Gold’s $2,150 Peak

![]() Bond Yields Could Boost Gold’s Prospects

Bond Yields Could Boost Gold’s Prospects

“There were some delighted gold traders overnight, but eventually, they went to sleep disappointed,” Sean Ring writes this morning at The Rude Awakening.

“There were some delighted gold traders overnight, but eventually, they went to sleep disappointed,” Sean Ring writes this morning at The Rude Awakening.

For one shining moment, gold hit a record-high near $2,150 per ounce. Yesterday, “the Twitterverse exploded, along with the gold price,” Sean notes.

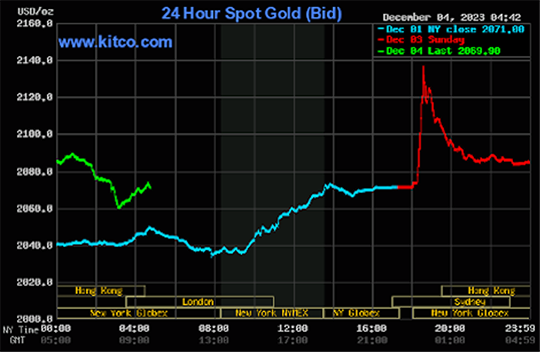

“Here’s the spot gold chart for this morning…

Source: Kitco

Source: Kitco

“Let’s start with Friday’s light blue line. We saw nice price movement from about $2,040 to the close of $2,071.

“Then we go into Sunday’s market (the red line),” Sean says. “Spot gold spiked to nearly $2,150, a tremendous $100 move over little more than a day.

“But what goes up parabolically usually comes down as fast. And so it was with gold. Gold closed Sunday with only a $10 move up.

“In short, the entirety of the crazy spike was eliminated.” On purpose? Keep in mind: “A high gold price isn’t good for the U.S. [economy],” Sean says. “Let’s look at the consequences of high gold prices…

- “Currency devaluation: Gold prices often move inversely to the U.S. dollar. So when gold prices are high, it can suggest a weaker dollar, affecting the U.S.’ purchasing power and trade balance

- “Inflation indicator: [Gold’s] rising price can indicate a lack of confidence in the stability of the current economic situation.”

So to combat inflation, the Federal Reserve has raised interest rates, making “borrowing more expensive, affecting business investments and consumer spending,” Sean says.

“The economy has been propped up by the consumer,” Paradigm’s macro expert Jim Rickards adds. Which goes a long way toward explaining a “not too shabby” projected 2023 annual GDP around 2.8%.

“The economy has been propped up by the consumer,” Paradigm’s macro expert Jim Rickards adds. Which goes a long way toward explaining a “not too shabby” projected 2023 annual GDP around 2.8%.

“But the consumer is on a non-sustainable path,” Jim says — a path initially driven by a “head of steam provided by handouts from Trump ($1,800 per adult) and Biden ($1,400 per adult) between April 2020 and March 2021.

“That was supplemented by $900 billion of Paycheck Protection Program loans, which were forgiven one year later,” he continues. “Student loan payments were suspended from 2020–2023. The Federal Reserve held interest rates at zero from 2020–2022.

“Now it’s all gone,” Jim says. “Interest rates are over 5%. Mortgage rates are over 7%. Student loan repayments have started again. There are no more pandemic handouts. Americans’ savings are depleted, and their credit cards are tapped out.

“Recession signs are real and growing worse,” Jim says, including tight borrowing conditions, increasing jobless claims and collapsing commercial real estate markets, to name a few.

“Recession signs are real and growing worse,” Jim says, including tight borrowing conditions, increasing jobless claims and collapsing commercial real estate markets, to name a few.

Clearly, “the world is searching for a safe haven away from government-induced inflation (fiscal policy) or central bank-induced inflation (monetary policy),” Sean Ring concludes.

And Jim concurs: “Gold has staged a significant price rally in the past several weeks, [moving] from $1,831 per ounce on Oct. 6 to $2,067 per ounce on Nov. 29, a 13% rally in just eight weeks.

“Once the gold rally begins, it can continue for at least a while on simple momentum. Traders who did not participate in the early stages of the rally want to jump in.

“Still, momentum can only carry gold so far…

“Eventually, a fundamental driver must be found to keep the gold rally going,” says Jim.

“Eventually, a fundamental driver must be found to keep the gold rally going,” says Jim.

“Treasury notes and gold are both high-quality assets that compete for investor allocations,” he says. “Gold does not have a yield (although it can produce significant capital gains).

“When yields on Treasuries drop, the zero yield on gold is relatively more attractive compared with the note yield, and gold prices start to rally.

“If the yield to maturity on the 10-year Treasury note were to drop,” Jim says, “gold could continue its upward move to $2,300 per ounce or much higher.”

[Better than gold? Jim Rickards explains how an alternative currency — which exists entirely outside the banking system — could be a key asset during a recession or financial crisis.

And with nearly $30 million of this currency already distributed to everyday Americans, its value has increased at twice the speed of gold.

If you hurry, you can claim some of this currency for yourself, courtesy of Jim and his team. Keep in mind, there’s a limited supply, so it’s going fast. Be one of the first to respond.]

![]() A Year-End Bank Liquidity Caution

A Year-End Bank Liquidity Caution

“After all the Fed hikes, you may be surprised to know that banks still pay bupkis for checking and savings,” says Paradigm market analyst Dan Amoss.

“After all the Fed hikes, you may be surprised to know that banks still pay bupkis for checking and savings,” says Paradigm market analyst Dan Amoss.

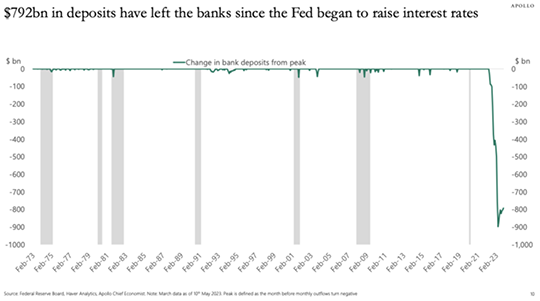

Exhibit A…

Source: FRED, Apollo chief economist

Source: FRED, Apollo chief economist

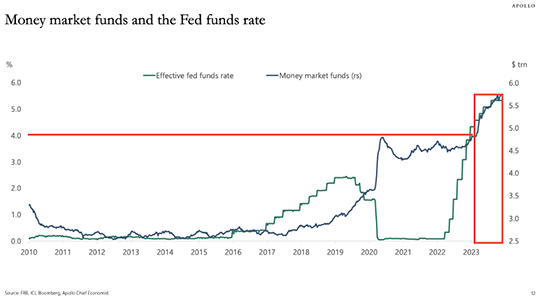

“There's a strong draw from bank savings and checking accounts to money market funds (MMFs),” Dan notes. “And it really took until about the SVB ‘crisis’ in March 2023 for depositors to wake up to the much better interest offered by MMFs…

Source: FRED, Apollo chief economist

Source: FRED, Apollo chief economist

“The box shows where the surge in MMF inflows started (at the expense of bank deposits),” he says. “It took MMF rates topping 4% for savers to wake up (see flat red line).”

Dan’s warning? “This could pressure bank liquidity heading into the year-end.”

Stocks are suffering today, with the Nasdaq hit hardest. The tech-laden index is down 1.20% to 14,135. At the same time, the S&P 500 (-0.75%) and the Big Board (-.0.35%) are down to 4,560 and 36,100 respectively.

Stocks are suffering today, with the Nasdaq hit hardest. The tech-laden index is down 1.20% to 14,135. At the same time, the S&P 500 (-0.75%) and the Big Board (-.0.35%) are down to 4,560 and 36,100 respectively.

Taking a peek at commodities, oil is down 0.85% to $73.40 for a barrel of WTI. As for precious metals, the price of gold is getting clobbered, down 2% to $2,021.90 per ounce. (The yellow metal isn’t going to get any relief from bond yields today — a 10-year Treasury yield is up to 4.28% today.) Silver, meanwhile, is down almost 1%, hanging out at $24.45, according to Kitco.

Despite in-the-red stocks and commodities, crypto is surging. Bitcoin — up 5% to $41,000 — is at a 19-month high, and Ethereum’s rallied 2.5% to $2,200.

And… another one bites the dust? Tech company Spotify announces it will cut 17% of its workforce. As CEO Daniel Ek put it: “Being lean is not just an option but a necessity.”

![]() Automakers’ EV Blindspot

Automakers’ EV Blindspot

“Sales for battery-powered vehicles grew 65% in 2022,” says Paradigm’s tech expert Ray Blanco. “The mass adoption of electric vehicles seemed like a foregone conclusion.

“Sales for battery-powered vehicles grew 65% in 2022,” says Paradigm’s tech expert Ray Blanco. “The mass adoption of electric vehicles seemed like a foregone conclusion.

“But now in 2023,” he says, “we’re seeing manufacturers slamming on the brakes…

- “Tesla is delaying the construction of their gigafactory in Monterrey, Mexico

- “Ford is postponing $12 billion in spending on electric vehicles and pressing pause on their construction of a new EV battery plant

- “General Motors is delaying the release of the EV versions of their Silverado and Sierra pickup trucks by one year. They’re also abandoning their target of producing 400,000 electric vehicles by mid-2024.”

Per Ray’s last point, given the choice between using $10 billion for EV research and development or returning cash to shareholders — via stock buybacks — GM recently chose the latter.

Taken as a whole, these factors indicate “demand is not matching the investment made by these companies.

“EV makers have aggressively cut prices, sacrificing profits in order to increase sales growth,” says Ray. “But adoption is still slowing.

“EV makers have aggressively cut prices, sacrificing profits in order to increase sales growth,” says Ray. “But adoption is still slowing.

“The average price for an EV has already dropped almost $10K so far this year,” he adds, with the average sticker price around $50,000.

“Companies will only be willing to forego profits for so long,” he notes, “and they can only cut prices so much.” Which still might not be good enough for many consumers.

“With inflation driving down the expendable income available for new vehicles and rising interest rates driving up the cost of financing, we’re seeing a growing unwillingness for consumers to match the lofty price tags of all-electric vehicles.

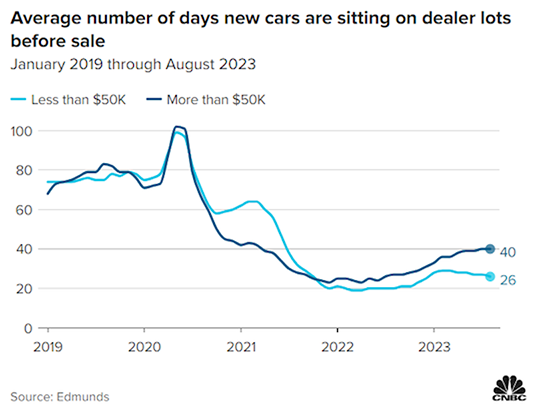

“Instead, cars and trucks priced under $50K are moving off of lots much faster than vehicles priced above that mark…

“Possibly the most damning thing for electric vehicles is that consumers have a better alternative.” Namely, hybrid vehicles.

“Eco-conscious consumers seem content to reduce without totally eliminating their emissions, especially if it means being able to afford their car payments,” Ray says.

“Eco-conscious consumers seem content to reduce without totally eliminating their emissions, especially if it means being able to afford their car payments,” Ray says.

“Who could have seen this coming? Toyota.

“The Japanese automaker bet heavily on hybrids while the rest of the auto world jumped on government incentives and an apparent EV-market boom.

“Now Toyota is taking a victory lap after reporting Q3 profits that were more than double those of 2022, driven by a 41% year-over-year sales increase in conventional hybrids and an almost 90% increase for plug-in hybrids.”

Ray’s takeaway? Automakers — not including Toyota — believed “hybrids would become history and all-electric vehicles would be the future.” But at present, at least, “it seems that a compromise is the best option.”

![]() Follow-up File: Venezuela Edges Closer to War

Follow-up File: Venezuela Edges Closer to War

On Sunday, more than 95% of Venezuelan voters approved annexing two-thirds of Guyana’s present-day territory.

On Sunday, more than 95% of Venezuelan voters approved annexing two-thirds of Guyana’s present-day territory.

Last week, we reported the hotly contested border dispute between the South American neighbors; at issue, an oil-rich region known as Essequibo.

“President Maduro, who has been in power since 2013, had urged people to turn out en masse and vote ‘five times "'yes”' to the five questions his government had posed on the status of Essequibo,” the BBC reports.

“The most controversial question was the fifth, which asked Venezuelans if they agreed with ‘the creation of the Guayana Esequiba state’ and its ‘incorporation into the map of Venezuelan territory.’”

Guyana’s president, however, vows to defend the country’s border while “citizens formed human chains on Sunday to show their support for Essequibo remaining under the control of their government…

Courtesy: X, @ppp_guyana

“The International Court of Justice has warned Venezuela not to take any action that may alter the status quo in Essequibo,” BBC says.

We’ll stay on top of this story…

![]() Peak Higher Ed… Peak MBA?

Peak Higher Ed… Peak MBA?

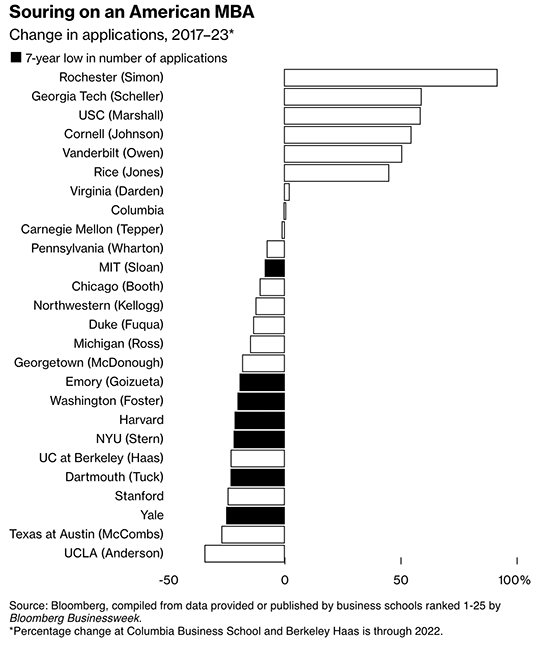

The number of applicants for MBA programs at top-tier American universities is down. This is a stark reversal from a trend we mentioned in 2020 when WFH prompted legions of students to apply for online MBA programs.

The number of applicants for MBA programs at top-tier American universities is down. This is a stark reversal from a trend we mentioned in 2020 when WFH prompted legions of students to apply for online MBA programs.

At the time, according to website Poets & Quants, applications at Columbia jumped more than 18%... while at Virginia they swelled 25%, for instance.

Source: Bloomberg

“At least 17 of the top 26 programs have seen long-term application declines — which for most of them continued into 2023,” Bloomberg says.

“Yale was practically begging people to apply,” says admissions consultant Barbara Coward. “Yale and other schools were sending messaging, emails and blogs that I’ve never seen before.”

Until and unless that messaging includes a massive tuition cut — Yale’s annual tuition and fees total $82,700 — the Ivy League school might be sh*t outta luck.

On Friday, Dave highlighted a phenomenon he called “Peak Higher Education” as fewer jobs are requiring bachelor’s degrees. Now, with any luck, we might have reached “Peak MBA.”

Take care! We’ll catch you tomorrow…

Best regards

Emily Clancy

Paradigm Pressroom’s 5 Bullets