Currency Wars Approaching Climax

- Climax to the currency wars

- Team Biden tackles AI (What could go wrong?)

- It’s not easy being green (mining)

- Establishment confessions: Lockdowns didn’t work

- Eat ze bugs (Yum!)

![]() Climax to the Currency Wars

Climax to the Currency Wars

The currency wars are approaching a climax — and Jim Rickards has just issued a critical update to a warning he issued over the summer.

The currency wars are approaching a climax — and Jim Rickards has just issued a critical update to a warning he issued over the summer.

If you’re scratching your head — What currency war? How long has it been going on? Why would it climax now? — today’s a great day to catch up. Events are moving quickly — and so should you.

It’s easy to lose track, even for someone like me who’s been working with Jim for nearly a decade: We remain in the midst of a currency war.

It’s easy to lose track, even for someone like me who’s been working with Jim for nearly a decade: We remain in the midst of a currency war.

Jim literally wrote the book on currency wars — his first book, 2011’s Currency Wars.

“Currency wars,” he wrote in that volume, “are fought globally in all major financial centers at once, 24 hours per day, by bankers, traders, politicians and automated systems — and the fates of economies and their affected citizens hang in the balance.”

The book opens in dramatic fashion — with the Pentagon’s first-ever “financial war game,” held even as the global financial crisis was still raging in early 2009.

Jim walked senior military leaders through a two-day exercise. At the conclusion of the exercise, the Russians and Chinese teamed up on a new gold-backed currency that muscled aside the U.S. dollar as the globe’s main reserve currency.

To say the other participants in the exercise were gobsmacked would be an understatement. Fourteen years later, it’s starting to look eerily prescient.

As Jim laid out in the book, the present currency war began in 2010… and marks the third such conflict in a century…

As Jim laid out in the book, the present currency war began in 2010… and marks the third such conflict in a century…

Currency War I (1921–1936): It begins with Germany's epic devaluation of the mark. Soon, everyone is devaluing. By 1933, FDR devalued the dollar against gold, from $20.67 an ounce to $35. The war ends in 1936 with a three-way truce between the United States, Britain and France. Alas, Germany was not a party to the agreement, and a shooting war was underway by 1939

Currency War II (1967–1987): It begins with Great Britain devaluing the pound against the dollar. Soon the dollar is under pressure, and in 1971, Nixon cuts the dollar's last tie to gold — sending the greenback on a roller coaster ride for the next 16 years. The Plaza Accord of 1985 and the Louvre Accord of 1987 lead to a new equilibrium

Currency War III (2010–present): It begins with President Obama announcing plans to double U.S. exports in five years. The only way to make that happen is to cheapen the currency. Months later, Brazil's finance minister declares, "We're in the midst of an international currency war, a general weakening of currency."

“The traditional and fastest way to increase exports had always been to cheapen the currency,” Jim explained in Currency Wars.

“The traditional and fastest way to increase exports had always been to cheapen the currency,” Jim explained in Currency Wars.

And everyone around the world in 2010 knew it. Cheapening the currency makes your exports less expensive for foreign buyers.

As it happens, Obama’s National Export Initiative — the act that started this dirty snowball rolling downhill — fell way short of its goals. Instead of doubling by 2015, U.S. exports grew only 50%.

We recount this history, both ancient and recent, to jog your memory if you’re a longtime reader — or clue you in if you’re a newer one.

Maybe you’re a Rickards’ Strategic Intelligence subscriber — but you became familiar with his work only in the last year through his “Biden Bucks” thesis. Maybe you didn’t even know until today that we’re in the midst of a currency war.

But no matter how long you’ve been a Paradigm Press reader, you should know that…

The previous two currency wars lasted 15–20 years. We’re now more than 13 years into the current one. This is the stage where things could start getting spicy.

The previous two currency wars lasted 15–20 years. We’re now more than 13 years into the current one. This is the stage where things could start getting spicy.

That’s why Jim issued an urgent update to his Currency Wars thesis on Sunday night during his exclusive briefing titled Rickards’ War Forum: The Next Shots Fired.

Today the Federal Reserve is convening one of its every-six-weeks policy meetings. At the conclusion of that meeting tomorrow afternoon, the Fed will issue a statement in which it will leave short-term interest rates unchanged.

Mainstream financial media outlets, as usual, are missing the real story. They’re posing questions like how will the recent surge in bond yields and the conflict in the Middle East affect Fed policy going into 2024.

As Jim sees it, what the Fed does could amount to a full-on declaration of economic war. “This is the biggest story you’re going to see this week, this month and maybe even this year,” Jim says.

It’s a story you won’t hear anywhere else — and you’ll want to be up to speed before the Fed makes its move tomorrow at 2:00 p.m. EDT.

Here’s the link: If you haven’t watched Rickards’ War Forum: The Next Shots Fired, you’ve got barely 24 hours.

![]() Team Biden Tackles AI. What Could Go Wrong?

Team Biden Tackles AI. What Could Go Wrong?

Because the Biden administration has solved all other problems, it’s now tackling artificial intelligence.

Because the Biden administration has solved all other problems, it’s now tackling artificial intelligence.

Yesterday the White House issued an appallingly wordy executive order that the American Enterprise Institute’s James Pethokoukis describes as “a massive escalation of government intervention into the American technology sector.”

We won’t belabor the sheer folly of this undertaking — colleague Sean Ring did a bang-up job of that in this morning’s Rude Awakening.

But we did perk up at how the order invokes the Defense Production Act of 1950: Companies must notify the government when developing any system that poses a “serious risk to national security, national economic security or national public health and safety.”

This administration has a penchant to cite the Defense Production Act — passed weeks after the United States intervened in the Korean War — to justify whatever schemes it wants to carry out. It even cited the law last year in its attempts to ramp up production of the metals that go into electric vehicle batteries. (More about those metals in today’s Bullet No. 3.)

That’s because this administration views everything through the lens of “national security.” Last spring, Treasury Secretary Janet Yellen delivered a speech in which she said the health of the U.S. economy must take a back seat to national-security concerns — specifically pointing to measures like the ban on U.S. exports of advanced semiconductors and other technology to China.

There’s no real reaction to speak of in the markets — either in the AI-adjacent Big Tech names or in the smaller, more specialized outfits like C3.ai Inc. (AI). It was known for weeks that the White House would drop this order yesterday… and that it would be a massive overreach.

The tech industry trade group NetChoice says it’s “ripe for legal action.” Let’s hope so.

As for the broad stock market, it’s stuck in neutral — waiting on what the Fed does tomorrow afternoon.

As for the broad stock market, it’s stuck in neutral — waiting on what the Fed does tomorrow afternoon.

None of the major U.S. indexes is moving meaningfully after yesterday’s rally; the S&P 500 has inched up to 4,167. For perspective, that’s no better than it was around Memorial Day. The 10-year Treasury yield has backed off to 4.85%.

The real action today might be in gold…

The real action today might be in gold…

In other words, if the powers that be allow gold to set a monthly close over $2,000, that’s a signal they’re willing to let the gold price sail much higher. (For a good backgrounder on precious-metals manipulation, here’s a writeup of ours from 2019.)

Gold’s October rally “could be a very big deal,” adds Greg Guenthner of The Trading Desk. “It's already broken out priced in euros, the pound, yen, etc. -- all-time highs.

“It's even more impressive that it's making this move in USD with the dollar index ripping. A breakout 3-plus years in the making. Once it goes, it won't look back. Insert gaudy price target of your choice here.”

As we write, the front-month gold contract is up about 10 bucks on the day at $2,016. Even the spot price has hoisted itself to $2,003. Spot silver, however, is down a dime to $23.19.

Crude, you ask? It’s stabilizing at $82.89.

![]() You Can’t Have “Green” Without Mining — and Lots of It

You Can’t Have “Green” Without Mining — and Lots of It

It’s finally dawning on the mainstream that the “green” economy ain’t gonna happen without a huge ramp-up in the volume of mining.

It’s finally dawning on the mainstream that the “green” economy ain’t gonna happen without a huge ramp-up in the volume of mining.

Lithium, copper, cobalt, nickel — electric-vehicle batteries don’t happen without them. But politically correct investors are skittish about investing in “dirty” mining. (And to be sure, a lot of mining is environmentally problematic.)

Enter one Evy Hambro — the mining-and-metals veteran at BlackRock, the world’s biggest asset manager.

“If people don’t give this sector a chance, then the energy transition is going to be impeded by the scarcity of materials to build everything required,” he tells the Financial Times. “This energy transition is starting to expose some weaknesses in that kind of complacent attitude.”

To be sure, global mining giants like BHP, Rio Tinto and Vale trade at bargain multiples of roughly 8.5 times earnings — compared with 18.5X for the S&P 500.

“The further you get away upstream from the renewable power companies, the lower the multiples go,” Hambro says. “But you can’t have the renewable power companies or electric-vehicle manufacturers without everything upstream of them. There’s this massive gap in valuation.”

Hambro says if decarbonizing is the goal, then mining companies should get a thumbs-up in Wall Street’s ESG criteria, evaluating companies based on environmental, social and governance factors.

“The demand for metals and materials is poised to surpass all prior estimates,”

Meanwhile, supply is likely to remain constrained. Case in point…

Meanwhile, supply is likely to remain constrained. Case in point…

Huge protests broke out last week in Panama over the future of a copper mine.

Canada-based First Quantum Minerals operates the Cobre Panama mine — one of the world’s newest copper mines, and already one of the biggest. The sprawling 32,000-acre complex employs more than 9,000 people; the company says its operations account for nearly 5% of Panama’s economy.

Earlier this month, Panama’s President Laurentino Cortizo approved a 20-year extension of First Quantum’s license.

The reaction was furious. “A broad cross-section of society has joined in demonstrations across the country for more than a week,” reports The Associated Press. “Critics say the concession puts Panama’s environment and water supply at risk.”

Yesterday, Cortizo announced the issue would be put up for a referendum in December. First Quantum’s share price cratered 28.5%.

Obviously there’s risk with smaller companies tied to a single huge project; First Quantum’s market cap is under $9 billion. But there’s less risk with the diversified giants like BHP, with a $144 billion market cap — and a dividend yield approaching 6%. (You still can’t get that with a Treasury bill, even now!)

![]() Establishment Confessions: Lockdowns Didn’t Work

Establishment Confessions: Lockdowns Didn’t Work

Now they tell us…

Now they tell us…

New York magazine has published an excerpt from a new book titled The Big Fail: What the Pandemic Revealed About Who America Protects and Who it Leaves Behind. The authors are New York Times veteran Joe Nocera and Vanity Fair contributing editor Bethany McLean. Very mainstream, respectable credentials.

“In the U.S. and the U.K.,” they write, “lockdowns went from being regarded as something that only an authoritarian government would attempt to an example of ‘following the science.’ But there was never any science behind lockdowns — not a single study had ever been undertaken to measure their efficacy in stopping a pandemic. When you got right down to it, lockdowns were little more than a giant experiment.”

They were also the pretext for unprecedented levels of tyranny, as we said last spring — freedom of association, freedom of movement, freedom of commerce, freedom of worship all obliterated in one fell swoop.

Not that the authors put it so bluntly, of course. But they do go so far as to call out the sainted Dr. Anthony Fauci: “What he could never acknowledge was that ‘shutting things down’ didn’t stop the virus, and that keeping schools closed didn’t save kids’ lives. Then again, to understand that, you had to be willing to follow the science.” Burn.

The book’s publication comes nearly a year after The Atlantic published a trial balloon in which the Establishment tried to come clean about its failures — Brown University health economist Emily Oster’s plea for a “pandemic amnesty.”

The book’s publication comes nearly a year after The Atlantic published a trial balloon in which the Establishment tried to come clean about its failures — Brown University health economist Emily Oster’s plea for a “pandemic amnesty.”

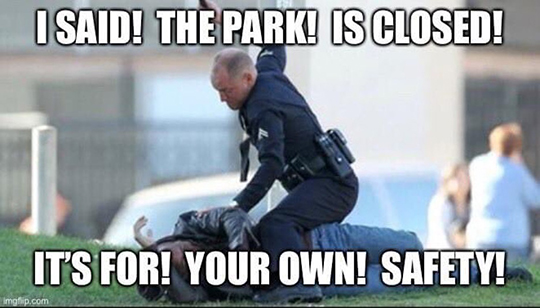

We roasted it at the time. To argue that “both sides got things wrong in 2020” is to overlook the fact that only one side sought to impose its worldview on the other through force of law. Enforcement of lockdown measures wasn’t quite this harsh…

… but it came damn close.

Anyway, Nocera and McLean are about as forthright as anyone in the mainstream can afford to be at this point. Only weeks ago, you could get booted off social media for saying this: “It’s time to be clear about the fact that lockdowns for any purpose other than keeping hospitals from being overrun in the short-term were a mistake that should not be repeated.”

Yeah, and the hospitals weren’t overwhelmed, either. Remember the Navy hospital ship that docked in New York Harbor? It sat nearly empty for a month before heading back to base.

To the extent there was any shortage of hospital beds, that was a result of crony-capitalist regulations limiting competition in the hospital industry. We mentioned the figures in the pandemic’s earliest days: America had 2.8 hospital beds per 1,000 people — compared with 12.3 in South Korea.

![]() Yum!

Yum!

Deadline approaches and our word count is already rather high. Just enough time to snag a better-than-average headline from The Babylon Bee for our Bullet No. 5…

Deadline approaches and our word count is already rather high. Just enough time to snag a better-than-average headline from The Babylon Bee for our Bullet No. 5…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets