Quiet Riot

![]() An Orderly Panic

An Orderly Panic

Panic has returned to the bond market.

Panic has returned to the bond market.

To be sure, it’s an orderly panic — unlike the messy panic last month. The MOVE index — a proxy for volatility in the bond market — sits below 100 this morning, nowhere near last month’s 140 level that warns of an imminent dislocation in financial markets.

The yield on a 30-year Treasury bond jumped over 5% this morning — the highest since October 2023. As a reminder, rising bond yields translate to falling bond prices.

All this because of two things that happened since the market closed on Friday.

The first was a what-took-you-so-long move by Moody’s — downgrading the federal government’s debt from a pristine “Aaa” rating to “Aa1.”

Moody’s was the last of the three major credit rating firms to recognize the reality that Uncle Sam is no longer a AAA credit risk. The first was Standard & Poor’s, which acted way back in 2011. Even back then, the call was too little, too late.

In any event, the president was not pleased.

But what else would you expect him to say?

Really, his reaction isn’t that different from when S&P downgraded U.S. debt nearly 14 years ago and Barack Obama’s singularly incompetent Treasury Secretary Timothy Geithner decried S&P’s “stunning lack of knowledge about basic U.S. fiscal budget math.”

(Your editor has a long memory and a voluminous archive of back issues. There isn’t that much that’s new under the sun…)

While Moody’s is ridiculously late to the party, its report does deserve credit for one thing: It called BS on the most important plank of Treasury Secretary Scott Bessent’s “3-3-3” plan.

While Moody’s is ridiculously late to the party, its report does deserve credit for one thing: It called BS on the most important plank of Treasury Secretary Scott Bessent’s “3-3-3” plan.

As a reminder, Bessent wants to shrink the annual federal budget deficit to 3% of GDP by 2028.

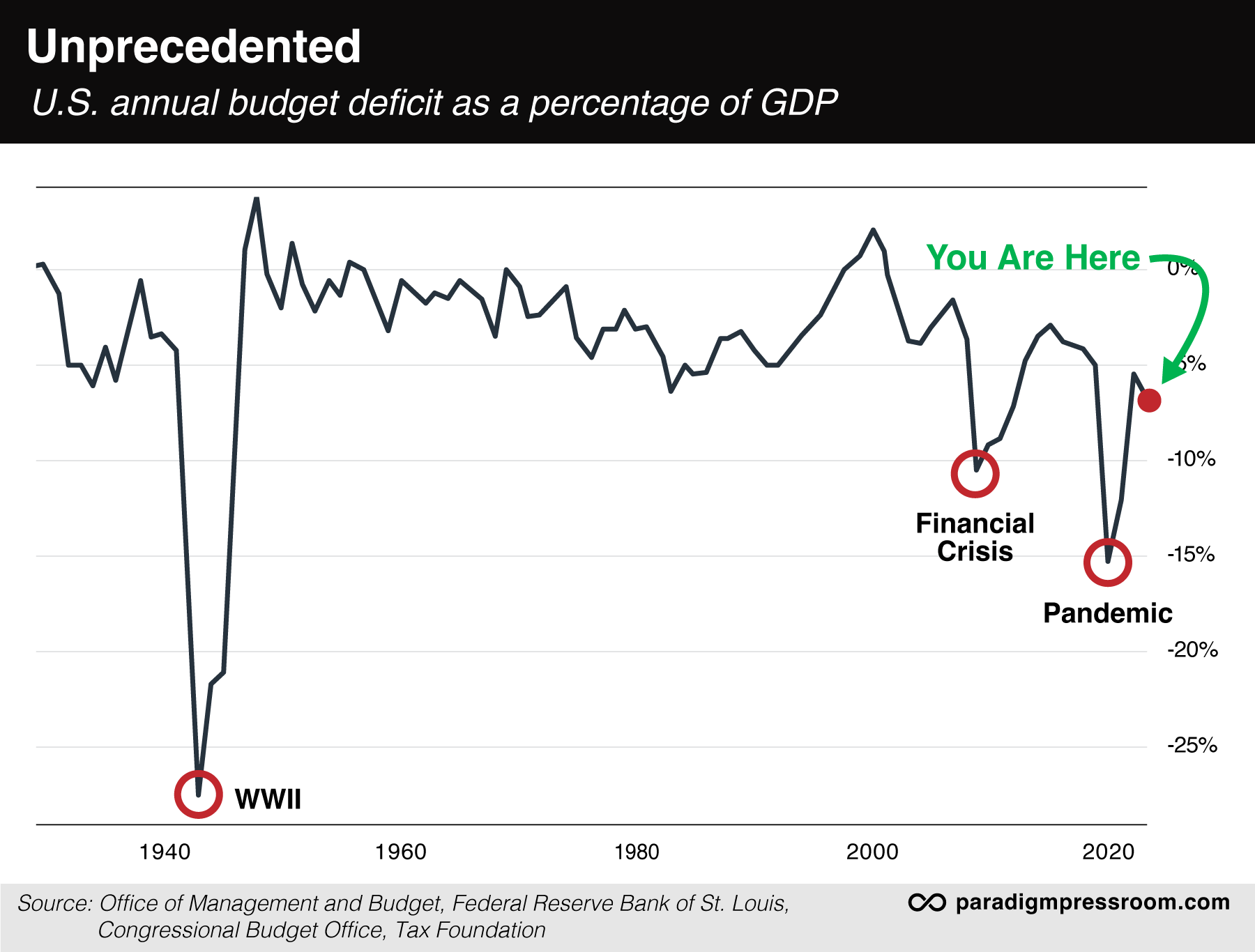

That was going to be a tough climb under the best of circumstances. Last year, the deficit was 6.4% of GDP — a number unprecedented outside of a world war, a financial crisis or a pandemic — and this year’s number is on track to be worse.

Here’s a chart we’ve shown before and can’t show often enough.

Moody’s projects the deficit will grow to nearly 9% of GDP by 2035.

Bessent went on the Sunday talk show circuit to try to tamp down such speculation. But all he could do was fall back on the hoary old Republican talking point about how tax cuts and deregulation will generate enough “economic growth” to goose the amount of tax revenue Uncle Sam collects.

Nothing wrong with tax cuts and deregulation, of course. But Republicans have been saying for over 40 years that their policies will shrink the deficit and it never works out that way. Why would it work out now?

Especially in light of the other thing that happened after the market closed on Friday.

Especially in light of the other thing that happened after the market closed on Friday.

Yesterday, the House Budget Committee passed an extension of the 2017 Trump tax cuts along with some additional tax cuts and an increase in the debt ceiling.

Spending cuts, you ask? That’s supposed to come later in a different bill.

If you were with us on Friday, you’ll recall this legislation originally went down in flames when five Republican spending hawks voted no. But after some arm-twisting from the president and House Speaker Mike Johnson, four of them voted “present” yesterday, allowing the bill to squeak by 17-16. A floor vote could come as early as this week.

The nonpartisan Committee for a Responsible Federal Budget says the bill would add $3.3 trillion to the national debt over the next decade — above and beyond the increases that were already baked into the cake.

“We are in a fiscal crisis and we're not willing to admit it," says angel investor David Friedberg on the All In podcast. "If you look across the board, all of these programs are…being proposed to run at a cost that's well in excess of their pre-COVID levels."

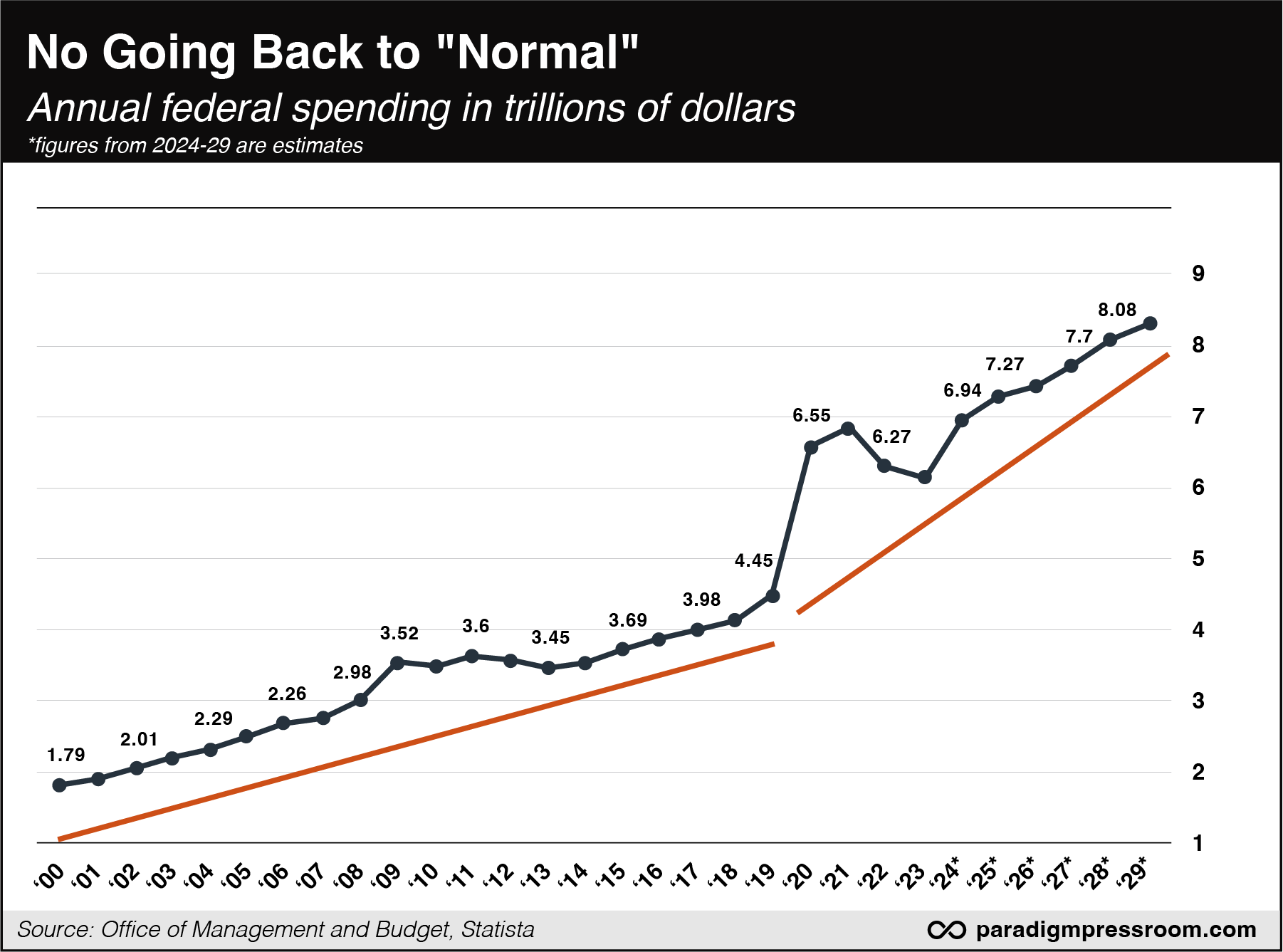

But that’s not news to you if you keep up with these daily dispatches. Here’s another chart we’ve run before and can’t run often enough. The trajectory of federal spending is such that it will never go back to a pre-COVID “normal.”

The Moody’s downgrade and the House Budget Committee vote are two more signposts that U.S. Treasuries are no longer the “safe haven” they were thought to be for many decades.

The Moody’s downgrade and the House Budget Committee vote are two more signposts that U.S. Treasuries are no longer the “safe haven” they were thought to be for many decades.

As late and lame as Moody’s call is, it does reinforce what we said during the bond-market freakout last month: It’s not all about Trump and tariffs. It’s about loss of confidence in a spendthrift U.S. government.

We’ll reiterate what we said on both occasions last month when we examined the bond market turmoil: Gold is the obvious long-term beneficiary, the new safe haven.

Its rally today is muted — up $32 to $3,233. That’s well below last month’s peak — but gold is still up over 20% year-to-date.

Once again, If you already have 10% of your portfolio allocated to gold — as Paradigm’s macro maven Jim Rickards has long recommended — good on you.

If not, time to get cracking. Dollar-cost averaging is the way to go: Buy a little bit at a time, every week or every month, until you get to your 10%.

Because as we said last month, Treasuries just aren’t the safe haven they used to be…

![]() “Eat the Tariffs”

“Eat the Tariffs”

The mainstream narrative is that today’s turbulence in the bond market is spilling over into the stock market.

The mainstream narrative is that today’s turbulence in the bond market is spilling over into the stock market.

“Stocks Retreat to Start Week as Yields Spike on U.S. Debt Downgrade,” says a representative headline from CNBC.

It’s not a huge sell-off, but as we write the S&P 500 is down about 0.4% to 5,935. The Nasdaq’s losses are steeper, the Dow’s narrower.

But we wonder if this is weighing on Mr. Market at least as much, if not more…

Last week on its quarterly conference call with Wall Street analysts, Walmart said it would raise prices on at least some items affected by tariffs.

There are only so many tariffs a company like Walmart can “eat” when it operates on a slender 2% profit margin.

Amid this browbeating from the White House — and the implicit threat of punishment that comes with it — WMT shares are down 1% on the day. We daresay this rant would be a drag on stocks even if all were calm today in bond-land.

➢ Come to think of it, it was kinda nice last week when the president was overseas and he had less time to opine on social media. He should travel more, tweet less.

Then again, the stock market was getting a little too far out over its skis last week anyway.

Then again, the stock market was getting a little too far out over its skis last week anyway.

“We need some downside action to bleed off the excess enthusiasm from last week’s impressive bounce,” Greg Guenthner tells his Trading Desk readers.

“We need potential trades to reset and prove they can withstand a little profit taking. Then we can swoop in and attempt to play any ensuing bounce.”

Gold’s rally that we mentioned above is not extending to silver — up only 6 cents to $32.33. Crude is up a quarter percent to $62.67.

Bitcoin took a run toward its $106,000 record over the weekend but at last check is back to $104,615. (More about crypto next…)

![]() Crypto Grows Up

Crypto Grows Up

This year’s big “Consensus” crypto conference was a snooze. And Paradigm crypto specialist Chris Campbell says that’s a good thing.

This year’s big “Consensus” crypto conference was a snooze. And Paradigm crypto specialist Chris Campbell says that’s a good thing.

Going into last week’s event in Toronto, Chris anticipated he’d get a definitive answer to the question Is crypto still a punchline? Or is it finally growing up?

Chris suspected the latter, and events confirmed that suspicion.

“This was an American crypto conference wearing a Canadian nametag,” he tells us — with branded escalators to prove it.

Donald Trump’s son Eric was there to launch “American Bitcoin” — a venture to mine Bitcoin on U.S. soil using ultra-cheap energy.

“They say they can currently mine Bitcoin for $38,000,” Chris tells us, “while the rest of the world is buying at $100,000. If that’s true, they’re not just mining—they’re printing.”

With a crypto-friendly administration in Washington, everything has changed since last year.

With a crypto-friendly administration in Washington, everything has changed since last year.

Said Ari Redbord of the blockchain intelligence firm TRM Labs: “We’re moving away from regulation by enforcement and toward targeting actual bad actors.”

In other words, no more haranguing Coinbase and other legit players just because they’re disrupting traditional finance.

“According to Ari,” says Chris, “about 1% of crypto activity is illicit. That’s what TRM Labs has discovered. Not 80%. Not even 10%. Just 1%. And that 1% includes North Korea’s entire cybercrime GDP.

“Meanwhile, TRM Labs is quietly working with every U.S. federal law enforcement agency.

Instead of going after developers who write DeFi code, they’re going after ransomware, pig-butchering scams (don’t Google it at night) and rogue states like North Korea laundering Bitcoin.”

Chris is stunned as he thinks about the evolution of both crypto and of this event: “In 2017, crypto was a toddler with a sugar high. In 2021, it was a teenager throwing a rave in your garage.

“In 2025, it’s becoming an adult. Not fully there. Still messes up. Still gets scammed sometimes.

But it shows up. Pays taxes. Talks to regulators. Builds products people actually use.

“And that? That’s the spark that kicks off a historic wealth transfer.”

![]() Follow-Up: Boeing Skates

Follow-Up: Boeing Skates

Some things don’t change no matter which political party is in power — like Boeing getting a pass for one colossal act of negligence after another.

Some things don’t change no matter which political party is in power — like Boeing getting a pass for one colossal act of negligence after another.

We’ll get to the latest developments shortly — but first, the background…

As you’ll recall, two Boeing 737 Max jets crashed in separate incidents overseas during 2018–19, killing 346 people.

In 2021, the Biden Justice Department reached a “deferred prosecution” agreement with Boeing — by which the firm would escape criminal fraud charges.

But then in January 2024, the fuselage blew out aboard an Alaska Airlines Boeing jet — not fatal at 16,000 feet, but at a higher altitude it would have been disastrous.

So the feds concluded the company had violated its end of the 2021 deal and threatened criminal charges anew.

When we last left this sorry saga in July 2024, Boeing agreed to what a lawyer for the families of the deceased called a “sweetheart plea deal” — a $243 million fine, three years’ probation and independent safety audits.

Yes, Boeing would be labeled a felon — but of course, no one would go to prison.

Yeah, well, now the Trump Justice Department is dispensing with the sweetheart plea deal. Boeing won’t even have to cop to a felony.

Yeah, well, now the Trump Justice Department is dispensing with the sweetheart plea deal. Boeing won’t even have to cop to a felony.

That’s according to The Wall Street Journal, citing “people familiar with the matter.”

“The Justice Department on Friday told families of those killed in the crashes that they still could lose at trial, which would prevent the government from getting any further relief for them. Boeing no longer agrees to plead guilty, prosecutors told the families, according to the people.”

Lose at trial?! In a typical year, the feds have a 98–99% conviction rate in the cases they prosecute.

The victims’ families are beside themselves. “Dismissing the case would dishonor the memories of 346 victims, who Boeing killed through its callous lies,” said attorney Paul Cassell, the one who was already apoplectic over the “sweetheart plea deal” last year.

Reading between the lines of the Journal story, this latest development is the fault of the Biden administration.

“U.S. District Judge Reed O’Connor in December rejected the plea over the inclusion of diversity considerations in the process for selecting a monitor. That pushed the case into January, giving Boeing an opportunity to lobby the Trump administration and new senior officials at the Justice Department for a better deal.”

So the families won’t get even a modicum of satisfaction because some Biden flunky was obsessed with DEI. Just frickin’ swell…

The families have one last hope in that it’s still up to Judge O’Connor to dismiss the original charge. We shall see…

![]() The Fourth Turning, Continued

The Fourth Turning, Continued

Some more feedback filtered in over the weekend after publishing what will be henceforth known as “the cynicism issue.”

Some more feedback filtered in over the weekend after publishing what will be henceforth known as “the cynicism issue.”

“I wanted to thank you for an excellent, thoughtful and thought provoking article that I decided to set aside and read again in a few quiet moments,” a reader writes.

“It didn’t hurt that you hit upon The Fourth Turning, which is a guiding foundational piece for me that I’ve presented at book clubs and other settings dating back to the ’90s.

“I don’t think anyone has ever labeled me a cynic, as I’m 180 degrees removed, but I appreciate your contributions and better understand your perceived cynicism based on a foundation of idealism.”

“Thank you very much for the reference to this fascinating read,” writes one of our regulars about the 1997 book The Fourth Turning: An American Prophecy.

“Thank you very much for the reference to this fascinating read,” writes one of our regulars about the 1997 book The Fourth Turning: An American Prophecy.

“Other books on cycles have left me questioning, because they appeared to be arbitrarily based on fuzzy mathematical premises. Even though The Fourth Turning was written 30 years ago, Neil Howe has added a recent and relevant forward.

“As a result of reading this I see no reason for being either pessimistically cynical or enthusiastically optimistic, since each one of the four seasons will inevitably follow, one after the other.

“I think the key concept is one of freedom from a belief in the simplicity of a two-dimensional history and future. Reality is obviously a more complicated process, requiring four distinct phases to develop. Alert adaptability to the present moment has to be the best preparation for a successful future.”

Dave responds: Well said.

I’m probably not alone in that I read The Fourth Turning within a few weeks or months of 9/11 — thinking that event marked the catalyst for a new crisis era.

But as Neil Howe made clear in subsequent interviews and essays over the years, 2001 was too early. The generational constellation wasn’t quite lined up right.

Boomers (a “prophet” generation analogous to FDR in the previous crisis) had taken over in the halls of power by that time. But millennials (a “hero” generation analogous to the GIs who fought in World War II) were only starting to come of age.

With the benefit of hindsight, 9/11 and the early years of the “War on Terror” were more of a Third Turning thing — as was World War I. Many parallels there, such as the initial rah-rah atmosphere that later turned to disillusionment.

For all those reasons and more, Howe marks the start of the current Fourth Turning with the 2008 financial crisis.

The previous Fourth Turning was short compared with many of the others — less than 16 years from the stock market crash in October 1929 to the Japanese surrender in August 1945.

A few months ago another truncated Fourth Turning seemed possible — quietly climaxing the morning of Nov. 6, 2024, when the outcome of the presidential election was both known and uncontested within 12 hours of the polls closing.

But that seems like a more dubious proposition now. Neil Howe for one certainly isn’t buying it. And looking at the action in the bond market today, neither am I.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets