Biden In Fantasyland

- Joe Biden, safe in his imperial delusions

- Everybody loves the stock market (uh-oh)

- California’s carbon compulsion

- A workaround for the cashless society?

- Hamas, Israel… and financial cancellation

![]() Joe Biden, Safe in His Delusions

Joe Biden, Safe in His Delusions

Joe Biden will take over prime-time TV tonight to deny that the United States is a dead-ass broke empire. Not that he’ll frame it in those terms exactly.

Joe Biden will take over prime-time TV tonight to deny that the United States is a dead-ass broke empire. Not that he’ll frame it in those terms exactly.

According to a White House statement, the president will “address the nation to discuss our response to Hamas’ terrorist attacks against Israel and Russia’s ongoing brutal war against Ukraine.”

Meh. We already know what he’s going to say. Treasury Secretary Janet Yellen said it on Monday. When it comes to Washington’s overseas obligations, money is no object…

Heck, Biden himself said as much the other night on 60 Minutes. “We’re the United States of America, for God’s sake, the most powerful nation in the history — not in the world, in the history of the world.”

Notice how he left the other part hanging — the one about And it will always be that way.

Notice how he left the other part hanging — the one about And it will always be that way.

Joe Biden was born in 1942 — not long before America became, indisputably, “the most powerful nation in the history of the world.” He’s never known anything else. As a lifelong politico, his whole identity is tied up with American might — economic, military, the whole ball of wax. The idea that it could be any other way is inconceivable.

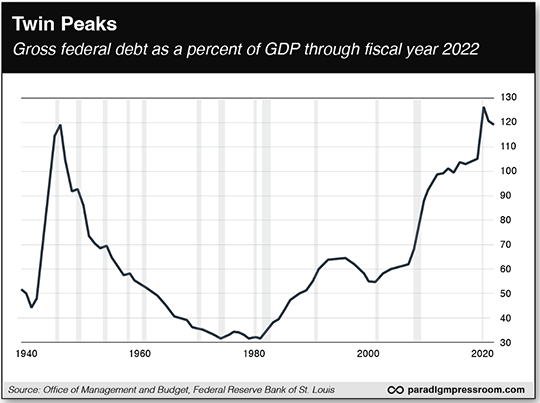

In 1946, when Joe Biden was four, spending for World War II had propelled the national debt to a towering 119% of GDP. In other words, Uncle Sam’s debts exceeded an entire year’s worth of American economic output.

In the COVID year of 2020, this debt-to-GDP ratio spiked to 126%. By 2022, it fell back to 120% — still higher than the post-WWII peak.

A landmark academic study published in 2010 by economists Kenneth Rogoff and Carmen Reinhart found that a debt-to-GDP ratio exceeding 90% marks a point of no return: Beyond 90%, government debt becomes a huge drag on economic growth… which means government collects less tax revenue… which means government goes into even deeper debt… and so on, and so on.

In time, government debt deprives the private sector of the oxygen it needs to survive, and the everyday person’s standard of living goes into terminal decline.

Of course, as you can see from the chart above, America broke that cycle in short order after World War II. We got the immense postwar boom that Joe Biden no doubt remembers fondly. Little wonder, too: America was more or less the only country in the world whose industry wasn’t smashed to bits during the war, and the dollar’s value was tied to an ounce of gold.

Today, American industry is hollowed out and the dollar floats on the faith of foreigners who are sick unto death of Washington meddling in their countries.

So ponder this: We might be in the early stages of World War III and the debt drag is already comparable to when World War II was over.

So ponder this: We might be in the early stages of World War III and the debt drag is already comparable to when World War II was over.

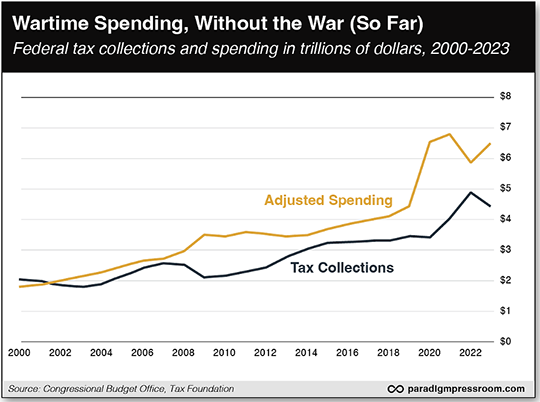

Here’s another chart, in which you can see that the explosion in federal spending brought about by COVID and lockdowns simply never went away.

Compared with the first two decades of this century, federal spending is on a much higher trajectory in the 2020s. Spending ticked down in fiscal year 2022, only to jump again in 2023. Meanwhile, tax receipts accelerated in 2021 and 2022 — only to fall dramatically this year.

To date, Congress has authorized $113 billion in spending for Ukraine. Now the buzz in Washington is that Biden wants another $100 billion for Ukraine and Israel and Taiwan. The additional buzz in Washington is that war hawk Rep. Mike Gallagher (R-Wisconsin) is maneuvering his way to becoming the next House speaker.

And so we come to the point I anticipated a week ago Monday, just after the Hamas attack in Israel — a giant bipartisan kumbaya for national bankruptcy and Armageddon.

Anyway, I just wanted to pass along this food for thought before our sundowning president indulges his delusions of American omnipotence on national TV tonight.

Rest assured, it’s our ongoing mission at Paradigm Press to guide you through the waters of the markets and the economy, whether they’re smooth or turbulent. We’ll stay on top of this story’s very long arc.

![]() Everybody Loves the Stock Market (Uh-Oh)

Everybody Loves the Stock Market (Uh-Oh)

Uhhh, we’re not done with scary charts today — although this one might not look so ominous on the surface.

Uhhh, we’re not done with scary charts today — although this one might not look so ominous on the surface.

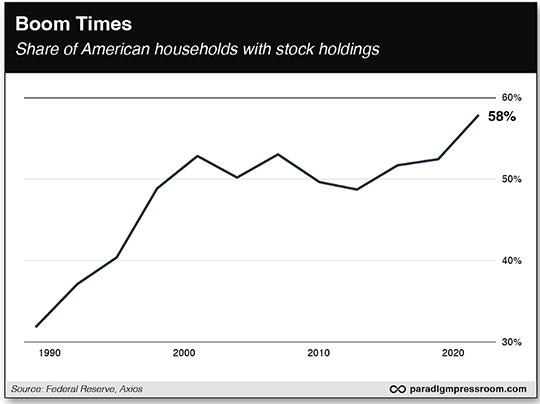

Every three years, the Federal Reserve publishes an exhaustive Survey of Consumer Finances. The Axios news site spotlights one of the major takeaways from the new edition: “The share of American households that own stock either in mutual funds, retirement accounts or as individual shares hit a new high in 2022.”

The number hit 58% last year, “the highest on record, trouncing the previous high-water mark of 53% seen during the dot-com boom and right before the Global Financial Crisis.”

One interesting change is that direct ownership of stocks — i.e., not through a mutual fund or ETF — leaped from 15% in 2019 to 21% in 2022.

As the Axios reporter writes, “This reflects COVID-related changes in behavior among Americans, many of whom first turned to the stock market as a way of scratching a sports gambling itch during the early phase of the pandemic.”

His conclusion: The data “suggests COVID-era trends in retail stock ownership could stick.”

Unless we’re headed into another 2000 or 2008 downturn, right?

The Gallup pollsters have asked a similar question over the years — and they turn up eerily similar results.

The Gallup pollsters have asked a similar question over the years — and they turn up eerily similar results.

Periodically since 1998, they’ve asked the question: “Do you, personally, or jointly with a spouse, have any money invested in the stock market right now -- either in an individual stock, a stock mutual fund or in a self-directed 401(k) or IRA?”

The number reached 62% in April of 2000 — just as the dot-com boom was starting to bust. After falling back, the number touched an even higher level of 65% in April of 2007 — shortly before the stock market peaked ahead of the 2008 crisis.

The figure languished in the 50%s for most of the 2010s, finally reaching a 13-year high of 61% as of the most recent survey this past April.

No, that’s not an instant “sell” signal. I’ve written about these figures periodically for years and as I mentioned in 2019, you could argue all day that current stock market valuations are historically high and out of whack with reality — but that doesn’t mean they can’t go higher from here.

In the meantime, the stock market is struggling to recover from yesterday’s drubbing.

In the meantime, the stock market is struggling to recover from yesterday’s drubbing.

The S&P 500 is down another quarter-percent today, clinging to the 4,300 level. Yes, it’s been lower than this recently — 4,229 less than three weeks ago — but the year-to-date high of 4,588 set on July 31 is looking mighty distant today.

All the same, it’s not a danger Will Robinson moment yet: On Monday colleague Sean Ring spotlighted the action in IWM, the Russell 2000 small-cap ETF. The level to start worrying is $161… but it still trades this morning just under $170.

Gold is holding onto its gains of recent days at $1,950 on the nose — but silver is backsliding to $22.67. Crude has backed off a bit, a barrel of West Texas Intermediate a hair below $88.

Meanwhile, there’s a handful of economic numbers to chew on…

- Existing home sales: Down in September to the lowest rate in 13 years. Mortgage rates are over 8% — the highest since 2000 — but a shortage of inventory is keeping prices elevated. The typical existing home is going for $394,300, up 2.8% from a year ago

- Mid-Atlantic manufacturing: Still contracting, according to the Philadelphia Fed Manufacturing Index. Except for last August, the mid-Atlantic factory sector has been shrinking steadily for over a year

- Leading economic indicators: Down 0.7% in September; among dozens of Wall Street economists polled by Econoday, no one expected a number this weak. The overall figure has been falling for the last year and a half.

The Conference Board, which compiles the leading indicators, anticipates a “shallow recession” in the first half of 2024.

![]() California’s Carbon Compulsion

California’s Carbon Compulsion

California has just enacted a law requiring corporations with over $1 billion in annual revenue to disclose their greenhouse gas emissions.

California has just enacted a law requiring corporations with over $1 billion in annual revenue to disclose their greenhouse gas emissions.

You’re probably not surprised, but here’s the weird thing: Gov. Gavin Newsom signed the bill even though he has qualms about how it will be carried out.

"This important policy, once again, demonstrates California's continued leadership with bold responses to the climate crisis," he wrote in a signing statement. "However, the implementation deadlines in this bill are likely infeasible."

In addition, he’s "concerned about the overall financial impact of this bill on businesses."

Usually politicians claim to be clueless about unintended consequences. But here’s the hair guy acknowledging them upfront — and barreling ahead anyway!

The all-powerful California Air Resources Board must draw up the relevant regulations by Jan. 1, 2025. Seeing as most corporations with over $1 billion in annual revenue probably do business in California, this becomes a de facto national standard.

That’s very convenient for the Biden administration; the Securities and Exchange Commission has been trying to pull off the same thing.

Lawsuits challenging the measure are almost inevitable, so stay tuned.

![]() Skirting the Cashless Society?

Skirting the Cashless Society?

Very briefly, an inquiry to the 5 Bullets readership, especially if you’re a small-business owner: Does anyone know anything about “reverse ATMs”?

Very briefly, an inquiry to the 5 Bullets readership, especially if you’re a small-business owner: Does anyone know anything about “reverse ATMs”?

I stumbled across a link to this outfit today. As near as I can tell, these “cash-to-card kiosks” are all the rage in urban jurisdictions where businesses want to go cashless, but local ordinances (New York, San Francisco) or state law (New Jersey, Colorado) forbid it.

Basically you stuff your cash in the machine and you get stored-value cards in exchange.

Given our interest in/concern about cashless-society schemes and central bank digital currencies at Paradigm Press, I’m most interested in the privacy angle: Is this a viable way to avoid leaving digital tracks? At least for now? Drop us a line: feedback@paradigmpressroom.com

![]() Hamas, Israel… and Financial Cancellation

Hamas, Israel… and Financial Cancellation

I’ve been sitting on a reader’s email for a few days now. Maybe today’s the day to give it space.

I’ve been sitting on a reader’s email for a few days now. Maybe today’s the day to give it space.

As a reader of Rickards’ Strategic Intelligence, he sent it to the “Ask Jim” email address for that publication — but he copied me as well…

“Hi Jim — as always, thanks for your insights.

“You said: ‘If you stand with Palestine, as do AOC and the Squad members and others, then you stand with the animals and killers and mutilators of small children and innocent women.’

“As someone who neither supports Hamas’ or the Israeli government’s (including the IDF’s) actions in this conflict, I found your above comment uncharacteristically lacking due consideration of the humanitarian crises/loss of life on both sides of the conflict.

“This should not be about someone supporting A (‘Palestine’) being automatically considered as pro-Hamas, or B (‘Israel’) being automatically considered as pro-Israeli government, Israel, etc.

“As you’ll appreciate, the situation is much more nuanced than that.

“Rather, the situation is such that both Hamas and the Israeli government are committing atrocities against civilians, irrespective of whether those people are Palestinians or Israelis.

“Of course, these atrocities need to stop immediately to avoid escalation.

“Any sane, humane person wants that, except if they’re a neocon globalist megalomaniac.

“It is also worth remembering that Hamas largely gained prominence in Palestine due to extensive U.S. and Israeli government support.

“Just sayin’…”

Dave responds: I’ll let Jim’s remarks to his readership speak for themselves.

But as long as you saw fit to copy me on your message, I’ll share a few thoughts of my own. Maybe the time is right, maybe not, but here goes...

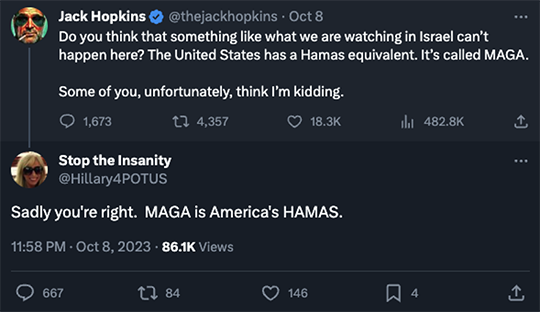

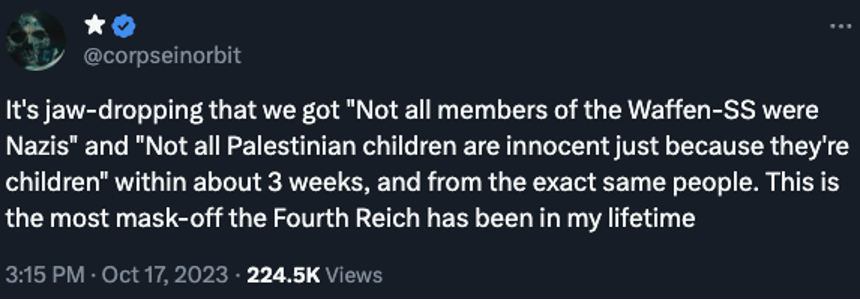

In the last two weeks, it’s been stunning to witness people who saw through the mainstream narrative about COVID… and who saw through the mainstream narrative about Ukraine… nonetheless swallowing the mainstream narrative about the Middle East hook, line and sinker.

In the last two weeks, it’s been appalling (but not surprising) to witness critics of cancel culture turn tail and screech anti-Semitism! at the mildest criticism of U.S. aid to Israel.

In the last two weeks, it’s been disturbing beyond belief to witness the “othering” of people who were born into the “wrong” ethnicity or who practice the “wrong” faith.

I’m an individualist, and the mindset that’s come to the fore in the last two weeks is one that’s profoundly collectivist — coming from the same place as fascism, communism and socialism.

And it cuts across ideological lines. If you’re pro-Israel and MAGA, please be aware that large numbers of pro-Israel liberals would have no compunction about cutting off water, food, fuel and electricity to MAGA enclaves — i.e., collective punishment — just as Israel did to Gaza…

Meanwhile, the shifting-back-and-forth 1984 levels of propaganda coming from the power elite have been — well, as this guy says, “jaw-dropping”:

Why do I bring any of this up? What’s the financial angle?

Remember, these are also the people who would love nothing more than to cut off your access to the financial system if they believe you’re engaged in “wrongthink.”

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. Two more thoughts: First, the reader is absolutely right that Israel’s government fostered the rise of Hamas, and indeed sustained it across decades. Here’s a comprehensive Twitter thread from my acquaintance Scott Horton of The Libertarian Institute, packed with primary and secondary sources.

Finally, with two U.S. aircraft carriers and other ships assembling in the Eastern Mediterranean, be very wary of another Gulf of Tonkin-type “incident” in the coming days and weeks.