Is Biden Planning ANOTHER War?

![]() American Exceptionalism Runs Amok

American Exceptionalism Runs Amok

And here you thought the Middle East was a total tire fire…

And here you thought the Middle East was a total tire fire…

Two South American neighbors, Venezuela and Guyana, are locked in a border dispute, each claiming Essequibo — a 62,000-square-mile oil-rich region.

Source: U.S. Southern Command

To be clear, the dispute between the two nations is nothing new; it’s a holdover from colonial days, dating all the way back to the 1800s. But in 2015, when Exxon Mobil discovered major oil deposits in Essequibo, it was game on.

“Another major discovery in Essequibo in October added further to Guyana's reserves, making them greater than those of Kuwait or the United Arab Emirates,” says an article at France 24.

Unsurprisingly, after the discovery in October, Chevron struck an all-stock deal with Hess worth $53 billion — giving Chevron access to parts of a huge oil find in Guyana.

In other words, the stakes are high — but tensions between Guyana and Venezuela, if possible, are higher.

“Caracas [has] organized a Dec. 3 poll to ask Venezuelans to consider annexing the Guyana-administered region… which makes up two-thirds of the tiny country,” France 24 reports.

“Caracas [has] organized a Dec. 3 poll to ask Venezuelans to consider annexing the Guyana-administered region… which makes up two-thirds of the tiny country,” France 24 reports.

In response, Guyanese Vice President Bharrat Jagdeo said last week: “We're interested in maintaining peace in our country and in our borders, but we're going to be working with our allies to ensure that we plan for all eventualities.”

In addition, Jagdeo said he’s now open to the installation of foreign military bases in Guyana. Apropos, “two teams from the U.S. Department of Defense [visited] Guyana.”

Photo courtesy: Guyana Defence Force (GDF)

U.S. Southern Command Gen. Laura Richardson with GDF officials on Nov. 27

“All the options available for us to defend our country will be pursued,” Jagdeo said. “Every option.”

So Biden’s two-front war — Ukraine and Israel/Palestine — might become a three-front war? Unreal.

![]() “Turn off Your Brain and Start Buying”

“Turn off Your Brain and Start Buying”

“Melt-up season has begun,” says Paradigm’s chart hound Greg Guenthner. “The herd can’t stop buying semiconductors, languishing IPOs and beaten-down tech stocks.”

“Melt-up season has begun,” says Paradigm’s chart hound Greg Guenthner. “The herd can’t stop buying semiconductors, languishing IPOs and beaten-down tech stocks.”

Particularly in view of November’s “cooler than expected” consumer price index (CPI), he says, “Everyone’s now convinced the Fed has whipped inflation and won’t raise rates again this cycle.

“Now, I know what you’re thinking,” Greg adds. “More than a few of these eager speculators scooping up stocks right now might be suffering from short-term memory loss.” Fed chair Jay Powell did say he’s ‘not confident’ the Fed has done enough to tame inflation.

“How could anyone feel comfortable buying stocks into the end of the year with wars raging, mega-cap valuations stretching and squishy economic data?” Nonetheless, Greg counters: “Do yourself a favor and table those concerns for the next few weeks.

“I’ll be blunt: If you want the chance to book outsized gains, [the] market isn’t going to wait around for ‘perfect’ conditions before it begins to rally.”

Greg’s advice? “Turn off your brain and start buying” because opportunities like these “only come around two or three times per year.”

He adds: “Here’s an important question heading into the holiday season…

“When was the last time you peeked at the speculative artificial intelligence (AI) stocks that captured investors’ imaginations earlier this year?” Greg asks.

“When was the last time you peeked at the speculative artificial intelligence (AI) stocks that captured investors’ imaginations earlier this year?” Greg asks.

Aside from Nvidia, which sucked the air out of the AI-stock space this year, he says: “That could change as traders look to rotate out of the big, year-to-date winners and into riskier plays as the melt up matures.”

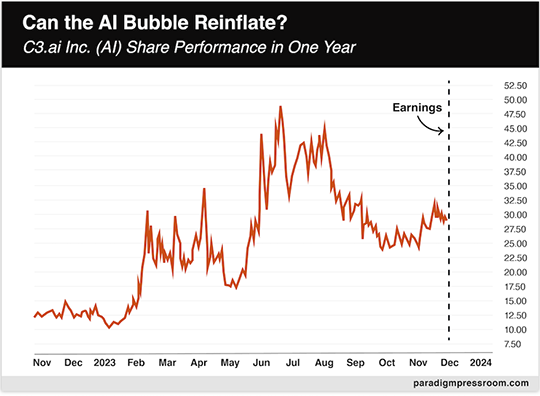

Take C3.ai Inc. (NYSE: AI), for instance — “the quintessential artificial intelligence bubble pure play,” Greg says. At one point early this year, AI shares exploded more than 370%, but by the summer, AI “faltered as the tech-growth trade started to unwind. [Shares] promptly chopped in half in just three months.

“While AI has regained some of that lost mojo in November, it has yet to recapture the magic of its early 2023 run.”

But the company is scheduled to announce earnings on Dec. 6, and Greg wonders if that might be the catalyst for AI shares to “claw” their way above $30.

“Of course, snagging shares ahead of earnings adds an extra layer of risk to any trade,” Greg remarks. “A more prudent option is waiting for the reaction, then playing for a post-earnings drift on any positive momentum.”

If you’re not interested in chasing momentum, Greg recommends a “solid” bet on AI: the Global X Robotics & Artificial Intelligence ETF (NASDAQ: BOTZ).

Greg’s takeaway: “The former tech-growth darlings are ripe for huge short-covering rallies. These [names] will be the best trades over the next seven weeks.”

Stocks are holding up today: The S&P 500 leads the way, up 0.20% to 4,565. The Big Board’s matching the S&P’s gains, up to 35,490. Meanwhile, the tech-heavy Nasdaq is up about 0.15% to 14,300.

Stocks are holding up today: The S&P 500 leads the way, up 0.20% to 4,565. The Big Board’s matching the S&P’s gains, up to 35,490. Meanwhile, the tech-heavy Nasdaq is up about 0.15% to 14,300.

Checking on commodities, the price of crude’s up 1.5% to $77.57 for a barrel of WTI. Precious metals? Citing Kitco’s price, gold’s up 0.10% — hanging tough at $2,042.30 per ounce — and silver’s clawed its way above $25.

The crypto market, however, is decidedly in the red at the time of writing. Flagship crypto Bitcoin is down 1.30% to $37,725; Ethereum is down almost 2%, but still above $2,000.

![]() Contracts Are Made to Be Broken?

Contracts Are Made to Be Broken?

Follow-up File (Part 1): Today, London's High Court ruled in favor of the London Metal Exchange (LME) in a lawsuit brought by two American firms.

Follow-up File (Part 1): Today, London's High Court ruled in favor of the London Metal Exchange (LME) in a lawsuit brought by two American firms.

Hedge fund Elliott Associates and trading firm Jane Street Global sued the LME for $472 million in compensation after a commodities-market earthquake event last year.

Namely, on March 8, 2022, the LME suspended nickel trading for one week because China’s nickel giant Tsingshan Holding Group, owned by the tycoon known as “Big Shot,” racked up $12 billion in trading losses after short-selling nickel futures, according to Reuters.

When the price of nickel shot up about 250%, Tsingshan didn’t have the cash to meet a margin call. So as an exceptional courtesy, the LME literally canceled some of the trades… after they’d been executed. In other words, the LME dispatched with the sanctity of contracts in order to protect its system from blowing up.

“In its written ruling, London's High Court said the LME could cancel trades in exceptional circumstances and was not obligated to consult market players prior to its decision,” Reuters says.

“Other exchanges were closely watching the case because it could have wider ramifications on their ability to react to crisis situations.” No doubt: This sets an unfavorable precedent.

A statement from Jane Street cuts to the heart of the matter: “We believe market participants should have confidence that trades entered in good faith are respected.”

So far, Elliott Associates plans to appeal the court’s decision. We’ll keep you posted.

![]() A Copper Mine Shutdown Has Global Consequences

A Copper Mine Shutdown Has Global Consequences

Follow-up File (Part 2): In other base-metal news, Panama’s president might have sealed the fate of the global “green transition.”

Follow-up File (Part 2): In other base-metal news, Panama’s president might have sealed the fate of the global “green transition.”

One of the world’s newest and largest copper mines — owned and operated by Canada-based First Quantum Minerals — the Cobre Panama mine covers 32,000 acres and employs more than 9,000 people; the company says its operations account for nearly 5% of Panama’s economy.

Nevertheless, when Panama’s President Laurentino Cortizo approved a 20-year extension of First Quantum’s license last month, the public reaction was enraged.

“The protests began as small, environmental ones against the mine but [morphed] into broader demonstrations against the government amid charges the contract was too generous,” says Reuters.

Last night, after Panama’s Supreme Court ruled the 20-year license unconstitutional, President Cortizo announced, via televised address, that the Cobre Panama mine would be shut down. First Quantum has complied, suspending production.

Reuters adds: “The ruling will also have consequences for the copper market, as Cobre Panama accounts for about 1% of global copper production. Benchmark copper on the London Metal Exchange was up 0.9% at $8,441 a metric ton.”

Also important? “Dwindling copper supply from Panama and Peru could wipe out global surplus in 2024.”

![]() An AI Solution Looking for a “Problem” to Solve

An AI Solution Looking for a “Problem” to Solve

Proving every company has been jumping on the AI bandwagon recently, PepsiCo’s snack brand Doritos claims to have created a “silent” virtual gaming experience.

Proving every company has been jumping on the AI bandwagon recently, PepsiCo’s snack brand Doritos claims to have created a “silent” virtual gaming experience.

“Crunch is one of the most distracting features that could throw someone off their game,” claims PepsiCo’s chief marketing officer Mustafa Shamseldin. (Never truer: first-world problems.)

So to keep gamers noshing on the nacho cheese-dusted triangles, “Doritos trained an AI model — using 5,000 distinct crunching sounds — to recognize the sound of a Doritos chip crunching,” says marketing-centric outlet The Drum.

“In harmony with another AI model that recognizes, isolates and amplifies the voice of the chewer, the sound of the crunch is removed from the audio stream.”

Image courtesy: Doritos.comNo models were harmed in the making of this campaign: “To protect against Doritos dust… actors [wore] prosthetic implants within their ears,” The Drum reassures us.

For whatever reason, snackers will still be able to hear themselves chewing. Go figure.

Sigh. My opinion of humanity — incredibly low already — might have sunk even lower. We take a remarkable tool like AI and use it for clownish marketing ploys.

Hang in there, reader, and take care of yourself. (Maybe lay off the Doritos? Or not.) We’ll be back tomorrow with another episode of the 5 Bullets.

Best regards,

Emily Clancy

Paradigm Pressrooom’s 5 Bullets