Nothing “Normal” About This

![]() The Mainstream Wakes Up — and Fouls Up

The Mainstream Wakes Up — and Fouls Up

As the saying goes, never believe a rumor in Washington until it’s been officially denied.

As the saying goes, never believe a rumor in Washington until it’s been officially denied.

Late yesterday, Bloomberg published the following:

Treasury Secretary Scott Bessent played down the recent selloff in the bond market, rejecting speculation that foreign nations were dumping their holdings of US Treasuries, while flagging that his department has tools to address dislocation if needed.

‘I don’t think there’s a dumping’ by foreign investors, Bessent said in an interview Monday with Bloomberg Television while on a visit to Buenos Aires, Argentina.

Last Thursday, we spilled a fair amount of digital ink on the proposition that foreigners were dumping their Treasuries — casting a no-confidence vote against an asset class that for many decades was thought to be a “safe haven.”

True or not, it was indisputable that Treasuries were not a safe haven in the aftermath of Donald Trump’s “Liberation Day” announcement. Typically when the stock market sells off hard, hot money that’s fleeing stocks will flood into Uncle Sam’s debt.

But that’s not what happened last week. Stocks and bonds sold off hard together.

It was this rupture in the bond market — not the stock market — that spooked the Trump administration and prompted the 90-day pause on much of its tariff regime.

Since our Thursday write-up, we see the mainstream picking up on this theme — but, of course, getting it totally wrong.

Since our Thursday write-up, we see the mainstream picking up on this theme — but, of course, getting it totally wrong.

The turmoil in the bond market “reflects deeper worries as Trump’s tariffs threats and erratic policy moves have made America seem hostile and unstable,” says The Associated Press — “fears that are not likely to go away even after the tariff turmoil ends.”

Reflecting on the safe-haven reputation of Treasuries, New York Times reporter Peter Goodman says the trouble in the bond market “revealed the extent to which President Trump has shaken faith in that basic proposition, challenging the previously unimpeachable solidity of U.S. government debt.”

For the mainstream, it’s all about Trump and tariffs because of course. But as we said last week, it’s about so much more.

For the mainstream, it’s all about Trump and tariffs because of course. But as we said last week, it’s about so much more.

Treasuries’ safe-haven reputation with foreigners was previously dealt a huge blow by the Biden administration. When Russia invaded Ukraine in 2022, Washington froze the Treasuries owned by Russia’s central bank — later confiscating the interest payments and handing them to Ukraine.

Every government on the face of the planet that had less-than-friendly relations with Washington logically wondered: Are we next?

It is no coincidence that since 2022, global central banks have been buying gold — an asset that lies beyond Washington’s reach — at a record pace.

And there’s still another factor in play -– one that goes much further back in history. Read on…

![]() Nothing “Normal” About This

Nothing “Normal” About This

Rewind again to last Thursday: Even though the Trump administration had declared its 90-day pause 24 hours earlier, the turbulence in the bond market persisted.

Rewind again to last Thursday: Even though the Trump administration had declared its 90-day pause 24 hours earlier, the turbulence in the bond market persisted.

Treasury prices continued to fall — pushing Treasury yields higher. For a while, the yield on a 10-year T-note surpassed 4.5% — up dramatically in less than a week from under 4.0%.

This too is something that under “normal” circumstances shouldn’t have happened.

What was it that was still spooking the bond market?

The answer is the gargantuan growth of the national debt — growth that the U.S. House voted last Thursday to accelerate.

The answer is the gargantuan growth of the national debt — growth that the U.S. House voted last Thursday to accelerate.

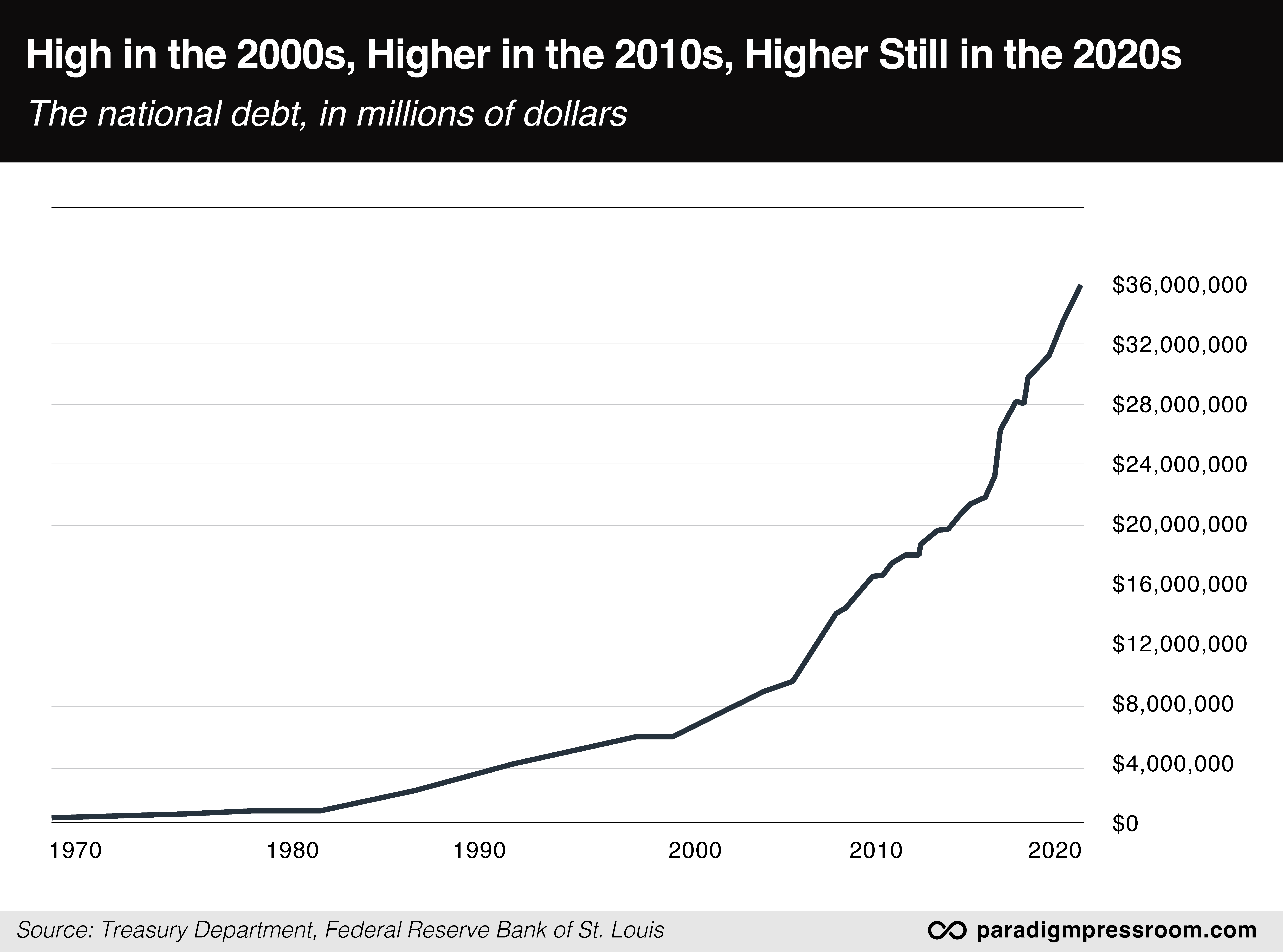

First, a chart for perspective. This is the national debt. You can see how it started taking off in the 2000s to fund the “forever wars”... went on a higher trajectory after the 2008 financial crisis… and went on a still higher trajectory after COVID.

Which brings us to the present moment: As we’ve mentioned periodically in recent months, the Trump tax cuts — aka the Tax Cuts and Jobs Act of 2017 — are set to expire at the end of this year.

The law was given an expiration date because of the peculiar way budget math works in Washington. The Congressional Budget Office evaluates big tax cuts and big new spending programs by how much they’ll cost over the next 10 years.

To keep these initiatives from costing “too much,” lawmakers usually give them an expiration date. Thus the architects of the Trump tax cuts agreed to sunset them after eight years. Reverting to Obama-era tax rates in 2026-27 made the weird budget math all work out over the 10-year “budget window.”

Obviously the president and the Republican majority in Congress would like to make these tax cuts permanent. But the budget-window custom — a phenomenon dating back to the Budget Act of 1974 — makes that a challenging task.

On Saturday April 5, the Senate passed a resolution effectively chucking this budget-window convention — clearing the way to make the tax cuts permanent.

This past Thursday, the House passed the same resolution. And the bond market freaked out anew.

This past Thursday, the House passed the same resolution. And the bond market freaked out anew.

Several Republican budget hawks resisted. They wanted spending cuts to match or exceed the amount of the tax cuts.

But House Speaker Mike Johnson once again exercised iron discipline over his slender majority.

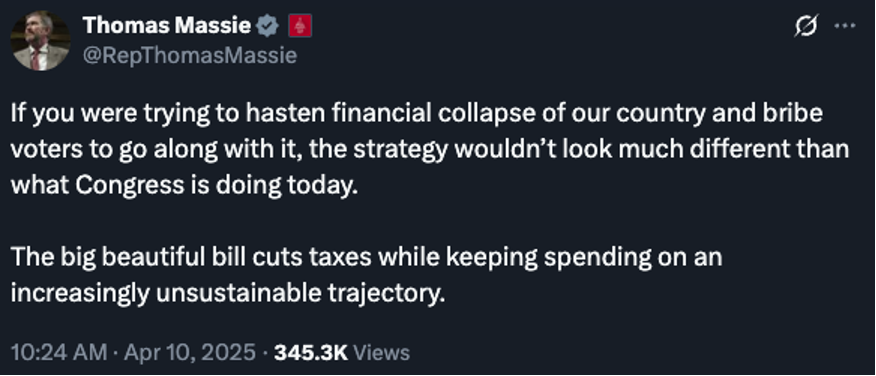

Only two Republicans held out — Indiana’s Victoria Spartz and the courageous Kentuckian Thomas Massie.

“This is really a complete evisceration of the budget resolution rules,” says demographer Neil Howe. “The whole idea was to keep this within a budget discipline and the 10-year rule was the one that’s always been traditionally used: Everything has to balance within 10 years.”

Mr. Howe is best known for coining the term “Millennial” along with his late collaborator William Strauss. But he’s also a D.C. budget wonk from back in the day, working with fiscal-hawk think tanks like the Concord Coalition. He knows this stuff backwards and forwards.

Key point, and it goes back to that first chart: Congress now has “a free ticket to borrow $3-5 trillion more over the next 10 years than the established budget rules would have allowed,” Mr. Howe said last week on his Trend Watch podcast.

Key point, and it goes back to that first chart: Congress now has “a free ticket to borrow $3-5 trillion more over the next 10 years than the established budget rules would have allowed,” Mr. Howe said last week on his Trend Watch podcast.

“And this means continually widening the projected deficit as a share of GDP rather than closing it.”

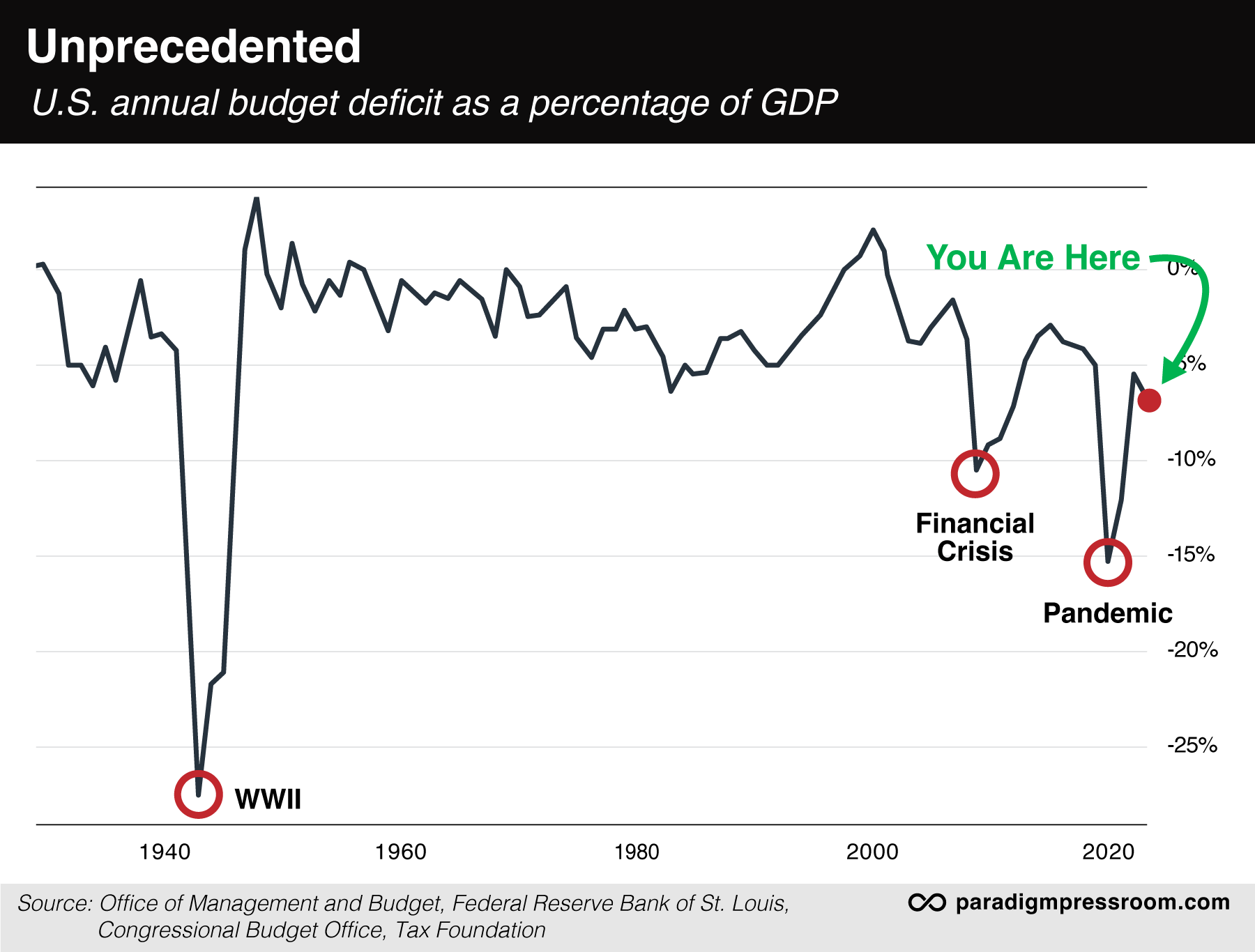

Here, we’ll re-up a chart we’ve shared several times in recent months. It shows that the annual budget deficit in fiscal year 2024 equaled 6.4% of America’s annual economic output as measured by GDP.

Outside of World War II, the global financial crisis and COVID, the number has never been this bad. There’s no such crisis now. It’s unprecedented.

And with half of fiscal year 2025 already in the books, this year’s number is on track to be worse.

That’s not “normal.” But the story doesn’t end there – as you’ll soon see…

![]() Bessent Is Trapped

Bessent Is Trapped

Next key point: The bill passed by Congress blows up Treasury Secretary Bessent’s vaunted “3-3-3 plan” to revive the economy.

Next key point: The bill passed by Congress blows up Treasury Secretary Bessent’s vaunted “3-3-3 plan” to revive the economy.

The first and perhaps most important plank of that plan is to shrink the deficit to 3% of GDP by 2028.

Again, the deficit was 6.4% of GDP in fiscal year 2024 and will be higher in fiscal year 2025. And as we mentioned on Friday, Elon Musk has dialed back his initial DOGE goal of $2 trillion in budget savings to a paltry $150 billion.

Unless Congress finds some sort of spending discipline — and how likely is that? — the line on that first chart of the national debt is set to go hyperbolic.

We said in January that Bessent’s 3-3-3 plan would be a tough row to hoe. Now it’s impossible. He’s trapped and can’t get out.

That’s why the bond market didn’t stabilize last Thursday.

True, it’s stabilized a bit since then in the absence of any new shocks. Even so, the yield on a 10-year Treasury this morning is 4.36%. In more “normal” times it wouldn’t be anywhere near this high.

These aren’t normal times. Treasuries have lost their luster as a safe haven. But now you know that the story is much more complex than just the tariffs. It’s a storm that’s been brewing throughout the 21st century.

We reiterate our guidance from last week: Gold is the new safe haven. It’s no coincidence that gold broke over $3,200 an ounce for the first time when the House voted last Thursday – and it’s still there today.

We reiterate our guidance from last week: Gold is the new safe haven. It’s no coincidence that gold broke over $3,200 an ounce for the first time when the House voted last Thursday – and it’s still there today.

Even the mainstream is glomming onto gold: Analysts at UBS are calling for $3,500 by year-end. Goldman Sachs is even more ambitious — $3,700 by year-end and $4,000 by mid-2026.

Hesitant to buy something when it’s at all-time highs? Buy silver.

At $32.16 an ounce it takes 100 ounces of silver to equal one ounce of gold — a rare occurrence that makes silver a real bargain relative to gold.

With the debt on its present trajectory, there’s nothing to stop silver from eventually reclaiming its 2011 high of $50 — or even its 2011 high adjusted for inflation, which is $70.

![]() Biggest Winner, Biggest Loser

Biggest Winner, Biggest Loser

With the stock market’s spate of volatility winding down for the moment, it’s not too early to assess winners and losers.

With the stock market’s spate of volatility winding down for the moment, it’s not too early to assess winners and losers.

As Paradigm’s macroeconomics authority Jim Rickards sees it, the biggest winner is Warren Buffett.

“He quietly sold off equities in 2023 and 2024 and accumulated a $325 billion pile of cash,” Jim says. “Now, he not only survived the storm but he’s getting ready to go shopping for good companies that have fallen even more than the market as a whole.”

The biggest loser? Germany.

“They were in sad shape before the trade war because they spent 14 years closing down every coal-fired power plant and almost every nuclear plant based on the phony climate change hoax,” says Jim. “Then they boycotted Russian energy.

“How do you power an industrial economy that runs on energy when you have no energy except for high-priced imports? You don’t. Germany is de-industrializing. Its major companies are moving operations to Hungary and Mexico.

“Now they have been slammed with tariffs on the manufactured goods they do still make, but their ability to negotiate is blunted by the leadership of the EU, which is even more delusional than the German leaders.

“It’s sad to see a great country and technological powerhouse go down the drain,” Jim concludes. “But that’s exactly where their incompetent globalist leadership is taking them.”

In the near-term, however, Germany’s benchmark DAX index has recovered all its post-”Liberation Day” losses. Go figure…

In the absence of any market-moving headlines, today might turn out to be a U.S. stock-market milestone.

In the absence of any market-moving headlines, today might turn out to be a U.S. stock-market milestone.

Recall that yesterday our chart hound Greg Guenthner said the last time the S&P 500 moved less than 1% within the trading day was March 25. It’s an extraordinary amount of up-and-down movement and it began well before the tariff announcement on April 2.

Lo and behold, calm is prevailing today: No big swings either way. At last check the S&P 500 is up a third of a percent at 5,424. That’s down 11.7% from the index’s record close on February 19… and up 8.8% from its closing low a week ago today.

The big banks continue to report bang-up earnings — today it was Citi and Bank of America’s turn. Both are up about 4% on the day.

Like the S&P 500, crude is looking calm, down 32 cents at $61.21.

Bitcoin is trying to break out of its trading range of recent days, now over $85,000.

![]() Comic Relief

Comic Relief

On this Tax Day, we leave you with the following…

On this Tax Day, we leave you with the following…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets