Mainstream Muddies the Waters (Inflation)

![]() Inflation Stupidity

Inflation Stupidity

The Wall Street Journal called you an ignoramus on its front page today.

The Wall Street Journal called you an ignoramus on its front page today.

To be precise, the paper isn’t talking about you as much as about three-quarters of respondents to a poll the paper commissioned in the seven “battleground states” that are toss-ups for the presidential election this November.

But if we’re talking about a cross-section of Americans, “you” is apparently close enough for journalism work…

The writer is Greg Ip, the Journal’s “chief economics commentator.” At his best, he can generate truly original insights. Today, he’s not at his best.

He begins thus…

In The Wall Street Journal’s latest poll of swing states, 74% of respondents said inflation has moved in the wrong direction in the past year.

This assessment, which holds across all seven states, is startling, sobering — and simply not true. I’m not stating an opinion. This isn’t something on which reasonable people can disagree. If hard economic data count for anything, we can say unambiguously that inflation has moved in the right direction in the past year.

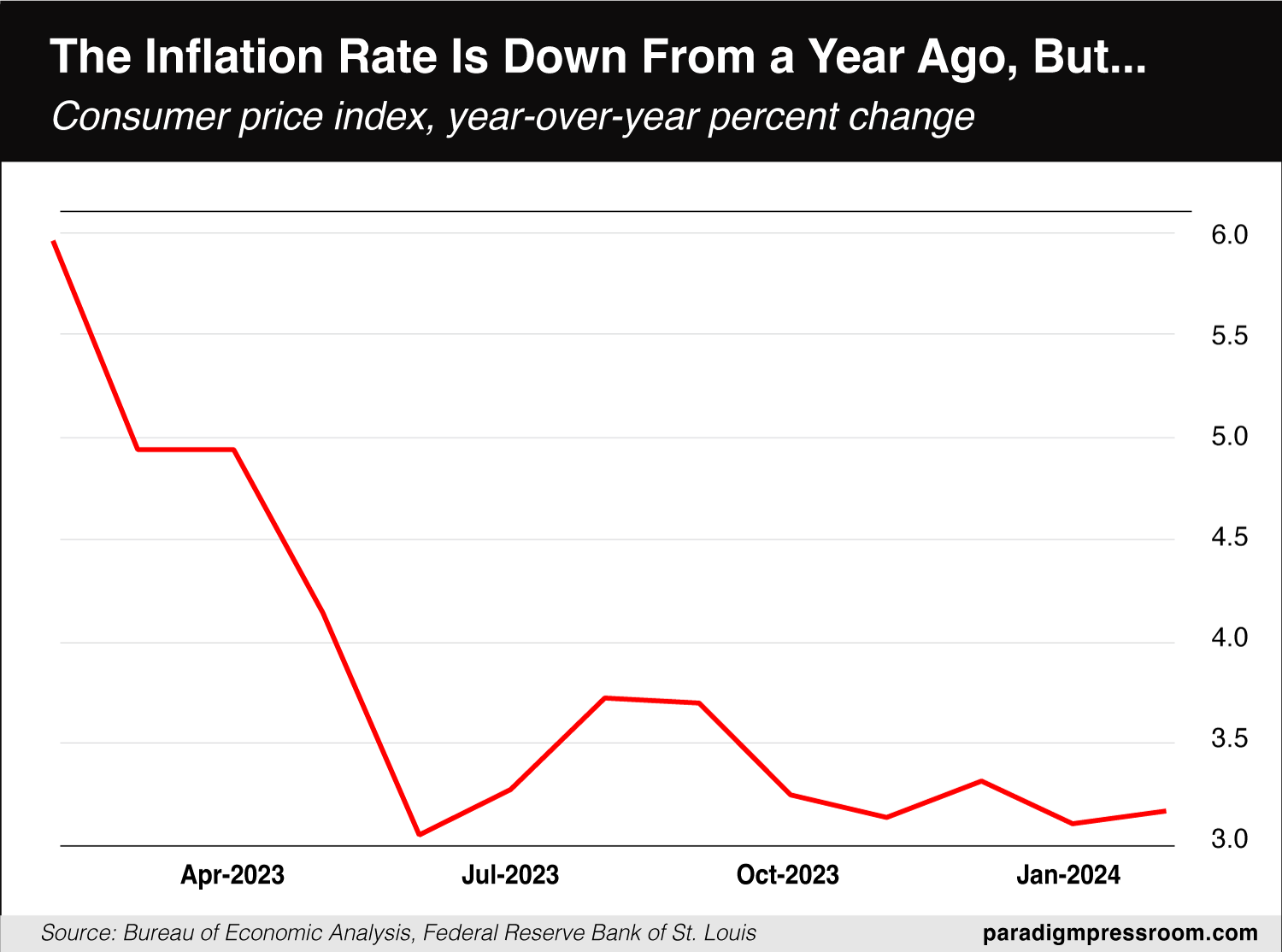

Ip’s nuh-uhh evidence is the year-over-year change in the inflation rate as defined by the consumer price index. The most recent figures show it was 3.2% in February, compared with 6% a year earlier.

Which is true as far as it goes, but…

This is a stupid conclusion to draw based on a stupid survey question.

This is a stupid conclusion to draw based on a stupid survey question.

Not included in his article is the actual wording of the question: “Over the past year, please tell me if you think the following measures have moved in the right direction or wrong direction.”

The first of three “measures” that survey respondents were asked about was “inflation.”

In the first place, “measures” is an odd word to use here. I’m not sure what a better word would be, but I suspect the typical individual listening to someone asking this question would fuzz out on the word “measures”... and infer that the question is about his or her own cost of living, even if it’s not.

But even if a survey respondent understood the question correctly, the part about “right direction or wrong direction” is problematic.

To his credit, Ip acknowledges this — up to a point. “It’s tempting to chalk this up to a misunderstanding. Lower inflation means the level of prices is still rising, just more slowly than before. People sometimes conflate inflation with the level of prices and believe inflation is getting worse because the price level keeps going up (it rarely goes down).”

But there’s another problem. Let’s take the statistic Ip cites and put it on a chart.

As you can see, the drop in the official inflation rate over the past year was all front-loaded. By the time we got to last June, it bottomed at 3.0%. The most recent figure from February is slightly higher, 3.2%. So the number is down from 12 months ago, yes, but it’s gone basically nowhere in the last eight.

Likely as not, a typical survey respondent fell victim to recency bias. He or she heard the part about “over the past year,” yes, but more likely thought about the experience of the last six–eight months — a timeframe in which neither the official inflation rate nor the growth in one’s personal cost of living was moving in “the right direction.”

So there you have it — a front-page story in the leading business daily built around a survey question that confused more than clarified. But to what end?

So there you have it — a front-page story in the leading business daily built around a survey question that confused more than clarified. But to what end?

In recent months, corporate media have been wringing their hands about a “vibecession” — in which everyday folks feel rotten about their economic circumstances despite sunny statistical aggregates.

It’s here where politics rears its ugly head. After all, there’s a reason the survey was conducted in only the seven states up for grabs in November.

“When it comes to the economy, the vibes are at war with the facts,” Ip writes, “and the vibes are winning. This is obviously bad news for President Biden’s re-election hopes.”

The term “vibecession” is new but the phenomenon is not. Check this out from over two years ago…

Two years later, the media continues to obsess over the disconnect.

Today isn’t the day for us to unpack the reasons behind the disconnect. We’ll just point out that berating everyday folks for giving the “wrong” answers to poorly worded questions about abstract economic statistics does nothing to advance the discussion.

Oh, but we’re not done carping about the media today…

![]() Fedspeak: In the Eye of the Beholder

Fedspeak: In the Eye of the Beholder

The media obsession over the Federal Reserve is getting ridiculous.

The media obsession over the Federal Reserve is getting ridiculous.

Fed chair Jerome Powell gave another speech yesterday. Here was CNBC’s take…

Federal Reserve Chairman Jerome Powell said Wednesday it will take a while for policymakers to evaluate the current state of inflation, keeping the timing of potential interest rate cuts uncertain.

Speaking specifically about stronger-than-expected price pressures to start the year, the central bank leader said he and his fellow officials are in no rush to ease monetary policy.

And here’s The Wall Street Journal…

Stronger-than-anticipated economic activity this year hasn’t changed the Federal Reserve’s broad expectation that declining inflation will allow for interest-rate cuts this year, Chair Jerome Powell said Wednesday.

Two very different spins, but the gist is that rate cuts are still on the table starting in mid-June or late July. Which has been the case for at least the last couple of weeks, but the media has to have something to fill bandwidth and airtime, right?

To the extent Powell’s remarks had any market impact, it was to help the major averages recover some early-day losses.

As for today, the major averages are all in the green at last check — the S&P 500 up more than a half-percent to 5,240. That’s about 14 points below last Thursday’s record close.

As for today, the major averages are all in the green at last check — the S&P 500 up more than a half-percent to 5,240. That’s about 14 points below last Thursday’s record close.

“I don't think most investors/traders are mentally prepared for a legitimate pullback,” says Paradigm trading pro Greg “Gunner” Guenthner. “The incredible five-month rally has lulled everyone to sleep.”

Here too, Gunner sees media malfeasance: Going into yesterday, “the financial media is already chirping about the market's ‘poor start’ to the second quarter. But the S&P is off by less than 1% to start the month. What will they say if it drops 4%, 5%, 7%???”

Congrats are in order, by the way, to readers of Alutcher’s True Alpha. This morning they collected 100% gains on Taiwan Semiconductor call options. As we mentioned yesterday, TSM was rallying despite worries about the impact of the earthquake just offshore.

Precious metals are looking stout — gold at $2,294 and silver at $27.09. And those numbers are down slightly from the close of electronic trading yesterday afternoon.

Crude is down a bit, but still over $85. Bitcoin is stabilizing over $67,000.

Tomorrow brings the monthly job numbers — and still more media obsession over what they mean for Fed policy. As always, we’ll aim to cut through the noise…

![]() Follow-up File: Chiefs Must Punt on Stadium Tax

Follow-up File: Chiefs Must Punt on Stadium Tax

Super Bowl glory or no, taxpayers are in no mood to finance renovations for the Kansas City Chiefs’ stadium.

Super Bowl glory or no, taxpayers are in no mood to finance renovations for the Kansas City Chiefs’ stadium.

As we mentioned earlier this week, voters in Jackson County, Missouri, went to the polls Tuesday to decide whether to extend a ⅜-of-1-cent sales tax. Proceeds would have gone for an overhaul of Arrowhead Stadium… along with a brand-new stadium for baseball’s Kansas City Royals.

The referendum failed. Badly. It got the same treatment the Chiefs’ stout defense delivers against a weak offensive line — going down by a 58-42% margin. That’s despite a threat by both teams to leave Kansas City.

Reading local media, it seems there were several potential deal-breakers — not the least of which is that the proposed location of the new Royals’ stadium would have entailed the demolition of several small businesses.

Not that the teams are giving up, though. "Hopefully everyone can take a deep breath, put all of the negative stuff behind us," says Jackson County Executive Frank White Jr., "and then come back to the table and work out a deal that's really affable [sic] for all parties involved."

![]() Check Your Confirmation Bias

Check Your Confirmation Bias

For as much as I’ve bashed the establishment media today, the alternative media needs a good thrashing too.

For as much as I’ve bashed the establishment media today, the alternative media needs a good thrashing too.

It’s a sign of the times that I had to spend five minutes this morning chasing down a headline I was pretty sure was bogus — but it was just believable enough I had to make sure.

I won’t dignify it with a screenshot, but the story was that Ukraine’s President Volodymyr Zelenskyy was buying Highgrove House — the country residence of King Charles in Gloucestershire, England — for 20 million pounds or about $25.3 million.

Everything I’ve seen traces back to something called “The London Crier” — which I’ve never heard of until today.

I don’t see this news in any mainstream outlet — and mainstream outlets would probably be reliable for a story of this nature.

Look, I understand why a lot of people would buy into the story: It feeds the confirmation bias of Americans who are rightly skeptical about Washington funneling money to a corrupt regime in Ukraine. But people who ought to know better are just putting it out there without a moment’s critical thought. (Lookin’ at you, Jim Quinn of The Burning Platform.)

*Sigh*... We’ve come a long way from the days of 2016 when bogus “news” articles about the pope endorsing Donald Trump would be amplified on social media. Those you could dismiss out of hand. Stuff like Zelenskyy buying Highgrove House has at least a hint of a suggestion of verisimilitude. (That said, people who follow the British royal family more closely than I tell me the notion is preposterous.)

Of course, if this story is corroborated elsewhere, The London Crier will have had one helluva scoop. But I’m not holding my breath…

![]() Mailbag: Uncle Sam’s Oil Stash, Gunner’s Trades

Mailbag: Uncle Sam’s Oil Stash, Gunner’s Trades

“Just read a report that the Strategic Petroleum Reserve is not being refilled due to the high cost of oil,” a reader writes.

“Just read a report that the Strategic Petroleum Reserve is not being refilled due to the high cost of oil,” a reader writes.

“Uh-oh, now how is Biden going to reduce the price of gas at the pump before this election, as he did at the midterms? It is only at 388 million barrels. Not to mention that we are a world of s*** if China makes a move anywhere in the world!”

Dave responds: Funny, a few of us at Paradigm were corresponding about this very topic today on our internal e-chat.

As it happens, your number is high. It’s less than 364 million barrels — a de minimis increase from 347 million barrels nine months ago.

I characterized the rebuild as “glacial.” Our energy authority Byron King shot back: “Glaciers are like the Indy 500 compared with how the Biden admin is refilling SPR.”

Other presidents have monkeyed with SPR levels over the decades, but the drawdown under Biden is a league apart. And don’t take that from us, take it from the Department of Energy: The Energy Information Administration publishes an easy-to-read chart of the SPR’s weekly levels going back to 1982.)

“Great deal,” reads the intriguing subject line from our final correspondent today.

“Great deal,” reads the intriguing subject line from our final correspondent today.

“I just watched the entire interview with Greg Guenthner. I am excited about his trading methods but when you are talking about $10,000 trades, it leaves us little people behind.

“I enjoy all the information I am getting from your messages.”

Dave responds: To be absolutely clear, you do not need $10,000 to lay down on a single trade. Gunner was simply citing examples of how a $10,000 stake could multiply into staggering sums.

You can start with $1,000 or even less and generate the same percentage return. Given that Gunner’s average recommendation generated 57% gains in a couple of weeks, a $1,000 stake would become $1,570.

Again, that’s an average. And it includes the losing trades. So if all you’ve got to work with is $1,000, best hold off on a membership in The Trading Desk and stick with the recommendations in whichever entry-level newsletter you currently subscribe to.

Our business model is based on the idea that the money you make from one of the monthly letters will allow you to step up to a higher level of service — hopefully sooner rather than later!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets