It’s a Rigged Game

![]() It’s a Rigged Game

It’s a Rigged Game

It’s a company that’s bided its time for years — waiting for the right opportunity to go public. And that opportunity is nearly here.

It’s a company that’s bided its time for years — waiting for the right opportunity to go public. And that opportunity is nearly here.

From the Reuters newswire: “Lime, a startup backed by Uber Technologies that operates an electric bike and scooter network, has hired investment banks to help it prepare for a long-awaited U.S. initial public offering, according to people familiar with the matter.”

It looks as if the IPO is on track for next year — with underwriting help from Goldman Sachs and JPMorgan Chase.

Launched in 2017, Lime won backing from Uber in 2020 — when it was valued around $510 million.

Management thought about going public in 2022. But the stock market took a wicked spill that year. Many companies that considered going public decided to hold off.

Only now is the listing market turning around, says Reuters: “This year, IPOs in the U.S. have raised nearly $27 billion, up nearly 45% from the same period last year, but still way off the all-time peak of roughly $177 billion that was raised in 2021 during the same period, according to data from Dealogic.”

So what’s this to you?

The problem — and the irony — is one we’ve lamented in these daily missives for years: The best time to get into an IPO… is before it goes public.

The problem — and the irony — is one we’ve lamented in these daily missives for years: The best time to get into an IPO… is before it goes public.

That’s where the big money is made. Too bad you as a retail investor are shut out. Yes, that’s how the system is designed. It’s a rigged game.

Retail investors think they’re getting in on the ground floor of a hot idea — when in fact they’re getting in at least 25 or 50 stories high. In the case of Lime, the real ground floor was years earlier when Uber and other deep-pocketed investors acquired shares at prices far below whatever Lime will sell for on the day it goes public.

Here’s a truly stark example of how the system works — Peter Thiel’s early investment in Facebook. Every $500 he plunked down in 2004 turned into $1 million by 2016.

Infuriating? Yes.

But Paradigm’s venture capital veteran James Altucher says this week is your chance to turn the tables. If you subscribe to our Microcap Millionaire service, you’re already up to speed.

If not — and in case you missed it — James sent you an email yesterday about a unique pre-IPO opportunity that’s open to everyday folks.

For real. “I just identified a company that is developing one of the most mission-critical products since the birth of the internet,” he said.

“You don’t need to be an accredited investor, have millions of dollars or any special connections.”

The window of opportunity here is slender: “It’s possible this company could go public in a matter of days,” says James. For that reason, the doors on this offer close when the market closes on Friday at 4:00 p.m. EDT.

Click here to see why James is so bullish on this company — and how you can buy shares before it lands a spot on a major exchange.

![]() Market Milestone

Market Milestone

Reports of the Magnificent 7’s death have been greatly exaggerated.

Reports of the Magnificent 7’s death have been greatly exaggerated.

As 2024 turned to 2025, it seemed as if the seven tech-adjacent megacap stocks had seen better days. Apple, Microsoft, Alphabet (Google), Meta (Facebook), Amazon, Tesla and Nvidia looked old and busted. Hot money was rotating to other areas of the market.

But yesterday, the Nasdaq-100 — which, as the name suggests, comprise the 100 biggest stocks traded on the Nasdaq — notched a record close for the first time since February.

The Nasdaq Composite has yet to do the same. Neither has the S&P 500. Certainly not the Dow.

Within the Nasdaq-100, the Mag 7 make up as much as 45% of the index, depending on the day.

The Mag 7 are doing just fine, thank you very much. The Roundhill Magnificent Seven ETF (MAGS) — in which all seven of those stocks are weighted equally — is up 10% over the last three months, compared with 5% for the S&P 500.

Meanwhile, the big market story today is far, far away from the sexy tech names.

Meanwhile, the big market story today is far, far away from the sexy tech names.

The Wall Street Journal reports a blockbuster Big Oil merger is in the works — Shell potentially acquiring BP for $80 billion.

It’s still early days, and the talks are going slowly — but if it happens it would be the biggest tie-up in the oil business since Exxon acquired Mobil in 1998.

For the moment, the Street doesn’t like the news for either company: At last check SHEL shares are down 1.5% on the day and BP 1%.

As for the major stock averages, the S&P 500 is ruler-flat at 6,094 after a respectable gain yesterday. The index is only 50 points away from its record close in February. The Nasdaq Composite is slightly in the green, the Dow slightly in the red. (And the Nasdaq-100 is creeping higher into record territory.)

Crude is experiencing an oversold bounce after yesterday’s mini-crash — up $1.26 as we write to $65.63. Precious metals are licking their wounds after yesterday’s drubbing — gold at $3,326 and silver at $36 on the nose.

Bitcoin is quietly rallying, over $107,000 now.

![]() Market Manipulations and Social Media

Market Manipulations and Social Media

Maybe it’s harder to manipulate markets in the age of social media.

Maybe it’s harder to manipulate markets in the age of social media.

Yesterday I devoted Bullet No. 2 to the plunge in oil prices that immediately followed Iran’s symbolic attack on the U.S. air base in Qatar the day before — in which there were no casualties.

I said someone must have had insider knowledge that Tehran gave the Qataris — and by extension the Americans — a heads-up. I recounted a brief history of oil-market manipulation as chronicled in the 2008 book The Oil Card by James Norman.

In retrospect, this isn’t a case of insider knowledge as much as advance knowledge — available for all to see.

Oil traders saw satellite photos of the U.S. base on social media. The images showed that the planes usually kept there… had been gone for days. From today’s Financial Times…

“It is all orchestrated, we know the base is empty. I knew from June 18 that the base was empty,” said Jorge Montepeque, an oil analyst at Onyx Capital Group, in a text message just after the attack began on Monday. “We have watched this movie before.”

Since the outbreak of hostilities between Israel and Iran, traders said they had been glued to social media and open source intelligence to interpret developments. “Everyone is in a similar boat, we are all tracking Twitter feeds, Osint accounts and everything you can to make sense of it,” said one executive at a major oil trading firm.

This democratization of information is an unquestionably good thing.

This democratization of information is an unquestionably good thing.

In September 2018, I did an issue-length retrospective to mark the 10th anniversary of the 2008 financial crisis.

One day during the heart of the 2008 panic, long lines had formed outside the Citi and Chase branches in Midtown Manhattan — lines populated by well-dressed Wall Streeters. They were pulling their money out. So was Financial Times columnist John Authers. “This was a run on the bank.”

Authors could have summoned a photographer and written a caption — but he did not. “Such a story on the FT’s front page might have been enough to push the system over the edge.”

No way could that sort of elite gatekeeping could happen now in an age of ubiquitous smartphones and social media.

Which is why, amid the meltdown at Silicon Valley Bank two years ago, a U.S. senator was demanding the Treasury Department and the Federal Reserve take steps to censor social media — the better to prevent a bank run.

![]() Partisan Investing

Partisan Investing

There’s an old saying about “Never let politics determine your investment decisions.” But more and more individual investors are throwing that guidance out the window.

There’s an old saying about “Never let politics determine your investment decisions.” But more and more individual investors are throwing that guidance out the window.

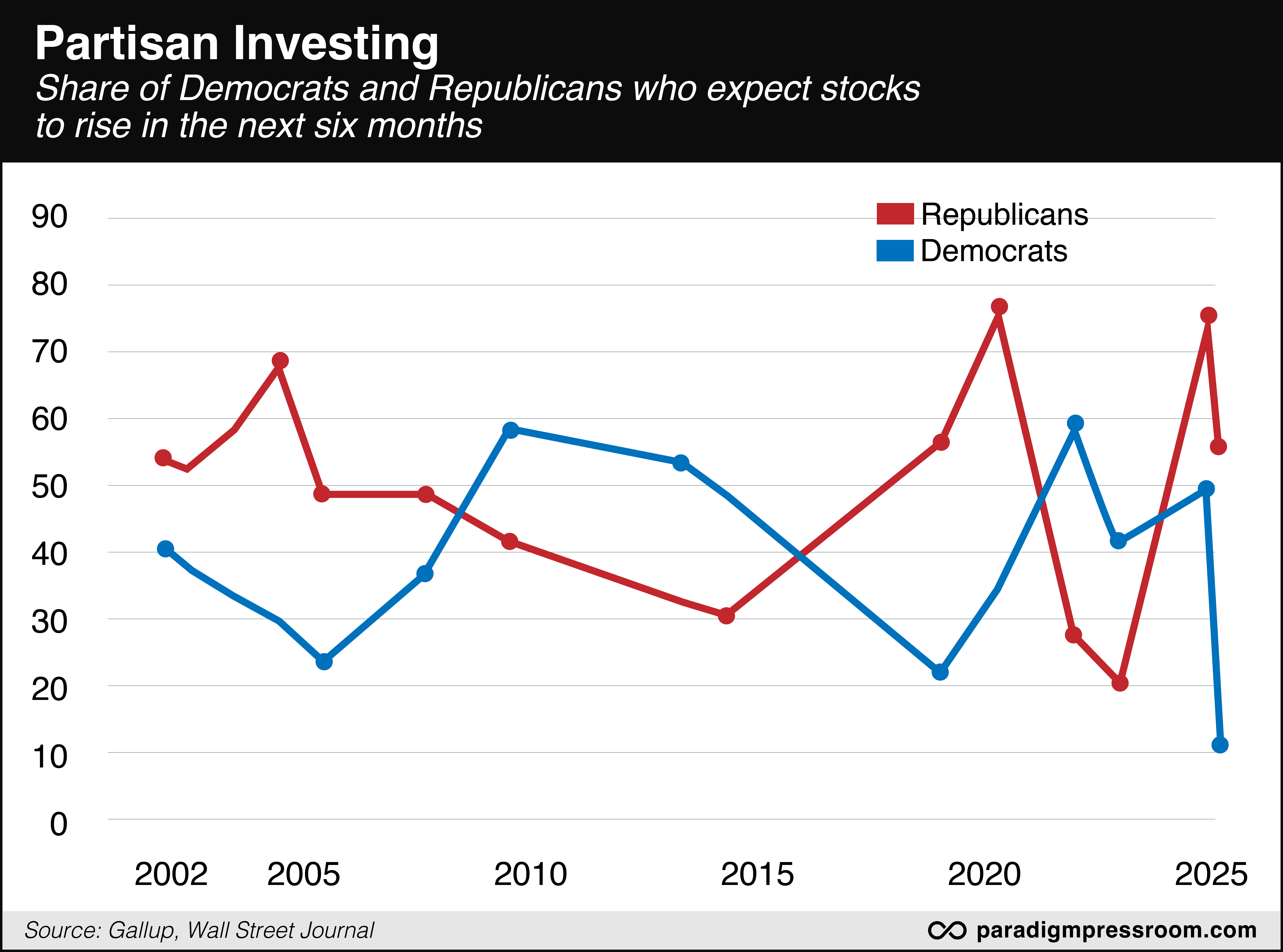

“Whenever a new party wins the White House, its voters become more bullish on the stock market,” says the Demography Unplugged Substack page — helmed by Neil Howe of The Fourth Turning fame.

“Republicans felt confident under Bush, and Democrats felt confident under Obama. But until recently, these shifts in investor sentiment were relatively modest. In the 2000s, the partisan gap in stock market expectations hovered between 10 and 20 percentage points.

“Today, that divide has exploded.”

Demography Unplugged points to a recent Gallup survey published by The Wall Street Journal: Nearly 60% of Republicans believe the stock market will rise over the next six months — compared with only 12% of Democrats.

That’s the widest gap on record — and Gallup started asking this question in 2001.

What’s more, “Investors are also choosing stocks based on their political leanings,” writes Mr. Howe and his collaborator Christian Ford.

“A recent study by the UBC Sauder School of Business looked at stock portfolios of wealthy Americans between 2001 and 2019. By the end of the period, 20% of portfolio holdings differed depending on whether households leaned Republican or Democratic.

“That’s more than twice the level of disagreement seen in 2001. The divide accelerated in 2013, after Obama’s second presidential victory.”

We want to hear from you: To what extent do you let politics drive your investing decisions? Has experience vindicated your judgment? Or do you have any regrets?

Write here and we’ll share a cross-section of reader feedback tomorrow: feedback@paradigmpressroom.com

And with that, on to today’s mailbag…

![]() Mailbag: War

Mailbag: War

“Nice try, Dave,” says a reader who blanched yesterday at my observance of the generational rift within MAGA — younger people fed up with endless U.S. interventions overseas.

“Nice try, Dave,” says a reader who blanched yesterday at my observance of the generational rift within MAGA — younger people fed up with endless U.S. interventions overseas.

“You say you and your generation are concerned about ‘forever wars.’ I have a forever war for you; it's the one that originated in the Middle East in the ’70s and has been raging under the surface for more than five decades, growing more dangerous every year. For most of that time, we could ignore it, until it came to our shores. Isn't it time to stop that forever war since it's the one war that can and likely will kill thousands (or more) of our people?

“Or is it all just about the money? I agree that Ukraine is nothing but a money pit and we should cut them off. If we do, Ukraine isn't going to send terrorists here, nor will Russia or European nations.

“I am a boomer who started following geopolitics during Reagan's presidency. The Soviet Union didn't go away until we made it go away. True it wasn't a shooting war. It was more like pressuring them on all fronts until they collapsed. Hey, that sounds a lot like what President Trump is doing right now. Trump will do the same to China if people will stop clutching their pearls and get behind his policies. Americans have a great memory but it's short.

“Ideology is a wonderful, seductive thing until a nuke goes off in your city.”

Dave responds: Short memory, sir? “Originated… in the ’70s?”

Among other things, you left out the part about how Washington overthrew a democratically elected government in Iran in 1953, restoring the shah to the Peacock Throne.

Swell guy the shah was — among other things, enforcing price controls by beating recalcitrant shopkeepers on the soles of their feet.

Iranian schoolkids learn about this history as intimately as American schoolkids learn about King George (probably better, given the state of American education).

As for the Soviet Union, it collapsed under the weight of a communist economic system. In time, China will collapse from its own self-inflicted demographic decline — if wise leaders in Washington would just step back and stay out of the way.

“I decided MAGA was a cruel joke last time DJT dropped the ball, locked us down, inflated our money enough that $4 became $5 out of thin air, changed nothing, enraged and emboldened the extreme left, etc, etc.,” says a disillusioned reader.

“I decided MAGA was a cruel joke last time DJT dropped the ball, locked us down, inflated our money enough that $4 became $5 out of thin air, changed nothing, enraged and emboldened the extreme left, etc, etc.,” says a disillusioned reader.

“I was so cautious of anticipating (hoping for?) real change this time around... Guess I will have to keep rubbing my friends’ noses in ‘I told you so…’ We get the government we deserve, right?”

“Did I just see a Photoshop of President Trump on an aircraft carrier with a banner behind him reading, ‘MISSION ACCOMPLISHED’?”

“Did I just see a Photoshop of President Trump on an aircraft carrier with a banner behind him reading, ‘MISSION ACCOMPLISHED’?”

Dave: Not in this e-letter, but it’s been making the rounds…

Finally, to the reader who recommends Fox News as a reliable source…

Finally, to the reader who recommends Fox News as a reliable source…

Please check out this 11-minute excerpt from Tucker Carlson’s latest interview — featuring his fellow Fox News exile Clayton Morris.

As a previous Carlson guest, Glenn Greenwald, tweeted yesterday: “A principal function of Fox News for the last 25 years is to scare the s*** out of the public with an endless array of fear-mongering propaganda, to make them believe they will die if they don't snap into line and cheer for every war that the Murdochs and neocons want.”

Word. Sometime in the months just after 9/11 — long before “memes” were a thing — someone created this fiendishly clever meme.

No one’s ever come out and said why Fox parted ways with Carlson in 2023 — even though he had the highest-rated program in all of prime-time cable news.

No one’s ever come out and said why Fox parted ways with Carlson in 2023 — even though he had the highest-rated program in all of prime-time cable news.

But as author David Talbot said at the time in a Facebook post, “I think the real reason that Carlson was fired was because he was evolving into a more independent voice on everything from the dominance of the war state — which goes unchallenged by our media and political elites — to the assassination of President Kennedy,

“Carlson believes that the CIA was involved in the assassination, the reason that the spy agency has repeatedly flouted the 1992 JFK Records Act and blocked the full release of Kennedy-related documents.”

Much about JFK has come to the fore this year thanks to a Trump executive order — but the CIA is still withholding essential documents.

More to come later this year in a comprehensive update of our Nov. 21, 2023 edition titled “From JFK to Jeffrey Epstein.”

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets