About Apple’s Next Big Reveal

![]() Apple’s Quiet Audio Secret

Apple’s Quiet Audio Secret

Cirrus Logic was once a behind-the-scenes semiconductor company, best known for its specialized audio chips used in car stereos and early portable music devices.

Cirrus Logic was once a behind-the-scenes semiconductor company, best known for its specialized audio chips used in car stereos and early portable music devices.

Founded in Salt Lake City in 1981 as a specialty chip designer, Cirrus spent years competing with much larger firms for space inside consumer gadgets.

But that changed dramatically in the early 2000s.

As Apple began its relentless pursuit of better device sound quality — starting with the iPod and then moving to the iPhone — engineers were searching for ultra-efficient chips to deliver crisp, reliable audio in small spaces.

Rather than relying on industry giants, Apple eventually selected Cirrus Logic for its innovative audio codec technology, quietly inserting the small firm’s parts into its devices.

By 2010, the iPhone 4 launched with Cirrus Logic embedded inside its audio system — a transformative moment for the company.

Apple’s endorsement was seismic…

Cirrus Logic’s net sales more than quadrupled in five years — from $174.6 million (FY2009) to $714.3 million (FY2014). And by 2014, Apple accounted for about 80% of Cirrus Logic’s total sales.

Cirrus Logic’s net sales more than quadrupled in five years — from $174.6 million (FY2009) to $714.3 million (FY2014). And by 2014, Apple accounted for about 80% of Cirrus Logic’s total sales.

The stock price reflected this trajectory: Cirrus shares swung from under $5 in 2008 to above $37.75 by May 2015, increasing more than 600% during major iPhone product cycles.

The partnership forced Cirrus Logic to innovate at warp speed, regularly ramping up production for each year’s global iPhone and, later, iPad or AirPods launches.

Cirrus diversified, acquiring new chip design capabilities and branching into haptic feedback and power management for wireless devices.

The company’s fortunes remain tightly wound to Apple, but its expertise and flexibility have carved out a niche in this brutally competitive chip sector.

Cirrus Logic’s climb from obscurity to prominence stands as a textbook tale of supply chain “kingmaking.”

Cirrus Logic’s climb from obscurity to prominence stands as a textbook tale of supply chain “kingmaking.”

Rather than inventing the next mainstream tech gadget, Cirrus focused on a single, high-impact function and delivered when Apple called. And Apple’s relentless push for innovation means it is always searching for the next breakthrough supplier.

The history of Cirrus Logic shows how a niche supplier can be thrust into the spotlight — and enjoy dramatic gains — simply by becoming indispensable to a giant like Apple.

As Apple readies its next big iPhone announcement on Tuesday, Sept. 9, stories like Cirrus’ make it clear: The right tech partnership can change everything for a small firm.

For today’s investors, Cirrus Logic’s journey illustrates how quickly fortunes can shift — and why today’s lesser-known companies could be at the threshold of Apple-fueled breakout moments.

[Ed. note: Apple’s about to make headlines on Sept. 9 with the launch of the iPhone 17 — a radical redesign that’s set to bring “Apple Intelligence” to the forefront.

But here’s where it gets really exciting: James Altucher’s proprietary financial AI has pinpointed a tiny tech company at the heart of this breakthrough. When Tim Cook unveils Apple’s next big move, this little-known stock could soar.

James’ AI isn’t guesswork — it’s flagged “Blue Spikes” before 84.7% of Wall Street’s biggest moves for nearly five years straight, with past trades delivering gains of 762%, 2,800% and even over 11,000%.

While returns like these are rare, this opportunity is extraordinary…And timing is everything. If you wait until after the announcement, it may be too late. Don’t miss your chance. Click here now to see the urgent details.]

![]() Labor Market Hits a Breaking Point

Labor Market Hits a Breaking Point

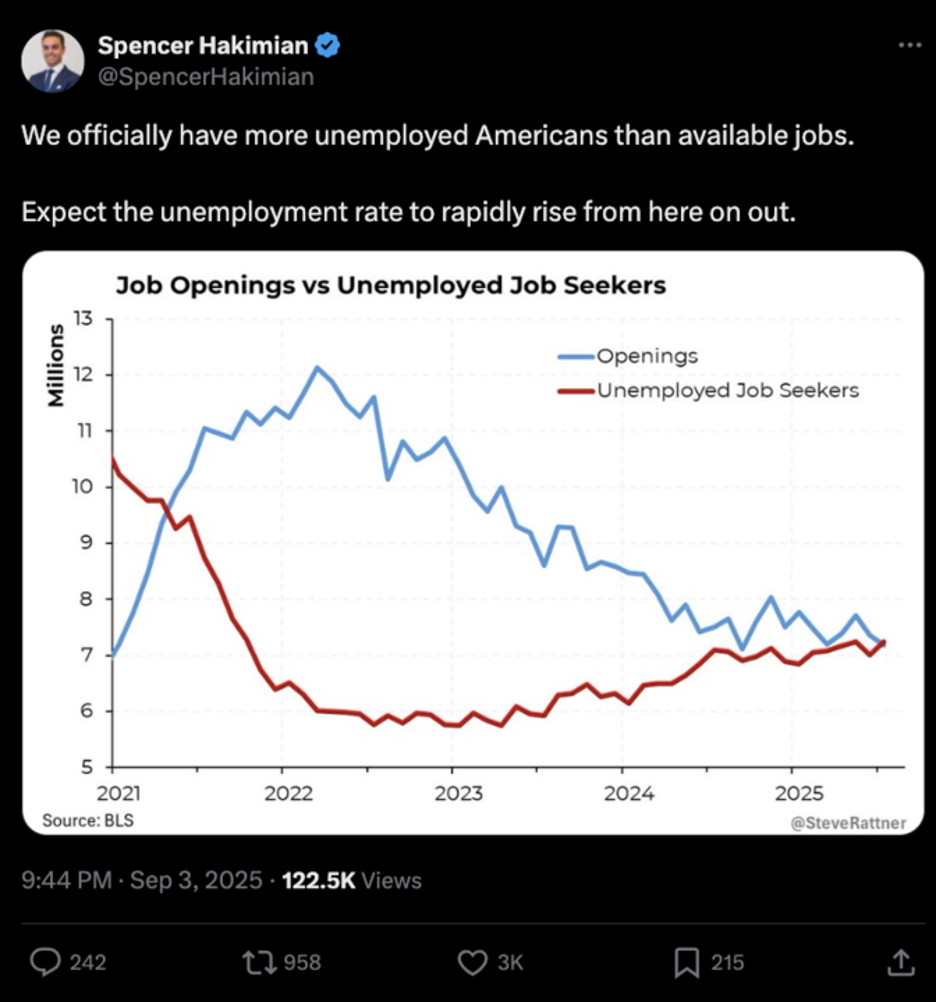

The Labor Department’s Job Openings and Labor Turnover Survey (JOLTS), released Wednesday, reports 7.18 million job openings in July.

The Labor Department’s Job Openings and Labor Turnover Survey (JOLTS), released Wednesday, reports 7.18 million job openings in July.

That’s the lowest reading since September 2024 and only the second time since late 2020 that openings dipped under 7.2 million. Economists surveyed by Dow Jones expected closer to 7.4 million job openings.

JOLTS tracks job listings, hires and separations to give a snapshot of how strong or weak the employment picture looks across the country. When openings are high, it usually signals confidence among employers. When they fall sharply, it suggests hiring is slowing and opportunities are drying up.

This latest decline means…

That’s a reversal from much of the past three years, when openings far exceeded job seekers and gave workers unusual leverage in the labor market.

“This is a turning point for the labor market,” says Heather Long, chief economist at Navy Federal Credit Union, in an interview at CNBC. “It’s yet another crack.”

With fewer jobs to go around, expect the unemployment rate to rise in the months ahead. Upcoming jobless claims and Friday’s payrolls report will offer the next test of whether this slowdown accelerates.

The ADP report today shows U.S. private employers added just 54,000 jobs in August, well below the 68,0000 economists expected. Meanwhile, initial jobless claims for the week ending Aug. 30 rose to 237,000, higher than the predicted 231,000.

The ADP report today shows U.S. private employers added just 54,000 jobs in August, well below the 68,0000 economists expected. Meanwhile, initial jobless claims for the week ending Aug. 30 rose to 237,000, higher than the predicted 231,000.

- The U.S. Composite PMI for August 2025 was revised down to 54.6, indicating the economy is still expanding, but at a slower pace compared to July’s 55.1. This number measures the combined health of both the manufacturing and service sectors; any value above 50 shows growth, so 54.6 signals continued, though moderating, business activity.

Sneaking a peek at the stock market today, the three major U.S. indexes are all in the green — each up about 0.40%. At the time of writing, the Dow, S&P 500 and Nasdaq are sitting at 45,485, 6,475 and 21,580 respectively.

Guess the weak jobs data is bolstering market hopes for a rate cut come September’s FOMC meeting…

Looking at commodities, oil’s down almost 1% to $63.40 for a barrel of West Texas Intermediate. Likewise, precious metals are down: Gold’s lost 0.65% to $3,611.10 per ounce, and silver’s down 1.50% to $41.

Crypto’s slumping as well. Bitcoin’s down 2.20%, just under $110,000; Ethereum, meanwhile, is down 3.80% to $4,300.

![]() The Longest Shot in D.C.

The Longest Shot in D.C.

After years pretending it was fine for lawmakers to gamble in the very casino they allegedly regulate, Congress might finally be ready to lock up the dice.

After years pretending it was fine for lawmakers to gamble in the very casino they allegedly regulate, Congress might finally be ready to lock up the dice.

On Wednesday, a bipartisan group unveiled the “Restore Trust in Congress Act” which would ban members of Congress, their spouses and dependent kids from owning or trading individual stocks.

Lawmakers would have 90–180 days to divest after being sworn in, and violators would pay a fine equal to 10% of the value of the trade — plus forfeit any profits.

As Rep. Seth Magaziner (D-RI) puts it: “It is crazy to the average person that this has been allowed to go on for so long.” Why, yes, yes it is… But “crazy” doesn’t begin to cover it.

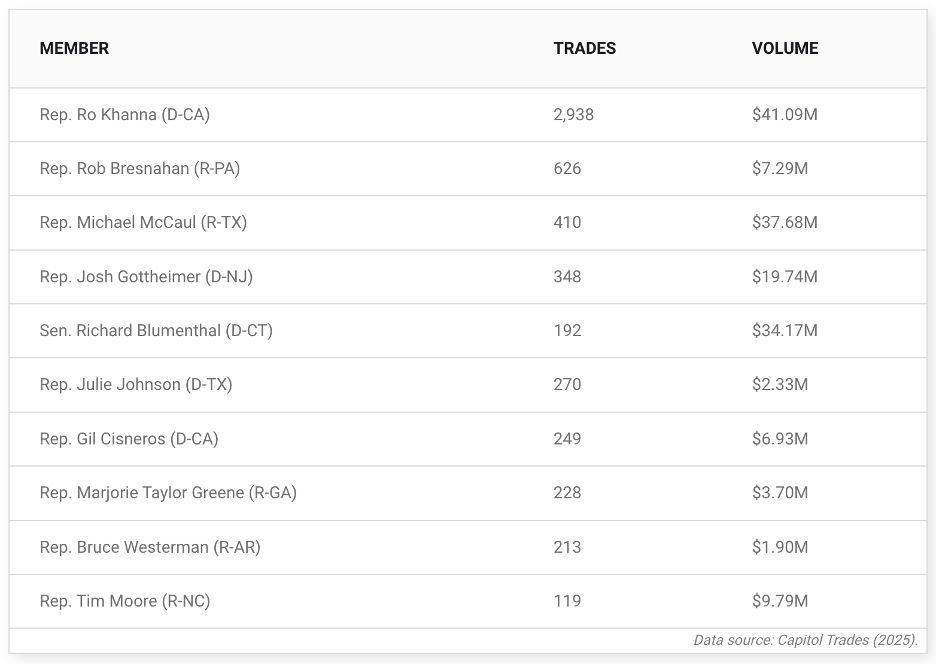

Here’s why people are fed up: More than 100 members of Congress make around 10,000 stock trades every year, according to Capitol Trades and Unusual Whales. That’s not dabbling — that’s day-trading!

Plus, congresscritters tend to beat the market…

Hmm, it’s almost as if voting on bills that move industries gives them an edge?!? And the trades haven’t been subtle.

Hmm, it’s almost as if voting on bills that move industries gives them an edge?!? And the trades haven’t been subtle.

- Nvidia was a favorite while Congress debated the CHIPS Act

- Social media stocks got a workout during the TikTok ban talks

- Defense shares moved while national security committees held hearings.

Some lawmakers, including Rep. Ro Khanna (D-CA), have racked up thousands of trades worth tens of millions of dollars, according to Capitol Trades data through July 2025…

Source: Capitol Trades (2025)

During the first seven months of 2025, in fact, lawmakers have already logged 7,810 trades covering 362 million shares — putting 2025 on track to set a new record.

While opponents argue banning stock trading would discourage “private-sector talent” from running for office, Rep. Anna Paulina Luna (R-FL) counters: “If you want to trade stocks go to Wall Street. Don’t go to Congress.”

Indeed.

We’ll see if Congress can pass this legislation. But betting against self-interest in Congress? That’s the longest shot in D.C.

![]() Tesla Fever Cools (Sorta)

Tesla Fever Cools (Sorta)

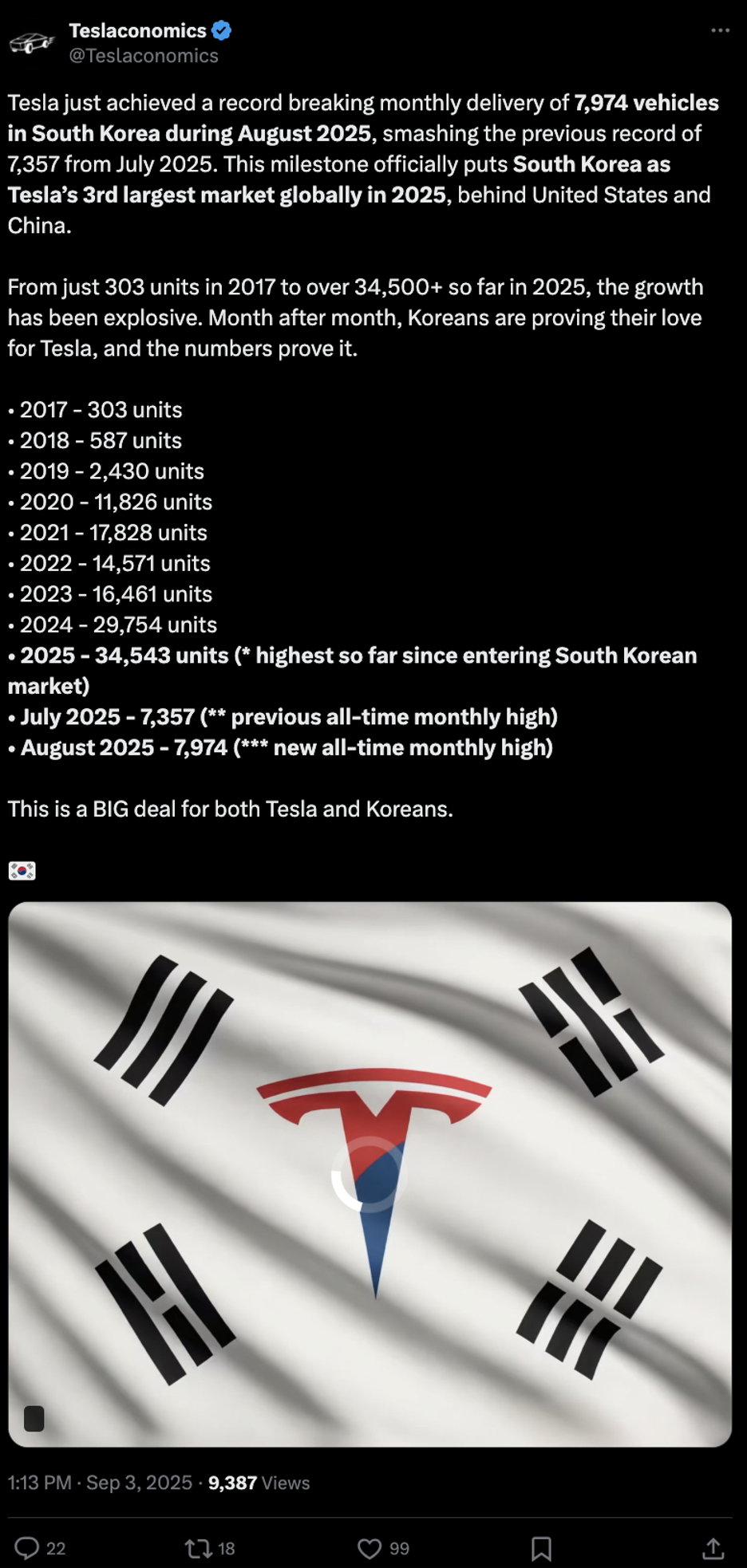

South Korea’s retail investors are backing away from Tesla (TSLA), cutting back their holdings as enthusiasm around the electric carmaker wanes.

South Korea’s retail investors are backing away from Tesla (TSLA), cutting back their holdings as enthusiasm around the electric carmaker wanes.

According to Bloomberg calculations of depository data, Korean investors sold a net $657 million of Tesla shares in August — the largest monthly outflow since, at least, early 2019.

Even leveraged bets are falling out of favor. The Direxion Daily TSLA Bull 2X Shares ETF (TSLL), which provides double exposure to Tesla, saw $554 million in outflows last month.

It marks part of a broader four-month trend that has seen $1.8 billion pulled out of Tesla stock, signaling waning enthusiasm among one of the company’s most steadfast global fan bases.

Instead, investors are chasing crypto companies, reflecting growing interest in cryptocurrencies at the expense of established U.S. tech giants

For instance, shares of Bitmine Immersion Technologies Inc., a stock viewed as a proxy for Ether, drew $253 million in net inflows last month.

“Tesla used to offer a lot of inspiring narratives but it has failed to win people’s hearts,” says Han Jungsu, a 33-year-old investor who first bought Tesla stock in 2019 but sold out earlier this year.

Clearly, the company is winning drivers’ hearts…

Here’s the buried lede: Despite the selling spree, Tesla remains the single most popular foreign stock among Korean retail investors. They still hold roughly $21.9 billion worth of shares — more than second-place Nvidia or third-place Palantir.

In other words, Korea’s traders may be trimming their positions, but Tesla’s grip on their portfolios (and parking garages?) remains strong.

![]() Nostalgia: “Super-Size It”

Nostalgia: “Super-Size It”

McDonald’s is going full time warp with the resurrection of its Extra Value Meals, hoping to lure budget-conscious diners back to the Golden Arches — one combo at a time.

McDonald’s is going full time warp with the resurrection of its Extra Value Meals, hoping to lure budget-conscious diners back to the Golden Arches — one combo at a time.

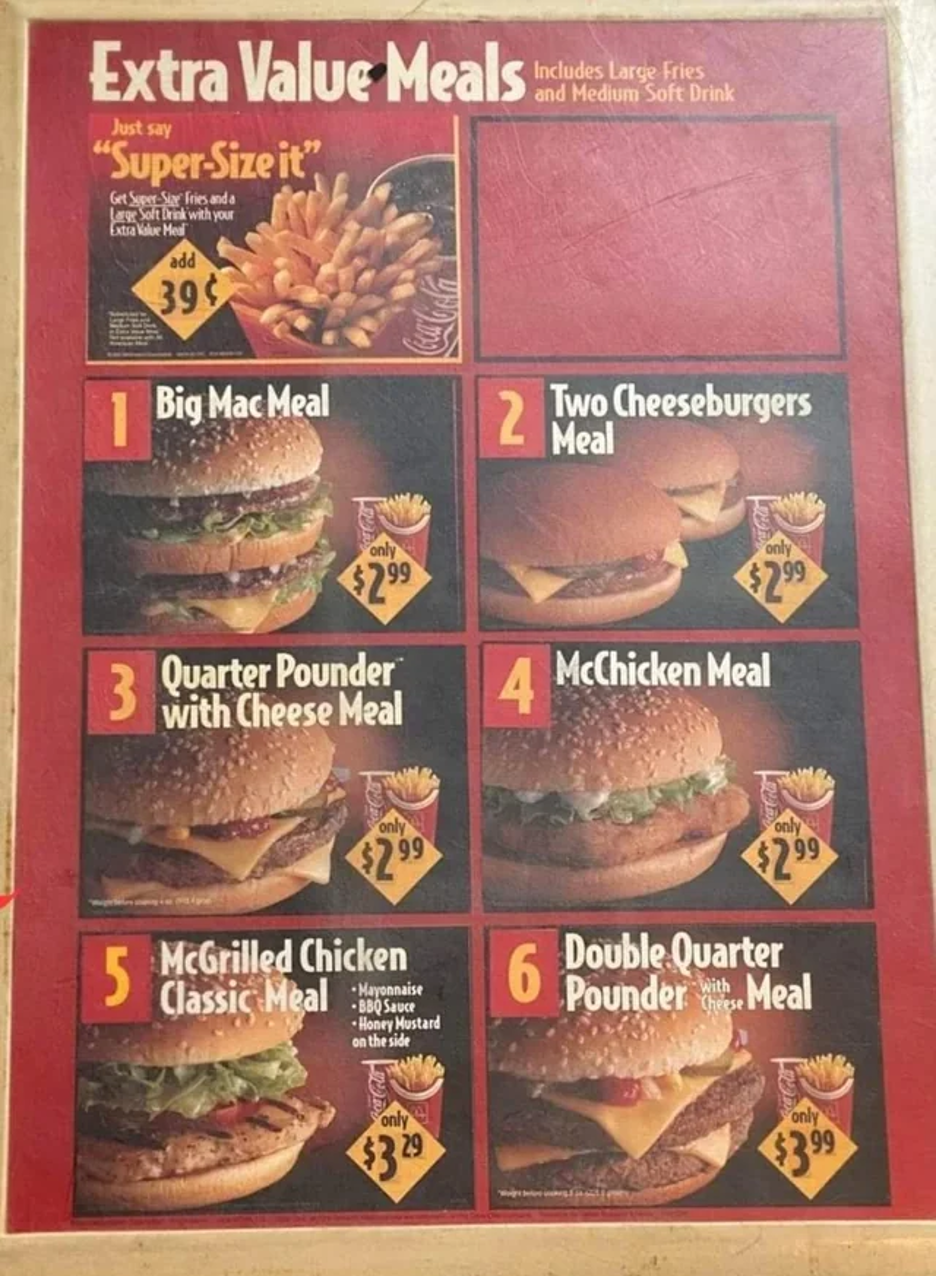

Rollout begins Sept. 8, and these combos promise 15% off compared to ordering individual menu items, covering breakfast, lunch or dinner: $5 for a Sausage McMuffin With Egg with hash brown and coffee; $8 for the Big Mac deal, fries and a drink included.

Naturally, prices like these are gone for good…

Courtesy: Reddit

Remember when a full meal cost less than a Starbucks coffee?

Why the throwback? With prices marching ever skyward, CEO Chris Kempczinski admits some regulars no longer see McDonald’s as a bargain. Thus its value menu reboot, with hopes of reversing sliding sales among price-sensitive fans.

“Extra Value Meals are an integral part of what McDonald’s represents,” Kempczinski tells CNBC, reminding folks of a time when ordering a combo by number actually felt like a deal.

Eight combos will make the cut, from classics like the Quarter Pounder and 10-piece Chicken McNuggets meals to revamped breakfast items. The deals last through the end of 2025 — unless McDonald’s pulls the plug earlier (no guarantees from corporate yet).

For now, it’s a “No. 3” for me — hold (some of) the regret.

We’ll be back Friday!

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets