You Should Own More Silver

![]() Silver’s “Critical” Condition

Silver’s “Critical” Condition

Back in the mid-2010s, lithium was a footnote in chemistry labs and the dreams of early Tesla enthusiasts. Uranium, after Fukushima, was considered dead weight in the energy world.

Back in the mid-2010s, lithium was a footnote in chemistry labs and the dreams of early Tesla enthusiasts. Uranium, after Fukushima, was considered dead weight in the energy world.

Yet when Washington put both metals on its official Critical Minerals List, fortunes flipped almost overnight. Now another metal is poised for its own breakout moment: silver.

As Paradigm editor Chris Campbell notes: “Silver just jumped from the kids’ table to the head of the banquet.”

That’s because, for the first time in history, the U.S. Department of the Interior has proposed adding silver to its Critical Minerals List draft for 2025.

The decision isn’t final — there’s a 30-day comment period before the list is locked-in — but the signal is clear. The world’s largest economy just declared that without silver, its future could be at risk.

History shows what happens when a commodity makes the government’s list.

History shows what happens when a commodity makes the government’s list.

Uranium spent most of the 2010s languishing around $25 a pound. Then, in 2018, it quietly won a spot on the Critical Minerals List.

By 2020, the Department of Energy was pushing for a national reserve, and by 2022, the Defense Production Act was backing the entire nuclear fuel supply chain. The mantra shifted from “cheap supply” to “secure supply.” Prices followed, surging past $100 a pound by 2024.

Lithium’s story is even more explosive. In 2018, lithium carbonate sold for about $7,000 a ton. Once designated critical, automakers inked long-term contracts, subsidies poured in and prices skyrocketed to $80,000 a ton by late 2022.

Even after cooling, lithium still trades at multiples of its old price. The designation “didn’t just nudge lithium higher,” says Chris, “it rewired the entire supply chain.

“The [silver] designation just shines a spotlight on a fire already ablaze,” Chris adds.

“The [silver] designation just shines a spotlight on a fire already ablaze,” Chris adds.

Silver, for instance, doesn’t sit idle. It gets consumed in solar panels, electric vehicles, semiconductors and medical devices, making it both an industrial backbone and a monetary hedge.

And the numbers are striking. Global demand in 2024 was about 1.16 billion ounces, while mine supply lagged at just 820 million.

That marks the fourth-straight year of deficits, with aboveground stocks covering only two–three years at current demand. Much of that supply is locked in exchange-traded funds or private vaults.

What happens if silver makes the final list?

The playbook’s already written: Demand surges instantly, while supply takes years to adjust.

The playbook’s already written: Demand surges instantly, while supply takes years to adjust.

That’s why uranium quadrupled and lithium went tenfold, Chris explains. With silver’s fragmented supply chain and chronic deficits, the move could be even sharper.

Big players are already circling…

- “Tech billionaire David Bateman recently took delivery of 12.7 million ounces,” says Chris, “about 1.5% of global annual production

- “Saudi Arabia’s central bank disclosed a $40 million ETF position.” In most commodities, those figures are minor. In silver, they’re enough to move the needle.

Washington doesn’t add minerals to its list lightly. “It runs thousands of disruption models across industries — energy, defense, health, technology — and only elevates commodities where shortages could break the system.”

If silver makes the cut, it will be a recognition of reality. “Ultimately, silver doesn’t need Washington’s blessing,” Chris concludes.

Silver’s already scarce. The designation would simply make it official.

![]() De-Dollarization in Action

De-Dollarization in Action

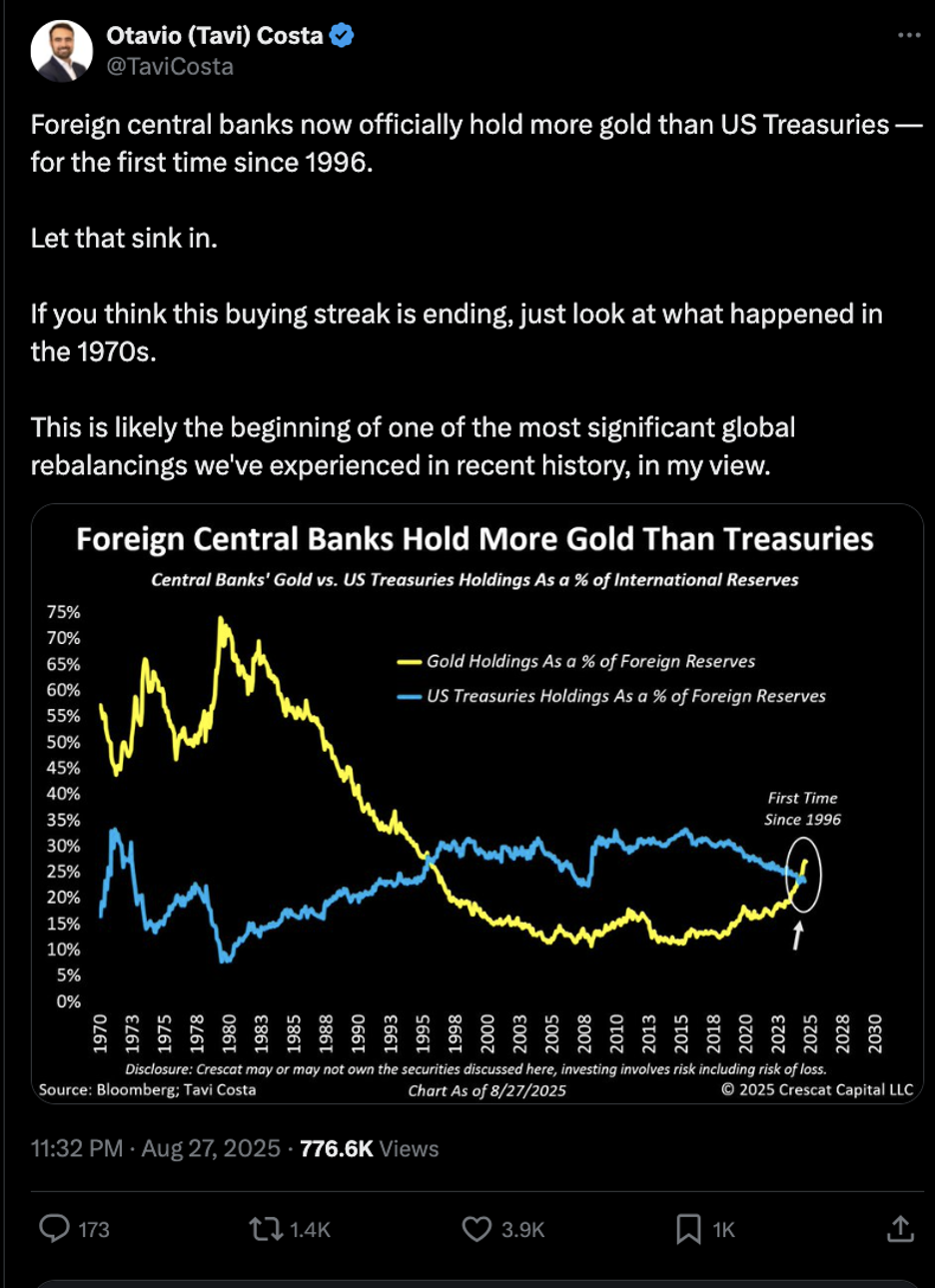

Central banks have been rewriting the playbook for global reserves. Over the past three years, they have purchased gold at near-record levels.

Central banks have been rewriting the playbook for global reserves. Over the past three years, they have purchased gold at near-record levels.

In 2022 alone, net purchases reached 1,136 tonnes — the highest on record since 1950. (For context, between 2010 and 2021, average annual purchases were only 473 tonnes.) Last year ranked as the third-largest expansion ever, just 6.2 tonnes shy of 2023.

At the same time, the dollar’s grip on world finance is loosening. Dollars accounted for just 57.8% of global reserves at the end of last year — the lowest share since 1994 and down sharply from 72% in 2002.

That decline is more than a currency story. It shows up most clearly in sagging foreign demand for U.S. Treasuries…

For decades, Treasuries have been the anchor of central bank reserves, absorbing America’s borrowing needs. But as central banks diversify into gold and other assets, fewer dollars are recycled into U.S. debt.

JPMorgan notes that central banks’ preference for gold is helping fuel the current bull market, with prices forecast to approach $4,000 an ounce by mid-2026.

Meanwhile, with the national debt now surpassing $37 trillion, investors are questioning whether Washington has stretched its “reserve currency privilege” too far.

To be clear, the dollar isn’t on the verge of collapse. But even modest de-dollarization could strain America’s ability to borrow, spend and manage deficits. For now, gold is quietly rewriting the rules of global finance.

![]() NVDA = “Backbone”

NVDA = “Backbone”

“Everything is sold out,” says Paradigm editor Davis Wilson at our sister e-letter The Million Mission. “That’s the reality of Nvidia’s business right now.”

“Everything is sold out,” says Paradigm editor Davis Wilson at our sister e-letter The Million Mission. “That’s the reality of Nvidia’s business right now.”

To wit, Nvidia’s H100 and H200 chips are backordered. Its latest Blackwell processors can’t be manufactured fast enough. Demand is so overwhelming that cloud giants are renting server capacity to one another to fill gaps.

Despite this, skeptics — including Paradigm’s trading pro Enrique Abeyta — see Nvidia as a bubble. (Enrique makes a compelling argument; we don’t hold to party lines around here.)

“They’ve been saying it for quarter after quarter,” Davis observes. “And they’ve been wrong every time.” Nvidia’s story isn’t about chasing one earnings beat. It’s about positioning for the largest technology buildout of the century.

At first glance, he notes, Nvidia’s $180 stock price looks lofty. Shares are up 12-fold since ChatGPT launched in late 2022. But earnings have grown even faster — up 17x in the same period.

“Over the last 90 days,” says Davis, “expectations for this year’s EPS jumped from $4.27 to $4.45. Next year’s numbers rose even more — from $5.73 to $6.18.

“When NVDA fundamentals are rising this fast, the stock is actually getting cheaper,” Davis adds.

“When NVDA fundamentals are rising this fast, the stock is actually getting cheaper,” Davis adds.

Not only that, Nvidia’s CEO Jensen Huang more than tripled his recent forecast for AI infrastructure spending — from $1 trillion to as much as $3–4 trillion by 2030.

Today’s focus on training AI models is only the first wave, Huang claims. Next comes inference, where those models are deployed at scale.

Beyond that? Robotics and autonomous systems — what Huang calls “physical AI” — which require exponentially more compute. With that, Wedbush analysts estimate demand for Nvidia’s newest chips could exceed supply by 10-to-1.

And if U.S. restrictions ease, the Chinese market could represent $50 billion in annual sales, with the potential to grow 50% annually thereafter. “That would be rocket fuel on top of an already unstoppable story,” says Davis.

“Nvidia’s earnings once again proved the skeptics wrong,” he concludes. “Yes, the stock traded flat after the announcement. But underneath the surface, the setup keeps getting better.

“Earnings estimates are rising. Growth prospects are accelerating. And a potential China reentry looms as a massive bonus.

“This is not a bubble stock waiting to crash. It’s the backbone of a once-in-a-generation technology shift,” Davis emphasizes. “Own it”

NVDA shares have pulled back slightly today, but one of its Mag 7 companions is catching a bid…

NVDA shares have pulled back slightly today, but one of its Mag 7 companions is catching a bid…

Namely, Alphabet (Google) dodged the harshest outcome in its antitrust case after a federal judge refused to force the sale of Chrome. Instead, Judge Amit Mehta banned the company from signing exclusive distribution deals for Search, Chrome, Gemini and Assistant.

Google can continue paying partners like Apple to set its products as defaults — a deal that nets Apple about $20 billion a year — but contracts must be nonexclusive and short-term. Mehta also ordered Google to share its search results with qualified competitors. The ruling preserves Apple’s cash flow while boosting its leverage in future talks. At the time of writing, GOOG shares are up 8.5%.

Taking a look at the rest of the market today, the tech-heavy Nasdaq is up almost 1% to 21,465 while the S&P 500 is up 0.30% to 5,435. At the same time, the Dow’s down 0.35% to 45,140.

Surveying commodities, oil is down 2.50% to $63.90 for a barrel of WTI. Precious metals? Gold and silver are both up about 1% to $3,627.20 per ounce and $41.50 respectively.

Finally, the crypto market is in the green. Bitcoin’s up 1.40% to $112,200 while Ethereum’s up over 4.70% to $4,475.

![]() Emergency in Name Only?

Emergency in Name Only?

Though details are murky, the Trump administration is floating the idea of declaring a “housing emergency” this fall.

Though details are murky, the Trump administration is floating the idea of declaring a “housing emergency” this fall.

Treasury Secretary Scott Bessent tells the Washington Examiner: “We’re trying to figure out what we can do,” he says, “and we don’t want to step into the business of states, counties and municipal governments.”

Emergency status, however, typically demands swift action to protect 1) life and 2) property. What’s being discussed here looks more like a possible policy shortcut — an attempt to bypass the normal legislative process by invoking emergency powers.

Still, the housing market does face real pressures. Excessive zoning rules and overregulation have driven up prices and limited supply. Yet Bessent’s comments suggest the administration isn’t prepared to tie federal dollars to zoning reforms.

In fact, according to an article at Reason, the White House proposes eliminating the Pathways to Removing Obstacles (PRO) to Housing program, a small federal grant designed to nudge cities and states toward easing restrictive zoning and permitting rules. (The administration argues the initiative has been “hijacked for woke purposes.”)

Meanwhile, one realistic option could be freeing up federal lands for housing — though that would likely face lawsuits from environmental groups. Also meanwhile? Trump-backed tariffs, including hikes on Canadian lumber and imported steel, only raise construction costs.

At best, a declared “housing emergency” could spark debate and push state and local governments to act. But unless paired with concrete reforms, it risks being little more than political theater.

![]() Caribbean AI and Arm Wrestling

Caribbean AI and Arm Wrestling

When the Caribbean island of Anguilla was handed the two-letter internet domain .ai back in the 1980s, nobody thought much of it.

When the Caribbean island of Anguilla was handed the two-letter internet domain .ai back in the 1980s, nobody thought much of it.

After all, the island had more pressing concerns: sun-seeking tourists, looming hurricanes and making sure coconuts outnumbered people (they still do). Fast-forward to 2025 and those two letters have turned into a gold mine.

With artificial intelligence now the hottest acronym on the planet, tech firms and entrepreneurs are clamoring for .ai website addresses.

Over 850,000 such domains now exist — up from fewer than 50,000 in 2020. Some sell for eye-watering sums: U.S. tech executive Dharmesh Shah, for instance, reportedly dropped $700,000 on you.ai earlier this year, betting that his idea for digital “clones” of people needed the perfect web home.

This isn’t the first time a small island struck digital gold. Tuvalu famously cashed in on its .tv domain about 20 years ago, licensing it to streaming services and broadcasters worldwide.

In Anguilla, the AI boom has transformed the island’s budget. In 2024, the government earned $39 million from .ai sales, nearly a quarter of its total revenue — second only to tourism. Officials project those revenues will keep climbing, with $49 million expected this year.

That’s a big deal for an island of just 16,000 residents, where tourism accounts for 37% of income but remains at the mercy of hurricane season.

To safeguard the digital windfall, Anguilla has struck a five-year deal with U.S. firm Identity Digital to host domains on global servers, ensuring that a storm knocking out power lines won’t also knock out profits.

Turns out the speck of an island’s most lucrative resource isn’t its crop of coconuts or its beautiful beaches. It’s two tiny letters.

And Anguilla didn’t even have to arm wrestle for them…

“Subaru missed a golden opportunity with Starlink,” writes a longtime reader — with a callback to “Malice in Dallas” circa 1992.

“Subaru missed a golden opportunity with Starlink,” writes a longtime reader — with a callback to “Malice in Dallas” circa 1992.

“I recall Southwest Airlines CEO Herb Kelleher arm wrestling a CEO for the use of the phrase ‘Just Plane Smart.’ Another airline had used the slogan first, and their CEO was an arm wrestling enthusiast. Herb turned the whole thing into a fun PR moment for both companies.

Courtesy: Southwest50.com

Colorful Southwest CEO Herb Kelleher was indeed… “Over the Top.”

“Subaru could have generated massive publicity,” he adds, “with a challenge that Musk would not have turned down.”

Thanks, reader, for the entertaining detour… We’ll be back tomorrow with a fresh round of 5 Bullets.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets