Drama in the Desert

- “I quickly understood what I had walked into"

- 18 months until the real bank trouble

- Best sector for the rest of 2023

- Business class gets no kick from Champagne

- Mailbag: Climate change, Elon Musk and anti-woke ETFs

![]() Tales of Economic Intrigue

Tales of Economic Intrigue

It was 1981. Ronald Reagan just took office as president. The first Indiana Jones movie just came out. And Citibank dispatched a young Jim Rickards to the middle of nowhere — Niamey, the capital of Niger in west Africa.

It was 1981. Ronald Reagan just took office as president. The first Indiana Jones movie just came out. And Citibank dispatched a young Jim Rickards to the middle of nowhere — Niamey, the capital of Niger in west Africa.

“Niamey is completely surrounded by the Sahara desert,” he tells us. “It’s not near the desert; it’s in the desert.”

As he looked out the window of his hotel room, “I saw something I had only seen in movies and never expected to see in real life — a caravan.

“It was a real one with camels tied together in a line laden with goods and camel drivers riding a few, and some herders walking alongside. They wore turbans and robes and were headed out into the desert. I’m not sure where they were going. Timbuktu is not far in case you’re in the neighborhood.”

At the time, Jim was a senior officer at Citibank HQ in New York. He was in Niamey to meet with the bank’s chief country officer for Niger.

“Before we got down to business,” Jim recalls, “I told the chief I had a question.

“Before we got down to business,” Jim recalls, “I told the chief I had a question.

“‘I understand what I’m doing here, but what are we doing here? Why on earth does Citibank have an office in such a primitive and deserted place?

“The chief looked at me like I was the new kid on the block. (I was.) He answered my question with one word: ‘Uranium.’

“He went on, ‘We’re here to keep an eye on the uranium and keep an eye on the French. We use finance as needed as a tool to maintain economic control.’

“At that time, it wasn’t unusual for the CIA to use bank and energy company officials as sources working under non-official cover. I quickly understood what I had walked into.”

Fast-forward 42 years and as you might have heard, there was recently a coup in Niger.

Fast-forward 42 years and as you might have heard, there was recently a coup in Niger.

And to this day, France — the old colonial power there — relies almost entirely on uranium yellowcake from Niger to supply its extensive nuclear power industry. Nuclear accounts for over two-thirds of France’s electricity.

➢ You didn’t know Washington has troops in Niger? Until four of them were killed by Islamist fighters in 2017, neither did most of Congress. “I didn’t know there was 1,000 troops in Niger,” Sen. Lindsey Graham (R-South Carolina) blurted out on Meet the Press. Bonus points: At the time, Graham was on the Armed Services Committee.

So was there any foreign influence behind the coup? And what’s the prospect of foreign military intervention to reverse the coup?

“There is no evidence yet that Russia planned the coup; it was most likely indigenous,” says Jim. “Still, it is clear that Russia is fanning the flames among the revolutionary forces and helping to keep the coup forces alive.

“There is no evidence yet that Russia planned the coup; it was most likely indigenous,” says Jim. “Still, it is clear that Russia is fanning the flames among the revolutionary forces and helping to keep the coup forces alive.

“Meanwhile, France is organizing a multilateral force around the Economic Community of West African States (ECOWAS) meeting in Abuja, Nigeria. France would supply well-trained French Foreign Legion and other special forces to the effort.

“U.S. warmonger Victoria Nuland (the architect of the war in Ukraine) tried meeting with coup leaders in the Niger capital of Niamey Monday. Her meeting was a complete failure and the coup leaders did not budge.

“The latest from Russia is that they may dispatch the non-official Wagner Group mercenaries to support the coup. It’s not clear if ECOWAS will follow France into a counter-coup.

“What is likely at this point is more violence, more chaos and at least a temporary cutoff of exports of uranium from Niger,” Jim says.

“What is likely at this point is more violence, more chaos and at least a temporary cutoff of exports of uranium from Niger,” Jim says.

“The chaos alone will result in a higher price for uranium. If Russia prevails, they will tighten their stranglehold on global supply and leave the French in desperate straits.”

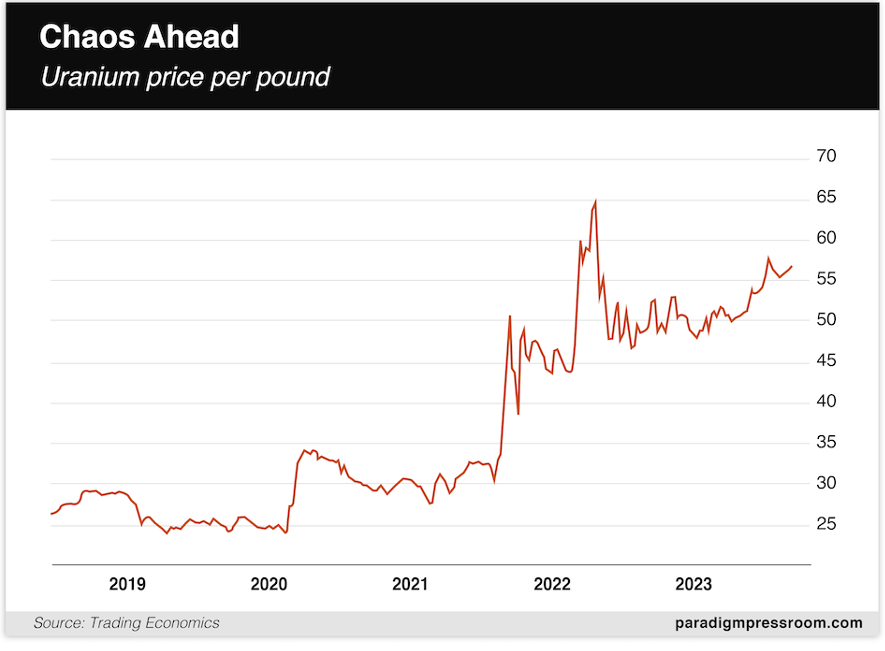

After Russia’s invasion of Ukraine last year, uranium prices zoomed up to 11-year highs of $65 a pound… then they quickly pulled back below $50. Prices started taking off again last May… but at $56.75 this morning, the Niger risk premium still isn’t fully priced in.

There are several uranium-themed ETFs out there — offering one-stop shopping for miners, refiners and equipment manufacturers. The biggest is the Global X Uranium ETF (URA).

However… just yesterday, Jim recommended a much more lucrative uranium-adjacent play for readers of The Situation Report. This one has potential upside of 500%.

To learn more about the Situation Report strategy and how it can power your portfolio to new heights, give this a look.

![]() Eighteen Months Until the Real Bank Trouble

Eighteen Months Until the Real Bank Trouble

“I’m reluctant to call this a ‘nothing burger,’ but it isn’t the bombshell everyone thinks it is,” colleague Sean Ring says of Moody’s decision to downgrade the credit ratings of 10 small and mid-size banks.

“I’m reluctant to call this a ‘nothing burger,’ but it isn’t the bombshell everyone thinks it is,” colleague Sean Ring says of Moody’s decision to downgrade the credit ratings of 10 small and mid-size banks.

On the one hand, Sean is inclined to write it off as a publicity stunt on Moody’s part — not unlike Fitch’s decision last week to downgrade U.S. government debt. “Since the publicity worked so well for Fitch, why not? Let’s dropkick the markets when everyone’s on vacation!”

In addition, Sean is quick to point out in today’s Rude Awakening that despite the downgrades, “none of these banks is in danger of becoming ‘fallen angels.’ That’s when an investment-grade bond descends below Baa3 into ‘junk status.’ However, the market ignored that tidbit.”

On the other hand, Sean says the Moody’s analysts had three valid reasons to do what they did…

- Rising funding costs: As the Federal Reserve raises interest rates, “it’s more expensive for banks to acquire the funds to loan out. If it’s more expensive to get those funds, then their profit margins are getting smaller.” If margins shrink too much, banks have to raise either debt or equity. “With debt, banks pay coupons and repay the principal. With equity, banks pay dividends, and the equity holder gets the capital gains. That’s a much more expensive proposition”

- Low regulatory capital: As you likely know, banks have to hold reserve funds against losses. But with rising rates, “some regionals have significant unrealized losses not reflected in their regulatory capital ratios,” Sean says. “Moody’s also expects a U.S. recession in early 2024 that will worsen banks' asset quality and increase the potential for capital erosion”

- Exposure to commercial real estate: “This is the big one,” says Sean. ”High CRE exposures are a crucial risk given sustained high interest rates, declines in office demand due to remote work and reduced availability of CRE credit.” The Moody’s analysts say a median of 46% of banks’ “tangible common equity” is exposed to CRE loans in the next 18 months.

➢ Amusing aside in light of that high CRE exposure: “If you’re wondering why newspapers suddenly print articles questioning the efficiency of ‘work from home,’ wonder no more,” Sean quips. “Their betters have instructed them to write that crap to get people back into the cities and prevent the commercial real estate market implosion.” Heh…

![]() Best Sector for the Rest of 2023: Energy

Best Sector for the Rest of 2023: Energy

In any event, the market has shaken off most of the jitters brought about by the Moody’s news.

In any event, the market has shaken off most of the jitters brought about by the Moody’s news.

What was a 400-point loss for the Dow when we hit “send” yesterday was pared to just 150 by day’s end. Today, the Big Board is almost ruler-flat at 35,301.

It’s the Nasdaq that’s once again taking it worst, down more than three-quarters of a percent to 13,773. The S&P 500 has shed another quarter-percent to 4,488.

Thus, the S&P is down 2.2% from its year-to-date high notched at the end of July. An earth-shattering crash? Hardly. But “the red-hot summer rally is clearly losing its momentum,” says Paradigm chart hound Greg Guenthner. “Last week’s reset should have been painfully obvious to anyone paying attention to seasonality and just how stretched the rally had become in late July.”

That July rally was atypical for the year before a presidential election — but not a huge outlier by historical standards. Looking ahead, “August is generally a weaker-performing month,” Greg says, “giving way to a choppy, corrective fall. We can then look forward to a final push higher into December.”

Meanwhile, crude’s brief pullback is already over: A barrel of West Texas Intermediate is up to nearly $84, the highest in nearly four months.

Meanwhile, crude’s brief pullback is already over: A barrel of West Texas Intermediate is up to nearly $84, the highest in nearly four months.

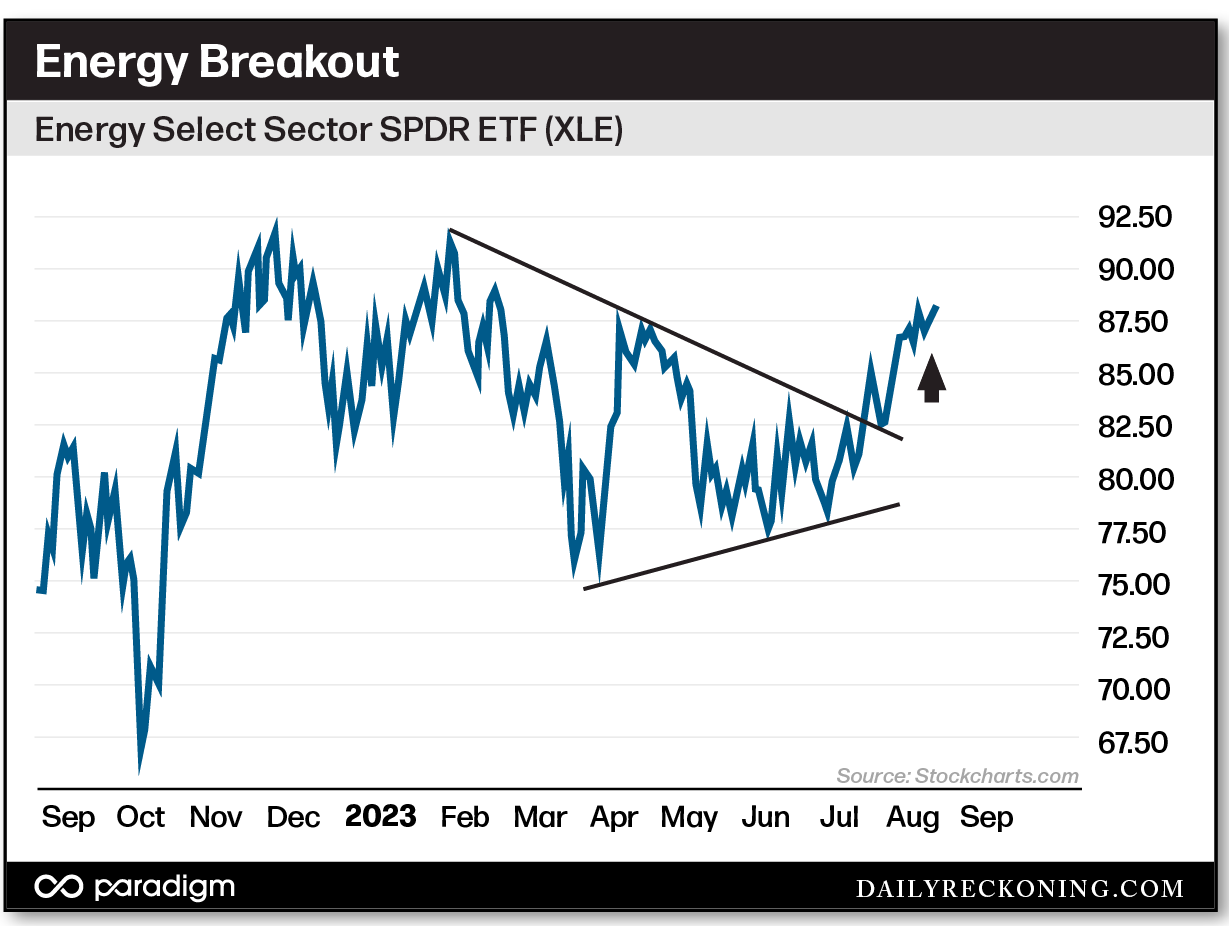

A chart of XLE, the big energy-stock ETF, shows an impressive breakout past its April highs. “That’s a huge move for the year’s worst-performing sector,” says Greg Guenthner, “and I’m betting it’s setting these stocks up for higher prices.”

The rally began with the oil services names like SLB and Halliburton. “Now we’re seeing the bigger exploration and production firms perk up,” says Greg. “These breakouts are going to catch more than a few investors flat-footed since most market watchers are laser-focused on the mega-caps and first-half tech snapbacks.”

Elsewhere, precious metals just can’t catch a break: Gold is down to early-July lows near $1,916 and silver has shed another dime to $22.65.

After a dip below $29,000, Bitcoin is making another run toward $30K.

![]() It Was an Employee’s Money-Saving Idea

It Was an Employee’s Money-Saving Idea

Look, times are tough all over…

Look, times are tough all over…

“Highflying oenophiles will have to get used to sipping a slightly less fancy fizz when traveling with American Airlines,” warns the Robb Report — which caters to the crowd that can afford a high-end lifestyle.

No more Champagne in business class on international flights — sparkling wine only.

“Fliers in business class will be served a Ferrari brut from Trentino, Italy, rather than bubbles from the famed French wine region,” says the article. “The brut in question is created with 100% Chardonnay grapes just like Ruinart’s signature Blanc de Blancs Champagne.”

American Airlines isn’t exactly wanting for additional revenue after a blockbuster 2022, but the firm is nonetheless open to money-saving ideas… and according to CEO Robert Isom, this one came up during an employee forum.

For what it’s worth, Champagne will still be served in first class.

![]() Mailbag: Climate Change, Elon Musk and Anti-Woke ETFs

Mailbag: Climate Change, Elon Musk and Anti-Woke ETFs

“Climate change has been real for millions of years,” a reader writes, “but the impact of human activity is an unproven hypothesis.

“Climate change has been real for millions of years,” a reader writes, “but the impact of human activity is an unproven hypothesis.

“Average global temperature is as useless as the average depth of the oceans. Besides, how did they come up with temps 120,000 years ago?

“I live in the San Francisco Bay Area, and our summers have been cooler than normal for the last few years.

“My take is this: As long as the Elite Climate Alarmists maintain their huge carbon footprint and buy mansions on the oceanfront, I will resist any attempts at curbing my small carbon contribution.

“To add one more point: Save the planet for what or whom? If you have to eat ze bugs and like it, is that the kind of life worth preserving?”

“Food for thought: Do you think, perhaps, that Elon Musk’s reference to retiring ‘all the birds’ is a subtle reference to the forced ending of the CIA Project Mockingbird, which, as you probably know, was their operation began in the ’50s and supposedly ended in the ’70s through which they undertook to control the media?

“Food for thought: Do you think, perhaps, that Elon Musk’s reference to retiring ‘all the birds’ is a subtle reference to the forced ending of the CIA Project Mockingbird, which, as you probably know, was their operation began in the ’50s and supposedly ended in the ’70s through which they undertook to control the media?

“Thank you for your daily thoughts. Yours is one of the few publications I read every day (still working, need to be selective).”

Dave responds:Who knows what goes through Elon’s mind? (I’m amused at the various message boards that refer to him as “Elmo” or “Leon.”)

Just remember that every time he does something that looks as if he’s trolling the power elite or the deep state… that much of his fortune depends on tax breaks for Tesla and federal contracts for SpaceX.

“Just a quick note about the 2ndVote ETFs,” writes our final correspondent: “The reason I would not invest is why take a chance to be put on a list that the left could use against you!

“Just a quick note about the 2ndVote ETFs,” writes our final correspondent: “The reason I would not invest is why take a chance to be put on a list that the left could use against you!

“Keep up the great work!”

Dave responds: Well, that’s interesting to think about — self-censorship when you invest.

I honestly don’t think I’ve ever done that myself — certainly not when it comes to fossil fuels.

Which is probably a good place to slip in today’s obligatory disclosure: Your editor has steadily built a position in the aforementioned XLE for more than a year, and I intend to keep doing so a while longer.

Not that my buys can possibly move such a huge, liquid ETF… but you deserve full transparency.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets