The Day Everything Changes (Aug. 22)

- D.C. hit snooze on the alarm clock… one too many times

- D-day for the U.S. dollar (Aug. 22)

- BRICS timeline: The rise of a global powerhouse

- The return of the gold standard?

- Western hegemony is a dead man walking

![]() Washington Finally Wakes Up (Too Late, of Course)

Washington Finally Wakes Up (Too Late, of Course)

You know de-dollarization has become “a thing” when it’s the topic of congressional hearings.

The House Financial Services Committee is holding a hearing today called Dollar Dominance: Preserving the U.S. Dollar’s Status as the Global Reserve Currency.

The five “expert” witnesses are a bunch of academics and think-tank types.

Not on the invite list — conspicuous by his absence, really — is Paradigm’s macroeconomics authority Jim Rickards.

More’s the pity. Jim’s been on the de-dollarization case for nearly 15 years — going back to a tabletop exercise he did with Pentagon brass in early 2009. It was the Defense Department’s first-ever “financial war game.”

“The scenario I presented at the time,” he recalled last year, “was that Russia and China would accumulate large gold reserves, pool their gold and launch a new digital currency backed by gold in place of the U.S. dollar. Russia and China would then insist that any purchases of Russian energy or Chinese manufactured goods be paid for in the new currency.

“It was a clear-cut effort to get out from under U.S. dollar hegemony and to protect themselves from U.S. dollar-based economic sanctions.”

The scenario Jim laid out in 2009 must sound eerily familiar if you just leafed through the new issue of Rickards’ Strategic Intelligence.

The scenario Jim laid out in 2009 must sound eerily familiar if you just leafed through the new issue of Rickards’ Strategic Intelligence.

Jim’s 10-page essay begins like this: “On Aug. 22, 2023, the most significant development in international finance since 1971 will be unveiled.”

Aug. 22 is when the leaders of the BRICS nations will convene for their annual summit in Durban, South Africa.

The year 1971, as you likely know, is when President Richard Nixon severed the dollar’s last tie to gold.

So yes, it’s significant.

Everything we’ve been describing in this e-letter about “de-dollarization” going back to 2014, everything Jim’s been writing about since his first book Currency Wars in 2011… it’s all coming to a head less than three months from now. “The world,” Jim writes, “is unprepared for this geopolitical shock wave.”

We’re going to do a CliffsNotes version of Jim’s writeup today — taking aim at the topic with all of our 5 Bullets. It’s that important.

If you’re a current Strategic Intelligence subscriber, we hope you’ll welcome a recap — and we hope you’ll agree that it’s worth breaking the paywall on this occasion to clue in as many people as possible (Of course, the two investment ideas included in the issue are reserved only for you.)

If you’re not a current Strategic Intelligence subscriber, you can remedy that right away at this link — no long video to watch.

![]() The End of Dollar Dominance Starts on Aug. 22

The End of Dollar Dominance Starts on Aug. 22

“We are now getting close to the rollout of a major new currency that could weaken the role of the dollar in global payments and ultimately displace the dollar in part as a global reserve currency,” Jim declares.

“We are now getting close to the rollout of a major new currency that could weaken the role of the dollar in global payments and ultimately displace the dollar in part as a global reserve currency,” Jim declares.

We won’t spend much time rehashing how we got here. Suffice to say that the Western sanctions targeting Russia after Russia invaded Ukraine last year were a watershed.

Washington froze the dollar-based assets of Russia’s central bank; a stroke of Joe Biden’s pen rendered them worthless. In addition, most Russian financial institutions were shut out of SWIFT, the financial-messaging system that greases the gears of the global economy.

Leaders of other nations outside of Washington’s orbit naturally looked around and wondered if they might be next.

The BRICS are the obvious grouping through which these nations can act — and shelter themselves from Washington’s weaponization of the dollar.

They’ve been steadily laying the groundwork since 2014 — the year that Washington engineered regime change in Ukraine, Russia seized the Crimean Peninsula in response and Washington retaliated with an earlier round of sanctions.

“Western elites,” Jim writes, “appear to have been asleep at the switch for the past nine years as the BRICS prepare to do without them.”

Some fast facts about the BRICS…

Some fast facts about the BRICS…

- They make up 40% of the Earth’s population

- They comprise 30% of the Earth’s dry surface and related natural resources

- They generate almost 50% of the world’s wheat and rice production

- They hold 15% of the world’s gold reserves.

Eight more countries have applied for membership — including longtime arch-rivals Saudi Arabia and Iran. Leaders of another 17 countries have expressed interest. BRICS will very soon be BRICS+.

It might not be long before BRICS+ includes two of the top three world oil producers — Russia and Saudi Arabia. BRICS already includes two of the top three nuclear-weapons states — Russia and China. In both cases the odd man out is the United States.

“By every measure,” says Jim, “BRICS is not just another multilateral debating society. They are a substantial and credible alternative to Western hegemony.”

And here with, the key dates in the development of BRICS as a global powerhouse…

And here with, the key dates in the development of BRICS as a global powerhouse…

November 2001: Goldman Sachs analyst Jim O’Neill issues a white paper laying out investment opportunities in the four biggest economies outside the G7 countries. Conveniently, the four — Brazil, Russia, India and China — made for the memorable acronym BRIC.

September 2006: What Jim describes as “a marketing gimmick” becomes “political reality” — as foreign ministers from the BRIC nations meet privately on the sidelines of the United Nations General Assembly’s annual gathering in New York.

June 2009: The BRIC nations’ heads of state meet in person for the first time in Yekaterinburg, Russia. “There was immediate agreement,” Jim writes, “that the BRIC nations should continue the dialogue and work together on critical issues including financial reform and the role of international currencies.”

December 2010: To give the BRIC roster an African presence, South Africa joins the group — conveniently rechristened BRICS.

July 2014: BRICS leaders agree to create the New Development Bank — a sort of BRICS alternative to the Western-oriented World Bank, with $100 billion at its disposal.

July 2015: BRICS leaders give the go-ahead for a complementary effort to the NDB dubbed the CRA, short for Contingent Reserve Arrangement. This is a sort of BRICS alternative to the Western-oriented International Monetary Fund, also with $100 billion in capital.

In essence, Jim says the BRICS replicated all the institutions under the Bretton Woods system that’s kept the dollar on top of the global heap for nearly 80 years.

Working groups from the BRICS nations hold 160 meetings every year in addition to the annual gatherings of the presidents and prime ministers. BRICS has a headquarters building — perhaps not surprisingly – in a shiny new skyscraper in Shanghai.

They’re even working on an undersea internet cable to share among themselves — and to shut out the U.S. National Security Agency.

The Fate of America (2043)

Executive Publisher Matt Insley is making sure Paradigm Press Group overdelivers on its promises to you.

Which means digging deeper… crunching more numbers… finding answers to questions no one is asking… and bringing you the absolute best analysis…. in time for you to act.

In Matt’s confessional interview from Jekyll Island, Georgia, he forecasts where he believes America is heading in the next 20 years — and his plan to protect his financial future for what’s to come.

![]() The Return of the Gold Standard — Brought to You by BRICS+

The Return of the Gold Standard — Brought to You by BRICS+

“All these arrangements may soon be superseded by a new BRICS+ currency,” says Jim — which he’s certain will be announced at the summit of BRICS leaders starting Aug. 22.

“All these arrangements may soon be superseded by a new BRICS+ currency,” says Jim — which he’s certain will be announced at the summit of BRICS leaders starting Aug. 22.

“This August meeting is by far the most important BRICS meeting since the founding of the organization in 2006.”

It shouldn’t come as a surprise to people in the Beltway… but it will. Even some of the people at that hearing in Washington today, probably.

“On numerous occasions from 2007–2014,” Jim writes, “I warned U.S. officials from the Treasury, Pentagon and the intelligence community that overuse or abuse of dollar sanctions would lead adversaries to abandon the dollar to avoid the impact of sanctions.

“Such abandonment would lead to the diluted potency of sanctions, unforeseen costs imposed on the U.S. and eventually the collapse of confidence in the dollar itself. These warnings were mostly ignored.

“We have now reached the first and second stages of this forecast and are dangerously close to the third…

“The BRICS+ and their institutional network present the best platform for a successful effort to de-dollarize global payments and eventually global reserves.”

Jim is convinced the new BRICS+ currency will have gold backing — but maybe not right away.

Jim is convinced the new BRICS+ currency will have gold backing — but maybe not right away.

For the moment, Jim’s sources tell him the scheme involves something “pegged to a basket of commodities for use in trade among members” — oil, grain, industrial metals.

It’s a convoluted scheme; something like it was considered during the Bretton Woods conference of 1944 that cemented the dollar’s place as the world’s reserve currency. In the end, it was just easier to peg the dollar to gold at $35 an ounce.

According to the information from Jim’s contacts, the BRICS+ will wind up in the same place eventually — and for obvious reasons that fulfill his 2009 scenario.

“This plays to the strengths of BRICS members Russia and China,” he writes, “who are the two largest gold producers in the world and are ranked sixth and seventh respectively among the 100 nations with gold reserves.”

So it’s at this point we need to return to a distinction Jim has been keen to make recently — between a “payment currency” and a “reserve currency.”

So it’s at this point we need to return to a distinction Jim has been keen to make recently — between a “payment currency” and a “reserve currency.”

“Payment currencies,” Jim writes, “are used in trade for goods and services and remittances of dividends, interest, royalties and other flows from direct foreign investment.”

This is relatively simple — it’s what’s behind all manner of two-way deals that have been announced regularly since 2014. For instance, China and Brazil struck a deal very recently: “China can buy Brazilian soybeans, sugar, oil, aircraft and other goods for yuan. Brazil can buy semiconductors, solar panels and other Chinese-manufactured goods for reais.” Easy-peasy.

A reserve currency — the status underpinning the dollar for all these decades — is more complicated.

“Reserve currencies (so-called) are, in effect, the savings accounts of sovereign nations that have earned them through trade surpluses,” Jim explains. “These balances are not held in currency form but in the form of securities” — that is, government bonds.

“You cannot have a reserve currency without a large well-developed sovereign bond market. No country in the world comes close to the U.S. Treasury market in terms of size, variety of maturities, liquidity, settlement, derivatives and other necessary features.”

![]() The Timeline Is Accelerating

The Timeline Is Accelerating

And yet Jim is now convinced the BRICS+ currency could achieve reserve-currency status much sooner than he previously assumed.

And yet Jim is now convinced the BRICS+ currency could achieve reserve-currency status much sooner than he previously assumed.

“The key,” he writes, “is to create a BRICS+ currency bond market in 20 or more countries at once, relying on retail investors in each country to buy the bonds.

“The BRICS+ bonds would be offered through banks and postal offices and other retail outlets. They would be denominated in BRICS+ currency but investors could purchase them in local currency at market-based exchange rates.

“Since the currency is gold backed it would offer an attractive store of value compared with inflation- or default-prone local instruments in countries like Brazil or Argentina. The Chinese in particular would find such investments attractive since they are largely banned from foreign markets and are overinvested in real estate and domestic stocks.

“It will take time for such a market to appeal to institutional investors, but the sheer volume of retail investing in BRICS+-denominated instruments in India, China, Brazil and Russia and other countries at the same time could absorb surpluses generated through world trade in the BRICS+ currency.

“In short, the way to create an instant reserve currency is to create an instant bond market using your own citizens as willing buyers.”

This process is exactly how the U.S. dollar began its ascent to reserve currency status.

This process is exactly how the U.S. dollar began its ascent to reserve currency status.

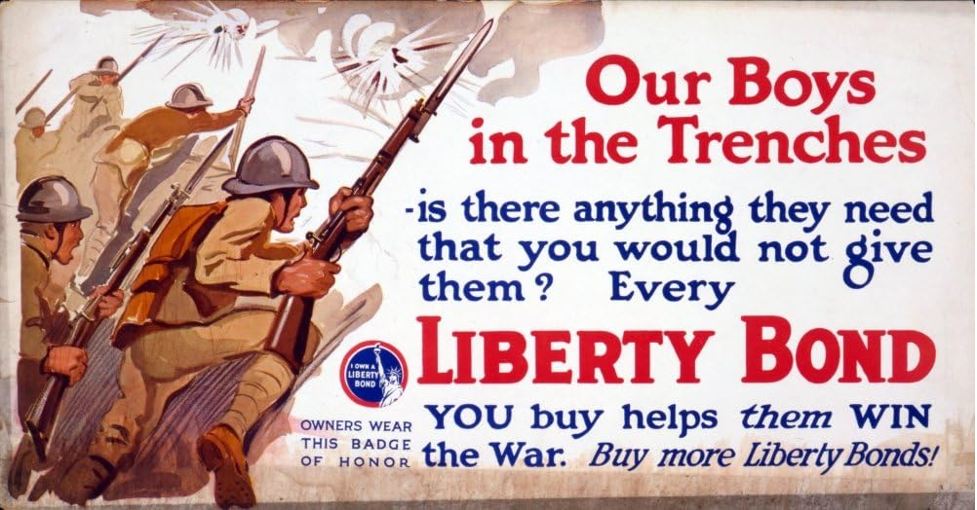

“From 1790–1917,” Jim writes, “the U.S. bond market was for professionals only. There was no retail market. That changed during World War I when Woodrow Wilson authorized Liberty Bonds to help finance the war. There were bond rallies and Liberty Bond parades in every major city. It became a patriotic duty to buy Liberty Bonds.”

By the time of the Bretton Woods conference in 1944, a nearly broke British Empire had no choice but to cede the pound’s reserve-currency status to the dollar.

But in an era of instantaneous communication, the process is sure to proceed much faster this time.

![]() Today’s Takeaways

Today’s Takeaways

“All of the pieces are now in place. The new currency arrives on Aug. 22,” Jim concludes.

“All of the pieces are now in place. The new currency arrives on Aug. 22,” Jim concludes.

“Since the BRICS+ currency will be gold-backed, and since participants in the scheme will continue to buy gold in order to maintain the needed backing support for the new currency, the price of gold will remain strong and steadily grow.”

As you might know, Jim recommends having 10% of your investable assets in physical gold. If you don’t have that allocation now, best act soon. You’ll need it as a hedge against the inevitable inflation that will occur as a tsunami of dollars currently held overseas starts returning to the United States.

And never forget how American leaders brought us to this place: “These blunders can all be traced to complacency by U.S. officials about the dollar’s status,” Jim writes, “and U.S. arrogance about the use of the dollar as a financial weapon.”

A couple of final thoughts: This level of analysis is typical of what you get with every monthly issue of Rickards’ Strategic Intelligence. Plus you get actionable investment recommendations from Dan Amoss, Zach Scheidt and Byron King. Not a subscriber yet? Here’s the link once more — again, no long video to watch.

And if you’re already a Strategic Intelligence subscriber, we cordially invite you to take the next step — with Rickards’ Insider Intel, Jim’s top-performing trading advisory.

In recent months, readers like you have been able to rack up gains like 128% in 28 days… 183% in 11 days… and 203% in 26 days.

Through midnight tonight, we’re offering you an account credit of $557 — good toward a Rickards’ Insider Intel membership. Yes, there are terms and conditions with this offer, but we think you’ll like them — as one of our customer-care reps shows you at this link.

Thanks for sticking through 5 Bullets on one topic today. Tomorrow we’re back to regularly scheduled programming. We’ll clue you in to a major shift taking place in the stock market this week — and how you can take advantage.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. The markets today, you ask? The major U.S. stock indexes are flipping their recent script — the Dow up a third of a percent, but the S&P 500 down a bit (to 4,276) and the Nasdaq down nearly 1%.

Gold got whacked, the bid now $1,943. Crude is up to $72.72. Crypto is calming down after the Coinbase scare yesterday.

With the debt ceiling lifted, the national debt swelled in one day by $359 billion — to $31.83 trillion. And there’s more where that came from.