Hey, Big Spender

![]() Hey, Big Spender

Hey, Big Spender

And people thought Jimmy Carter was a “big-spending Democrat.”

And people thought Jimmy Carter was a “big-spending Democrat.”

As maybe you’ve heard, the U.S. stock market is closed today for the funeral of the 39th president.

That’s not unusual, if you’re wondering. During this century the market closed for George H.W. Bush’s funeral in 2018, for Gerald Ford’s in 2006 and Ronald Reagan’s in 2004.

You can find Carter remembrances anywhere — some of them fond, others less fond, still others indifferent. Today, we simply direct your attention to a startling statistic, courtesy of our acquaintance and one-time colleague David Stockman.

Mr. Stockman was a young congressmember from western Michigan during the Carter years — before becoming Ronald Reagan’s first budget director.

He points out that Jimmy Carter’s biggest annual budget deficit was $74 billion. Using the yardstick of “constant 2024 dollars of purchasing power,” that translates to $240 billion in today’s money.

For perspective, Uncle Sam ran up the national credit card by $367 billion during a single month back in November.

“It can be well and truly said that the Washington UniParty is now capable of generating more red ink in 20 days than Jimmy Carter did during his worst year,” Stockman writes.

When Carter left office in 1981, the national debt was $908 billion. Adjusted for inflation, that’s $3.46 trillion.

When Carter left office in 1981, the national debt was $908 billion. Adjusted for inflation, that’s $3.46 trillion.

Even grading on a curve with inflation-adjusted numbers, the national debt has grown more than tenfold since Carter’s day — sitting this morning at $36.18 trillion.

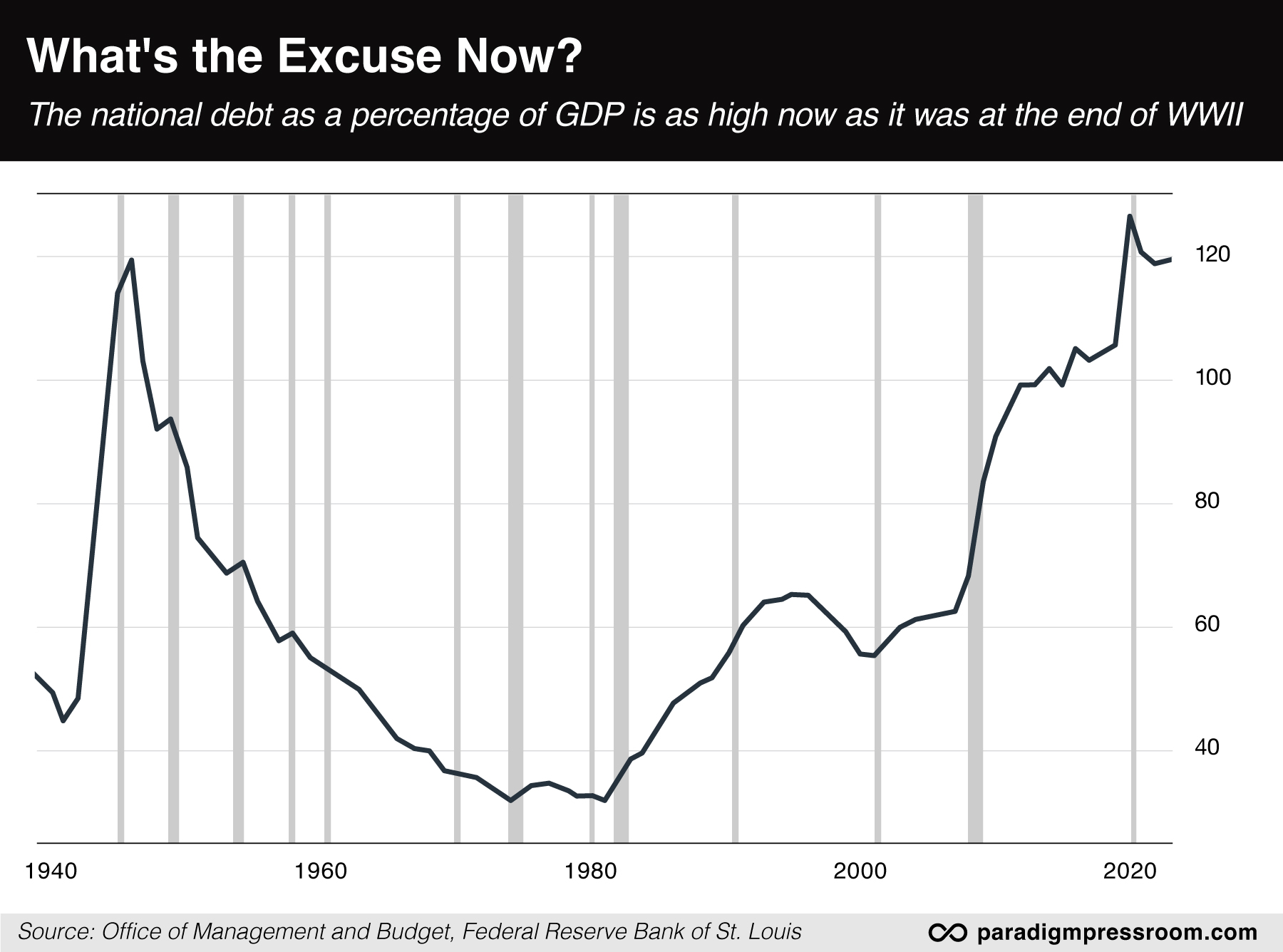

That’s bad enough but this is worse: Back then, the national debt was only 31% of America’s annual economic output.

In 2023, the most recent figures available, it was 119%.

It’s just as high now as it was in 1946 — when Washington had the excuse of fighting World War II to justify unprecedented deficit spending. What’s the excuse now?

For years, Paradigm’s macroeconomics maven Jim Rickards has cited the research of economists Kenneth Rogoff and Carmen Reinhart, summarized in their 2009 book This Time Is Different: Eight Centuries of Financial Folly.

Rogoff and Reinhart’s central insight was that once government debt reaches 90% of economic output… well, that’s the point of no return.

As Jim explained it in his 2019 book Aftermath, “The debt itself causes reduced confidence in growth prospects partly due to fear of higher taxes or inflation, which results in a material decline in growth relative to long-term trends.”

Yes, this debt-to-GDP ratio fell steadily after WWII. But that was an extraordinary circumstance: The United States’ industrial base emerged from the war unscathed, while the rest of the world’s was devastated.

No such consolation this time. Now we’re just in the same high-debt company with developed-world basket cases like Japan, Italy and Greece.

That’s a vicious headwind facing Donald Trump as he embarks on his second term — a headwind Ronald Reagan did not face after taking the baton from Jimmy Carter 44 years ago.

That’s a vicious headwind facing Donald Trump as he embarks on his second term — a headwind Ronald Reagan did not face after taking the baton from Jimmy Carter 44 years ago.

Any hope for a revival of authentic American prosperity depends on the Trump administration pulling down that sky-high line on the chart above.

“The national debt does not have to be paid off,” Jim Rickards wrote his Strategic Intelligence readers last month. “It just has to be made sustainable so it can be rolled over.

“That requires reductions in the debt-to-GDP ratio, which can be achieved with higher real growth and smaller deficits from spending reductions.”

Spending reductions. That’s what it will take. Any revival of authentic American prosperity is riding on Elon Musk and Vivek Ramaswamy’s DOGE project (“Department of Government Efficiency”) — and Musk’s target of $2 trillion in spending cuts.

But the swamp water in Washington runs deep — as the aforementioned David Stockman knows well.

He too had a blueprint to cut spending as Reagan’s budget director. But Reagan was surrounded by deep-state types who tore up that blueprint. The national debt tripled during Reagan’s two terms — a feat no one has matched since.

Something to think about today as Jimmy Carter is laid to rest… and Donald Trump prepares to return to the Oval Office.

[Editor’s note: Do you belong to Jim Rickards’ new “testing group”?

Jim has 500 spots available to test his new controversial stock-scanning software based on his work for the CIA. And they’re filling up fast.

Our customer service team has been flooded with calls from Jim’s readers who don’t want to miss out on what’s happening. If you’re wondering what the buzz is all about, Jim just released a two-minute video where you can learn how to test his patented stock-scanning software now. Click here to watch immediately.]

![]() Why Did Trump Post This Video?

Why Did Trump Post This Video?

What’s the one thing that could derail the Trump economic agenda faster than anything else?

What’s the one thing that could derail the Trump economic agenda faster than anything else?

The Paradigm Press editors kicked around that question yesterday during our weekly conference call.

The most obvious thing that came to mind was an outbreak of war within the first 60 days of Trump’s term — well, an outbreak above and beyond the current conflicts in Eastern Europe and the Middle East.

It’s a possibility that’s been on this editor’s mind ever since Trump’s win in November.

One week after Election Day, I mentioned how Trump was already surrounding himself with warhawks like Marco Rubio (secretary of state), Mike Waltz (national security adviser) and Elise Stefanik (UN ambassador).

I cited former CIA analyst Larry Johnson. “Trump is staffing his new administration with pro-Zionists who are likely to press for a conflict with Iran.”

And I cited retired Army Col. Lawrence Wilkerson. “This is the one place where Trump really worries me — doing everything in his power for Israel.”

I mention all of this to tee up the following…

Two days ago on his Truth Social account, Trump shared a video in which Columbia economist Jeffrey Sachs labeled Israeli Prime Minister Benjamin Netanyahu “a deep, dark son of a bitch.”

Two days ago on his Truth Social account, Trump shared a video in which Columbia economist Jeffrey Sachs labeled Israeli Prime Minister Benjamin Netanyahu “a deep, dark son of a bitch.”

Sachs has emerged in recent years as one of the most trenchant critics of the bipartisan “blob” that runs U.S. foreign policy — neoconservatives on the right, liberal internationalists on the left.

The video clip Trump shared was an interview Sachs did with Tucker Carlson. Sachs said Netanyahu deftly maneuvered Washington into several Middle East conflicts and now wants U.S. forces to go to war with Iran.

“Netanyahu had, from 1995 onward, the theory that the only way we’re going to get rid of Hamas and Hezbollah is by toppling the governments that support them. That’s Iraq, Syria and Iran. And the guy is nothing if not obsessive,” Sachs said. “He’s gotten us into endless wars and because of the power of all of this in U.S. politics, he’s gotten his way.”

As a reminder, Netanyahu came to Washington in 2002 to sell Congress on going to war with Iraq: “If you take out Saddam, Saddam’s regime, I guarantee you that it will have enormous positive reverberations on the region,” he said.

Yeah, not so much.

We have no idea why Trump chose to post this video. But it’s worth your contemplation as an informed citizen — and so far, U.S. corporate media haven’t picked up the story.

Israeli media, in contrast, are all over it. You find full-length writeups inYedioth Ahronoth,The Times of Israel and Israel Hayom, the free daily founded by the late casino magnate Sheldon Adelson.

Count on us to keep tabs on this situation, since neither mainstream nor conservative media will.

![]() Money Miscellany

Money Miscellany

One thing Trump won’t be facing as he begins his second term is a dockworker strike.

One thing Trump won’t be facing as he begins his second term is a dockworker strike.

The International Longshoremen’s Association and the U.S. Maritime Alliance have reached a tentative contract agreement — heading off a strike at East Coast and Gulf Coast ports. Absent the deal, 45,000 workers from Maine to Texas would have walked next Wednesday.

Both sides still have to ratify the agreement. Neither side is saying how they came to terms.

Labor and management agreed last year on a pay package but they remained far apart on the issue of automation — and Trump weighed in on the side of the union.

The tension between the incoming president and the Federal Reserve is getting thick.

The tension between the incoming president and the Federal Reserve is getting thick.

Yesterday afternoon the Fed released the minutes from its December meeting. At the risk of repeating ourselves, Fed “minutes” aren’t like the minutes from your local sewer board. They’re not an objective record of who said what. They’re a political document, calculated to telegraph a message to the markets.

And the message in this case is, “Trump’s policies could be inflationary.”

Of course, Trump’s name shows up nowhere in the Fed’s document. But it’s easy to read between the lines — especially in the discussion about how soon inflation might return to the Fed’s 2% target.

With regard to the outlook for inflation, participants expected that inflation would continue to move toward 2%, although they noted that recent higher-than-expected readings on inflation, and the effects of potential changes in trade and immigration policy, suggested that the process could take longer than previously anticipated. [Emphasis ours.]

After the release of the minutes, the trade in fed funds futures suggested the Fed might be already done with its rate-cutting cycle, which began only last September.

There’s a 95% probability the Fed will leave rates alone at its next meeting on Jan. 29 — and an over-50% probability of the same outcome on March 19. (Beyond the next one or two meetings, this metric has zero predictive value.)

Trump can’t be happy. “Interest rates are far too high,” he complained during a rambling press conference at Mar-a-Lago on Tuesday. Hilariously, that sentence was preceded by the assertion that “inflation is continuing to rage.”

Well, yes it is. That’s why the Fed might be done cutting rates. More cuts would goose the economy short term, but they’d also stoke the inflationary fires.

Trump wants low rates and low inflation. Well, so would we. We’d also like a pony.

While stock and bond markets are closed today, the commodity complex is still buzzing — and rallying.

While stock and bond markets are closed today, the commodity complex is still buzzing — and rallying.

Gold is up another $11 at last check to $2,674, the highest since mid-December. Silver’s grip on the $30 handle is getting firmer, now $30.26. Crude has rebounded past $74.

Crypto, of course, trades 24/7. Alas, Bitcoin has slipped below $94,000 for the first time this year.

![]() Comic Relief

Comic Relief

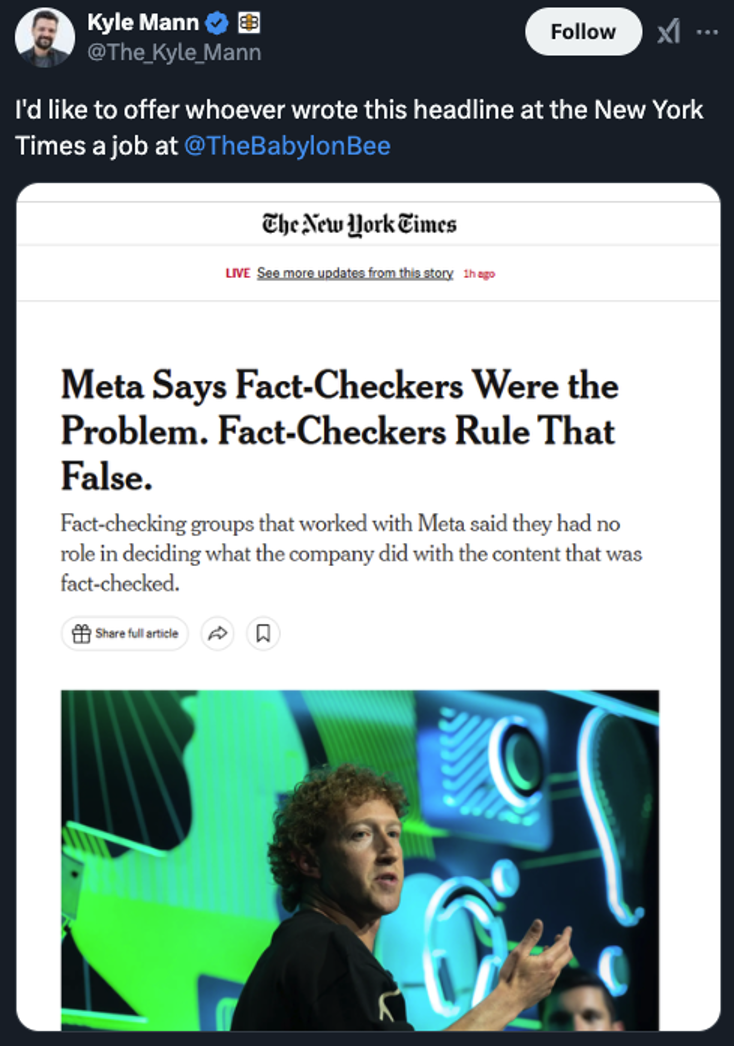

We don’t have much to say about Mark Zuckerberg’s decision to give “fact-checkers” the boot at Facebook, Instagram, etc.

We don’t have much to say about Mark Zuckerberg’s decision to give “fact-checkers” the boot at Facebook, Instagram, etc.

Of course, we’ve said plenty over the years about the censorship-industrial complex. Our own firm was the victim of it shortly after Election Day — and it wasn’t the first instance. As time has gone by, we’ve also run afoul of the fact-checkers.

But the caterwauling from the mainstream after Zuck’s move has been something to behold. This is, hands-down, our favorite hot take.

![]() About Those Costco Apartments…

About Those Costco Apartments…

On the subject of a developer’s plans to build apartments atop a Costco in Los Angeles, a couple of readers weigh in…

On the subject of a developer’s plans to build apartments atop a Costco in Los Angeles, a couple of readers weigh in…

“If I remember correctly Costco members have an average income Of $90K per year. I wonder what will happen when it is integrated with a low-income housing project?”

“What about the parking?” wonders another. “They better have a lot/garage with tenant only access because when the wife and I go to Costco, parking is the biggest exercise in futility.

What a mess!”

Dave: The developer plans two levels of underground parking. That’s the extent of what we know.

As for the first question, it’s a novel arrangement. Costco typically owns its properties, but not in this case. Costco will pay rent to the developer, Thrive Living. The rent in turn will help Thrive rely less on government affordable-housing subsidies.

Or so says Thrive founder Ben Shaoul, who tells The Wall Street Journal that if this project flies, it’ll be a model for more affordable housing elsewhere.

Honestly, I’ll be surprised if it ever gets off the ground given that we were first writing about it nearly two years ago and nothing of substance seems to have happened since…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets