful weekend!

Best regards,

Emily Clancy

Paradigm Pressroom’s 5 Bullets