Ukraine’s Mayday

![]() Ukraine’s Mayday

Ukraine’s Mayday

Your tax dollars at work?

Your tax dollars at work?

Budmo!

Albeit, this X-tweet is a bit misleading: The CBS Mornings piece is from July 2023. Nonetheless, according to an article published last week at Wine Enthusiast, Ukraine’s bar scene is still humming.

“On my second night in town in the Ukrainian city of Lviv,” writes freelancer Adam Robb, “I was enjoying happy hour at Siaivo, a two-story Art Deco coffee shop and bar, when an air raid siren sounded from my phone.

“The day before,” he says, “I was encouraged to download Air Alert, an early-warning app developed by the Ukrainian government and voiced by Mark Hamill — yes, Star Wars’ Luke Skywalker — who was now warning me to proceed to the nearest shelter.

“No one [was] going anywhere,” Mr. Robb says. “The bar was actually filling up.”

On that incongruous note, Paradigm’s macro expert — and former White House insider — Jim Rickards says: “It’s time to take another look at the war in Ukraine…

“The vaunted ‘summer offensive’ by Ukraine in June 2023 failed completely,” says Jim. “Ukraine had between one-third and one-half of its armor destroyed, suffered huge casualties and used up its reserves.

“The vaunted ‘summer offensive’ by Ukraine in June 2023 failed completely,” says Jim. “Ukraine had between one-third and one-half of its armor destroyed, suffered huge casualties and used up its reserves.

“Ukraine never got close to the main Russian defensive lines let alone its goal of reaching the Black Sea. What little land was gained has since been recaptured by the Russians.

“Early this year, Russia launched a full-scale assault on the major town of Avdiivka, which had been used by Ukraine to fire artillery at Donetsk and which was outfitted as a Ukrainian citadel.

“The Russians routed the Ukrainians and sent them into a disorderly retreat to the west,” Jim says. “Ukrainian casualties are estimated at 100,000 since January, and 30,000 in the month of March alone.

Courtesy: ISW, BBC (As of Feb. 20, 2024)

“Late this year, Russia may control the four provinces it has formally annexed — Donetsk, Luhansk, Kherson and Zaporizhzhia — effectively all the former Ukraine east of the Dnipro River, as well as the entire Black Sea and Sea of Azov coastline,” Jim anticipates.

“Ukraine will be left as a landlocked rump state with Kyiv as its capital…

“While the kinetic war has been playing out, the U.S. is also conducting a financial war against Russia in the form of economic sanctions,” says Jim.

“While the kinetic war has been playing out, the U.S. is also conducting a financial war against Russia in the form of economic sanctions,” says Jim.

“This war is going even worse than the kinetic war,” he notes.

“Russia is growing at full capacity and has spot labor shortages:

- The Russian economy currently has an unemployment rate of 2.8%

- Russia’s economy grew at an annualized rate of 5.5% in 2023

- Russia’s debt-to-GDP level is 17.2% (compared with the U.S. level of 131.0%)

- The Russian ruble is steady against the dollar at about 92:1.

“By every measure, Russia’s economy is outperforming the U.S. and is doing so on a more sustainable level from a debt perspective,” Jim explains. “The Russian economy is booming while the economies of the U.S., Europe and Japan are in recession.

“Financial sanctions against Russia have been a complete failure,” he concludes.

“As if this were not bad enough, the dumbest idea of all is to steal $300 billion of U.S. Treasury securities, owned by Russia, and use the money to pay for the war against Russia.

“As if this were not bad enough, the dumbest idea of all is to steal $300 billion of U.S. Treasury securities, owned by Russia, and use the money to pay for the war against Russia.

“The Treasury securities were legally purchased by Russia using dollars earned through the sale of oil prior to the war,” Jim says. “They were frozen in early 2022, something the U.S. has done before to Iran, Syria, North Korea, Venezuela and other nations.

“Now the U.S. is going a step further and trying to seize these assets. This is outright theft and a violation of the Foreign Sovereign Immunities Act.”

Jim clarifies: “This theft would destroy the creditworthiness of the United States. Countries with large Treasury holdings — such as China, Taiwan, Japan, South Korea, Brazil and Saudi Arabia — would move their reserves to physical gold, which cannot be seized (one reason gold prices have been surging lately).

“Finally, most of the Russian-owned Treasuries are in custody in Euroclear in Belgium, the largest clearinghouse and securities custodian in Europe.

“If assets are seized, Russia could sue Euroclear branches in friendly jurisdictions such as Singapore and Hong Kong and likely win damages,” Jim notes. “More to the point, this would destroy the credit of Euroclear and possibly lead to a global financial panic.”

Jim’s takeaway: “The war is going badly for the U.S.” — and for Ukraine — “militarily, financially and politically. Investors should prepare for a financial meltdown as this plays out,” he cautions. “Physical gold and cash are the best go-to assets in an environment like this.”

![]() Make It Make Sense

Make It Make Sense

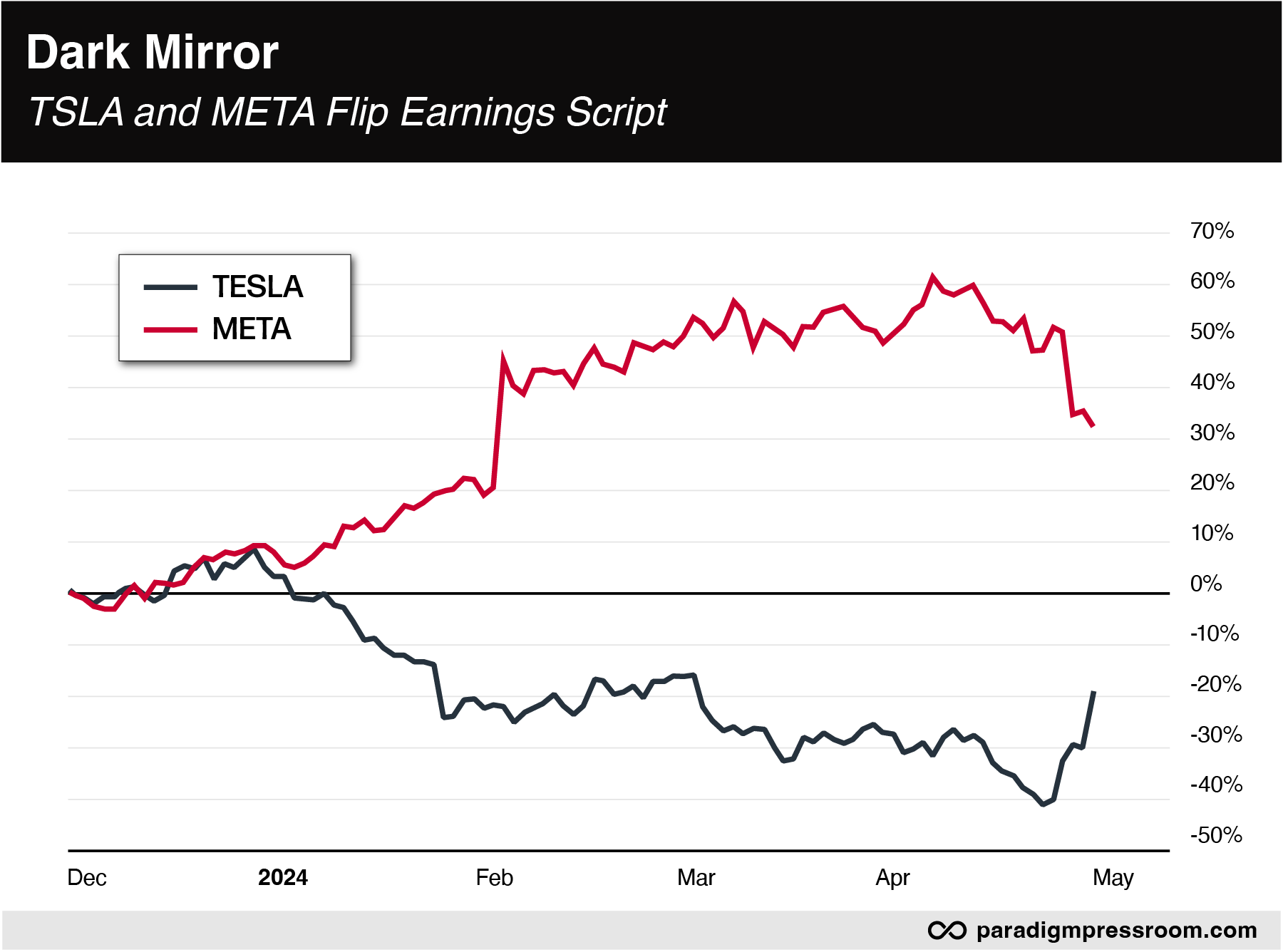

“Last week, we witnessed Tesla Inc. (TSLA) rally off 52-week lows, closing higher by more than 12% after reporting an earnings miss,” says Paradigm’s chart hound Greg “Gunner” Guenthner.

“Last week, we witnessed Tesla Inc. (TSLA) rally off 52-week lows, closing higher by more than 12% after reporting an earnings miss,” says Paradigm’s chart hound Greg “Gunner” Guenthner.

“The very next day, investors were forced to watch Meta Platforms Inc. (META) crater more than 15% after beating both top- and bottom-line estimates.

“To truly understand why the market reacted as it did,” Gunner says, “we have to zoom out and place the earnings into the context of the bigger price trends shaping these two popular stocks…

“TSLA shares had already coughed up more than 40% year-to-date,” he says. “Sentiment couldn’t have been more bearish heading into last week’s announcement. Most investors expected the worst.

“Combine that with the strong downtrend and breakdown to fresh lows and you have a recipe for a big bounce on mediocre results,” he says. “Tesla only needed a report that was slightly better than apocalyptic… And that’s exactly what happened!

“The opposite was true for Meta,” Greg asserts. “The stock was on a historic run, posting one of the best-looking charts amongst the mega-caps extending back to the 2022 bear market lows. This strong uptrend [left] little room for error.

“Anything less than a ‘perfect’ earnings report would of course entice investors to take profits — which is exactly what happened.

“Bottom line,” Gunner says, when it comes to earnings season, “you have to separate the financials from how the herd feels about a stock. The best way to do that is to analyze prices and trends.”

After the market’s close yesterday, Amazon reported boffo earnings: Most notably, after running ads on Prime Video starting in January, Amazon’s advertising sales jumped 24%.

After the market’s close yesterday, Amazon reported boffo earnings: Most notably, after running ads on Prime Video starting in January, Amazon’s advertising sales jumped 24%.

“Amazon remains a standout among mega-cap internet companies in that it’s yet to implement a quarterly dividend,” CNBC highlights, “even as cash and equivalents jumped to $73.9 billion in the quarter from $54.3 billion a year earlier.”

But investor appetite for AMZN is just meh. Shares are up about 1.6% at the time of writing.

- One economic number of note: The ISM Manufacturing Index is back in “shrinkage” territory, falling to 49.2% in April — which is below the dividing line between a growing factory sector and a contracting one. In March, the index, at 50.3, delivered its first positive reading in 17 months.

“Looking at the ISM data out today,” says Paradigm analyst Dan Amoss, “the internals of the survey point to stagflation: lower new orders, higher employment and many more survey respondents saying input prices are rising in the past four months.

“Will Jay Powell brush it off?” Dan asks. “We'll see soon.” (More on the FOMC meeting in a moment.)

Checking on stocks this afternoon, the Big Board is holding up best: The Dow’s added 0.30% to 37,930. On the other hand, the S&P 500 and Nasdaq are both in the red — both down about 0.30% to 5,020 and 15,594 respectively.

Checking on stocks this afternoon, the Big Board is holding up best: The Dow’s added 0.30% to 37,930. On the other hand, the S&P 500 and Nasdaq are both in the red — both down about 0.30% to 5,020 and 15,594 respectively.

It’s a mixed bag for commodities too. Oil’s slumped 3.15% to a seven-week low, right under $80 for a barrel of WTI. Precious metals, however, are catching bids. The price of gold is up 0.60% to $2,316.50 per ounce while silver’s up 0.50%, hanging tight above $26.

It’s a bad day for crypto (but it’ll bounce back): Bitcoin’s lost 4.6% to $57,000, and Ethereum’s sitting at $2,900.

![]() Powell’s Persistent Problem

Powell’s Persistent Problem

The third FOMC meeting of 2024 is underway: “We expect that the Fed’s rate hike cycle, which began in March 2022, is over,” says Jim Rickards.

The third FOMC meeting of 2024 is underway: “We expect that the Fed’s rate hike cycle, which began in March 2022, is over,” says Jim Rickards.

“In effect, the Fed has concluded that they have reached the terminal rate — the rate at which inflation is expected to come down on its own without further rate hikes.

“The reason for the Fed sitting tight and not cutting rates (the infamous ‘pivot’ that Wall Street has been wrong about for two years) is that the Fed is losing the battle against inflation.

“The best that can be said,” Jim adds, “is that inflation is in a range with a central tendency of about 3.3%. It has been stuck in that range for almost one year, and is not trending toward the Fed’s goal of 2.0%.

“The Fed’s dilemma carried over from prior meetings is still unresolved…

- Continuing high inflation and high oil prices argue for keeping rates where they are

- Reduced consumer spending, higher credit card balances and higher loan delinquencies argue for possibly cutting rates to avoid a recession,” Jim concludes.

In light of such conflicting data? We’ll have robust coverage of Powell’s press conference in a special edition tomorrow morning…

![]() After 50 Years, DEA Admits Blunder

After 50 Years, DEA Admits Blunder

Yesterday, The Associated Press was the first to report the Drug Enforcement Administration’s intention to “reschedule” marijuana.

Yesterday, The Associated Press was the first to report the Drug Enforcement Administration’s intention to “reschedule” marijuana.

(Heh, at least that’s the scoop according to “five people familiar with the matter who spoke on the condition of anonymity to discuss the sensitive regulatory review,” the AP says.)

Regardless, this is historic: “The proposal, which still must be reviewed by the White House Office of Management and Budget, would recognize the medical uses of cannabis and acknowledge it has less potential for abuse than some of the nation’s most dangerous drugs,” says the AP. “However, it would not [federally] legalize marijuana outright for recreational use.”

Here’s what Paradigm’s pot-stock authority Ray Blanco said in 2018…

Even if you personally think recreational pot is a bridge too far, it’s impossible for any reasonable person to make the case that marijuana should remain a Schedule I drug — considered by the federal government to be more dangerous than crack cocaine, meth and PCP.

Yesterday, Ray commented: “Not only could this produce a tax windfall and a million jobs — two things our country could certainly use — it would also make U.S.-based pot companies competitive with their foreign rivals for the first time.”

Speaking of cannabis…

![]() A Toker Takes Umbrage

A Toker Takes Umbrage

“As a cannabis user (for my health), your stereotype is unfair,” a new reader writes about cannabis consumption and typical “munchies.”

“As a cannabis user (for my health), your stereotype is unfair,” a new reader writes about cannabis consumption and typical “munchies.”

Our reader continues: “I am in my mid-40s, love to cook healthy stuff and will never eat fast food.

“I am productive as I spend much of my time reading Paradigm Press insights and applying it to my investing strategies. So far, I am doing well. So thanks!”

Cheers to your health (and portfolio)! That’s all very gratifying to hear…

Best regards,

Emily Clancy

Paradigm Pressroom’s 5 Bullets