Avoiding the T-word

![]() While Stocks Yo-Yo, This Asset Class Holds Fast

While Stocks Yo-Yo, This Asset Class Holds Fast

Let’s see if we can make it through our first couple of Bullets today without a mention of the t-word.

Let’s see if we can make it through our first couple of Bullets today without a mention of the t-word.

“Amidst the chaos, one asset class is showing remarkable resilience,” says Paradigm’s own James Altucher as he surveys a very chaotic week.

That asset class happens to be right in his wheelhouse — cryptocurrencies.

For real.

“While traditional markets swing wildly between euphoria and despair,” he tells his Altucher Investment Network readers, “Bitcoin has been trading in a relatively stable range between $78,000 and $84,000.”

And he believes that’s no accident. “Something bigger is brewing beneath the surface of the crypto markets.

“I call it ‘The Great Gain’ — and it's being driven by two massive forces that are converging right now for the first time in history.”

The first force is a presidency that’s embracing this asset class — as opposed to Joe Biden’s hostility or the indifference of Trump 45 and Obama.

The first force is a presidency that’s embracing this asset class — as opposed to Joe Biden’s hostility or the indifference of Trump 45 and Obama.

On Wednesday, the Senate confirmed Paul Atkins as the new chair of the Securities and Exchange Commission.

When Donald Trump nominated Atkins in December, we told you about Atkins’ background as co-chair of a pro-crypto lobbying group. We also told you his views align with Trump’s intentions of making America “the crypto capital of the planet” — moving the locus of innovation away from Europe and Asia.

“If the SEC were more accommodating and would deal straightforwardly with these firms,” Atkins said in a 2023 podcast interview, “it would be a lot better to have things happen here in the United States.”

He reinforced that view during his confirmation hearings, telling senators his “top priority” would be to create a “firm regulatory foundation for digital assets.”

“The old anti-crypto guard has officially been swept aside,” James declares.

“Atkins joins an administration that already includes a dedicated ‘crypto czar’ (David Sacks) and a planned Crypto Advisory Council to the White House.

“For the first time, the entire federal government — from the White House to the Treasury to the SEC — is aligned in support of cryptocurrency's growth.”

The first force will reinforce the power of the second — the Bitcoin halving cycle.

The first force will reinforce the power of the second — the Bitcoin halving cycle.

As a reminder: Every four years, give or take, a programming feature of Bitcoin kicks in. The rewards from Bitcoin mining are cut in half. This scheme was built into Bitcoin from the beginning by the mysterious “Satoshi Nakamoto” back in 2008.

The idea is to keep a built-in cap on Bitcoin’s quantity — a feature notably missing from government-issued fiat currencies.

The most recent halving took place a year ago.

“History shows these halvings kick off predictable bull cycles,” James says. And while Bitcoin gets all the attention, “it’s actually the ‘altcoins’ — cryptocurrencies beyond Bitcoin — that deliver the truly life-changing returns.

“And that's where the extraordinary opportunity lies.”

It’s the combination of these two forces that will drive what James calls “The Great Gain.”

“It's a once-in-a-lifetime convergence that could dwarf previous crypto bull markets,” he says.

“If crypto could deliver those kinds of returns while fighting against hostile regulators and skeptical institutions, imagine what's possible now that the entire U.S. government is actively supporting its growth.”

Bottom line: “Despite all the market chaos, I remain more confident than ever about the crypto opportunity ahead. This isn't just another bull market.”

To seize maximum advantage — five tiny coins he believes have the most explosive potential — take a look at this briefing James recorded recently.

![]() There’s Still Money to Be Made in Stocks

There’s Still Money to Be Made in Stocks

The bull market in stocks might be over, but there’s still money to be made.

The bull market in stocks might be over, but there’s still money to be made.

“We have simply entered a transition phase,” says Paradigm trading pro Enrique Abeyta — “which means we need to adjust to more volatile conditions.”

On Monday, Enrique made the case that the present moment is not analogous to the 2008 meltdown. He drew a parallel instead to the first Trump tariff scare of 2018.

[Whoop, there’s the t-word. Oh well…]

Today he draws another comparison — this time to a more dire moment, the COVID crash of 2020.

“Even when markets produce eye-popping statistics like we have never seen,” Enrique says, “they will eventually play out like patterns from the past.”

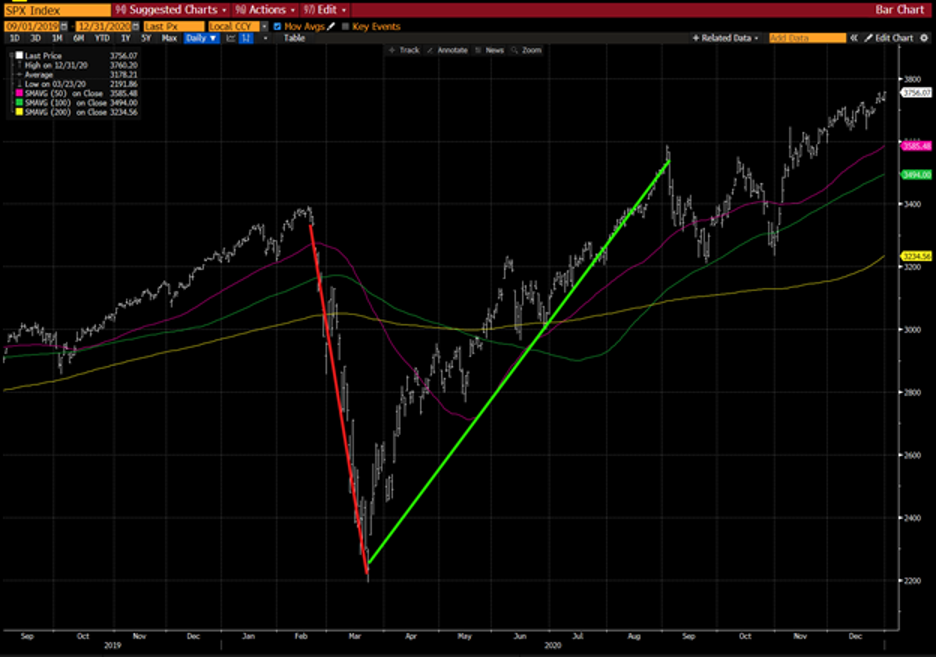

With that, here’s a chart of the S&P 500 starting in September 2019, continuing through all of 2020.

“The 50-day, 100-day and 200-day moving averages are also on this chart,” he says, “along with trendlines showing the steep sell-off (thick red line) and recovery (thick green line).

“The similarities here are powerful,” Enrique continues.

“The similarities here are powerful,” Enrique continues.

“The stock market had a good year in 2019 and rallied strongly into year-end. It spent the entire second half of the year well above the 200-day moving average.

“We also began to see some speculative activity bubble up in areas like cryptocurrency and technology. Sound familiar?

“After setting a new high on Feb. 19, 2020, the stock market began to plummet with the realization that COVID was going to be a big issue.”

Then the S&P 500 tumbled 12% in seven days — not unlike the five-day drop of 12% following Trump’s “Liberation Day” announcement last week.

“Back in 2020,” Enrique continues, “the stock market then stabilized for a few days and retraced about 5% before sliding 9%. Then stocks saw a 5% snapback before an incredible two-day collapse of 14%.

“The three trading days between March 12–16 were some of the craziest in the stock market since the Great Depression. The market averaged a double-digit move in each of those three days.”

But… one of those moves was higher. And so was the day after that three-day roller coaster.

“This detail is interesting,” he says, “because when the stock market sells off, it feels like it will never go up again.”

Maybe you felt the same way this week before Wednesday afternoon’s massive rip higher?

So how do you seize on this volatility to make money?

So how do you seize on this volatility to make money?

Enrique is fond of something he calls the rule of 3.5%.

“The idea is that you divide your trading portfolio into several parts, say six or eight. Any day the market is down 3.5%, you buy one of these parts. Any day it’s up 3.5%, you sell one of these parts.

“This strategy would have worked in the 2020 sell-off — and in every single sell-off that has happened over the last 30 years.

“The key to all of it is to remain nimble and be as willing to sell your quick wins as you are to buy the stock market panic.”

If you’re a trading novice, there’s no better time to get started than now — and no better way to get started than Enrique’s entry-level newsletter Breaking Profits. It’s not a costly premium advisory. Instead it’s the perfect low-risk way to discover if trading is right for you. Give it a look right here.

![]() Shocking Stock Stat

Shocking Stock Stat

OK, let’s pause and get our bearings as the week winds down.

OK, let’s pause and get our bearings as the week winds down.

For starters, early this morning the Chinese government jacked up its tariffs on imports from the United States to 125% — up from 84% on Wednesday.

Meanwhile, the stock market action looks positively tame by this week’s standards. At last check, the S&P 500 is down less than a third of a percent at 5,253.

Should that number hold by day’s end, the index will have jumped nearly 3.9% since last Friday’s close.

Shocking, right? That’s how nutty this week has been. (The index is still down nearly 15% from its Feb. 19 peak.)

For once, the Nasdaq is faring better than the S&P today and the Dow worse.

Lost in the tariff shuffle is the fact earnings season is now underway. As usual, JPMorgan Chase got things started — trouncing analyst expectations. JPM shares are up 2.8% on the day.

The sell-off in the bond market — explored in detail in yesterday’s edition — is picking up steam again.

The sell-off in the bond market — explored in detail in yesterday’s edition — is picking up steam again.

Once more, we remind you that falling prices translate to rising yields. And the yield on a 10-year Treasury note is now over 4.55% for the first time in two months.

On his X feed, bond-fund manager Jim Bianco says most of today’s selling is coming from Europe — or indirectly from China, which is believed to hold many of its Treasuries in Belgium and Luxembourg.

Meanwhile, a Substack post is getting much attention for a jaw-dropping hypothesis behind the meltdown in Treasuries earlier this week.

It comes from a Canadian sports writer named Dean Blundell, now making a foray into international finance. He claims the whole thing was deliberately engineered by Canada’s new prime minister Mark Carney in cahoots with government officials from the European Union and Japan — with an aim of forcing the 90-day tariff pause Trump announced Wednesday.

Talk about the ultimate MAGA-versus-globalist showdown. Whether it’s true is another matter altogether…

Gold is on track to notch its first weekly close over $3,200.

Gold is on track to notch its first weekly close over $3,200.

The Midas metal is up another $64 or 2% at last check to $3,239. And for once, silver’s gains are even stronger — up a dollar or 3.2% to $32.14. And the mining stocks are ripping higher, the HUI index up 5.3% to 387, a level last seen in 2013.

Crude’s wild week — from peak to trough it moved $17! — is winding down with a barrel of West Texas intermediate fetching $60.61.

Bitcoin is steady-Eddie at $82,439.

![]() DOGE Dials Back Its Goals — Bigly

DOGE Dials Back Its Goals — Bigly

With Elon Musk exiting the DOGE door at the end of May, he’s quietly dialed back the agency’s ambitions.

With Elon Musk exiting the DOGE door at the end of May, he’s quietly dialed back the agency’s ambitions.

As you’ll recall, Musk stormed in with the promise that his Department of Government Efficiency would cut the federal budget by $2 trillion.

Then he hedged: “I think we’ll try for $2 trillion. I think that’s the best-case outcome. But I do think that you kind of have to have some overage. I think if we try for $2 trillion, we’ve got a good shot at getting $1 [trillion].”

Yesterday during a cabinet meeting, Musk casually tossed off a new figure, laying out the savings during fiscal year 2026, which begins next October.

“I’m excited to announce that we anticipate savings in ’26 from reduction of waste and fraud by $150 billion.”

$150 billion?

As Glenn Greenwald points out on his X feed, $150 billion equals the amount Trump wants to raise the Pentagon budget by. Alrighty then…

But there’s another way to measure the DOGE boys’ efforts — and by this yardstick there’s a hint of progress.

But there’s another way to measure the DOGE boys’ efforts — and by this yardstick there’s a hint of progress.

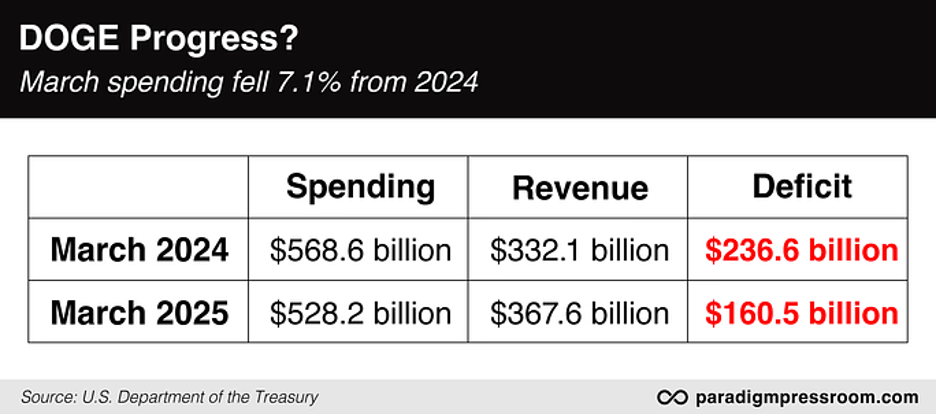

Yesterday the U.S. Treasury issued its monthly statement of income and outflows for the month of March.

The February numbers were the first full month of the Trump administration — and they didn’t reflect well on DOGE at all.

But the March numbers are an improvement: Total federal spending in March 2025 is down 7.1% from March 2024. And with revenue up, the shortfall was down considerably from a year earlier.

But it’s too soon to say whether this represents genuine progress on DOGE’s part or if a 7.1% drop in one month’s spending is a typical fluctuation from year to year.

For the first six months of fiscal year 2025 — a little over half of which occurred on Joe Biden’s watch — total spending grew 10% from a year earlier.

And the total six-month deficit is $1.3 trillion, a figure eclipsed only by the pandemic-juiced spending in the first half of fiscal year 2021. Yikes…

![]() Brickbats and Bouquets

Brickbats and Bouquets

“Just Couldn’t Help Yourself” reads the subject line of a reader’s email reacting to Monday’s edition.

“Just Couldn’t Help Yourself” reads the subject line of a reader’s email reacting to Monday’s edition.

“So in the middle of a very complicated, difficult-to-follow assessment of our economic situation for us dummies, you just couldn't help from reverting back to the old standby line, blame it on Biden.

“Your entire article discusses current economic events, but you needed for some unknown reason to print:

And if it’s the prospect of a recession that suddenly has Wall Street’s “professionals” worried… well, Paradigm’s macro maven Jim Rickards has been warning since Election Day that Trump would likely inherit a recession resulting from the excesses of the Biden years.

“Why is it that after all those years of your recession prediction that never came close to materializing, now, all of a sudden, in the shadow of an unprecedented trade war obviously created by Donald Trump, you had to go back to the old tired line of ‘Blame it on Biden’?

“It is so obvious that perhaps a shrink might be helpful. I think you still have Biden stuck in your craw. Just admit that you and/or Jim got it wrong, and get help! The Biden economy continued to clip along just fine until Liberation Day.”

Dave responds: On the contrary, we chronicled it last December when an extremely reliable recession indicator flashed red — suggesting an incoming recession sometime between February and August of 2025.

Blame it on “Liberation Day” if you want — but it’s been in the cards for a while.

In a similar vein, this indicator flashed a 2020 recession in October 2019 — months before anyone heard of a novel strain of coronavirus in China’s Hubei province.

And as we’ve mentioned more than once, Trump was engaged in his own excesses at the time — running up a $1 trillion deficit without Barack Obama’s excuse of recovering from the “Great Recession.”

“You guys are great. This is The Real News we need to know,” a reader writes after yesterday’s dive into the real reason Trump paused much of his tariff regime for 90 days.

“You guys are great. This is The Real News we need to know,” a reader writes after yesterday’s dive into the real reason Trump paused much of his tariff regime for 90 days.

“And thanks for making it understandable to amateur investors like myself.

“I have 30 acres of farmland. Now it's Go for the Gold. (I don't do paper assets.)”

Dave: You’re too kind. Oh, and your portfolio strategy — if that’s what it can be called — brings to mind the following meme I ran across just this morning…

Before we go, a quick shout-out for Thomas Jefferson’s birthday. It falls on Sunday this year so I can’t do my usual “Happy Jefferson’s Birthday” sign-off in homage to the sage of Monticello.

Before we go, a quick shout-out for Thomas Jefferson’s birthday. It falls on Sunday this year so I can’t do my usual “Happy Jefferson’s Birthday” sign-off in homage to the sage of Monticello.

Instead, it’s my usual Friday farewell…

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets