Inflation Isn’t Done With You Yet

- No denying it: Inflation is staging a comeback

- Good news, bad news (Unemployment)

- The sanctions backfired

- “Razzlekhan” pleads out

- Climate mailbag

![]() No Denying It: Inflation Staging a Comeback

No Denying It: Inflation Staging a Comeback

A month after we first suggested that inflation has bottomed for now and is on its way back up… the evidence is becoming overwhelming.

A month after we first suggested that inflation has bottomed for now and is on its way back up… the evidence is becoming overwhelming.

First we noticed the observations of outside-Paradigm experts like Jim Bianco and Greg Weldon. The simple fact that the inflation rate peaked 12 months ago means 12 months later and going forward, the year-over-year comparisons aren’t going to look so impressive.

No more statistical tailwinds, in other words: Getting 9.1% inflation down to 3.0% was the “easy” part. Getting it any lower? And preventing it from taking off again? Research shows that could take 10 years or longer.

Then a titan of finance weighed in — Bob Prince of the hedge fund giant Bridgewater Associates. Inflation, he told the Financial Times, “is probably going to level out where it is.”

Finally our own Jim Rickards pointed out that — at long last — workers are getting respectable pay increases.

If you’re among them, bully for you. But the Federal Reserve sees pay raises as fueling the dreaded “wage-price spiral” that made inflation so persistent in the late 1970s. “That kind of inflation feeds on itself,” Jim told us, “as businesses raise prices to cover higher wages and employees demand more wage hikes to cover higher prices.”

[We have new developments on that score later in today’s edition…]

In the month since we made our humble suggestion, oil prices jumped 11%.

In the month since we made our humble suggestion, oil prices jumped 11%.

Meanwhile, the national average for a gallon of gasoline jumped over 8% — most of that increase coming within the last week.

Nearly everyone on the Paradigm team — whatever their outlook on the stock market — agreed a few weeks ago that oil prices were set to rebound the rest of this year and the mainstream wouldn’t see it coming.

As we noted yesterday, Saudi Arabia has tightened its spigots to the point that the OPEC+ nations’ output just registered the biggest one-month drop since lockdown in 2020.

Meanwhile, the Biden administration is delaying plans to start refilling the Strategic Petroleum Reserve. (It’s less than half-full after the White House drained it to suppress gasoline prices last year.) According to a Department of Energy flack, “The DOE remains committed to its replenishment strategy for the SPR, including direct purchases when we can secure a good deal for taxpayers.”

You mean, you’re waiting for the price to come back down? Good luck with that.

The price of energy affects the price of nearly everything else. And the price of energy will feed through to the official inflation numbers — which will be released next Thursday.

But the most powerful confirmation that inflation remains “sticky” comes from perhaps the most authoritative source of all — the bond market.

But the most powerful confirmation that inflation remains “sticky” comes from perhaps the most authoritative source of all — the bond market.

OK, the orange line on that chart is self-explanatory — gas prices.

The blue line is the spread between the yields on 5-year U.S. Treasury notes and 5-year TIPS — Treasury Inflation-Protected Securities.

Esoteric, yes, but the point today is that this number is a powerful indicator of “inflationary psychology” — and the number is now at its highest in over a year.

So ignore the mainstream bleating about how “inflation is back under control.” It’s not under control — and worse, it’s about to take off again.

And in any event, the government routinely lies about the inflation rate. That’s not a Joe Biden thing — the lies go back to the Reagan era, in fact.

But with inflation staging a rebound — Jim Rickards sees “massive cost-of-living increases” going into 2024 — it’s more important than ever to take preventive measures.

![]() Good News, Bad News (Unemployment)

Good News, Bad News (Unemployment)

Speaking of gamed economic numbers, it’s the first Friday of the month — time for the government’s employment report.

Speaking of gamed economic numbers, it’s the first Friday of the month — time for the government’s employment report.

The wonks at the Bureau of Labor Statistics conjured only 187,000 new jobs for July. For a second straight month, the number has come in below the expectations of Wall Street economists. What’s more, the June and May numbers were revised downward. The official unemployment rate ticked down to 3.5% as a few folks who’d given up looking for work started looking again.

In theory, a cooling job market is an argument for the Federal Reserve to call it quits raising interest rates.

But within this month’s report is a compelling counterargument — rising wages. Average hourly earnings jumped 0.4% last month. The year-over-year increase is 4.4%, higher than the typical Wall Street economist, who was expecting 4.2%.

Again, it’s the wage-price spiral that gives Fed chair Jerome Powell spooky ’70s flashbacks — much worse than disco and leisure suits.

But for the moment, Wall Street is putting more emphasis on the cooling job number than on the rising wages.

But for the moment, Wall Street is putting more emphasis on the cooling job number than on the rising wages.

All the major U.S. indexes are in the green — the Dow up a half percent to 35,387, the S&P 500 up a half percent to 4,525 and the Nasdaq up two-thirds of a percent, back above 14,000.

The futures markets suggest only a 14% probability the Fed will raise interest rates at its Sept. 19-20 meeting. But there’s a lot more economic data coming out between now and then — including, as mentioned before, inflation next Tuesday.

In addition to the job numbers, traders are chewing on quarterly numbers from two of the “Magnificent Seven” stocks: Apple is down nearly 3% after reporting a third straight quarter of declining revenue; sales of iPhones, iPads and Macs are all slumping. Amazon, meanwhile, is up a scorching 9.4% after crushing the Street’s expectations.

“Overall, I don't trust tech right now and it feels like we're in the beginning phases of a larger pullback,” Greg Guenthner wrote his Trading Desk readers as midday approached. “I suspect the Nasdaq might post a small gain today, or even fade after lunch. But I do not think it will just start blasting off again back to its highs.

“Now's not the time to go chasing tech breakouts or trying to force any new trades in this group.”

![]() The Sanctions Backfired

The Sanctions Backfired

We already knew this, but now there’s additional confirmation: Russia is weathering Western economic sanctions better than Western governments hoped.

We already knew this, but now there’s additional confirmation: Russia is weathering Western economic sanctions better than Western governments hoped.

The International Monetary Fund is out with its latest projections of GDP for the world’s major countries: It forecasts 1.5% economic growth in Russia for 2023 — not far off the U.S. mark of 1.8%. And the IMF forecasts Russian GDP growth will outstrip America’s next year.

Back in May we were already noticing how the mainstream was starting to acknowledge the sanctions were a failure.

Now, the IMF’s numbers are the occasion for a Wall Street Journal story characterizing the economic war a “stalemate” — not unlike the war on the battlefield.

Failure, stalemate — whatever you want to call it, it doesn’t live up to Joe Biden’s boast about how he’d “turn the ruble into rubble.”

In particular, Russia has had little problem re-routing its oil sales from Western countries toward China and India.

The sanctions are further backfiring in this sense: Other governments that don’t get along with Washington are drawing together as a bloc.

The sanctions are further backfiring in this sense: Other governments that don’t get along with Washington are drawing together as a bloc.

Of course, you probably know that already as Jim Rickards watches for developments in the run-up to the summit of BRICS leaders later this month, starting Aug. 22.

But other countries don’t have to create a reserve-currency alternative to the dollar to escape the consequences of U.S. economic warfare. Here’s an eye-opening statistic we hadn’t run across until today: Despite Donald Trump withdrawing from the Iran nuclear deal in 2018 and reimposing sanctions… Iranian oil sales rebounded last year to exceed 2016 levels. China has been happy to buy as much oil as Iran is willing to sell.

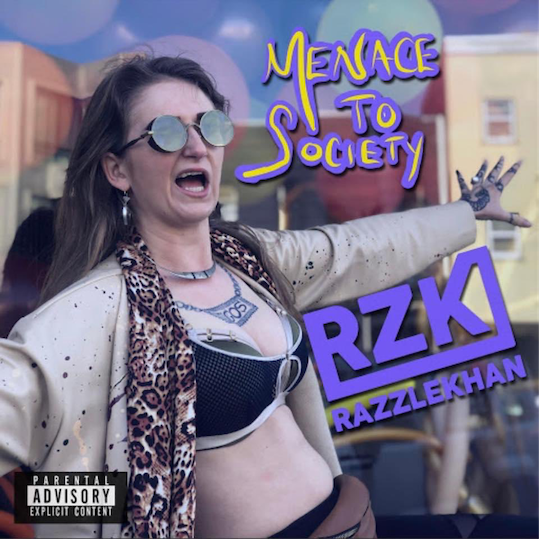

![]() “Razzlekhan” Pleads Out

“Razzlekhan” Pleads Out

OK, maybe this individual really is a criminal mastermind…

OK, maybe this individual really is a criminal mastermind…

“A husband-and-wife duo on Thursday pleaded guilty to laundering money stolen in a 2016 hack of cryptocurrency exchange Bitfinex,” reports the Reuters wire, “through an elaborate scheme involving burying gold coins and burning documents in a trash can in Kazakhstan.”

Eighteen months ago when they were arrested, we were gobsmacked by the spectacle: The feds accused Ilya Lichtenstein and Heather Morgan of laundering 120,000 Bitcoin stolen from the crypto exchange Bitfinex in 2016.

In the intervening six years, the haul had appreciated from roughly $71 million to $5 billion. Also in the intervening six years, Ms. Morgan made a name for herself as an aspiring rapper going by the pseudonym Razzlekhan. (“Like Genghis Khan, but with more pizzazz,” said her website.)

You can still find her signature music video “Versace Bedouin” on YouTube — prancing around Wall Street declaring herself a “badass moneymaker.” As the kids would say, it’s cringe. (Don’t click unless you’re prepared for NSFW lyrics.)

Neither Morgan nor Lichtenstein was charged with the actual theft of the Bitcoin — but under the plea deal, Lichtenstein admits he’s the one behind the hack.

Here’s one thing this case proves definitively: Whatever benefits Bitcoin confers over fiat, anonymity is not one of them.

Here’s one thing this case proves definitively: Whatever benefits Bitcoin confers over fiat, anonymity is not one of them.

“The successful police operation,” reports the BBC, “is the latest case to utilize tools able to analyze transactions on Bitcoin's public blockchain ledger.”

Court records show the couple went to considerable lengths to cover their tracks — for instance, splitting the haul into tiny amounts and transferring it into thousands of crypto wallets with fake identities. They also mixed their haul with other suspect crypto assets on a darknet marketplace called Alphabay.

One thing that tripped them up, however — shopping with Walmart gift cards.

"Police were able to link the Walmart gift cards back to some of the proceeds of the Bitfinex hack, which then opened up the further investigation," says Jonathan Levin, founder of an outfit called Chainalysis, which aided in the investigation.

"Buying gift cards and moving between different exchanges and different cryptocurrency never actually created this sort of break in provenance that the couple intended.”

A sentencing date has yet to be set. Lichtenstein faces up to 20 years, Morgan 10.

Oh, the gold coins, you wonder? “Lichtenstein acknowledged converting some funds to gold coins, which he gave to Morgan, who buried them in California,” says the Reuters story. “Law enforcement has since dug them up, a prosecutor said.”

Oh, the gold coins, you wonder? “Lichtenstein acknowledged converting some funds to gold coins, which he gave to Morgan, who buried them in California,” says the Reuters story. “Law enforcement has since dug them up, a prosecutor said.”

Physical gold still has perfect anonymity — unless you do something stupid.

![]() Climate Mailbag

Climate Mailbag

“Every day this summer I hear the daily weather report turned into a commentary on climate change,” a reader observes after Wednesday’s edition.

“Every day this summer I hear the daily weather report turned into a commentary on climate change,” a reader observes after Wednesday’s edition.

“I guess the power behind the news media hope we mistake ‘weather’ for climate. Climate needs to be measured over many decades or centuries. Also, tying in the invisible clean gas of life CO2 (a trace gas that makes up less than a half percent of our atmosphere) is not historically accurate when you look at the millennia.”

Another reader takes issue with our concluding thoughts Wednesday: “That 1936 comment is whataboutism. Scientists are saying July 2023 was the hottest month in 120,000 years, with respect to the average surface temperature around the globe.

Another reader takes issue with our concluding thoughts Wednesday: “That 1936 comment is whataboutism. Scientists are saying July 2023 was the hottest month in 120,000 years, with respect to the average surface temperature around the globe.

“You contradict your own comments when you claim that France being cooler than usual means anything. That's akin to the idiotic GOP comments about how snow on the ground in February proves there's no ‘global warming.’

“I live in central Texas and the summers are hotter than they used to be, especially overnight. Even back in 2011 when it was crazy hot during the days, we were dropping into the low/mid-70s at night. We haven't seen anything under 78 in two months.

“Climate change is not only real, but it's already well down the path that has been predicted for decades. Denying it at this point is just naive.”

Dave responds: The observation about France is indeed but a single observation. The point is that, as the reader above points out, garden-variety hot weather is now described with inflammatory language — “inferno,” “boiling” and so on.

Let’s leave it here this week: In general, we could all have a much more productive discussion about climate change if we could separate three issues…

- Whether the planet is warming on a dramatic scale

- Whether such warming is caused by human activity

- Whether the entirety of human activity should be reordered by top-down bureaucratic diktat on the theory that doing so would start to cool the planet again.

Even if you accept 1) and 2) as a given… does that make 3) indisputable?

It comes back to something I’ve described more than once this year — the contrast between pie-in-the-sky promises about a seamless transition to renewable electricity and electrified transportation on the one hand… and on the other hand, a series of carrots and sticks driving humanity into “15 minute” cities or whatever else The Science™ is dreaming up for us.

Going forward, that’s where I’m going to keep the discussion focused. 1) and 2) are, frankly, distractions. 3) is where everything’s at stake, starting with the first-world lifestyle we’ve taken for granted lo these many decades.