The Real Reason for the Tariff Pause

![]() The Real Reason for the Tariff Pause

The Real Reason for the Tariff Pause

It was Jan. 7, 1993 — two weeks before Bill Clinton would be sworn in as the 42nd president.

It was Jan. 7, 1993 — two weeks before Bill Clinton would be sworn in as the 42nd president.

His economic policy team was gathered in Little Rock. At some point during the six-hour meeting, Clinton burst into one of his frequent foulmouthed tirades: “You mean to tell me that the success of my program and my re-election hinges on the Federal Reserve and a bunch of ****ing bond traders?”

To a great degree, yes. Especially those bond traders.

In a 13-month stretch from October 1993–November 1994, the yield on a 10-year U.S. Treasury note climbed from 5.2% to over 8%. That was the bond market expressing zero confidence that Washington would ever get its fiscal house in order.

Clinton adviser James Carville: "I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody."

Fast-forward 32 years to yesterday… and another baby boomer president learned the lesson anew.

Fast-forward 32 years to yesterday… and another baby boomer president learned the lesson anew.

As you’ve no doubt heard, Donald Trump put a 90-day pause on the “reciprocal” tariffs against every country but China. (The total tariff on Chinese imports to the United States is now 145%,)

The mainstream narrative is that after weeks of Trump and his advisers saying they didn’t care about a falling stock market because the richest 10% of Americans own 88% of all stocks… Trump caved yesterday once the S&P 500 fell 20% from its February peak.

But it wasn’t the stock market freaking him out. It was the bond market.

Nobody paid attention — because it didn’t feed the mainstream narrative — but Trump himself said as much yesterday.

Nobody paid attention — because it didn’t feed the mainstream narrative — but Trump himself said as much yesterday.

“The bond market is very tricky, I was watching it… people were getting a little queasy.”

The MOVE Index is a measure of volatility in bonds — comparable to the VIX for stocks. Anytime the MOVE index surpasses 140, it typically signals some sort of imminent dislocation in financial markets.

Yesterday the MOVE Index hit 172.

That’s happened only three times before — the collapse of Silicon Valley Bank two years ago… the collapse of Lehman Bros. in 2008… and the collapse of the hedge fund Long Term Capital Management in 1998.

Going by Wall Street’s conventional wisdom, the bond market “shouldn’t” have blown up yesterday.

Going by Wall Street’s conventional wisdom, the bond market “shouldn’t” have blown up yesterday.

A CNBC article republished at the NBC News website described the action as “confounding.”

Usually amid a stock-market rout, hot money floods into Treasuries because of their perceived safety.

As the thinking goes, when you lend money to Uncle Sam, you know he’ll pay you back. Even if he pays you back in depreciating fiat currency, that’s a better bet at a time the stock market is going to hell.

That’s exactly what happened during the global financial crisis in 2008. Anyone sitting on long-term Treasuries was able to ride out the crisis in style and make up for some of their stock losses. (A substantial position in long-term Treasuries saved your editor’s bacon in 2008.)

But before the tariff reversal yesterday afternoon, both the stock market and the bond market were going to hell at the same time.

But before the tariff reversal yesterday afternoon, both the stock market and the bond market were going to hell at the same time.

Reminder: Falling bond prices translate to rising bond yields. The yield on a 10-year Treasury note leaped from 3.99% as of last Friday’s close to a peak of 4.51% yesterday.

In bond market terms, that’s not just an earthquake. That’s Fukushima — an earthquake, a tsunami and a nuclear reactor meltdown.

As the bond market fell apart, so did the Trump administration’s hopes that its policies would drive down longer-term interest rates — making it easier for businesses and consumers to borrow and especially to lessen the burden of financing Uncle Sam’s colossal debt load.

(We’ll come back to the part about the government’s debt load shortly…)

But forget the mainstream and forget conventional wisdom: The bond-market train wreck is “confounding” only to someone who hasn’t been paying attention. As you’ll see momentarily…

![]() The World “Nopes out” of Treasuries

The World “Nopes out” of Treasuries

That the bond market was going haywire was beyond dispute. Exactly why is open to interpretation.

That the bond market was going haywire was beyond dispute. Exactly why is open to interpretation.

By some accounts, the “basis trade” was blowing up. The basis trade is something hedge funds do to exploit the tiny gaps between the price of U.S. Treasuries and the price of Treasury futures. These hedge funds employ enormous amounts of leverage to achieve outsized profits.

But a sudden jump in bond yields can wreck these basis trades in short order. As the thinking goes, some big player — maybe Ken Griffin’s Citadel, maybe someone else — was in deep doo-doo and owed beaucoup bucks to someone else and didn’t have the ready cash.

Perhaps that “someone else” also lacked ready cash to pay their counterparties… and so on, and so on. That’s a recipe for “contagion” and a 2008-style disaster at warp speed.

That’s one possibility. The other is that foreign holders of Treasuries exercised a vote of no confidence in the U.S. government.

That’s one possibility. The other is that foreign holders of Treasuries exercised a vote of no confidence in the U.S. government.

That’s the possibility broached yesterday by Fox Business reporter Charlie Gasparino. “And who are those people dumping our bonds? Japan, the biggest holder of bonds, was selling bonds,” he said. “That’s what I’m getting from some very big money managers. China, maybe to some extent, but it was largely Japan and others.

“If you have a mass sale of bonds, that means people are losing confidence in the U.S. economy, on the ability to do deals with us; and from what I understand, this is what forced the hand of this 90-day reprieve.”

We’ll take Gasparino’s hypothesis one step further.

If it was foreigners dumping Treasuries, that’s because foreigners see the tariffs as a “last straw” piled on top of an enormous haystack that’s been accumulating for years.

If it was foreigners dumping Treasuries, that’s because foreigners see the tariffs as a “last straw” piled on top of an enormous haystack that’s been accumulating for years.

Begin with the sheer size of the national debt — $36.2 trillion.

That’s 120% the size of America’s annual economic output– far beyond the “point of no return” when the scale of the debt chokes off any prospect of meaningful economic growth in the future. Weak economic growth translates to weak tax revenue, which only makes the debt load worse and worse.

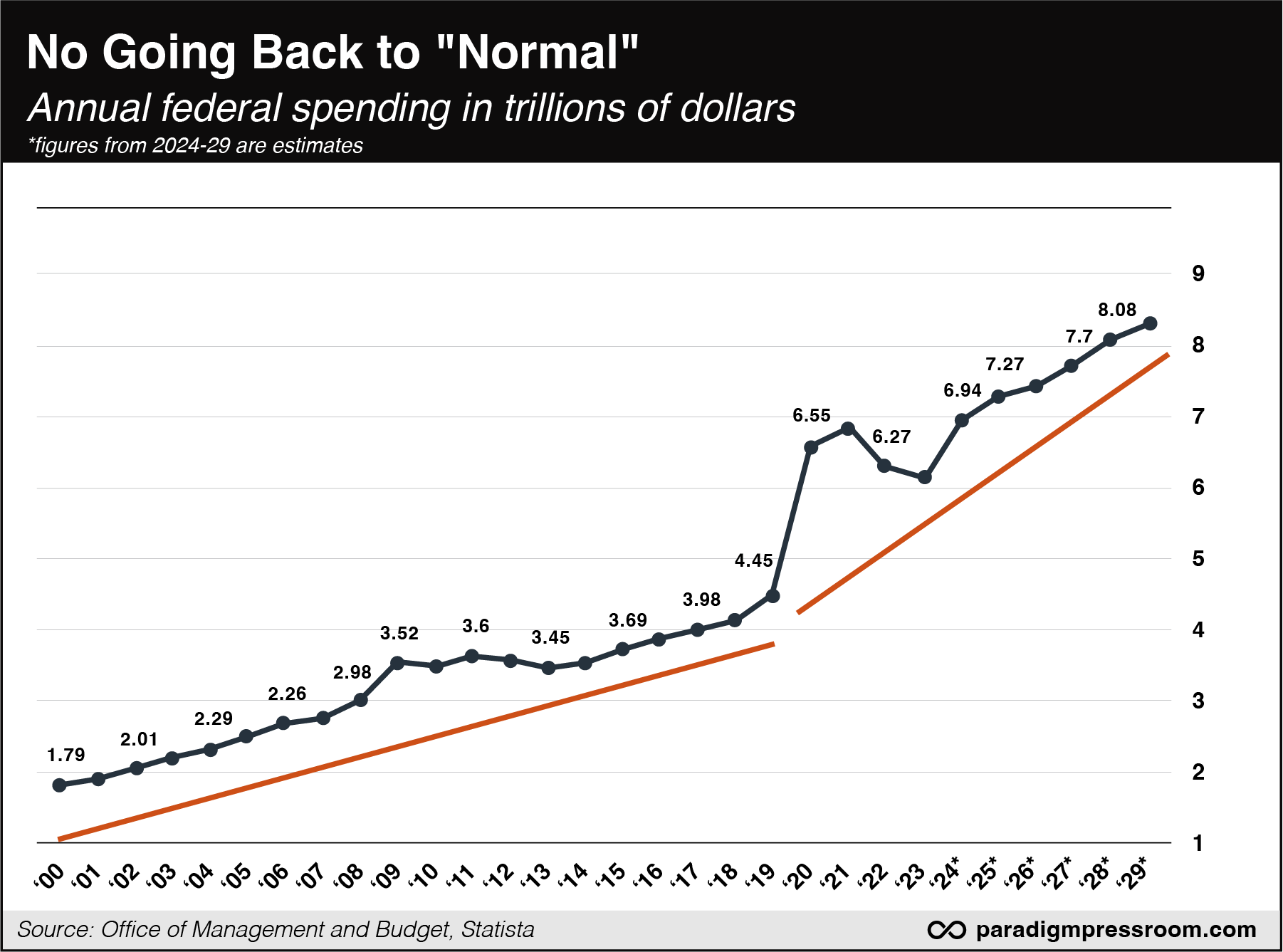

Meanwhile, the efforts of the DOGE boys have yet to put a significant dent in this chart — which we can’t share often enough. Since 2020, federal spending has gone onto a permanently higher trajectory. We’re not going back to some sort of pre-pandemic “normal.”

Beyond the sheer size of the debt, there’s the fact U.S. Treasuries have become a weapon of economic warfare.

Beyond the sheer size of the debt, there’s the fact U.S. Treasuries have become a weapon of economic warfare.

This too we can’t say often enough: The Biden administration’s unprecedented sanctions on Russia — freezing the Russian central bank’s Treasuries — undermined foreigners’ confidence in Treasuries as a “safe” asset.

And now that the Trump administration is using tariffs not as a way to “level the playing field” with trading partners but rather to get concessions on everything from fentanyl to migrants to punishing the buyers of Venezuelan oil…

… is it any wonder a critical mass of foreigners might be “noping out” of U.S. Treasuries for good?

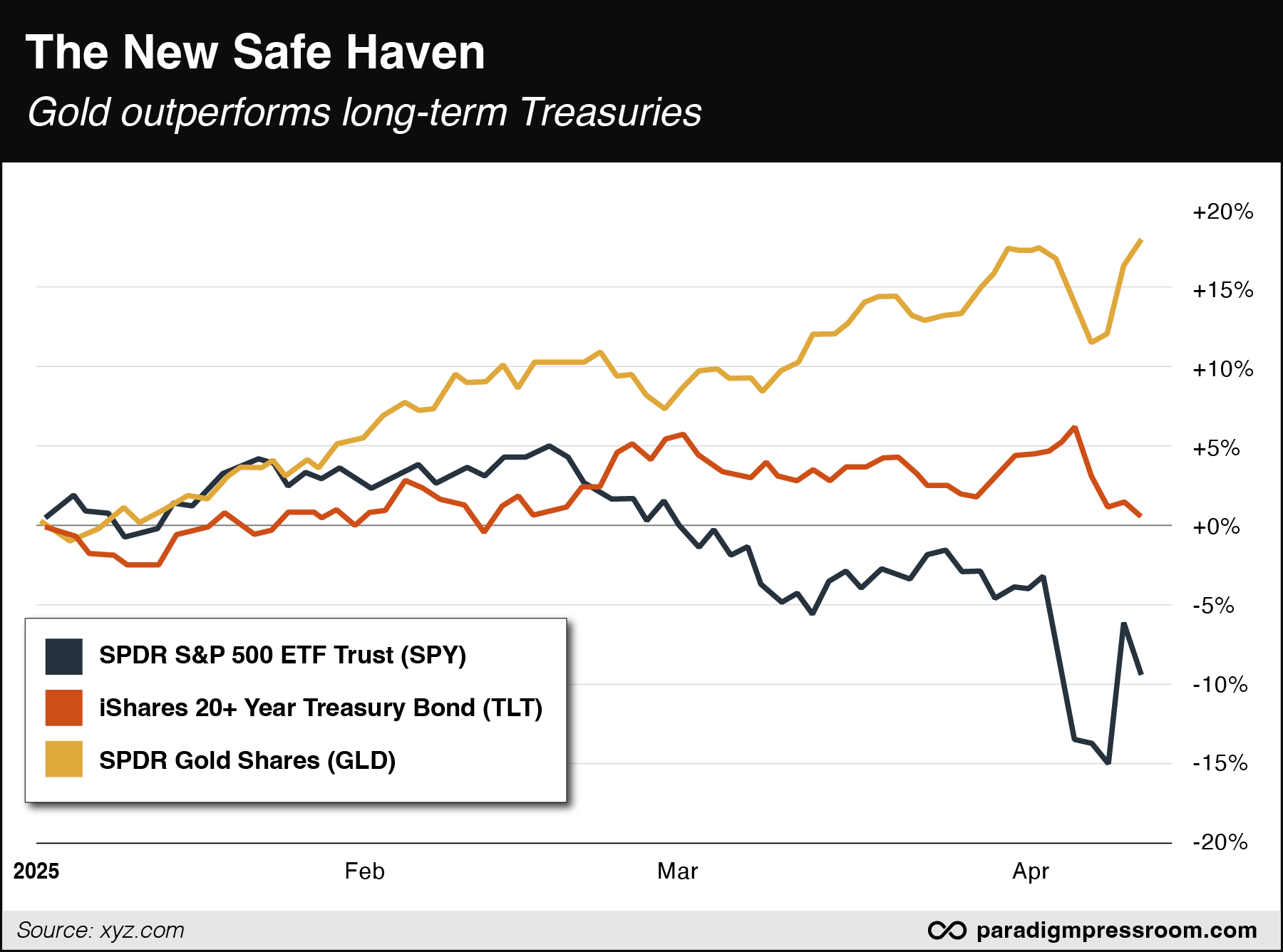

It’s no coincidence that as stocks and bonds both sold off yesterday, the real “safe haven” was gold.

It’s no coincidence that as stocks and bonds both sold off yesterday, the real “safe haven” was gold.

Gold soared over $100 in a day — something keen observers of the precious metals markets can’t recall happening before. Gold was where the hot money was flowing.

Year-to-date, gold is up 18% while the S&P 500 is down 10% and long-term Treasuries are flat after this week’s sell-off. (I ditched my own long-term Treasuries last year and I don’t expect to buy them again until at least the 2050s, assuming I live that long.)

Yes, gold is back near all-time highs this morning at $3,148 — up another $66 on the day! And while it might pull back to $2,800–2,900 during this spring and early summer, the long-term path is still much, much higher.

If you already have 10% of your portfolio allocated to gold, as Paradigm’s macro maven Jim Rickards has long recommended, good on you.

If not, don’t be intimidated by the all-time high. Just dollar-cost average: Buy a little bit at a time, every week or every month, until you get to your 10%.

Because like it or not, Treasuries just aren’t the safe haven they used to be…

![]() The Reversal After Reversal Day

The Reversal After Reversal Day

After ripping 9.3% higher on the day yesterday, the stock market is down 3.2% as we write today. Good times.

After ripping 9.3% higher on the day yesterday, the stock market is down 3.2% as we write today. Good times.

The S&P 500 rests at 5,285, down 6.5% from where it stood before the “Liberation Day” announcement eight days ago. The Dow’s losses on the day are narrower, the Nasdaq’s steeper.

Despite yesterday’s monster rally, the biggest since the 2008 financial crisis, “not much has changed,” ventures Paradigm chart hound Greg Guenthner.

The major U.S. indexes “remain below their respective 200-day moving averages. The tariff situation has evolved, but it hasn’t gone away (and won’t anytime soon). Volatility remains elevated.

“Taking all this into account, I do not believe this market will sprint back to new highs right away.”

That doesn’t necessarily mean a crash — but it does likely mean a lot of sideways chop.

Elsewhere, crude is back below $60. Yesterday it traded as low as $55 and as high as $62.50.

Elsewhere, crude is back below $60. Yesterday it traded as low as $55 and as high as $62.50.

The White House no doubt welcomes lower oil prices. But if they get much lower than this, some wells will cease to be profitable and their operators will cap them. Which would have the effect of constraining supply and pushing prices back higher.

As it happens, a downtrend in energy prices helped bring the official inflation number to its lowest in six months.

As it happens, a downtrend in energy prices helped bring the official inflation number to its lowest in six months.

The Bureau of Labor Statistics says inflation is now running 2.4% year-over-year. On the one hand, that’s down sharply from 3.0% only two months earlier. On the other hand, it’s no better than it was last fall.

It helped that gasoline prices tumbled 6.3% between February and March. Overall energy costs — fuel, heat, electricity — fell 2.4%.

As we wrap up the day’s market action, let’s not forget silver is still a bargain relative to gold at $31.11. The gold price is still 100x higher as it’s been since late last week. The only other time that’s been the case was during the market meltdown of 2020.

Bitcoin hovers around $80,000.

![]() AI Needs Electricity (No Way! Really?)

AI Needs Electricity (No Way! Really?)

Took long enough: The International Energy Agency has issued a report saying AI will place extreme demands on power grids worldwide, and especially in the United States.

Took long enough: The International Energy Agency has issued a report saying AI will place extreme demands on power grids worldwide, and especially in the United States.

We’ve been on the case in these virtual pages since early 2024: The U.S. power grid was already in rough shape before AI datacenters started growing like topsy.

Now the IEA — an information clearinghouse for 31 member governments including all of North America and much of Europe — is finally getting around to acknowledging that “the rise of AI has huge implications for energy.”

A few interesting tidbits emerge in its new AI report: America will capture the biggest share of growing AI power demand. “By the end of the decade,” says a Wall Street Journal summary, “the country is expected to consume more electricity for AI-driven data processing than for the production of aluminium, steel, cement and chemicals combined…”

Investment implications? “To meet rising demand, a diverse mix of energy sources will be tapped,” the Journal continues. “Renewables and natural gas are expected to play a leading role.”

The IEA is all aboard the climate-change train so of course it’s going to tout renewables. But it’s onto something with natural gas: Gas is the only way to quickly spin up added capacity. Nuclear is viable, yes — but construction is slow and the industry needs juice now.

![]() Comic Relief

Comic Relief

Before we go, an oldie but goodie…

Before we go, an oldie but goodie…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets