Stagflation Nation

- Stagflation equation

- Bitcoin’s rocket fuel

- History-making auto loan delinquencies

- Cowboy State: #1… Garden State: #50

- A late-to-the-party Luddite

![]() Stagflation Equation

Stagflation Equation

“The U.S. may be heading for the worst of all economic worlds — recession and inflation combined — known as stagflation,” warns Paradigm’s macro expert Jim Rickards.

“The U.S. may be heading for the worst of all economic worlds — recession and inflation combined — known as stagflation,” warns Paradigm’s macro expert Jim Rickards.

Quite simply: Low growth + inflation = stagflation.

“This is exactly what happened in the 1970s,” Jim continues. “Inflation began from the supply side with the Arab oil embargo of 1973 after the Yom Kippur War.

“The U.S. suffered a severe recession from 1973–1975 with peak unemployment of 9.0%. The U.S. had another recession in 1980, and a third in 1981–1982 in which unemployment hit 10.8%. That last recession was the most severe at the time since the Great Depression.

“Inflation that began on the supply side in 1973” — and moved to the demand side by 1977 — “was out of control,” Jim explains.

“Despite three recessions in nine years, double-digit unemployment and two stock market crashes, the mid-to-late 1970s and early 1980s witnessed the highest inflation since the end of World War II. By 1981, inflation had reached 15% and interest rates were raised to 20% to combat inflation.”

And with relentlessly “sticky” inflation today plus a looming recession, it's easy to see how a similar scenario could unfold through the mid-2020s. (So are you ready for life in leisure suits?)

“The problem now is that the Wall Street narratives have run out of steam. Reality can’t be ignored,” says Jim.

“The problem now is that the Wall Street narratives have run out of steam. Reality can’t be ignored,” says Jim.

“Economic data does not support the happy-talk narrative,” he says. “After dropping from 9.1% in June 2022 to 3.0% in June 2023, inflation has taken off again.” Accordingly, CPI ticked up to 3.7% as of September.

“The Federal Reserve will hike interest rates at least one more time this year (probably on Nov. 1) before deciding to pause rate hikes for an extended period of time,” Jim adds.

More pessimistic data? “Investors dazzled by the summer rally and the hype about AI and ChatGPT may have lost sight of this persistent long-term downtrend in all major U.S. stock markets.” Take in the following statistics…

- “The tech-driven Nasdaq Composite Index has fallen from 16,057 on Nov. 19, 2021, to 13,201 on Sept. 28, 2023,” Jim notes, “an 18% decline in almost two years”

- The S&P 500 Index has dipped from 4,796 on Jan. 3, 2022, to 4,274 on Sept. 28, 2023, an 11% decline over the past 21 months

- The Dow Jones Industrial Average Index has dropped from 36,799 on Jan. 4, 2022, to 33,613 on Sept. 28, 2023, an 6% decline over the same 21-month period.

“U.S. stock markets are in a long-term decline with potential for a severe market crash,” Jim reiterates. “There are no rate cuts in sight until mid-2024 at the earliest, as far as the Fed is concerned” — meaning, no intervening “sugar rush” for Wall Street. “The damage has been done. A severe recession is on the way.”

[If you’re uneasy about ongoing conflicts abroad, Jim Rickards is going live this Sunday at 6:30 p.m. EST with a private “War Forum,” complete with a direct-to-reader TacChat feature.

And what Jim has to say could have a profound impact on your and your family’s financial security in the months to come.

To login and register for this event, click here. (Your password: Patriot1*)]

![]() Bitcoin’s Rocket Fuel

Bitcoin’s Rocket Fuel

“What in the world is going on with Bitcoin?” asks Paradigm’s science-and-tech maven Ray Blanco. “After yesterday’s surge, Bitcoin is at its highest price since May 2022.

“What in the world is going on with Bitcoin?” asks Paradigm’s science-and-tech maven Ray Blanco. “After yesterday’s surge, Bitcoin is at its highest price since May 2022.

“Why the sudden interest? And where does it go from here?

“Three letters loom large over Bitcoin and the future of cryptocurrency: SEC,” Ray says. “SEC chair Gary Gensler has seemingly made it his life’s purpose to dismantle cryptocurrency.” (More on Gensler later.)

“The SEC brought lawsuits against several crypto exchanges, including Coinbase and Binance, for selling unregistered securities. Possibly more damaging than the legal action, Gensler and the SEC continue to withhold any clarity on which cryptocurrencies should be considered securities.

“This forced holding pattern… has been crypto’s greatest obstacle in recent years,” says Ray, “which brings us back to Bitcoin’s recent price surge.

“BlackRock, the world’s largest asset management firm, has applied for approval for a Bitcoin ETF, which suggests to many that they already have unofficial approval from the Securities and Exchange Commission.”

“BlackRock, the world’s largest asset management firm, has applied for approval for a Bitcoin ETF, which suggests to many that they already have unofficial approval from the Securities and Exchange Commission.”

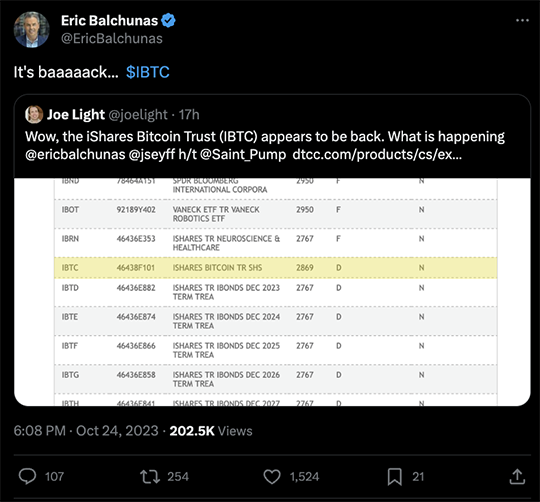

Bloomberg’s ETF analyst Eric Balchunas tweeted Monday: “The iShares Bitcoin Trust has been listed on the DTCC (Depository Trust & Clearing Corporation, which clears NASDAQ trades). And the ticker will be IBTC.”

Ray says: “This would also likely be the first of many approvals for Bitcoin ETFs, and possibly many other cryptocurrencies.

“With the SEC facing a deadline of Jan. 10 to either approve or deny the ETF, investors seem to be getting ahead of the game,” Ray concludes. “But is it enough to set off a third crypto bull run?”

Checking our screens today, crypto continues to climb: Bitcoin is up 3.5%, this close to $35,000. At the same time, Ethereum’s getting some love too; the second-place crypto is up almost 2%, over $1,800.

Checking our screens today, crypto continues to climb: Bitcoin is up 3.5%, this close to $35,000. At the same time, Ethereum’s getting some love too; the second-place crypto is up almost 2%, over $1,800.

But when it comes to stocks, we’re seeing red… The Nasdaq’s market cap has been trimmed almost 2% to just under 13,000. The S&P 500 has managed to hold losses to 1%, landing around 4,200, while the Dow’s just slightly negative at 33,125.

Oil and gold are getting a bump, at the time of writing. A barrel of WTI is up 0.50% to $84.20, and the yellow metal is up $11.60 per ounce to $1,982.10, according to Kitco. Silver, on the other hand, is down about 0.15%, above $22.50.

The only noteworthy economic number today — new home sales — surged big-time in September, up 12% from August’s revised data, blowing the consensus out of the water.

![]() History-Making Auto Loan Delinquencies

History-Making Auto Loan Delinquencies

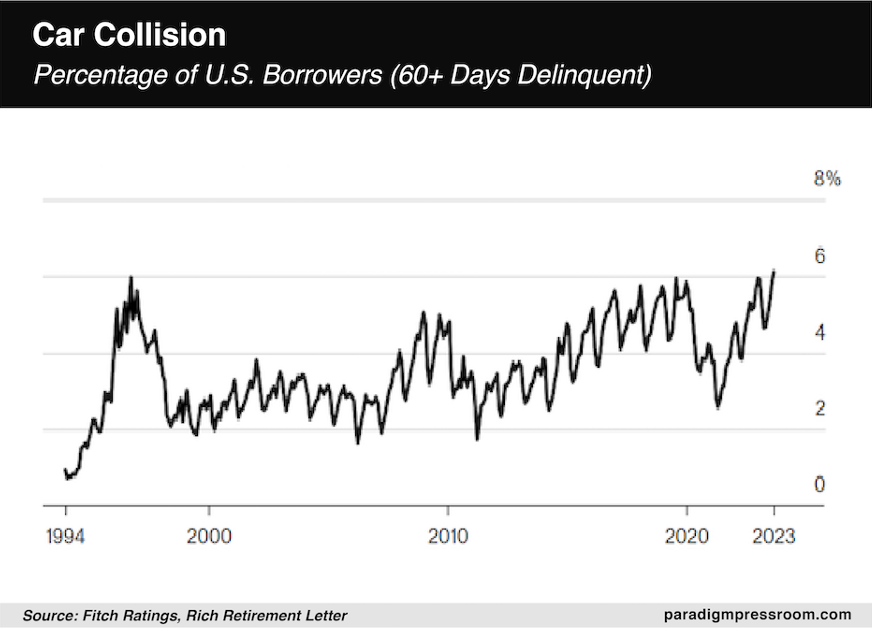

“[Auto loan] delinquencies are hitting an all-time high as inflation makes it more and more difficult for families to pay their bills,” says Paradigm’s income-investing authority Zach Scheidt.

“[Auto loan] delinquencies are hitting an all-time high as inflation makes it more and more difficult for families to pay their bills,” says Paradigm’s income-investing authority Zach Scheidt.

“Take a look at the chart below that shows the percentage of subprime auto loans that are at least 60 days late.

“This chart is particularly concerning when you think about the way many families organize their budgets,” he adds.

“Typically, most families start by making sure their housing payment is covered with the family's car payment being a close second on the priority list.

“Once those two items are covered, families then divide the remaining income [among] other family expenses.

“The fact that auto delinquencies are hitting an all-time high is a very sobering statistic for our consumer-led economy,” says Zach.

“The fact that auto delinquencies are hitting an all-time high is a very sobering statistic for our consumer-led economy,” says Zach.

“While many affluent consumers are in decent shape because of rising home values, many middle-class and lower-income families are struggling with stubborn inflation.

“Wage gains simply haven't been strong enough to offset rising costs. And that's why we're seeing more people default on auto loans.

“The risk of default continues to climb [especially] for companies who lend to lower-income families. Lenders simply can't charge enough interest to make up for the delinquencies and defaults,” Zach says.

“Shares of credit issuers Discover Financial (DFS) and Capital One Financial (COF) are now in clear downtrends and could have much further to fall.”

[Full Disclosure: Zach has a personal bearish position in COF as part of his Income Alliance model portfolio.]

“Buying put contracts on these subprime lenders is a great way to protect your wealth and actually profit in a challenging period for investors,” Zach says.

“Buying put contracts on these subprime lenders is a great way to protect your wealth and actually profit in a challenging period for investors,” Zach says.

“To be clear, buying put contracts on DFS or COF won’t harm the families that borrow money from these credit card companies. So you're not making money off the backs of working-class consumers.

“However, shares of these lenders are likely to continue lower as delinquencies rise. And as investors, it's our responsibility to take advantage of the opportunities that this market presents.

“It's certainly a challenging time for investors,” says Zach. “But with the proper tools, you can continue to grow your retirement wealth even while traditional investors are stuck treading water.”

![]() Cowboy State: #1… Garden State: #50

Cowboy State: #1… Garden State: #50

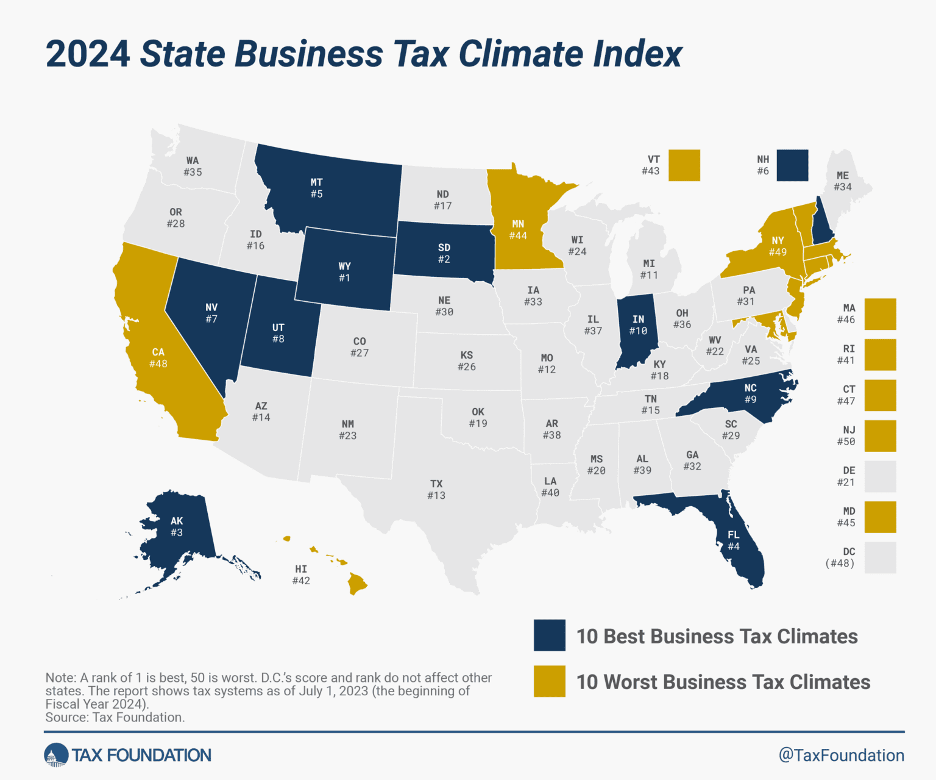

How does your home state measure up on the 2023 “State Business Tax Climate Index”?

How does your home state measure up on the 2023 “State Business Tax Climate Index”?

“While there are many ways to show how much is collected in taxes by state governments, the index is designed to show how well states structure their tax systems,” says the Tax Foundation.

Although property and unemployment insurance taxes are a fixture of all 50 states, there are more than a handful of states that jettison one or more of the so-called “major taxes,” including corporate income tax, individual income tax and sales tax.

“This does not mean, however, that a state cannot rank in the top 10 while still levying all the major taxes,” Tax Foundation says, as do Utah (No. 8) and Indiana (No. 10).

Filling out the rest of the top 10 business-friendly states (in descending order): Wyoming, South Dakota, Alaska, Florida, Montana, New Hampshire, Nevada and North Carolina.

“The states in the bottom 10 tend to have a number of afflictions in common: complex, nonneutral taxes with comparatively high rates.”

In dead-last place, New Jersey is a cluster of tax “afflictions” — with eye-wateringly high property taxes, individual income taxes and superlatively high corporate income taxes. Plus, consider Jersey’s inheritance tax, a punishing tax on foreign income and more. (No wonder Tyreek Hill hard-passed on playing for the N.Y. Jets last year.)

As for the rest of the biggest tax losers? Rhode Island, Hawaii, Vermont, Minnesota, Maryland (Paradigm’s HQ state), Massachusetts, Connecticut, California and New York fill out the ranks of worst tax offenders.

As an aside, we wonder why the colors of the best and worst states on the Tax Foundation map weren’t flipped? If you catch my drift…

![]() A Late-to-the-Party Luddite

A Late-to-the-Party Luddite

“Is Gary (Goober) Gensler a modern-day Luddite?” a reader wonders.

“Is Gary (Goober) Gensler a modern-day Luddite?” a reader wonders.

“I read that he thinks artificial intelligence needs to be regulated (I prefer to say, ‘restricted’) because of the chance that some bots might be prone to cause a market crash, in the same way one fake-news report might. But I have a few questions for him…

- Multiple people use these machine learning programs to make decisions in the financial markets. Is he implying that (almost) all of them program their AI with the same key words and phrases? Follow-up question: What good is it to follow the same program as your competitor?

- Who made Gensler the news censor for the financial marketplace?

“Hey, a flash crash can happen. Why should it be wrong to take advantage of that? Whatever happened to ‘Buy at the sound of cannons, sell at the sound of trumpets’?”

Even more to the point, robo-advisers — the computer algos programmed to manage investment portfolios — launched during the financial panic of 2008, ostensibly to promote less-risky passive investing… Where was pearl-clutching Gensler then?

Hang in there, reader… Join us tomorrow for another round of 5 Bullets.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets