Scott Bessent’s 3-3-3 = 666

![]() 3-3-3’s 666

3-3-3’s 666

Does Scott Bessent really know what he’s getting into?

Does Scott Bessent really know what he’s getting into?

As you might be aware, the Senate has begun nomination hearings for Donald Trump’s cabinet appointments. Treasury Secretary-designate Scott Bessent, an investor and hedge fund manager, goes before the Senate Finance Committee tomorrow.

Bessent will likely sail through the process. There’s no controversy following him around — although he ought to face a pointed question or two about his long history with the billionaire do-gooder George Soros.

As long ago as last summer, Bessent was playing up an economic program he calls 3-3-3. Not surprisingly, it has three goals all involving the number three…

As long ago as last summer, Bessent was playing up an economic program he calls 3-3-3. Not surprisingly, it has three goals all involving the number three…

- Cutting the federal budget deficit to an amount that’s 3% of GDP

- 3% GDP growth by the final year of Trump’s term

- Growth in energy production equivalent to 3 million barrels of oil per day.

Those aren’t the kind of goals that’ll get everyday Americans psyched. But they do form the basis of discussion among think-tank types and Capitol Hill aides. They’ll surely come up during the hearings tomorrow.

But what do those goals mean to your own day-to-day prosperity? And how achievable are they? Strap in for Bullet No. 2…

![]() Bessent’s 3-3-3 DOA

Bessent’s 3-3-3 DOA

The first of those goals sounds really wonkish. But a return to authentic American prosperity is riding on it.

The first of those goals sounds really wonkish. But a return to authentic American prosperity is riding on it.

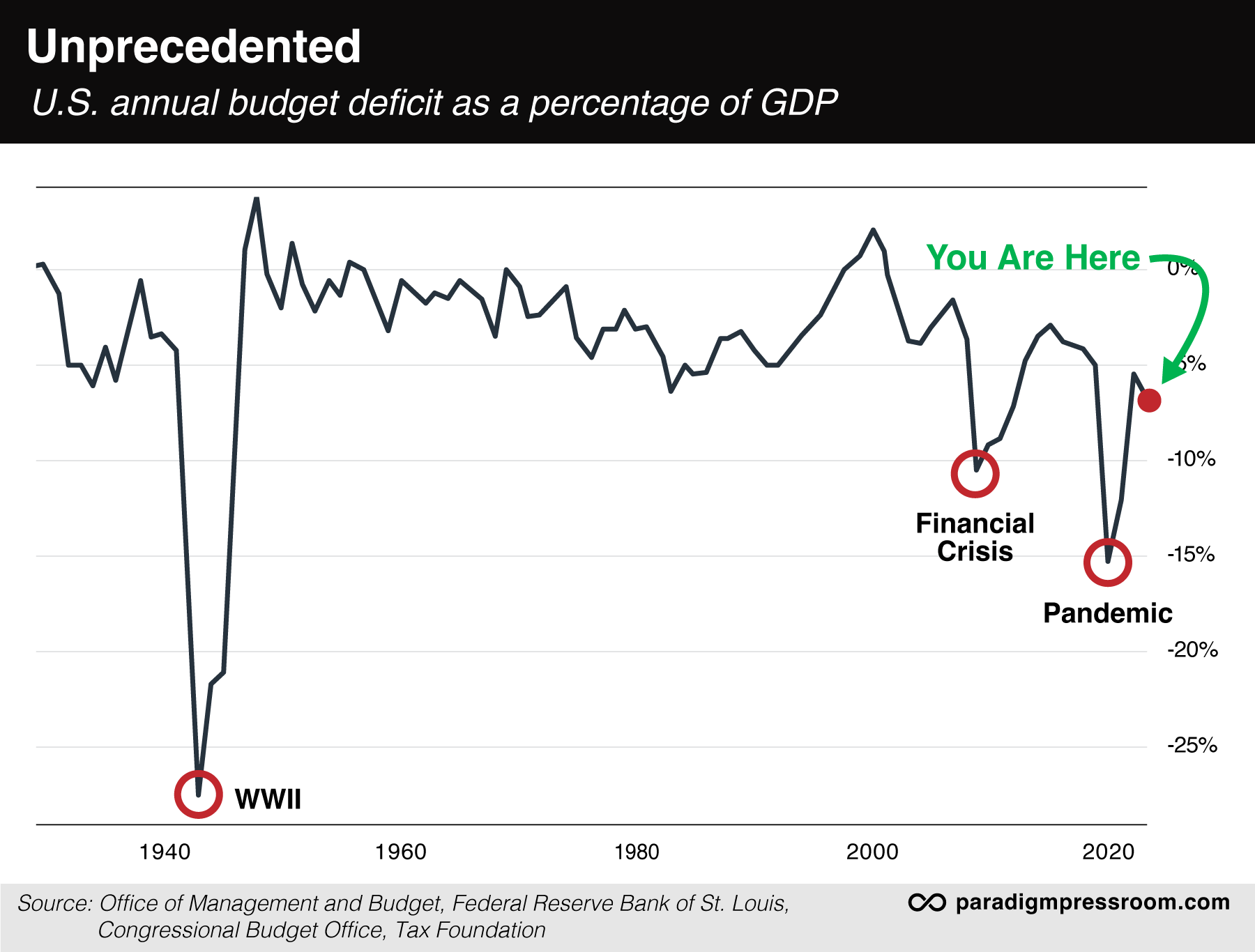

Last fall, we took note that Uncle Sam’s annual budget deficit for fiscal 2024 — $1.8 trillion — equaled 6.4% of America’s annual economic output as measured by GDP.

In records going back nearly a century, there are only three times this number has been worse — World War II, the aftermath of the 2008 financial crisis and the 2020 pandemic.

You’ll notice none of those conditions is present now: No WWII-scale conflict, no financial crisis, no pandemic.

A deficit of this magnitude… under these conditions… is unprecedented. We’ve shown this chart several times in recent months and we still can’t show it too often.

Why does it matter? Because deficits of this magnitude, year after year, will end up choking the private sector and, in time, asphyxiating any hope of sustainable prosperity. So Bessent’s aim is in the right place.

How to get there? Understand, there are only a limited number of ways a government can overcome a crushing debt burden:

- It can slash federal spending and/or raise taxes...

- It can default on the debt (not good for the government’s credibility)…

- It can inflate the debt away (a sneaky way to default)...

- Or it can try to enact policies that will generate more “economic growth” and a higher GDP number, thus generating more tax revenue.

As for No. 1 on that list, tax increases are a non-starter for Team Trump — as well they should be.

But spending will be a problem; we’ve chronicled how Elon Musk is already dialing back his ambitions for the semi-official DOGE or “Department of Government Efficiency.” He’s gone from $2 trillion in budget cuts to $1 trillion.

Given a gargantuan $6.75 trillion annual budget, that just won’t be enough to get to Bessent’s 3%-of-GDP goal.

Which means the only remotely plausible way to get there will be to juice economic growth. That’s the point of Bessent’s second goal, 3% GDP growth by 2028.

Which means the only remotely plausible way to get there will be to juice economic growth. That’s the point of Bessent’s second goal, 3% GDP growth by 2028.

To his credit, Bessent is giving himself a long runway here with 2028. Surely he’s looked at the same numbers you and I can find with a basic web search.

GDP growth during Trump’s first term never hit 3%. Indeed since 2000, annual GDP growth has been 3% or greater in only three years — 2004, 2005 and 2021.

The first two of those years were a phony prosperity built on cheap credit that fueled a housing bubble and ultimately the 2008 financial crisis. That’s no good. The last of those three years was the recovery from COVID lockdowns in 2020. Also not a model to work off of.

Bessent believes the Trump administration can get to 3% growth “through deregulation, more U.S. energy production, slaying inflation and forward guidance on confidence for people to make investments so that the private sector can take over from this bloated government spending." That’s how he put it last summer during a talk at the Manhattan Institute.

OK, hold that thought. We’ll come back to it.

The last of Bessent’s goals seems readily achievable.

The last of Bessent’s goals seems readily achievable.

In part, that’s because it’s less ambitious than it sounds. It’s not 3 million barrels a day of new oil production.

That would be hard to achieve even with a drill-baby-drill policy. Wonderful as the shale revolution of the 2010s has been, it’s getting long in the tooth.

It was a fantastic feat of American know-how, going from 5 million barrels a day of U.S. oil production in 2006–2008 to a record 13.6 million barrels a day now. But shale formations tap out quickly. As a result, the only U.S. oil field where production is still growing is the Permian Basin in Texas — and production there might peak this year.

But if you throw still-bountiful natural gas into the mix, you can come up with a “barrels of oil equivalent” figure that will likely get the oil-and-gas industry to that 3 million figure.

In the end, 3-3-3 is a variation on the same old playbook that’s never worked.

In the end, 3-3-3 is a variation on the same old playbook that’s never worked.

“Growing our way out of debt” has been the aim of every Republican administration going back to Ronald Reagan.

And they never get there because they never get a handle on spending. (Republicans find their budget-cutting religion only when they’re out of power.) Meanwhile, the hoped-for bump in tax revenue from economic growth never materializes. Bessent hasn’t said anything to convey that the playbook will be different this time.

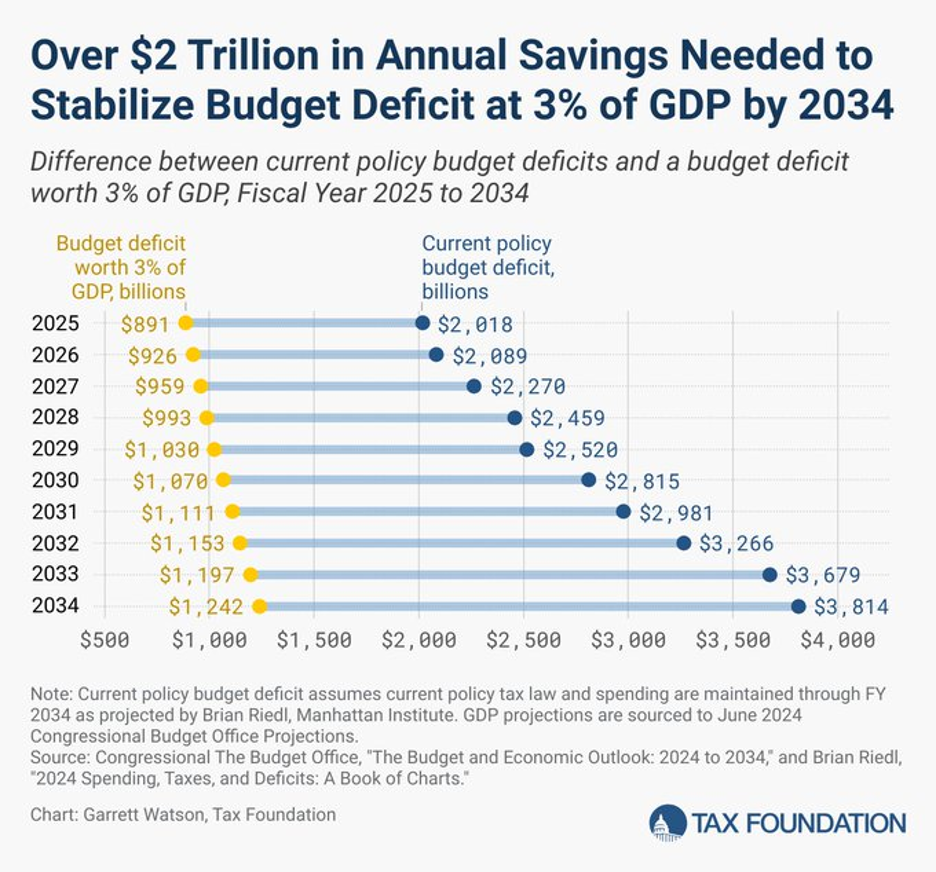

But don’t take it from us; take it from the good folks at the Tax Foundation. They’ve run the numbers and concluded the only way to get the deficit to 3% of GDP… is with the $2 trillion in budget cuts that Elon Musk has already taken off the table.

On one level, Bessent understands the stakes: "I think we're at the last-chance bar and grill for growing our way out of this,” he said last summer.

More likely, however, is that the bar is already shutting down for the night and Uncle Sam is fumbling through his pockets for his flask.

Of course, we’ll be delighted to be proven wrong.

Regardless, we’ll keep tabs through the year on how close the administration is getting to Bessent’s 3-3-3 goals.

![]() Wall Street Thinks Inflation Is Contained

Wall Street Thinks Inflation Is Contained

As far as Wall Street is concerned, the only inflation that matters is inflation for people who don’t eat or drive.

As far as Wall Street is concerned, the only inflation that matters is inflation for people who don’t eat or drive.

The Labor Department is out with a market-moving economic report — the official inflation numbers.

The headline inflation rate continues to move in the wrong direction — up 2.9% year-over-year. That’s up from 2.4% in only three months.

But the “core” inflation rate — excluding food and energy — came in cooler than expected, up 3.2% year-over-year. The previous month, it was 3.3%.

Economists think the core rate matters because food and energy prices can be volatile month-to-month. Stripping them out supposedly makes for a better representation of the underlying trend.

This microscopic surprise to the downside in the core inflation rate has touched off a scorching stock-market rally.

This microscopic surprise to the downside in the core inflation rate has touched off a scorching stock-market rally.

As the “thinking” goes, a falling core rate makes it more likely the Federal Reserve will conclude that inflation is “contained,” clearing the way for another cut in short-term interest rates — if not this month, then perhaps later this year.

At last check, the Dow is up 1.5% and the Nasdaq nearly 2.25%. The S&P 500 is up 1.6% to 5,937, wiping out the last six trading days of losses.

Bonds are also rallying, pushing yields lower; the 10-year Treasury sits at 4.64%, the lowest in over a week.

Gold is nearly flat at $2,679 but silver has rallied past $30 again. Bitcoin’s swoon didn’t last long; it’s back above $99,000 again.

Crude is once again pushing $79 a barrel after the Energy Department’s weekly inventory numbers.

![]() Making Money From “Earnings Reversals”

Making Money From “Earnings Reversals”

Earnings season is off to a strong start — and it’s a good time to remind you that for the most part, trading around earnings releases is a fool’s errand.

Earnings season is off to a strong start — and it’s a good time to remind you that for the most part, trading around earnings releases is a fool’s errand.

In keeping with recent custom, earnings season started today with releases by several of the Big Six American banks. The headline figures include net income rising 50% at JPMorgan Chase and more than doubling at Goldman Sachs.

“I don’t jump in front of earnings announcements with a fresh trade in the hopes that I somehow get lucky and guess the market reaction ahead of time,” says Greg Guenthner, editor of Paradigm’s Trading Desk service.

“You never know how a stock will react, even to solid numbers. The CFO could hiccup during the conference call and crash the stock 10%.

“Any stock you buy just before earnings are announced is a pure gamble, hence my first earnings trading rule: Only buy after the numbers are released and the conference call is complete.”

Now, on the surface that sounds silly. By that time, the reaction is already reflected in the share price, right?

But Greg has a very specific circumstance in mind: “The crowd’s initial earnings reactions are sometimes wrong, catching traders offside and leading to some of the most powerful trading setups in the market.”

No, it doesn’t happen often. But when it does, it can be very lucrative.

No, it doesn’t happen often. But when it does, it can be very lucrative.

“First,” Greg says, “you want to track stocks that have just reported earnings and are gapping down on the news. The reasons don’t matter. It could be obvious — lowered guidance or whiffing on top-line or bottom-line estimates.

“Next, wait to see how the stock behaves after it gaps lower. If it catches a bid and starts to recover, watch closely. If it can close the earnings gap in just one or two trading days, you have your signal: It’s a buy!

“These trades work due to the herd’s extreme post-earnings emotions. For whatever reason, a wave of sellers ditch the stock immediately after earnings are announced. Then, cooler heads prevail and the more patient buyers swoop in to pick up shares at a discount. Once the rest of the crowd realizes the stock isn’t broken, they pile back in. And the trend usually extends higher.”

Example: Nvidia after reporting earnings one day in 2017. An initial 5% gap down was reversed the next day with an 8% gain. NVDA went on to rally nearly 40% from its lows over the next three months.

“Keep an eye out for these earnings reversal setups over the next few weeks,” Greg concludes. “It’s the perfect strategy to deploy in these uncertain times.”

![]() California’s Home Insurance FUBAR

California’s Home Insurance FUBAR

“Thinking about the Los Angeles fires,” writes a member of our Omega Wealth Circle, “I have read that it was already difficult (and expensive!) to get homeowners insurance in California.

“Thinking about the Los Angeles fires,” writes a member of our Omega Wealth Circle, “I have read that it was already difficult (and expensive!) to get homeowners insurance in California.

“Now, with the fires in Los Angeles, I suspect that even more insurers will either leave the state or raise their rates to levels that most owners simply won't be able to pay. If you can't get insurance, you can't get a mortgage, which will further complicate efforts to rebuild.

“I wonder how this may affect efforts to rebuild burned homes, or, if people are unable to do so, what the follow-on impacts may be for California, and by extension, to the rest of the country.

Reconstruction will require the efforts of tens of thousands of skilled builders, the majority of which (according to reports) speak Spanish as their native language, and may not be legally resident in the U.S.

“And where will these laborers live while they are working to rebuild homes? And oh so many more questions that follow.

“I am very glad that I am not in charge of organizing these efforts, but when I look at the current leadership of California and Los Angeles in particular, I suspect I might do a better job. Fortunately, I am sure that I won't be invited to help.”

Dave responds: I mentioned on Friday that the insurers pulling out of California is a good thing. I should amend that.

I still concur with the California blogger who says the insurers pulling out of the state is a plus because “they were otherwise being forced to subsidize (on the backs of ordinary policyholders) rich, entitled idiots building mansions inches away from literal tons of fireload.”

But here’s the downside. Once the insurers pull out (because state regulators won’t let them raise rates to reflect the risk)... homeowners end up in a state-run last-resort insurance scheme called the FAIR Plan.

Alas, the FAIR Plan doesn’t have adequate reserves. “So in order to pay out when the predictable catastrophe happens,” tweets attorney Laura Powell, “all the other homeowners in the state will have to pay a surcharge to cover the loss.

“So in effect, what is happening is that the burden of the loss is shifted from homeowners in very high-risk areas to homeowners in lower-risk areas. Homeowners in very high-risk areas actually should pay very high premiums, because this will serve as a disincentive for building in those areas. Pooling the loss instead of allocating it based on risk is bad policy.”

The law of unintended consequences bites hard in California. And often.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets