Fink's Flip-Flop

![]() BlackRock CEO Larry Fink’s Crypto Evolution

BlackRock CEO Larry Fink’s Crypto Evolution

In 2017, BlackRock CEO Larry Fink called crypto “an index of money laundering.”

In 2017, BlackRock CEO Larry Fink called crypto “an index of money laundering.”

Seven years ago, Fink clearly scoffed at crypto, dismissing digital currency as something his clients wouldn’t be interested in.

In terms of clients, BlackRock — the asset management company Fink founded in 1988 — is the largest of its kind, managing an estimated $10 trillion. To give you an idea, that’s about three times the market cap of Microsoft.

Today? “[Crypto] is an important topic for our clients,” says BlackRock’s COO Rob Goldstein. “We view a core part of our mission as providing choice and access.”

So in 2023, BlackRock filed with the SEC for a spot Bitcoin ETF. And what BlackRock wants, BlackRock gets: The SEC has approved 99.8% of the firm’s ETF applications.

As CPA Trevor Ward notes at Bitwave: “Larry Fink is a man of influence, deeply connected in the political world. He was even considered for the position of Treasury secretary under Hillary Clinton.”

Whether Mr. Fink believes in crypto as a legitimate asset class is neither here nor there. His about-face on crypto can be chalked about up to little more than avarice. Or, you know, maximizing “shareholder value” seeing as BlackRock (BLK) is a publicly traded company.

“BlackRock currently earns an average fee of about 0.19% on assets in its Bitcoin ETF,” The Wall Street Journal reports. “After the first year, the fee will rise to 0.25%.”

With nearly $10 billion net inflows into BlackRock’s iShares Bitcoin Trust ETF (IBIT) since January… Well, you do the math.

And Fink’s BlackRock is taking another plunge into the world of decentralized finance (DeFi)…

“BlackRock [unveiled] its first tokenized fund on a public blockchain,” CoinDesk says.

“BlackRock [unveiled] its first tokenized fund on a public blockchain,” CoinDesk says.

Rather than using a private blockchain, BlackRock will utilize Ethereum’s network for its BlackRock USD Institutional Digital Liquidity Fund, represented by the BUIDL token.

“BUIDL will provide qualified investors” — with a minimum investment of $5 million — “the opportunity to earn U.S. dollar yields by subscribing to the fund through Securitize Markets LLC,” Business Wire explains.

- “BUIDL seeks to offer a stable value of $1 per token and pays daily accrued dividends directly to investors' wallets as new tokens each month

- “The fund invests 100% of its total assets in cash, U.S. Treasury bills and repurchase agreements, allowing investors to earn yield while holding the token on the blockchain.”

CoinDesk notes: “Securitize will act as a transfer agent and tokenization platform, while BNY Mellon is the custodian of the fund's assets… Anchorage Digital Bank NA, BitGo, Coinbase and Fireblocks also participate in the fund's ecosystem…

“Creating blockchain-based tokens of traditional investments such as bonds and funds — known as tokenization of real-world assets (RWA) — is a fast-growing use case for blockchains as digital assets and traditional finance (TradFi) are becoming more intertwined,” CoinDesk says. .

CPA Trevor Ward concludes: “BlackRock's entry into the Bitcoin ETF space is a vote of confidence in the future of cryptocurrencies. [And] given BlackRock's influence and reach, this could open the floodgates.”

All that to say, once staunchly anti-crypto, Larry Fink — along with BlackRock — are now jumping neck-deep into crypto.

[Note: An unprecedented amount of money is flowing into crypto. In particular, one specific coin is now set to rally 100X over the next five years.

BlackRock, for instance, is already getting a head start on this $16 trillion boom. And you shouldn’t get left behind…

That’s why Paradigm’s early crypto investor James Altucher recorded a timely briefing about a fast-moving opportunity that’s still up for grabs for everyday investors.

Plus, James reveals the name of his favorite crypto for 2024 — 100% free of charge — no opt-in required.]

![]() Follow-up File: Baltimore Bridge Collapse

Follow-up File: Baltimore Bridge Collapse

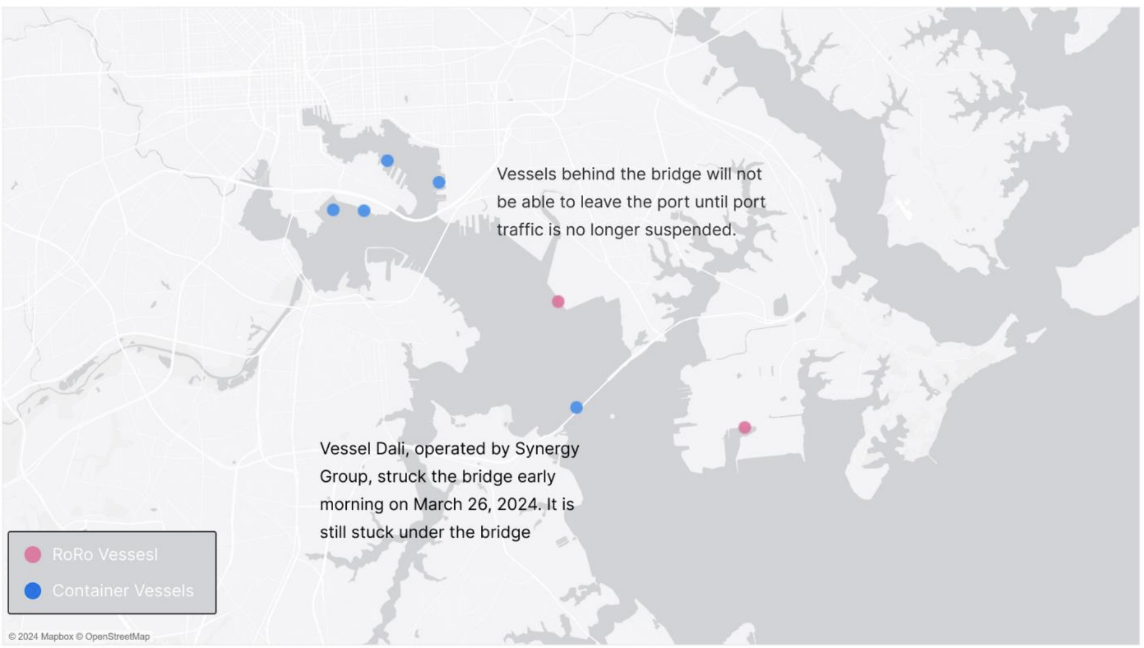

“[Container vessel] Dali remains stuck under the bridge and all vessel traffic is still suspended,” says supply-chain publication Project44.

“[Container vessel] Dali remains stuck under the bridge and all vessel traffic is still suspended,” says supply-chain publication Project44.

“The map view below shows the Dali, the vessel that struck the bridge, as well as the four container vessels currently moored in the Port of Baltimore and one [roll-on, roll-off] vessel at Dundalk.”

Courtesy: Project44

Courtesy: Project44

Roll-on, roll-off vessels — a.k.a RoRo vessels — carry wheeled cargo, everything from motorcycles to tractor trailers. “Baltimore is a key city for automobile manufacturing in the United States, with the Port of Baltimore being the No. 1 handler in the U.S. for car imports and exports.

“The Port of Baltimore handles freight from major automakers including, but not limited to, Nissan, Toyota, General Motors and Volvo.

“Expect disruptions to manufacturing in the automobile market. [The] automobile industry is notoriously lean, meaning any disruptions will have ripple effects throughout the manufacturing process,” says Project44.

Just as soon as the auto industry ironed out its pandemic-era shortage of semiconductors, right?

“Gold and energy are really starting to take off!” says Paradigm’s chart hound Greg “Gunner” Guenthner.

“Gold and energy are really starting to take off!” says Paradigm’s chart hound Greg “Gunner” Guenthner.

“Our ‘rotation trade’ themes are booming this week as gold once again powers to new all-time highs,” he says. “The dollar index is strong again this morning and even that’s not stopping gold’s run.”

Indeed, taking a look at Kitco, the price of gold is powering higher — up 0.90% — to $2,213.70 per ounce. Silver, too, is up 0.50% today, but still stuck below $25. Rounding out commodities, a barrel of West Texas crude is priced at $82.60, up 1.5%.

Checking on stocks, the tech-heavy Nasdaq is slightly in the red at 16,385. But the DJIA and S&P 500 are both in the green at 39,785 and 5,250 respectively. With markets closed tomorrow for Good Friday, the S&P is on track to end the quarter at record highs.

And the crypto market is revving up: Bitcoin is up 3.30% to $70,890, at the time of writing, while Ethereum is up 2.30% to $3,565.

![]() Shove Over, Nvidia

Shove Over, Nvidia

“Nvidia has been the best way to play the AI trend for a decade. Now we have alternatives,” says Paradigm’s science-and-tech maven Ray Blanco.

“Nvidia has been the best way to play the AI trend for a decade. Now we have alternatives,” says Paradigm’s science-and-tech maven Ray Blanco.

Notwithstanding, Nvidia’s CEO Jensen Huang wowed technophiles last week, unveiling Blackwell B200 GPU — aka “the world’s most powerful chip.”

“Huang touted the new chip would be able to perform AI training more than five times faster than its existing Hopper GPU,” Ray says. “Moreover, inference — where a trained AI is put to work on fresh data — is up to 30 times faster.” Plus? “The new platform will consume less power as it crunches through AI operations.”

He adds: “The new superchip will use a newer generation of memory with higher bandwidth, reducing latency for the whole system and improving performance. In keeping with improved input/output performance, a new generation of the company’s communications chips will boost the speed between GPUs in a single node.

“Blackwell’s release is expected in the fourth quarter of this year. Nvidia won’t have any trouble selling every chip it makes.

“With the ongoing AI boom and long wait times for Nvidia GPUs, that’s a great window of opportunity for competitors,” Ray observes.

“With the ongoing AI boom and long wait times for Nvidia GPUs, that’s a great window of opportunity for competitors,” Ray observes.

“I expect Advanced Micro Devices (AMD) will [generate] billions from what will probably be the quickest off-the-shelf chip it’s ever launched.”

Namely, AMD’s MI300 AI accelerators launched in November 2023. According to the company’s CTO in February, AMD is already considering upgrading the chip sometime this year. Not to mention, Ray expects Nvidia’s Blackwell GPU will cost twice as much as AMD’s MI300.

“Next up this year,” Ray says, “we’ll see Intel (INTC) launch its next-generation AI accelerator, Gaudi3. It’s due in the third quarter this year and should prove competitive with Nvidia from price and availability standpoints.”

Ray’s takeaway: “The market is big enough — and growing fast enough — to support big gains for new AI competitors.”

![]() Everything’s Bigger in Texas

Everything’s Bigger in Texas

“The hailstorm we experienced Saturday morning was unimaginable. We've never seen anything like it in our lifetime,” says Nick Kaminski who lives in Fort Bend County, Texas.

“The hailstorm we experienced Saturday morning was unimaginable. We've never seen anything like it in our lifetime,” says Nick Kaminski who lives in Fort Bend County, Texas.

First, storm winds tore the roof off Mr. Kaminski’s house. After, golf ball-sized hail hammered the house he shares with his wife and two children. As devastating as that is, he’s more concerned that his well water might be contaminated.

After seeing battered panels from the Fighting Jays Solar Farm in the nearby town of Guy, Mr. Kaminski says: “They look like somebody took a shotgun and blasted it into the air and let the pellets fall down and shatter holes all in them.”

These panels look like they took a direct hit from a shotgun…

Courtesy: X

Courtesy: X

Back to contaminated water, “cadmium telluride panels are cheaper and tend to be found on large solar farms,” reports Houston’s ABC affiliate. “It is a toxic substance that can cause kidney, heart, skin and lung issues.

“The solar farm's website doesn't mention anything about chemicals in the solar panels but states that insurance policies will cover a hailstorm if it hits.”

Rice University professor Ramamoorthy Ramesh says: “It's possible you dented the solar panel, but they have a lot of protection layers on top of that. [Even] if I expose it, it has to get into the groundwater, which means water has to dissolve the cadmium telluride. Cadmium telluride does not dissolve in water.”

Nevertheless, a hazmat crew and the Texas Commission of Environmental Quality is investigating fallout at the solar farm, and they might issue a report as soon as Friday — a report local residents would like to see for themselves.

It’s a potential downside to green energy you might not have considered (unless you’re a 5 Bullets reader)...

![]() Mailbag: Gold, Silver… and the More You Know

Mailbag: Gold, Silver… and the More You Know

“One thing I believe you should occasionally point out is that gold and silver are considered collectibles for IRS tax purposes,” a reader writes. “This includes the ETFs GLD, IAU and SLV.

“One thing I believe you should occasionally point out is that gold and silver are considered collectibles for IRS tax purposes,” a reader writes. “This includes the ETFs GLD, IAU and SLV.

“The capital gains will be taxed at 28% instead of your normal rate of 0%, 15% or 20%. It’s the after-tax return that’s important! Instead of paying 15% you could end up paying almost double the tax.

“Thanks, and keep up the good work.”

Emily: Another thing we should occasionally point out? Something Jim Rogers — co-founder of the legendary Quantum Fund — said during pandemic times in 2020: “If I’m right, gold is going to go much, much, much higher before this is over.

“Gold may well turn into a bubble. I hope it doesn’t, because if it turns into a bubble, I’ll have to sell it and I never want to sell it. I want my children to have my gold and silver someday,” he said.

Not a bad legacy — lest we forget the oldest currency in the world. Best to have gold and silver on hand, just in case.

“I, for one, am particularly OK with political analysis infused with financial research,” a contributor says, countering our disgruntled reader yesterday. “The more information I have, the better financial decisions I will make.”

“I, for one, am particularly OK with political analysis infused with financial research,” a contributor says, countering our disgruntled reader yesterday. “The more information I have, the better financial decisions I will make.”

Well said.

Take care, and have a wonderful holiday weekend!

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets

P.S. The market will be closed tomorrow in observance of Good Friday, but we’ll have a special episode of the 5 Bullets featuring James Altucher — it’s something you’ll want to check out, whether you’re brand-new to Paradigm Press or whether you’ve been in the fold for years.