A 1,435% Gold Shocker

![]() How Gold Can Leap 7.5X by 2026

How Gold Can Leap 7.5X by 2026

For two weeks running, gold has held the line on $2,000 an ounce — although it was a close shave this morning.

For two weeks running, gold has held the line on $2,000 an ounce — although it was a close shave this morning.

The Labor Department released the monthly job numbers — more about those in Bullet No. 2 — and the Midas Metal took a quick tumble from $2,026.

“Mr. Slammy” took the spot price to $1,999.90 — but only for a nanosecond before bouncing back.

As Paradigm chart hound Greg Guenthner told us yesterday, hour-to-hour wiggles won’t disrupt the medium-term trend — in which he sees a clear path for gold reaching $2,600.

But what about gold reaching $15,000 by 2026? That’s the projection of Paradigm’s macroeconomics authority Jim Rickards.

But what about gold reaching $15,000 by 2026? That’s the projection of Paradigm’s macroeconomics authority Jim Rickards.

“That’s not a guess; it’s the result of rigorous analysis,” he says.

Of course, it’s not a guaranteed outcome… but he bases his forecast “on the best available tools and models that have proved accurate in many other contexts.”

Specifically, Jim has examined the two prior bull markets in gold and compared them with the current one.

Specifically, Jim has examined the two prior bull markets in gold and compared them with the current one.

“The first bull market in gold ran from August 1971 to January 1980,” he tells us. The dollar price of gold rallied from $35 per ounce to $800 per ounce. That’s a 2,200% gain in 9.4 years.

“The second bull market in gold ran from August 1999 to August 2011. The dollar price of gold rallied from $250 per ounce to $1,900 per ounce. That’s a 670% gain in 12.0 years.

“If we take a simple average of the price gains and durations of the two prior bull markets in gold, we arrive at a 1,435% gain over a period of 10.7 years.”

The current bull market in gold began in December 2015 when gold bottomed at $1,050 — a bottom that Jim called almost to the day with the help of commodity investing legend Jim Rogers.

The current bull market in gold began in December 2015 when gold bottomed at $1,050 — a bottom that Jim called almost to the day with the help of commodity investing legend Jim Rogers.

A 1,435% gain over 10.7 years results in a gold price of $15,070 by August 2026.

“There’s nothing deterministic about this model,” Jim cautions. “Actual gains could run ahead of this projection both in time and by amount. Conversely, the bull market could end at any time for a wide variety of reasons. The prior bull market gains could be annualized to produce a slightly lower average gain per year.

“Still, the bull market assumptions are moderate since we have taken a simple average and not stretched for the higher gain or the shorter duration of the two.”

But wait, you might be saying — gold hasn’t even doubled yet from that 2015 low. How can it get from $2,000 now to over $15,000 in less than three years?

But wait, you might be saying — gold hasn’t even doubled yet from that 2015 low. How can it get from $2,000 now to over $15,000 in less than three years?

“A move from $2,000 per ounce to $3,000 per ounce is a heavy lift,” Jim allows. “That’s a 50% increase and could easily take a year or more.

“Beyond that, a further increase from $3,000 per ounce to $4,000 per ounce is a 33% increase; another large rally. A further gain from $4,000 per ounce to $5,000 per ounce is a further gain of 25%.

“But notice the pattern. Each gain is $1,000 per ounce, but the percentage increase drops from 50% to 33% to 25%. That’s because the starting point is higher while the $1,000 gain is constant. Each $1,000 jump represents a smaller (and easier) percentage gain than the one before.”

By the time you get to $14,000, the jump to $15,000 is only 7%. Gold frequently rallies by that percentage or even more — most recently during the month of October.

Jim’s bottom line: By buying now, “you’ll get more gold for your money at the outset and high percentage returns as gold rallies from a lower base.

“Toward the end of the long march to $15,000 per ounce, you’ll have bigger dollar gains because you started with more gold. Others will jump on the bandwagon, but you’ll already have a comfortable seat.”

[Editor’s note: Jim will be joined by the entire Paradigm team of experts next week for our 7 Predictions Summit — James Altucher, Ray Blanco, Byron King, Greg Guenthner, Zach Scheidt, Alan Knuckman and Sean Ring. Each of them will lay out the biggest wealth-building trend they see coming in 2024.

Normally it would cost $2,000 to attend an event like this — but as a paid-up Paradigm Press reader, you’re entitled to join us FREE. And there won’t be any heavy-handed upsell — just solid information that will give you confidence going into next year.

Join us LIVE on Zoom next Wednesday at 3:00 p.m. EST. Here’s the sign-up link: All we need is your name and email address, and you’re in!]

![]() A Goldilocks Job Report

A Goldilocks Job Report

To the extent the Labor Department’s monthly job numbers can be believed, November was a Goldilocks month — not too hot, not too cold.

To the extent the Labor Department’s monthly job numbers can be believed, November was a Goldilocks month — not too hot, not too cold.

The wonks at the Bureau of Labor Statistics conjured 199,000 new jobs for the month — a bit more than expected. That said, the October and September numbers were revised down by a combined 35,000.

The official unemployment rate fell from 3.9% to 3.7%. The U-6 rate — which includes part-timers who want to work full-time plus people who’ve given up looking for work within the last year — fell from 7.2% to 7.0%.

Nothing in this report alters the outlook for what the Federal Reserve will do with interest rates: The Fed will keep the fed funds rate at 5.5% next week.

That said, another number out today might indeed change the Fed’s calculus going into 2024.

That said, another number out today might indeed change the Fed’s calculus going into 2024.

The University of Michigan has issued its monthly consumer sentiment survey. This report is nigh-worthless — based on a survey of fewer than 500 people — but nonetheless the Fed pays heed to a portion of the survey dealing with whether folks think inflation will get better or worse.

Here, the expectation is that inflation will run 3.1% in the next year — down sharply from 4.5% the previous month, and the lowest reading since March 2021.

The survey also asks about inflation five years out: Here, the typical respondent expects a rate of 2.8%, down from 3.2% the previous month.

CNBC channels the conventional wisdom: “The switch in sentiment could further convince policymakers to keep interest rates on hold and possibly start cutting in 2024.”

The result of all these numbers and associated Fed-guessing? The U.S. stock market is nearly flat on the day.

The result of all these numbers and associated Fed-guessing? The U.S. stock market is nearly flat on the day.

The S&P 500 is up a mere five points to 4,590 — very near the year-to-date closing high of last Friday. The Dow and the Nasdaq are likewise in the green, just barely. Treasury yields are rebounding, the 10-year note at 4.23%.

After the slam at 8:30 a.m. EST, the spot price of gold has recovered to $2,008, while the front-month futures contract is at $2,028. Spot silver is down 39 cents on the day to $23.40.

Crypto is quiet for once, Bitcoin a little below $43,000, Etherum just under $2.350.

![]() Crosscurrents in the Oil Market

Crosscurrents in the Oil Market

Crude has bounced nearly two bucks — to $71.27 — amid several crosscurrents in the oil market.

Crude has bounced nearly two bucks — to $71.27 — amid several crosscurrents in the oil market.

It’s becoming more and more evident that the OPEC+ nations still can’t come to terms on production levels for 2024.

Russian President Vladimir Putin paid a call this week on the leaders of both Saudi Arabia and the United Arab Emirates. At the conclusion of those meetings, the Kremlin issued a statement that “commended the close cooperation between them and the successful efforts of the OPEC+ countries in enhancing the stability of global oil markets.”

But the problem isn’t among those Big Three producers: It’s the smaller fry — many in Africa — that are officially excluded from taking part in the cartel’s production cuts. The Big Three would like them to voluntarily join in, but so far they’re not going along. That goes a long way to explain oil’s big slide in barely a week from $78 to below $70.

Meanwhile, the U.S. military is pouring fuel on the smoldering fire in Latin America.

Meanwhile, the U.S. military is pouring fuel on the smoldering fire in Latin America.

The U.S. embassy in Guyana has issued a statement saying U.S. Southern Command conducted “flight operations” with Guyana’s military yesterday “that build on its routine engagement.”

Guess we should quickly recap the developments we laid out yesterday: Guyana has put its military on high alert as its bigger next-door neighbor Venezuela has mobilized the army. Venezuelan President Nicolas Maduro has declared the annexation of Guyana’s Essequibo region, which makes up about two-thirds of Guyana’s territory. It’s a border dispute going back to the 1800s, made much more intense now by a huge oil find offshore Essequibo.

“U.S. Risks Being Dragged Into Third War,” says a bizarro headline at Newsweek — as if American leaders have no agency in deciding whether and how to employ their own military resources in Latin America, in the Middle East, in Ukraine.

Anyway, the trajectory isn’t good: Guyana’s President Irfaan Ali says Venezuela poses “a direct threat to Guyana’s territorial integrity, sovereignty and political independence” — all the right words to stir the Beltway into action.

Or as Newsweek puts it, “The language has clear echoes of the U.S. rationale for its involvement in the ongoing wars in the Middle East and Eastern Europe.”

And you thought the “forever wars” were over when Washington finally gave up on its Afghanistan adventure after 20 years…

![]() Taylor Swift and the 2024 Election

Taylor Swift and the 2024 Election

This is a little off the beaten path of our usual fare, but…

This is a little off the beaten path of our usual fare, but…

It’s Friday, I’m crashing deadline, and our internal metrics at Paradigm tell us that readers want to see election predictions, even if there’s no direct financial angle — to wit, this interview with Jim Rickards that’s getting traction on our YouTube channel.

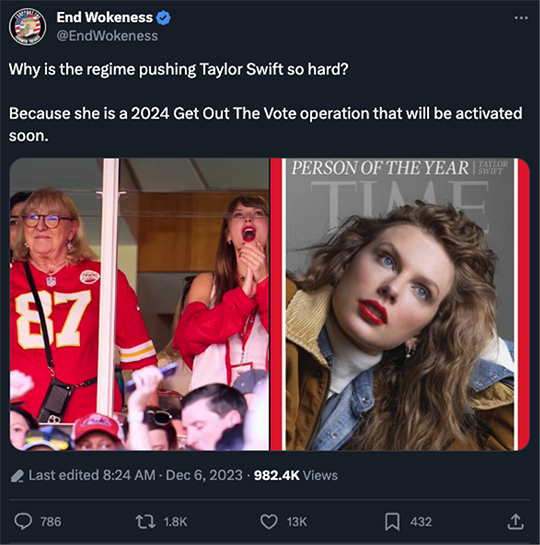

With that in mind… I pass along the following not because it’s necessarily true but because it’s becoming “a thing,” at least among conservative-leaning folks…

Somebody even made a cartoon out of it already…

I have zero opinion in the matter, but… does this thesis seem plausible? Drop us a line: feedback@paradigmpressroom.com.

Could make for a lively mailbag on Monday. Or not. But in any event, it caught my eye…

![]() An Oily Mailbag

An Oily Mailbag

On the subject of the Strategic Petroleum Reserve, which turned up in the mailbag yesterday, a reader wishes to follow up…

On the subject of the Strategic Petroleum Reserve, which turned up in the mailbag yesterday, a reader wishes to follow up…

“The reserve is at 352 million barrels, less than half of the 2010 highs.

“So just to replace the 180 million barrels Biden drained, at 3 million barrels a month will take 60 months, or five years!

“To get it back to 700 barrels, near the 2010 highs, will take 117 months or almost 10 years!

“Thanks for the reporting!”

“Dave, if you are going to mention Exxon Mobil in Guyana, then you should at least give some credit to Chevron or Hess as they also have interests there.”

“Dave, if you are going to mention Exxon Mobil in Guyana, then you should at least give some credit to Chevron or Hess as they also have interests there.”

Dave responds: Indeed, Emily mentioned last week that Chevron agreed to acquire Hess specifically for access to the huge project in Guyana.

But it’s Exxon Mobil that made the initial find, has the biggest stake and arguably is the most at risk. That’s the only reason I gave it precedence yesterday.

Let’s hope, as I tried to tease out yesterday, that Maduro in Venezuela is simply looking to get a better bargain with Washington when it comes to sanctions relief.

The problem is that “exercises” of the sort that Washington is carrying out in Guyana can often lead to “accidents” that result in armed conflict. (See: “Tonkin, Gulf of.”)

Try to have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets