India’s Not Blinking

![]() Trump’s Tariffs, Modi’s Gold

Trump’s Tariffs, Modi’s Gold

Washington’s latest squeeze play on India looks less like strategy and more like self-sabotage.

Washington’s latest squeeze play on India looks less like strategy and more like self-sabotage.

The Trump administration slapped 25% tariffs on Indian goods earlier this summer, then doubled down with a 50% hit when New Delhi refused to cut back on Russian oil imports.

The result? India didn’t fold. It doubled down too — buying more discounted crude, shifting more of its reserves into gold and trimming U.S. Treasury holdings by about $15 billion over the past year.

That gold bet is no token move. India’s reserves climbed from 840.76 tonnes in mid-2024 to nearly 880 tonnes this year. At a time when the U.S. needs loyal buyers of its debt, one of the biggest emerging economies is swapping Treasuries for bullion.

India’s reallocation mirrors dynamics we mentioned earlier this week: Central banks diversifying away from dollar-denominated assets and reducing exposure to Washington’s risky spending and debt issues.

Instead of isolating India, American pressure is pushing it closer to the very rivals D.C. worries about most.

Instead of isolating India, American pressure is pushing it closer to the very rivals D.C. worries about most.

Days ago, Prime Minister Modi shared a warm handshake with Xi Jinping — which is hugely significant considering the long-standing bad blood between India and China.

Add to that India’s deepening energy ties with Russia and its growing influence inside the BRICS bloc, and the picture is clear: The more Washington tariffs/sanctions the largest democracy in the world, the more New Delhi hedges.

We’ll give the last word to one of our astute readers, who snarks: “Maybe Trump will earn a Nobel Peace Prize after all…

“Mending relations between India and China is no small feat! Not to mention bringing together so many nations in the BRICS alliance for the purpose of financial sovereignty.

“Only shame is what pulling that off is going to cost America and Americans.”

![]() Stupid BLS Tricks?

Stupid BLS Tricks?

The Bureau of Labor Statistics (BLS) drew attention this morning when it flaggedissues that threatened to delay or disrupt its August jobs report — one of the most closely watched government economic releases.

The Bureau of Labor Statistics (BLS) drew attention this morning when it flaggedissues that threatened to delay or disrupt its August jobs report — one of the most closely watched government economic releases.

Such hiccups are rare, but fuel speculation about the reliability of the data, especially after major downward revisions and questionable survey response rates in recent months.

In fact, the BLS reports responses to its Current Employment Statistics (CES) survey, which produces the monthly jobs report, has declined significantly since 2020, falling from 60% to around 40% in 2024–2025.

With fewer responses, the bureau relies more on statistical models (yikes), perhaps exemplified by the recent downward revisions of 258,000 combined jobs in May and June — a scale not seen since 1968.

![]() Labor Market Loses Heat

Labor Market Loses Heat

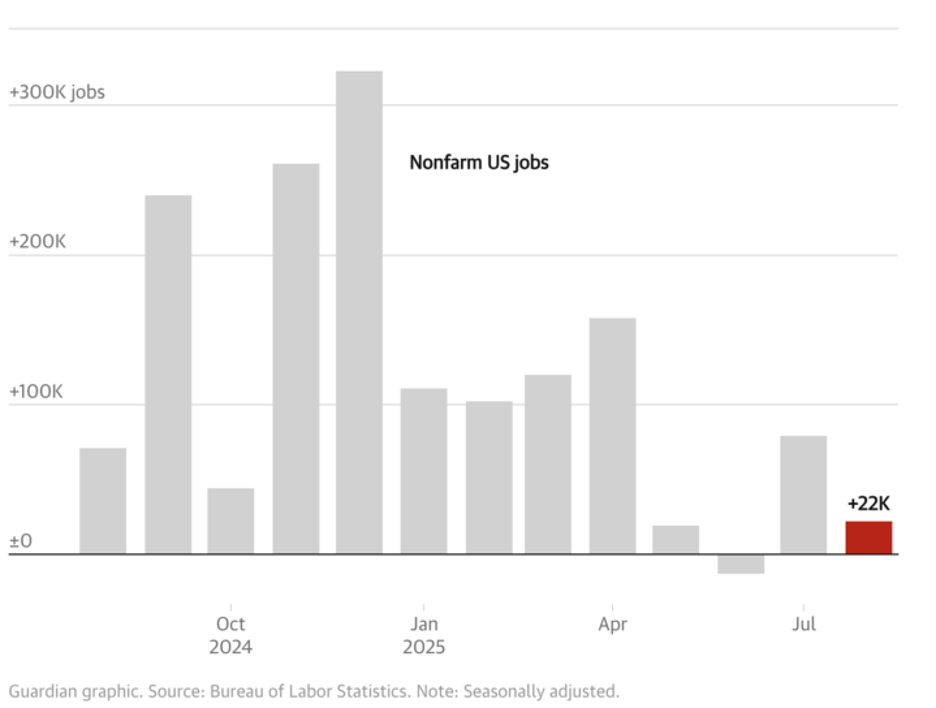

The U.S. economy barely moved the needle in August, adding just 22,000 jobs. Economists indicate the country needs to add roughly 100,000–150,000 jobs per month to keep pace with population growth.

The U.S. economy barely moved the needle in August, adding just 22,000 jobs. Economists indicate the country needs to add roughly 100,000–150,000 jobs per month to keep pace with population growth.

Strikingly, June’s numbers were revised downward to show a 13,000 job loss — the first such negative monthly decline since December 2020.

Source: BLS, The Guardian

The only sector with notable gains was health care, which added 31,000 jobs. However, these gains were offset by declines in federal government employment (down 15,000 in August, 97,000 since January) and manufacturing (basically flat in August, but down 78,000 year-to-date).

The unemployment rate ticked up to 4.3%, its highest level since 2021. The labor market is clearly cooling under the chill of — take your pick — Trump’s tariffs? Corporate belt-tightening? Automation and AI?

Markets now see the odds of a Federal Reserve quarter-point rate cut in September above 80% as the weak jobs report signals the U.S. labor market is softening fast.

Predictably, stocks are sliding today — with the three major U.S. indexes entrenched in the red. The tech-heavy Nasdaq is faring best, down 0.15% to 21,670. On the other end of the spectrum, the Big Board’s lost 0.60% to 45,365 while the S&P 500 is stuck in the middle: down 0.45% to 6,475.

Predictably, stocks are sliding today — with the three major U.S. indexes entrenched in the red. The tech-heavy Nasdaq is faring best, down 0.15% to 21,670. On the other end of the spectrum, the Big Board’s lost 0.60% to 45,365 while the S&P 500 is stuck in the middle: down 0.45% to 6,475.

Surveying the commodities complex, the price of oil’s sliding bigly — down 3% to $61.55 for a barrel of WTI. (More on that in a moment.) But it’s a banner day for precious metals. Gold’s setting a fresh record, up 1.25% to $3,651.80 per ounce, and silver’s up 0.50%, hanging onto $41.60.

- Treasury yields, across the board, are slumping with the 10-year note dropping more than 9 basis points to 4.08%, its lowest point since early April. The 2-year yield has fallen even further, down over 11 basis points to 3.48%. Meanwhile, the 30-year bond slipped today more than 8 basis points to 4.79%.

Finally, we have some crypto news to report: Tether, the issuer of the USDT stablecoin, is exploring investments beyond its traditional holdings by entering the gold sector. The company is in talks with groups across the gold supply chain — including miners, refiners and royalty firms — as a way to diversify.

Tether already holds $8.7 billion worth of physical gold bars, which it keeps in Zurich vaults. In June 2025, Tether invested $105 million to buy a minority stake in Elemental Altus Royalties, a company that earns income from gold mining projects. When Elemental Altus merged with another royalties firm, EMX, Tether committed another $100 million as part of that deal.

Tether CEO Paolo Ardoino described gold as “bitcoin in nature” during a speech at the Bitcoin 2025 conference in May. (An anonymous mining exec, heh, describes Tether as “the weirdest company I have ever dealt with.”)

In terms of the crypto market? Flagship crypto Bitcoin is up 0.85%, just under $111K, and Ethereum’s up 0.50% to $4,300.

![]() An Energy COP-Out

An Energy COP-Out

Yesterday, ConocoPhillips (COP) announced plans to cut 20–25% of its workforce — about 3,000 jobs — prompted by rising costs and lackluster oil prices.

Yesterday, ConocoPhillips (COP) announced plans to cut 20–25% of its workforce — about 3,000 jobs — prompted by rising costs and lackluster oil prices.

Most layoffs will hit before the end of the year, with CEO Ryan Lance telling staff that “fewer roles” are needed as the company seeks efficiency in a tough market. COP shares immediately sank 4% on the news, capping a near-14% drop from a year ago.

The mass layoffs at ConocoPhillips reflect the larger trend unfolding across the U.S. labor market as hiring slows and companies, especially in energy, trim their sails. BP, Chevron and oil field services giant SLB all rolled out job cuts earlier this year in response to similar pressures: sagging demand, price volatility and post-pandemic inflation.

“From the demand side, where I’m arguing from, the International Energy Agency (IEA) notes that demand is expected to decelerate for the remainder of 2025, following a strong first quarter, due to weaker economic activity worldwide,” editor Sean Ring notes.

“Trade tensions, especially the imposition of tariffs by the U.S. and retaliatory measures by other countries, are dampening economic growth and, consequently, oil demand.

“The recent de-escalation of Middle East tensions — such as the ceasefire between Iran and Israel — has removed the risk premium from oil prices, contributing to the decline in prices,” he concludes.

“Yes, oil prices are low. This means that it’s cheaper now (!) to acquire acreage. To do geophysics. Early-phase exploration. And be prepared for the inevitable upswing,” says Paradigm editor and geologist Byron King, taking up the other side of the argument.

“Yes, oil prices are low. This means that it’s cheaper now (!) to acquire acreage. To do geophysics. Early-phase exploration. And be prepared for the inevitable upswing,” says Paradigm editor and geologist Byron King, taking up the other side of the argument.

“There is no ‘energy transition.’ Only energy addition,” he continues. “Did ConocoPhillips management buy into the idea that oil is a terminal industry? That the world will mirror California-scale idiocy?

“COP management must not be very good. They are in the phase of corporate life when the operation is run by accountants and lawyers, although not (yet) the bankruptcy lawyers.

“If management hates the workforce so much, then management should resign. This is not a problem caused by ‘too many people,’ although there are always some no-loads in every big organization.

“It’s more like management is out of ideas (if they ever had any). Maybe COP should self-liquidate. Sell off its assets to other companies with more ambition.

“As for drill, baby, drill? Trump is in a tough spot,” Byron concedes. “Facile campaign slogan meets geologic reality.”

![]() Zuck Meets His Match

Zuck Meets His Match

Imagine being punished for your name. That’s the predicament of Indiana bankruptcy attorney Mark S. Zuckerberg — who happens to share a name with the billionaire founder of Facebook, Mark E. Zuckerberg.

Imagine being punished for your name. That’s the predicament of Indiana bankruptcy attorney Mark S. Zuckerberg — who happens to share a name with the billionaire founder of Facebook, Mark E. Zuckerberg.

For eight years, the attorney’s social media account has been flipped on and off in the manner of a toddler playing with a light switch. Each time, Meta accuses him of “impersonating a celebrity.” Each time, he swears he isn’t. After all, Mr. Zuckerberg’s been practicing law since young Zuck was in elementary school.

Courtesy: Mark S. Zuckerberg

The older Mark insists this is no laughing matter. He claims repeat suspensions have cost him thousands in lost business, not to mention the $11,000 he shelled out for ads that were unceremoniously yanked. He compares it to buying a billboard — only to have Meta shroud it with a blanket.

Acknowledging the error, Meta has restored his account. But only after he filed a lawsuit.

So Mark Zuckerberg had to sue Facebook… for alleging he was pretending to be Mark Zuckerberg.

Turns out, the only thing worse than having the same name as a billionaire is proving you’re not him.

Take care, reader! Enjoy your weekend, and don’t forget to check out Saturday’s Gavin Newsom-centric highlights issue.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets