Inflation Is [CENSORED]

![]() Inflation… and Censorship

Inflation… and Censorship

Well… nothing bad will come out of this, right?

Well… nothing bad will come out of this, right?

On the day after Thanksgiving, The Washington Post published a lengthy article addressing two related phenomena: 1) Everyday folks feel lousy about their personal economic circumstances despite mostly sunny economic data, and; 2) This (alleged) disconnect might cost Joe Biden a second term.

The headline was: “The Viral $16 McDonald’s Meal That May Explain Voter Anger at Biden.”

It seems the whole “costly McDonald’s” thing that we first noticed here a few weeks ago actually began last December with someone’s visit to a Mickey D’s in the Idaho panhandle — and went viral from there.

“These stories soon reached the White House Office of Digital Strategy,” says the article, “which tracked the meme as one of many exaggerated examples of the nation’s economic woes, according to a White House official, speaking on the condition of anonymity to reflect internal discussions.”

Not included in the WaPo story is the fact that the White House has been fretting about these phenomena since the spring of last year. Here’s some mainstream spin we noticed 20 months ago…

Not included in the WaPo story is the fact that the White House has been fretting about these phenomena since the spring of last year. Here’s some mainstream spin we noticed 20 months ago…

By summertime 2022, debate was raging online over whether a recession had begun. The social media giants took their cue from the administration and Meta’s Instagram restricted access to a popular post suggesting a recession was indeed underway — an act so egregious it was how we kicked off that year’s edition of our annual censorship issue.

To be sure, there were no obvious government fingerprints on Instagram’s decision — unlike the widespread censorship of social-media posts that run afoul of conventional wisdom on COVID. But clearly there’s a “chilling effect” at work.

Which brings us back to the present moment, and a tidbit buried 21 paragraphs deep in the Post article.

Which brings us back to the present moment, and a tidbit buried 21 paragraphs deep in the Post article.

In the present day and age, you often need to read mainstream media the same way Russians read Soviet media during the 20th century — between the lines, teasing out for yourself why certain things are being emphasized and others not.

This article spends a lot of digital ink fretting about TikTok — without saying exactly why. But we can tell you why right here: TikTok is the platform most used by the younger set that Democrats need to hold onto the White House next year. And TikTok is one of the few platforms still independent of U.S. government influence, owing to its Chinese ownership.

“TikTok abounds with misleading or inaccurate information about the economy,” the article asserts — pointing, for instance, to a video with 2.3 million views last September that said there’s a “SILENT DEPRESSION.”

Which tees up the key paragraph: “The White House official said the administration is working with TikTok creators to tell positive stories of Biden’s economic stewardship, while also working with social media platforms to counter misinformation.” [Emphasis ours]

There were no additional details on that score. But given everything that’s happened with online censorship since 2018 and especially since 2020, there’s ample cause for concern.

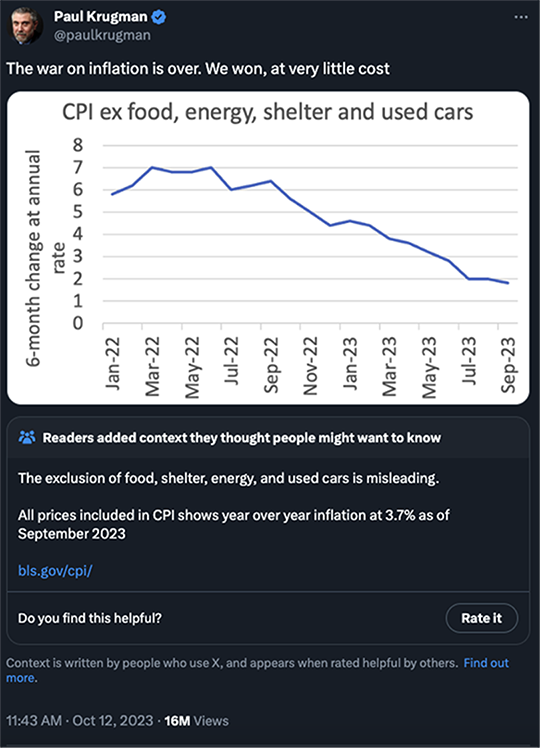

Clearly, Team Biden has realized it will no longer work to lecture the American people about how their economic circumstances are better than they think — which is what celebrity economist Paul Krugman tried to do much of this autumn…

Clearly, Team Biden has realized it will no longer work to lecture the American people about how their economic circumstances are better than they think — which is what celebrity economist Paul Krugman tried to do much of this autumn…

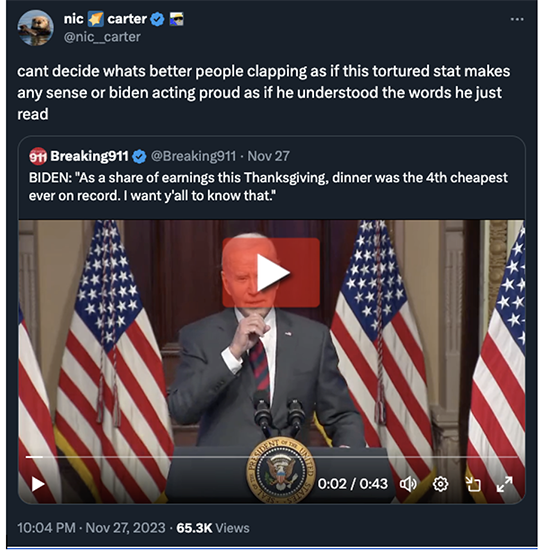

Unfortunately for the president, he scrambled whatever messaging his handlers were trying to get out earlier this week…

As the week wore on, however, the messaging has been modified: The White House is blaming inflation on… corporate greed.

"Let me be clear,” said the president: “To any corporation that has not brought their prices back down — even as inflation has come down, even as supply chains have been rebuilt — it's time to stop the price gouging,"

Right. As if companies decided to get greedy just at the moment that COVID lockdowns balled up the supply chain and Biden engaged in an inflationary spending spree (which, to be totally fair, started with Donald Trump).

This gambit will likely fail as well. So… look for more social media censorship about the economy going into 2024. (That’s one of the advantages of our old-school email distribution: We’re not at the mercy of the Big Tech behemoths. We can speak freely. We’ve got your back…)

![]() Gold on the Brink

Gold on the Brink

With only a few trading hours remaining in November, gold appears set to notch its first monthly close over $2,000 an ounce.

With only a few trading hours remaining in November, gold appears set to notch its first monthly close over $2,000 an ounce.

That would be a significant milestone. Several Paradigm Press experts — as well as many analysts outside our stable — agree that a monthly close over $2K amounts to a signal from the powers that be that they’re willing to let the gold price sail much higher.

At last check, the front-month contract on the Midas metal is down 12 bucks to $2,055… while the spot price is $2,037. Either way, it’s looking promising.

By the way, don’t miss colleague Sean Ring’s new interview with natural-resource investing legend Rick Rule — including Mr. Rule’s long-term outlook for gold. It’s on the Paradigm Press YouTube channel…

Gold dodged a bullet this morning with the release of “core PCE” — the Federal Reserve’s favorite measure of inflation.

Gold dodged a bullet this morning with the release of “core PCE” — the Federal Reserve’s favorite measure of inflation.

This number came in as expected — a 3.5% jump year-over-year. That’s down meaningfully from the 5.6% peak in early 2022. But 3.5% is still 75% higher than the Fed’s 2% inflation target… and it’s no better than it was in the spring of 2021.

Still, as far as the mercurial Mr. Market is concerned, all that matters is that the inflation rate continues to come down. Any resurgence in the inflation rate would make the Fed more likely to keep interest rates “higher for longer.”

All else being equal, higher interest rates make cash and bonds more attractive to hold than gold. But if rates climb down, gold starts to look better. With the Fed on track to start cutting rates in the first half of next year, the gold price is holding its own this morning.

Likewise the U.S. stock market is holding its own going into the end of the month.

Likewise the U.S. stock market is holding its own going into the end of the month.

The major averages are mixed — the Dow up three-quarters of a percent, the Nasdaq down two-thirds of a percent. The S&P 500 is splitting the difference, marginally in the red at 4,545.

The price of crude sits more or less where it did 24 hours ago at $77.62 — despite the news from the OPEC+ meetings: “OPEC+ agreed to make 1 million barrels a day of additional oil-supply cuts,” according to Bloomberg, “to go alongside Saudi Arabia’s much-anticipated extension of its voluntary reduction of the same size.”

Granted, this move hasn’t been put to a formal vote yet. There might still be some more haggling before all’s said and done.

For the record: General Motors just gave the clearest sign yet that we’re at “Peak Green” — that is, the beginning of the end of the renewable-energy frenzy.

For the record: General Motors just gave the clearest sign yet that we’re at “Peak Green” — that is, the beginning of the end of the renewable-energy frenzy.

Yesterday, GM announced a $10 billion share buyback for next year. “The company will fund it in part by freeing up capital previously earmarked for development of EVs and autonomous vehicles,” says The Wall Street Journal. That’s a shift of emphasis for CEO Mary Barra, who is “trying to jump-start GM’s flailing shares while also refocusing investors on the underlying strength of its main business: selling gas- and diesel-powered trucks and SUVs.”

In general, a company sitting on a pile of cash has two choices about how to deploy it: Invest in the future growth of the business, or return the cash to shareholders. GM’s choice says nothing good about the future of green.

![]() Munger: The Good and the Bad

Munger: The Good and the Bad

We got to thinking about long time frames upon seeing the news that Charlie Munger died this week.

We got to thinking about long time frames upon seeing the news that Charlie Munger died this week.

Munger lived a long life — 99 years — much of that as Warren Buffett’s business partner and cantankerous foil at Berkshire Hathaway.

But he also exercised an immense amount of patience: Asked how much he worried when Berkshire’s share price falls, Munger said “Zero.”

Notably, he said that in 2009 — when it seemed the world was coming to an end, at least financially.

“This is the third time that Warren and I have seen our holdings in Berkshire go down, top tick to bottom tick, by 50%,” Munger told the BBC. “I think it's in the nature of long-term shareholding that the normal vicissitudes in worldly outcomes and in markets that the long-term holder has his quoted value of his stock go down and then… by, say, 50%.

“In fact, you can argue that if you're not willing to react with equanimity to a market price decline of 50% two or three times a century, you're not fit to be a common shareholder and you deserve the mediocre result you're going to get compared to the people who do have the temperament who can be more philosophical about these market fluctuations.”

Our former colleague Chris Mayer — he runs a hedge fund these days — has long recommended a book called Poor Charlie’s Almanack — a collection of Munger speeches. “I guarantee your time spent with this book is a lot more worthwhile than trying to guess where the market will go or watching your stock prices all day.”

Meanwhile, don’t miss current colleague Sean Ring’s remembrance of Munger at The Daily Reckoning.

Still, we’d be remiss to ignore the dark side of Munger — and the Berkshire mystique.

Still, we’d be remiss to ignore the dark side of Munger — and the Berkshire mystique.

During the 2008 financial crisis, Munger and Buffett knew that bank bailouts would come sooner or later. Thus, they cut a series of sweetheart deals with most of the biggest banks early that fall — lucrative arrangements that were off-limits to retail investors like you.

Just one example: Berkshire invested $5 billion in Goldman Sachs in exchange for preferred shares yielding a 10% dividend. It’s the sort of thing that belies ol’ Uncle Warren’s down-home, hamburger-chomping persona.

In 2010 Munger delivered a speech to students at his alma mater, the University of Michigan. “You should thank God” for bank bailouts, he thundered.

“Hit the economy with enough misery and enough disruption, destroy the currency and God knows what happens. So I think when you have troubles like that, you shouldn’t be bitching about a little bailout. You should have been thinking it should have been bigger.”

But how about bailouts for everyday folks walloped by the crisis, say, young jobless adults struggling beneath crushing loads of student debt?

“Now, if you talk about bailouts for everybody else,” said Munger, “there comes a place where if you just start bailing out all the individuals instead of telling them to adapt, the culture dies…

“At a certain place, you’ve got to say to the people, ‘Suck it in and cope, buddy. Suck it in and cope.’”

It was a mask-off moment, for sure. We’ve told the story a few times before. We’re just cynical enough to do it one more time today.

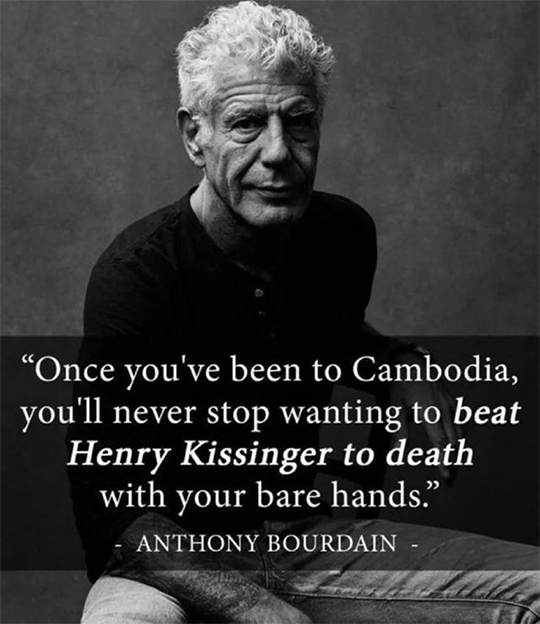

![]() As Long as We’re in Obituary Mode…

As Long as We’re in Obituary Mode…

Meanwhile…

Meanwhile…

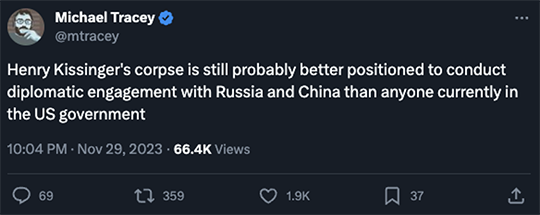

All that said, our favorite political reporter has a point…

![]() JFK and Silver?

JFK and Silver?

On the subject of the JFK murder, “I read somewhere that Kennedy had silver certificates printed by the U.S. government rather than the Federal Reserve.

On the subject of the JFK murder, “I read somewhere that Kennedy had silver certificates printed by the U.S. government rather than the Federal Reserve.

“To me this is a major reason for his assassination. So it appears there were many who would be happy with his demise.

“You didn't mention the silver certificates in your article and I'm curious if you knew about it and if so is it a fact that Kennedy was instrumental in having them printed?”

Dave responds: We’re vaguely familiar with the theory, but in the absence of further evidence it seems unpersuasive.

From the work of authors and researchers like James W. Douglass and David Talbot, it seems much more plausible that JFK had alienated elements within the deep state after the Cuban Missile Crisis. He saw the Cold War ending in a very hot place, and he sought to wind it down — to wit, his June 1963 speech at American University.

“Getting a little tired of you giving voice to all the conspiracy theorists out there,” a reader carps.

“Getting a little tired of you giving voice to all the conspiracy theorists out there,” a reader carps.

“They need to get a life of their own and stop blaming their unfulfilled lives on someone or something else.

“If you'd like to weed them out, just ask them a couple of simple questions and see how they respond. Did Neil Armstrong really land on the moon, who won the 2020 presidential election and what color is the sky on a beautiful sunny day? If they can't give a clear, concise answer, ‘Yes, Joe Biden and blue,’ then don't waste your print time on them. They are just spouting off trying to explain why their lives didn't turn out the way they had hoped and they are willing to take others down with them.

“Trump did this and see where it got him, impeached twice, lost an election as an incumbent, and 91 indictments!”

Dave responds: So you address precisely none of the points we raised last week, nor the thoughtful responses from your fellow readers.

That’s the best attempt at misdirection you’ve got? As Biden would say, “C’mon man!” and as Trump would say, “Sad!”

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets