🔜 Dollar Earthquake

- BRICS’ fault lines and fellowship

- Hot take: Fitch ditches AAA rating for U.S. debt

- OPEC+ cuts oil production to COVID-era levels

- Will copper get scrapped?

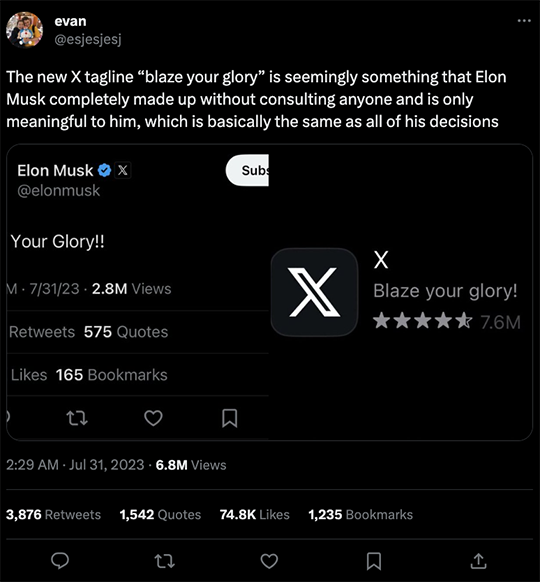

- Elon Musk is a bad brand manager

![]() BRICS’ Fault Lines and Fellowship

BRICS’ Fault Lines and Fellowship

“BRICS has been a catalyst for a tectonic change you will see in the global geopolitical architecture starting with the summit,” says Anil Sooklal, South Africa’s BRICS ambassador.

“BRICS has been a catalyst for a tectonic change you will see in the global geopolitical architecture starting with the summit,” says Anil Sooklal, South Africa’s BRICS ambassador.

The Aug. 22–24 BRICS summit, convening in Johannesburg soon, will be the largest meeting of its kind with 71 countries — or about 36% of the planet’s nations — invited to attend.

At last count, 22 countries have formally petitioned for BRICS membership while 20 others have floated informal applications. According to Sooklal, an expanded BRICS would represent “almost 50% of the global population and over 35% of global GDP.”

In which case, BRICS could usher in a seismic shift in global power. But with the summit less than three weeks away, the current BRICS bloc is, by no means, seamless.

When it comes to playing nice with the West, nations are divided into good cop-bad cop. But fractures have formed along other fault lines as well — namely, the most substantial political, economic and social fault line of all: war.

The Sino-Indian border dispute has been dragging on for 60 years, nine months and 12 days. At issue, a dispute over the border in the Himalayas that’s been simmering since 1962.

The Sino-Indian border dispute has been dragging on for 60 years, nine months and 12 days. At issue, a dispute over the border in the Himalayas that’s been simmering since 1962.

Although no shots have been fired since 1975 — China and India forbid gunfire within 1.25 miles of the “line of control” — soldiers from both countries tangled, at an elevation of 17,000 feet, in June 2020.

By many accounts, the fighting was brutal hand-to-hand combat. In the aftermath, India and China confirmed 20 and four deaths respectively.

“Relations between New Delhi and Beijing nose-dived,” Reuters says. To the point where, if Prime Minister Narendra Modi can avoid breathing the same air as President Xi Jinping, he will.

Courtesy: Twitter

Modi: What the hell, man?

Xi: Umm… Security?

Putin: I’m NOT in the hot seat?

Take, for instance, last month’s summit of the Shanghai Cooperation Organization (SCO). India was supposed to host the event; instead, Modi’s administration announced a switch to a “virtual format” at the end of May. Now, Reuters reports, Modi will likely be a “virtual participant” at the BRICS summit in South Africa.

“One Indian government official said there is growing discomfort in New Delhi about being part of groupings like BRICS and SCO which China dominates,” says Reuters, “especially as India inches closer to the United States and other Western powers.”

Really? India has refused to pick a side in the Russia-Ukraine war; instead, eschewing Western sanctions, the “largest democracy in the world” has purchased about half of Russia’s oil exports since Putin invaded Ukraine in 2022.

The Russia-Ukraine war has caused another fault line to form within the BRICS bloc. In fact, Vladimir Putin will also be a virtual attendant at the BRICS summit… because he could be arrested if he steps foot on South African soil.

The Russia-Ukraine war has caused another fault line to form within the BRICS bloc. In fact, Vladimir Putin will also be a virtual attendant at the BRICS summit… because he could be arrested if he steps foot on South African soil.

“Putin is the subject of a warrant of arrest by the International Criminal Court related to alleged war crimes during Russia’s invasion of Ukraine,” the AP says. “As a signatory to the Rome Statute that established the ICC, South Africa would be obligated to arrest Putin if he visits the African nation.”

Awkward… Although President Cyril Ramaphosa declined to draw a hard line, instead saying: “Russia has made it clear that arresting its sitting president would be a declaration of war. It would be inconsistent with our Constitution to risk engaging in war with Russia.”

This is one dysfunctional family, no? And BRICS expansion remains a sensitive subject among member countries.

China has been a vocal proponent of BRICS+ and, just today, Kremlin spokesman Dmitry Peskov says: “Of course we believe… the expansion of BRICS will contribute to the further development and strengthening of this organization.”

Once again, India claims it wants to slow everyone’s expansion roll. Brazil, leery of losing dominance in South America, has sided with India in the past, but President Lula is keeping his options open. South Africa, too, straddles the BRICS expansion fence.

But what could unite this motley BRICS crew, each with its own competing interests? A common currency.

But what could unite this motley BRICS crew, each with its own competing interests? A common currency.

First, Paradigm’s macro expert Jim Rickards expects BRICS expansion in the near term; most notably, Jim anticipates that Saudi Arabia will be added.

Second, alongside the growing demand for de-dollarization, he believes — in the long term — BRICS+ will roll out a payment currency. “The new BRICS+ Currency Union will be formed with expected participation by members of the Eurasian Economic Union (EEU) and the Shanghai Cooperation Organization (SCO),” Jim says.

“They will launch the new currency starting with an announcement on Aug. 22,” he notes. “It will take a decade or more to reach maturity, but the launch itself will shock markets.”

Which jibes with Kremlin spokesman Dmitry Peskov’s comments today, who affirms the “relentless” global movement to ditch the dollar. A BRICS currency, he says, “can hardly be implemented in the near time… But it does not mean it should not be discussed.”

In this instance, it sounds as if Russia is playing both good and bad cop. At the same time, Peskov’s statement sounds like a purposeful lowering of expectations… ahead of something actually meaningful.

![]() Hot Take: Fitch Ditches AAA Rating for U.S. Debt

Hot Take: Fitch Ditches AAA Rating for U.S. Debt

“I'm not sure why we're supposed to believe there's any connection,” says Paradigm’s chart hound Greg Guenther about the media’s correlation between Fitch downgrading U.S. debt and the market hitting the skids yesterday.

“I'm not sure why we're supposed to believe there's any connection,” says Paradigm’s chart hound Greg Guenther about the media’s correlation between Fitch downgrading U.S. debt and the market hitting the skids yesterday.

Greg doesn’t buy the mainstream’s narrative “especially since the dollar isn't budging,” he says. “Stocks are likely down because the market’s getting a little too frothy… following a red-hot July.

“I have one big question on my mind this week as we consider this market action,” says Greg. “Will we see a broader move lower that will culminate in an actual pullback of 5% or more, with most stocks and sectors moving lower?

“Or… Will recent winners (semis, megacaps, tech-growth) drop sharply, while buyers immediately rotate into other stocks and sectors?”

For the moment, at least, the tech-heavy Nasdaq is getting a reprieve of sorts: The index is in the green — up 0.10% — at 13,985. On the other hand, the S&P 500 has lost 0.15% market cap to 4,505 while the DJIA is down 0.10% to 35,240.

Checking on commodities today, it’s as if the Fitch-downgrade sell-off never even happened, with crude rebounding 1.75% today to $80.90 for a barrel of WTI. (Our colleague Sean Ring believes $95 is in sight… More on that in a moment.) As for precious metals, gold’s spot price is up $2.70 to $1,936.90, according to Kitco, but silver is down 0.20% below $24.

Meanwhile, the crypto market is hanging out in the green: Bitcoin is up 0.33% to $29,250 and Ethereum is up 0.10% to $1,840.

![]() OPEC+ Cuts Oil Production to COVID-Era Levels

OPEC+ Cuts Oil Production to COVID-Era Levels

“OPEC’s crude production tumbled by the most in three years as Saudi Arabia implemented a deeper cutback in a bid to shore up global markets,” Bloomberg reports.

“OPEC’s crude production tumbled by the most in three years as Saudi Arabia implemented a deeper cutback in a bid to shore up global markets,” Bloomberg reports.

Citing a Bloomberg survey, July output among OPEC nations dropped 900,000 barrels per day. “It’s the biggest reduction since the group and its allies slashed supplies during the depths of the COVID pandemic in 2020.”

Saudi Arabia promised to cut oil production in a bid to stabilize oil prices following “lackluster economic data in China and concerns about recession in the U.S.,” Bloomberg says. “Traders expect the kingdom will announce an extension of the measure into September… deepening signs of a supply shortfall in the market.”

Further bolstering Saudi Arabia’s admittance to BRICS+? “The Saudis are also — belatedly — receiving some help in their effort to support the market from Russia, a member of a wider alliance known as OPEC+.

“Moscow had for many months flouted pledges to reduce supplies as it focused on maximizing revenues to fund its war against Ukraine,” Bloomberg adds, “but tanker-tracking data shows it’s now paring exports. Shipments have slumped to a seven-month low at just under 3 million barrels a day.”

![]() Will Copper Get Scrapped?

Will Copper Get Scrapped?

South Korean scientists claim they’ve found a ‘room-temperature superconductor’ that can transport electricity frictionlessly.

South Korean scientists claim they’ve found a ‘room-temperature superconductor’ that can transport electricity frictionlessly.

“Typically, superconductors require extremely low temperatures to function effectively,” says a post at Fagen Wasanni Technologies blog.

But according to the researchers’ paper (which has not been peer-reviewed yet): “All evidence and explanation lead that LK-99 is the first room-temperature and ambient-pressure superconductor. The LK-99 has many possibilities for various applications such as magnet, motor, cable, levitation train, power cable, qubit for a quantum computer, THz antennas, etc.”

The blog post notes: “The research team has also measured the critical current, lack of electrical resistance, critical magnetic field and the Meissner effect in the LK-99 material. The Meissner effect refers to a superconductor’s ability to expel a magnetic field… These observed properties have led the researchers to assert that LK-99 is indeed a superconductor.

“The creation of a superconductor that can operate under regular conditions outside of a laboratory would be revolutionary.”

We maintain a healthy skepticism, particularly since 21st-century innovation in “real stuff” — meaning outside the realm of computers — has largely ground to a standstill. Nevertheless, for now, we’re cautiously optimistic.

![]() Elon Musk Is a Bad Brand Manager

Elon Musk Is a Bad Brand Manager

Say what you will about the world’s wealthiest individual, but Musk’s Twitter rebrand is objectively terrible.

Say what you will about the world’s wealthiest individual, but Musk’s Twitter rebrand is objectively terrible.

With zero warning or fanfare, on Sunday, July 23, Twitter users logged onto the app to find a black X had replaced the company’s iconic blue bird.

“After announcing that the communication platform will pivot to include a variety of upcoming services” — under the X Corp. umbrella — “Musk also said eventually ‘all the birds’ and the Twitter branding would be retired,” the BBC reports.

Which, apparently, also includes Twitter’s slogan: “Let’s Talk.”

Blaze your glory? A word salad if there ever was one.

“I think there was a true affinity for Twitter and the brand,” says “branding leader” Orlando Baeza. “Their brand identity went from feeling warm and welcoming to dark and members-only.”

Come to think of it, though, what should we expect from someone who named his child X Æ A-12?

You all take care… And be sure to join us tomorrow for another 5 Bullets edition.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets