Atomic IPO

![]() Atomic IPO

Atomic IPO

One of our major themes of the last 18 months just intersected with one of our major themes of this week.

One of our major themes of the last 18 months just intersected with one of our major themes of this week.

“Holtec International, a key player in the nuclear industry, plans to go public within several months,” reports Barron’s.

“The IPO would almost certainly be the largest nuclear-energy offering in years, giving investors one of the few pure-play ways of buying into the industry… The company could be worth more than $10 billion.”

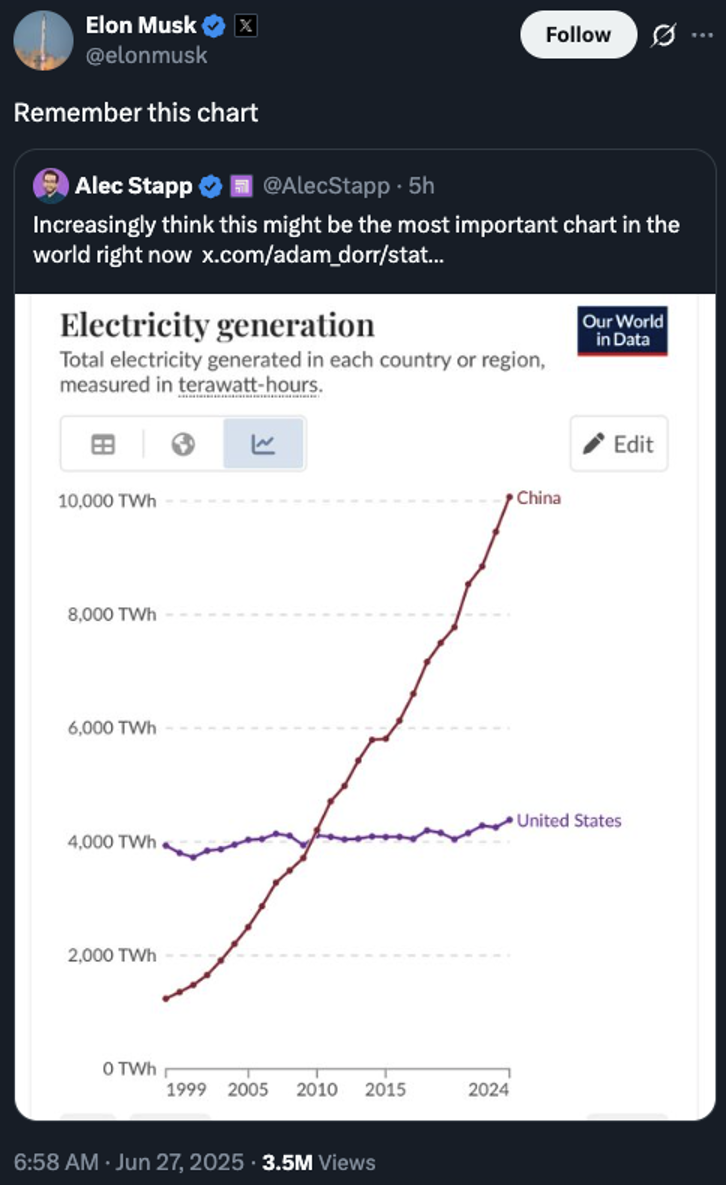

Since early 2024 we’ve been sounding the alarm in these virtual pages about the enormous demands that AI is making on the U.S. power grid — a grid whose capacity hasn’t grown for over a decade.

To illustrate, Elon Musk posted the following just this morning…

Result: During a heat wave this week, large swaths of the eastern and central United States were at risk of rolling blackouts. Fortunately, it didn’t come to that. This time.

Amid that backdrop, Holtec is in the process of restarting a shuttered nuclear power plant — a first for the industry. The Palisades plant in southwest Michigan was mothballed in 2022.

Holtec also plans to beef up Palisades’ capacity with the installation of two SMRs or “small modular reactors” at the site. (SMRs are still a fledgling technology; none has yet been deployed in the United States.)

If all goes according to plan, Palisades should be up and running again this fall — a few months before Holtec starts trading publicly in early 2026.

It’s been a good year for IPOs in the United States. With an asterisk.

It’s been a good year for IPOs in the United States. With an asterisk.

As of Wednesday, Bloomberg says the share price of companies that started trading in 2025 are up by a weighted average of 53%.

But hold on: That number’s been pulled artificially higher by the blockbuster performance of crypto phenom Circle Internet Group — spotlighted in this space yesterday — as well as the cloud computing firm CoreWeave.

And even for the rare exceptions that deliver blockbuster performance, the problem remains for retail investors: The biggest gains, by far, are had before a company goes public.

Unfortunately those gains are limited to investors with deep pockets.

That’s a situation that Paradigm’s venture capital veteran James Altucher has been out to remedy this week. His contacts have clued him into a rare loophole in the IPO market — affording everyday folks like you the chance to buy into an up-and-coming quantum computing firm before it goes public.

As you might already know, quantum computing stocks have been on a hot streak at times this year — leaping as high as 2,798% in just months.

But this isn’t just any quantum-computing company. “I have reason to believe that every business on Earth will need this company’s products,” James tells us — “real soon.”

Readers of James’ Microcap Millionaire service already know he plans to buy in next week — and he’s giving them the chance to do so first.

If you’re not among them, and we’ve piqued your curiosity, time is running out: You’ll want to click here and check out James’ presentation before the market closes at 4:00 p.m. EDT.

Give it a look now. You can always come back to the rest of our 5 Bullets later.

![]() Inflation: Can’t Catch a Break

Inflation: Can’t Catch a Break

Uh-oh — another sign that inflation is moving in the wrong direction.

Uh-oh — another sign that inflation is moving in the wrong direction.

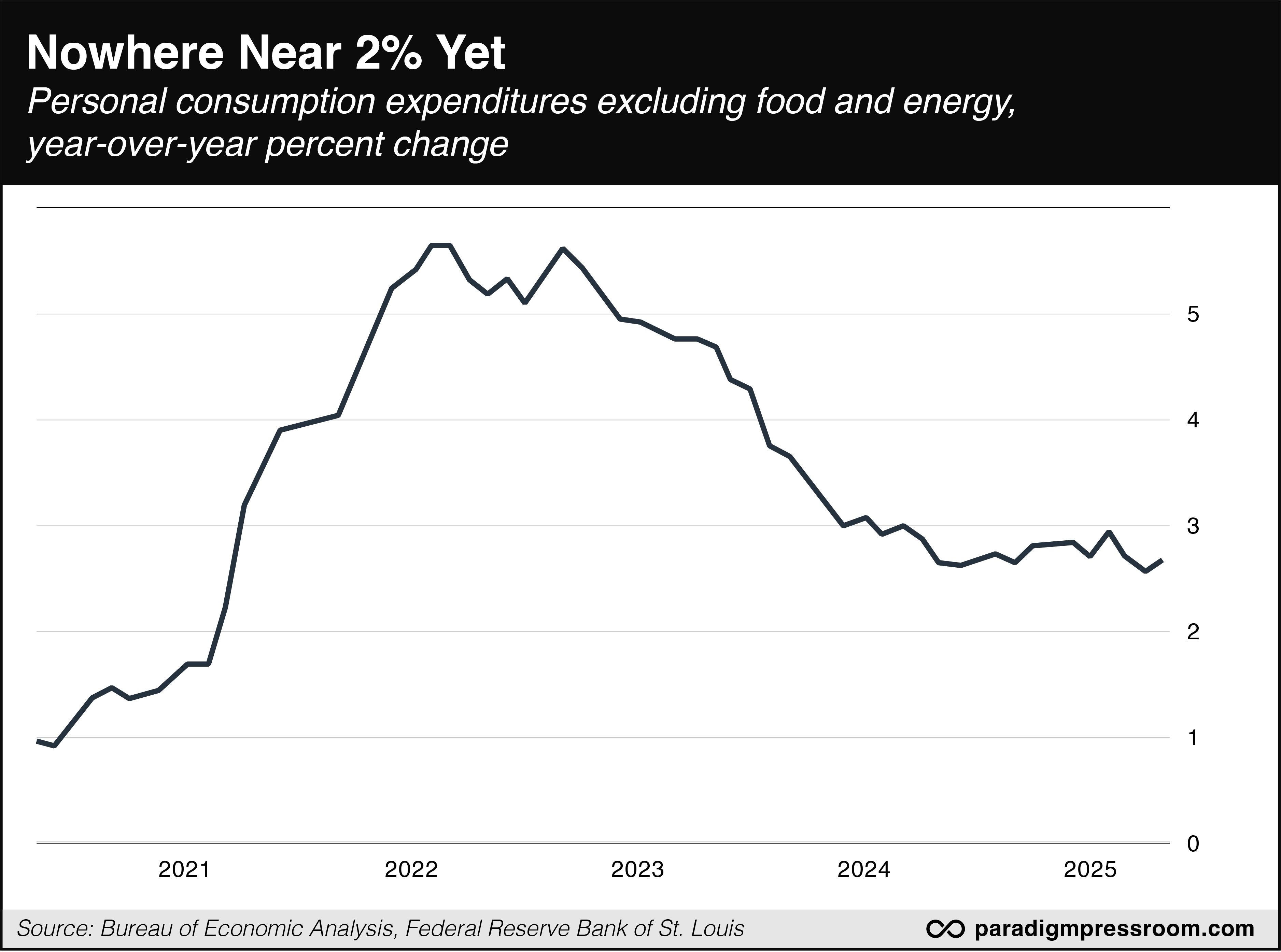

Earlier this month, the consumer price index from the Labor Department showed that the annual inflation rate inched up from 2.4% to 2.5%.

This morning the Commerce Department delivered “core PCE,” which is the Federal Reserve’s preferred inflation gauge. This too inched up — from 2.6% to 2.7% — confounding the expectations of Wall Street economists.

Zooming out, it’s apparent that over the last year this particular inflation measure has bottomed out in a range between 2.6–3.0%. That’s nowhere near the Fed’s desired 2% inflation target.

If you’ve been with us for the last year or two, this should be no surprise: More than once, we’ve pointed to powerful evidence that once inflation sails beyond 5% — as it did in 2022 — it typically takes a decade to return to “normal” 2% inflation.

How will this number affect the Fed’s path on interest rates? Looking at the futures markets this morning, traders are pricing in a 79% probability the Fed will stand pat at its next meeting on July 30 — keeping the fed funds rate at 4.5%.

If true, the first rate cut of 2025 won’t come until mid-September.

No doubt this development is a disappointment for Mr. Market — but so far he’s taking it in stride today.

No doubt this development is a disappointment for Mr. Market — but so far he’s taking it in stride today.

At last check, the S&P is up half a percent on the day at 6,174. If that holds by day’s end, the index will have surpassed its previous record close four months ago.

The Nasdaq is likewise up about a half percent, the Dow about three-quarters of a percent.

Among the other cross-currents that have traders chattering today — the possibility Donald Trump will name a replacement for Fed chair Jerome Powell this fall, even though Powell’s term isn’t up till May 15 next year.

In addition, U.S. and Chinese negotiators have supposedly come to terms on a “trade framework” — although the details from both sides are, to say the least, vague.

“Mr. Slammy” showed up for the precious metals today. The shadowy forces that depress prices every now and then have crushed gold by nearly 2%, the bid down to $3,264.

“Mr. Slammy” showed up for the precious metals today. The shadowy forces that depress prices every now and then have crushed gold by nearly 2%, the bid down to $3,264.

In addition, silver is losing its grip on the $36 level. And platinum, which hit its highest level since 2014 yesterday, is down 5.5% to $1,341.

Crude is up about 1% as its bounce from oversold levels earlier this week continues. At last check a barrel of West Texas Intermediate was fetching $65.87.

Bitcoin is stuck in the mud at $106,585.

![]() Bonds: An Orderly Race for the Exits

Bonds: An Orderly Race for the Exits

The speedy whoosh in the bond market is in the rear-view. Now comes the slow-motion sell-off.

The speedy whoosh in the bond market is in the rear-view. Now comes the slow-motion sell-off.

In April, amid the market panic surrounding Donald Trump’s “Liberation Day” announcement, a funny thing happened: While stocks were selling off hard, so were bonds.

Usually at times like that, scared money floods into bonds as a safe haven. But not then: Bond prices fell hard and yields rose sharply. The yield on a 10-year U.S. Treasury note soared past 4.5%.

It was this panic in the bond market that prompted the president to announce a 90-day pause on his tariff regime. (Those 90 days are up on July 8, by the way.)

The mainstream was quick to chalk up the bond market panic to a lack of confidence in Trump’s tariff policy. But as we said at the time, there was more to it than that.

There was Joe Biden’s radical step of freezing the U.S. Treasuries held by Russia’s central bank. And there was the lingering unease with Uncle Sam’s debt burden — already steep going into the 2020 pandemic, and growing at an even faster pace since.

The initial bond-market panic in April has eased. The yield on a 10-year Treasury today is 4.27%.

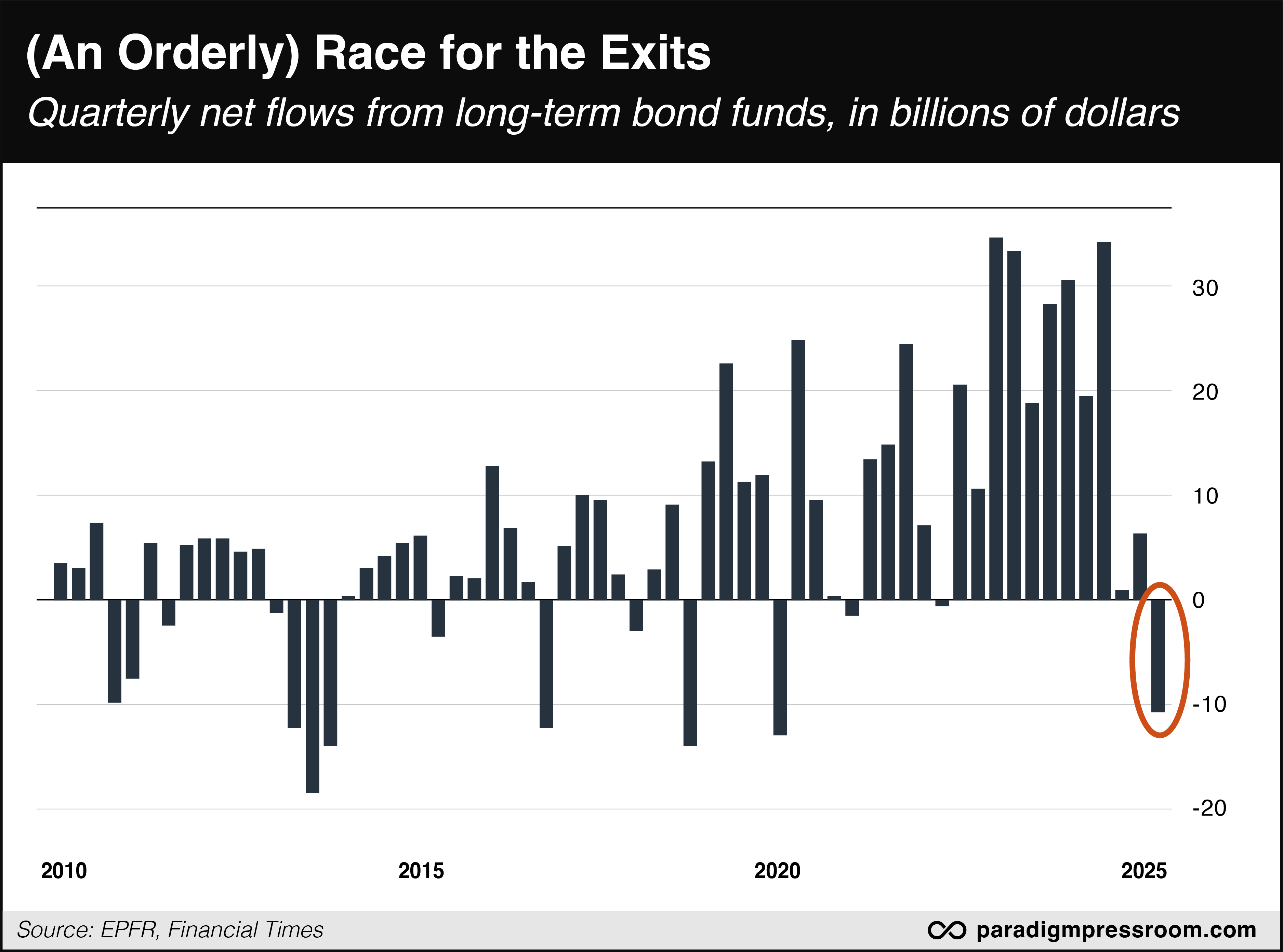

But that doesn’t mean confidence in Uncle Sam’s debt has returned: “Investors are fleeing long-term U.S. bond funds at the swiftest rate since the height of the COVID-19 pandemic five years ago,” says the Financial Times — “as America’s soaring debt load tarnishes the appeal of one of the world’s most important markets.”

But that doesn’t mean confidence in Uncle Sam’s debt has returned: “Investors are fleeing long-term U.S. bond funds at the swiftest rate since the height of the COVID-19 pandemic five years ago,” says the Financial Times — “as America’s soaring debt load tarnishes the appeal of one of the world’s most important markets.”

From early 2022 through early 2025, long-term bond funds took in about $20 billion every quarter. But during the second quarter of this year, $11 billion has fled these funds.

It’s not a panic — more like an orderly race for the exits.

Bond funds are only a slender portion of the enormous bond market — but they’re a valuable snapshot of the market vibe.

“It’s a symptom of a much bigger problem,” DoubleLine Capital’s Bill Campbell tells the FT. “There is a lot of concern domestically and from the foreign investor community about owning the long end of the Treasury curve.”

Those jitters have only grown as the “Big Beautiful Bill” takes shape in Washington. (The Senate might vote on its version of the bill as early as today.) Now that the promised budget savings from DOGE have turned out to be a bust, the bill is likely to accelerate the national debt’s growth trajectory.

The Trump administration insists its policies will in fact slow the growth of Uncle Sam’s debt load — but we’ve heard those promises from Republican administrations before and they never pan out. (That’s not to let spendthrift Democrats off the hook, to be clear.)

The stakes couldn’t be higher: Shrinking demand for U.S. Treasury debt translates over time to higher interest rates — which makes the government’s debt burden only worse.

Imagine taking on new credit card debt just to keep up the minimum payments on your existing debt.

That’s bad for a household. It’s way worse for a country…

![]() Comic Relief (and Some Myth-Busting)

Comic Relief (and Some Myth-Busting)

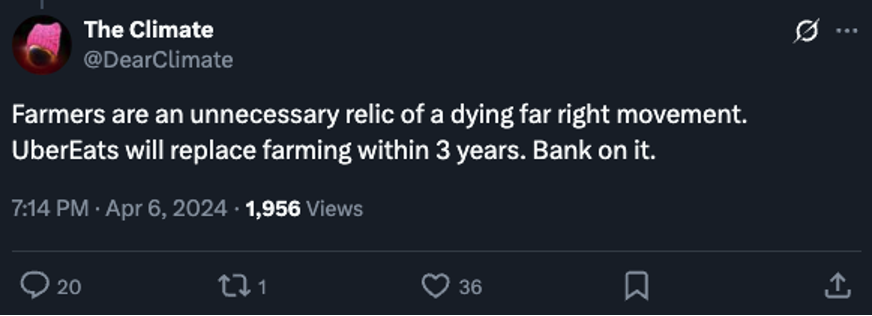

For whatever reason, this tweet from last year is making the rounds now — and people are taking it seriously.

For whatever reason, this tweet from last year is making the rounds now — and people are taking it seriously.

“Who’s gonna tell him?” says a post this week on the alt-right social media platform Gab. And there’s more where that came from.

Looking at the account of the individual behind this tweet, it’s definitely satire. The account is run by a Canadian who routinely skewers the climate-obsessed control freaks and power trippers in his country and elsewhere. Now you know…

![]() Politics and Investing

Politics and Investing

We heard from another reader after our inquiry on Wednesday: Have you ever let your politics drive your investing decisions?

We heard from another reader after our inquiry on Wednesday: Have you ever let your politics drive your investing decisions?

“Thanks to turmoil/volatility created by the current administration the ‘playtime’ part of my portfolio has increased 5x, mostly via put options. About to pay off the five-year car loan I signed up for last December. Not happy but making bank.”

Dave responds: Sounds like it. Interesting contrast with the fellow yesterday who sold California municipal bonds and bought shares of the Big Oil firm Chevron. He’s happy too.

Probably not the last we’re going to hear of this theme — the growing partisan divide reflected in attitudes toward future stock market performance. It’s been interesting exploring it this week.

All of which brings up a paradox for our firm and many of our readers.

All of which brings up a paradox for our firm and many of our readers.

It’s safe to say, based on our various marketing campaigns of the last several years, that the overwhelming majority of Jim Rickards’ readers lean Republican.

Which means, if the Gallup polling data is accurate, that they’re by and large optimistic about the stock market’s near-term prospects because a Republican occupies the White House.

Of course, Jim is not optimistic about the stock market’s near-term prospects.

Yes, he’s keen on Individual names tied to his “American Birthright” thesis. But the broad market dominated by the Magnificent 7? Not so much.

So if you’re having trouble squaring that circle, let me try to help.

Jim spent a long time on Wall Street — long enough to be completely jaded by Wall Street firms’ relentless pressure on their clients to buy stocks. That’s just how he rolls.

Even before he joined our firm, I remember sitting in a Vancouver hotel conference room in 2013 watching him describe his preferred asset mix — gold, cash, land, fine art, private equity.

Notice that stocks are absent. Unlike most entry-level newsletters, there’s no portfolio on the back page of Strategic Intelligence, and there never has been.

Jim is always on alert for something to go wrong in the stock market because it is inextricably linked to the banks and the financial system. You would be too if you had a front-row seat to the near-calamity that was the collapse of Long Term Capital Management in 1998. It’s a lived experience and a worldview that commands a loyal following.

Do we have other experts in our stable who disagree with Jim’s outlook? Absolutely.

We don’t enforce a “company line” around here. True to our name, we ask only that our editors bring a rigorous paradigm to their work — a model of how the markets and the economy operate.

They don’t have to agree — as anyone who’s witnessed one of our rollicking Whiskey Bar panel discussions can attest — but they have to have a systematic outlook and the ability to defend it.

That’s how they can build a following — and we can maintain a sustainable business.

It’s not easy — but with informed and engaged readers, it’s more than worthwhile!

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets