The Recession Indicator to Watch

![]() The Chart to Watch

The Chart to Watch

Are you feeling jittery here in early 2025? As if we’re on the edge of a recession or a bear market or both?

Are you feeling jittery here in early 2025? As if we’re on the edge of a recession or a bear market or both?

To be sure, many people have been feeling those jitters for many months. The jitters abated for a while after Election Day — either because of a perception that Donald Trump was the better presidential candidate for the economy, or simply relief that there’d be no long drawn-out drama about who actually won. But with the passage of time, those jitters are back.

Notice I said the “edge” of a recession or bear market — meaning the outcome could go either way right now.

On Wednesday, during the Paradigm editors’ weekly conference call, publisher Matt Insley issued a challenge: Identify three or four sure-fire indicators that everyday folks like you can look at to know whether things are going into the tank.

Bob Byrne, James Altucher’s top stock analyst, pinpointed one right away — and several of his colleagues agreed.

We’ll tell you what it is momentarily — after we dig into the monthly job numbers, out this morning.

We’ll tell you what it is momentarily — after we dig into the monthly job numbers, out this morning.

The wonks at the Bureau of Labor Statistics conjured 256,000 new jobs for the month of December — a stunningly good number, better than the most optimistic guess among dozens of Wall Street economists.

To be sure, some of that reflects a recovery from the Boeing strike as well as Hurricanes Helene and Milton. (For what it’s worth, there was little downward revision to the November and October figures.)

The official unemployment rate ticked down to 4.1%.

So… the sure-fire indicator of a recession is the total number of “non-farm payroll” jobs in the country.

So… the sure-fire indicator of a recession is the total number of “non-farm payroll” jobs in the country.

This number comes out every month with the jobs report. Today it’s an all-time high of 159.5 million.

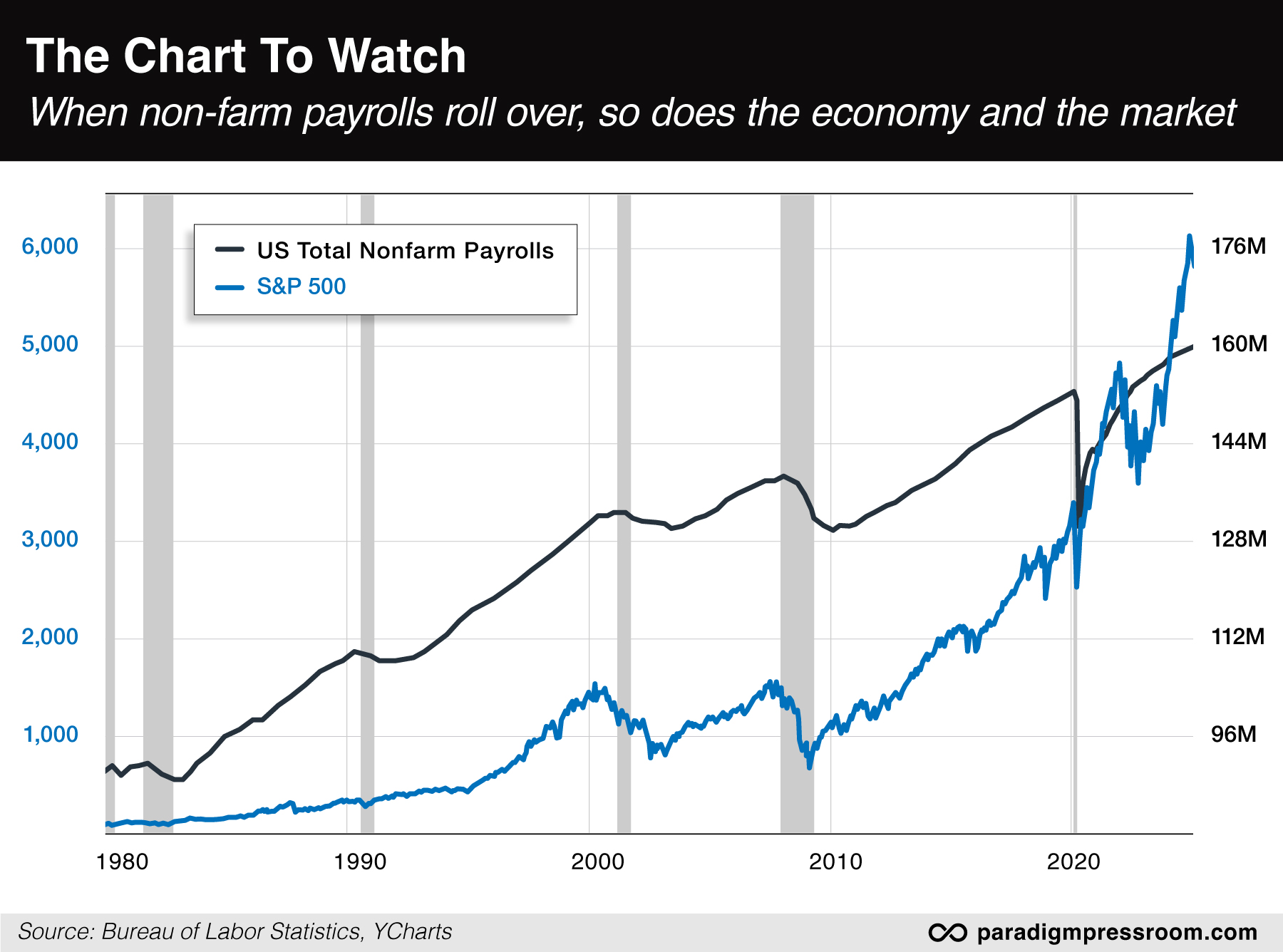

On the following chart, the monthly non-farm payroll total is the black line. The gray vertical bars indicate all the recessions going back to 1980. And we’ve also overlaid a chart of the S&P 500. That’s the blue line…

Pretty obvious, right? When the nonfarm payroll number rolls over, so do the economy and the stock market.

So if the question is “Are we on the verge of a recession and/or bear market?”... the answer for the moment is no.

I hear an objection already — especially from readers who’ve been with us for a long time. The job numbers are bogus! You can’t believe them!

I hear an objection already — especially from readers who’ve been with us for a long time. The job numbers are bogus! You can’t believe them!

True enough. The numbers are counted very differently now than they were when Jimmy Carter was president. Back then, the unemployment rate included part-timers who wanted to work full time. It also included folks who’d given up looking for work — even if they’d given up years ago and were living on the streets.

The research firm Shadow Government Statistics runs the numbers the same way the feds did in 1980. By its yardstick, the real-world unemployment rate is well north of 20% — in contrast with today’s official figure of 4.1%.

But for our purposes today, that doesn’t matter. The numbers have been increasingly gamed over the last 40-plus years. But even allowing for that, the pattern is unmistakable: When the total number of non-farm payrolls drops, it’s confirmation that trouble is underway.

And we’re just not there yet.

We’ll leave it there for today. Our team will continue the process of identifying two or three more sure-fire indicators of trouble — trading pro Enrique Abeyta says we should have a total of “Four Horsemen!” — and keep regular tabs throughout the year. Stay tuned…

All that said, Wall Street’s immediate reaction to the job numbers isn’t good. Let’s see…

All that said, Wall Street’s immediate reaction to the job numbers isn’t good. Let’s see…

- All the major U.S. stock indexes are deep in the red. The S&P 500 is down 1.5% to 5,827, the lowest point yet since its record close near 6,100 on Dec. 6

- Bond yields continue to soar. The 10-year Treasury is up to 4.75%. Next target: The October 2023 highs at 5%

- The U.S. dollar index is screaming higher. At 109.75, it’s at levels last seen in late 2022.

“Good news is bad news again,” says Paradigm chart hound Greg Guenthner — “and the economy is showing no signs of cracking that would lead the Fed to continue to lower rates at the previously expected pace.

“In fact, the market is now expecting only ONE rate cut in 2025 as of right now — and not until June the earliest.”

All that said, “We can be in a bull market with the averages simply in correction mode. It happens! We tend to forget when everything is going so well with no real downside action.”

Greg warned us last month that we’re overdue for a 10% pullback sometime before summer. Even so, “The bull is intact until proven otherwise.”

Elsewhere…

- Precious metals are pushing higher despite that dollar strength. Gold is back within a few bucks of $2,700 and silver’s up to $30.52

- Crude has powered two bucks higher, now over $76 for the first time since October

- Crypto is holding its own, Bitcoin hanging in there a little under $94,000.

![]() Verdict From CES 2025: Hype Is Finally Reality

Verdict From CES 2025: Hype Is Finally Reality

For the first time in years, the 2025 edition of the Consumer Electronics Show wasn’t about “vaporware.”

For the first time in years, the 2025 edition of the Consumer Electronics Show wasn’t about “vaporware.”

Paradigm’s Davis Wilson has ventured to Las Vegas for this gathering more times than he can count. Too often, the hype doesn’t live up to the reality. “Self-driving cars, AI and robotics have been headliners for over a decade,” he says, “but they always seemed stuck in a perpetual ‘just around the corner’ phase.”

No more: “For the first time, I was genuinely impressed by the number of conversations I had with engineers who told me these products and services are not only functional but actively being deployed.”

- When it comes to self-driving vehicles, “Companies like Waymo and Zoox are no longer in the ‘testing phase.’ They’re transporting passengers in select cities around the country. Autonomous ride-hailing is no longer theoretical — it’s operational. The future of transportation is happening right now, and it’s reshaping how we think about mobility and logistics”

- Artificial intelligence is getting real too: “Nvidia demonstrated how the use of AI dramatically improved efficiency in their design process, dropping the price point of their gaming GPUs from $1,599 to only $549. Soon other industries will adopt AI in their research and design efforts as well, making cutting-edge technology more accessible to consumers and driving new waves of demand”

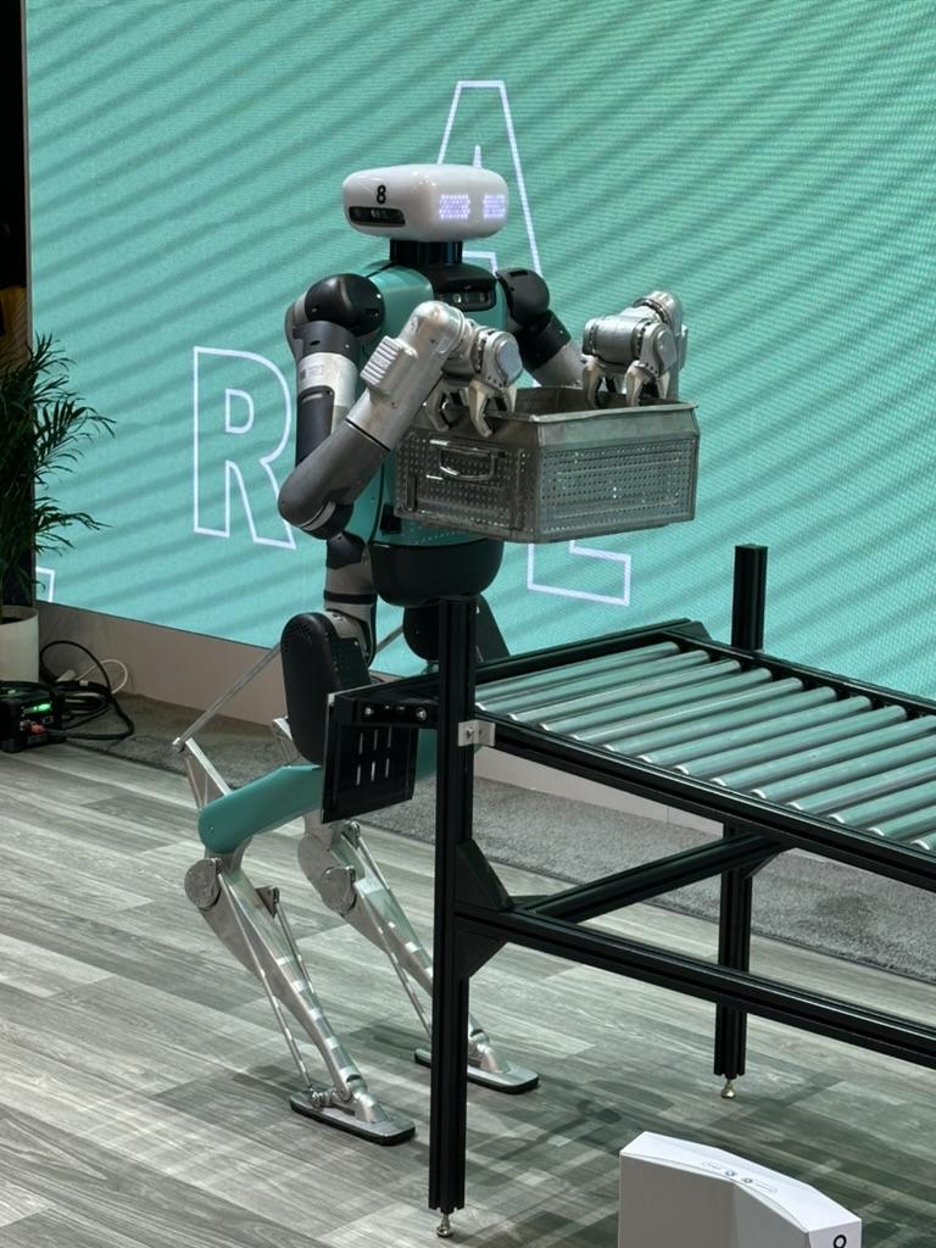

- And then there’s robotics. Davis says it’s “no longer confined to labs and research facilities. Humanoid robots are already performing tasks in warehouses and construction sites, increasing safety and reliability. These machines are reducing workplace injuries and improving productivity, which is just the beginning of a seismic shift in how industries will operate.”

Robotics: No longer in the concept phase…

“CES 2025 confirmed that the technologies we’ve long associated with the future are here now,” Davis says, “and they’re about to reshape our world.

“Companies like Alphabet, Nvidia and Amazon (owner of Zoox) are no longer pitching visions — they’re executing them. These are the kinds of companies I’ll be watching closely as we move into 2025, because they’re not just adapting to change, they’re driving it.”

![]() Follow-up: Musk Dials Back DOGE Ambitions

Follow-up: Musk Dials Back DOGE Ambitions

Sometimes the universe has a sick sense of comedic timing.

Sometimes the universe has a sick sense of comedic timing.

In yesterday’s edition, we drew a thread from Jimmy Carter’s legacy to Uncle Sam’s mad post-pandemic spending spree. We said a revival of authentic American prosperity is riding on big reductions in government spending — which is the aim of Elon Musk’s semi-official DOGE or Department of Government Efficiency. We also warned that the swamp water in Washington runs deep.

No sooner did we hit the “send” button than this news hit the wire…

Musk did an interview with the pollster and political strategist Mark Penn — who’s worked for everyone over the years from the Clintons to Trump.

Addressing his own rhetoric on the campaign trail last year for $2 trillion in spending cuts, Musk said, “I think we’ll try for $2 trillion. I think that’s the best-case outcome.

“But I do think that you kind of have to have some overage. I think if we try for $2 trillion, we’ve got a good shot at getting $1 [trillion].”

Musk then attempted to put lipstick on the pig like so: “If we can drop the budget deficit from $2 trillion to $1 trillion and free up the economy to have additional growth, such that the output of goods and services keeps pace with the increase in the money supply, then there will be no inflation. So that, I think, would be an epic outcome.”

So we’re going to “grow our way out of it.” Which is what every deficits-don’t-matter Republican has been saying for over 40 years and the national debt keeps growing like Topsy. Pathetic.

Hey Elmo, what happened to the idea of recruiting Ron Paul for your DOGE effort? He could get you to $2 trillion easily. Likewise with David Stockman, who we cited yesterday.

➢ One more follow-up from yesterday: Israeli prime minister Benjamin Netanyahu has dropped plans to attend Donald Trump’s inauguration 10 days from now. Whether that’s because of Trump’s cryptic social-media post on Tuesday or some other reason, no one’s saying.

![]() Stat of the Day

Stat of the Day

The following meme going around in light of the California wildfires is mostly accurate…

The following meme going around in light of the California wildfires is mostly accurate…

LA County is the most populous county in the United States — nearly 9.7 million, per a 2023 Census Bureau estimate.

If it were a state unto itself, it would be the 11th largest. Contrary to the map, Michigan, North Carolina and Georgia are in fact bigger than LA County, each exceeding 10 million.

![]() Mailbag: Wildfires, Napolitano, “Congressmember,” Etc.

Mailbag: Wildfires, Napolitano, “Congressmember,” Etc.

We haven’t had much to say about the wildfires — not much we can add to the banger of a piece Sean Ring had in yesterday’s Rude Awakening — but a reader wishes to weigh in…

We haven’t had much to say about the wildfires — not much we can add to the banger of a piece Sean Ring had in yesterday’s Rude Awakening — but a reader wishes to weigh in…

“Pacific Palisades and Altadena have nearly disappeared due to the fires. So what is the impact and process of insurance companies paying off their clients for all the losses due to the LA fires?

“Presumably much of their reserve assets are held in stocks. What is the possible impact of pulling multiple billions of dollars out of the market in short order? I also just heard the federal cash register ring for billions of recovery dollars.

“BTW — I hate the long sales videos, but I love The 5!”

Dave: As we understand it, many home insurers pulled out of California before this latest debacle. They saw the risks, they sought to raise rates, the regulators said “nope” and the insurers said “buh-bye.”

As a Southern California blogger who goes by the name “Aesop” writes, “Insurance companies abandoning coverage in Califrutopia was a net plus, not a terrible thing, because they were otherwise being forced to subsidize (on the backs of ordinary policyholders) rich, entitled idiots building mansions inches away from literal tons of fireload, in brush-choked wind-tunnel canyons that burn regularly for not years, not decades, not centuries, but for millennia, since Hammurabi himself was in diapers.”

After our item in yesterday’s 5 Bullets about Donald Trump’s curious repost of a video featuring Columbia economist Jeffrey Sachs, a reader writes…

After our item in yesterday’s 5 Bullets about Donald Trump’s curious repost of a video featuring Columbia economist Jeffrey Sachs, a reader writes…

“I was pleasantly pleased to know that Paradigm Press is following some of the commentators that have been appearing the last 18 months on Judge Napolitano's Judging Freedom, which is an excellent one — which I'm sure you already know!

“I read all of your Paradigm Press releases.”

Dave: Seems The Judge is focusing almost exclusively on geopolitics these days — which is great.

That said, for my money my acquaintance Scott Horton will always be tops.

His interview schedule has been light lately — only because he’s doing interviews on the other side of the mic to promote his book Provoked: How Washington Started the New Cold War With Russia and the Catastrophe in Ukraine.

“I am a longtime reader of The 5, and I enjoy your clear, concise style,” a reader writes after yesterday’s edition.

“I am a longtime reader of The 5, and I enjoy your clear, concise style,” a reader writes after yesterday’s edition.

[Your editor has been at this long enough to know a “but” is coming, even if it’s only implied…]

“It disturbs me when you use words like congressmember. David Stockman is a former representative, i.e., a member of the U.S. House of Representatives, just as members in the other wing of the Capitol are senators.

“Starting with the U.S. Constitution, Congress refers to both houses of the legislature, like the Congressional Record that contains information about the activities of both houses.

“English is a concise language when properly used.

“Keep up the good work.”

Dave: English is also an ever-evolving thing. For decades, people have said “my congressman” when speaking about their representative in the House. The distinction from a senator is broadly understood. That’s not a train I care to stand in front of.

Now, when people speak of the president as “the commander in chief” and they’re not talking about his role overseeing the armed forces — or worse, they say “my commander in chief” and they’re a civilian — I’ll object loudly. Language like that betrays an ignorance of how the Founders sought to separate civilian and military power. That’s a hill I’ll die on any day.

“I found Dave Gonigam’s Jan. 9 article — ‘Hey, Big Spender’ — very informative, fair, well-balanced and believable,” writes our final correspondent.

“I found Dave Gonigam’s Jan. 9 article — ‘Hey, Big Spender’ — very informative, fair, well-balanced and believable,” writes our final correspondent.

[There’s no “but” here; this is coming from a fairly new reader…]

“Innuendo, myth, false narratives and outright propaganda surround us from all angles, including Paradigm Press. I will look for more articles by him in the future and hope his aim stays true.”

Dave: Thank you. According to our records you’ve been with us for a little over four months, coming on board via Altucher’s Investment Network. Been at this for 14 years, so it’s always good to hear from newer folks.

Over time I end up saying something that offends everyone, and some of them bail. I like to think that the folks who remain make up a robust remnant of truly independent thinkers…

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets