$2K Gold Is Old News — Hold on Tight!

![]() If You Like Gold at $2,000, You’ll Love It at $2,600

If You Like Gold at $2,000, You’ll Love It at $2,600

The last time the dollar price of gold was anywhere under $2,000 an ounce was nearly two weeks ago. Resilient, no?

The last time the dollar price of gold was anywhere under $2,000 an ounce was nearly two weeks ago. Resilient, no?

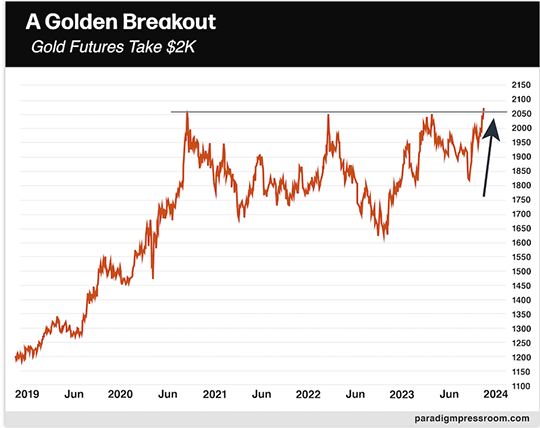

“Gold futures have finally broken free of a choppy four-year range to extend to new all-time highs,” affirms Paradigm trading whiz Greg “Gunner” Guenthner.

So where from here?

First, a little history — because you can’t know where you’re going if you don’t know where you’ve been.

First, a little history — because you can’t know where you’re going if you don’t know where you’ve been.

“Gold quickly became one of the most frustrating plays on the market almost immediately after the pandemic bubble started to percolate way back in early 2020,” Gunner reminds us. “In fact, for nearly four years, every single major gold rally failed to extend and produce a major breakout.

“The first attempt at fresh highs began as gold futures exploded off their lows in March 2020. In just five months, gold jumped from $1,450 to $2,000.

“But the big breakout above round-number resistance at $2K didn’t stick, and gold promptly fell back into a wide range. Gold futures sank back below $1,700 by early 2021, then repeated the process. First, a rally back toward $2,000. Failure quickly followed every extended gain. The bulls would walk away, and gold futures would enter a tailspin until buyers showed up in the $1,600–1,700 range. Lather, rinse, repeat.”

This pattern continued into 2023 — $2K once again proving to be a powerful ceiling in the spring, followed by a sickening grind lower to less than $1,850 in early October.

And then…

“Thankfully for the gold bulls, the U.S. dollar index offered a small spark to help break the cycle of chop,” Gunner continues.

“Thankfully for the gold bulls, the U.S. dollar index offered a small spark to help break the cycle of chop,” Gunner continues.

“The dollar finally began to roll over in October, helping gold firm up and push back toward its summer highs. The end of October even featured a quick ‘tease’ above $2K — but the monthly candle finished just below the historic level. Following a short consolidation, gold was back in action in late November, finally producing the first-ever monthly candle to close above $2,000.”

Yes, “Mr. Slammy” showed up on Sunday night and slammed the gold price after a hyperbolic jump to $2,150 — but that’s OK. That’s because…

“Once gold extends into blue skies, it’s highly unlikely the rally ends anytime soon,” Gunner says.

“Once gold extends into blue skies, it’s highly unlikely the rally ends anytime soon,” Gunner says.

“Remember, this breakout is years in the making. The bigger the base, the higher in space.

➢ Case in point: Bloomberg had a headline Monday morning: “Here’s How to Invest in Gold as It Hits an All-Time High.”

“This first move above $2K is only the beginning,” Gunner concludes. “Once we churn past some of this whipsaw action, a quick jump to $2,600 is possible before gold even thinks about consolidating.

“But before that, the miners will probably wake up and start to run. The VanEck Vectors Gold Miners ETF (GDX) has already cleared resistance at $30. We should look for it to take out those summer highs near $36 in short order.”

For more precious-metals trading ideas, check out Gunner’s latest video — released a little over 48 hours ago. There’s no hard sell here, just solid information you can put to work in your portfolio right away.

And if you like what you see, make sure to sign up for Gunner’s weekly segment called Top Trades Live. That way you’ll have access to all his briefings LIVE as they happen, every Tuesday at 11:00 a.m. Eastern.

![]() The Most Obvious “Reality Check” Ever

The Most Obvious “Reality Check” Ever

Gee, ya don’t say? “The big rate-cut trade is facing a reality check in markets,” says a dispatch from Bloomberg.

Gee, ya don’t say? “The big rate-cut trade is facing a reality check in markets,” says a dispatch from Bloomberg.

It was evident days ago that Mr. Market was getting too far out over his skis, anticipating the Federal Reserve would cut interest rates four times next year. Yes, the inflation rate is falling, but it’s not falling nearly as quickly as the Fed would like.

With reality setting in, the U.S. stock market spent much of this week moving sideways after a furious November rally.

Then again, it might have nothing to do with the Fed at all. Every rally needs time to consolidate and catch its breath before the next leg higher.

Indeed, the next leg higher might be underway today.

Indeed, the next leg higher might be underway today.

The S&P 500 is up two-thirds of a percent to 4,579 — only 15 points below Friday’s year-to-date closing high of 4,594. Meanwhile, the Nasdaq has powered past 14,300 for the first time in over four months, while the Dow is treading water a little over 36,000.

Gold is up slightly to $2,031. The Midas Metal’s resilience this week is impressive in light of a rally in the dollar. The U.S. dollar index has rallied sharply from below 102.5 to over 104 in the space of a week — but as mentioned off the top, gold’s been hanging tough over $2,000 the whole time.

Alas, silver has lost its grip on $24, the bid $23.80 at last check.

Crude is little moved from this time 24 hours ago — a barrel of West Texas Intermediate still near five-month lows, a little below $70.

![]() War in the Latin American Oil Patch?

War in the Latin American Oil Patch?

And yet, events are getting sporty in a corner of the world that’s home to the biggest oil discovery in many years.

And yet, events are getting sporty in a corner of the world that’s home to the biggest oil discovery in many years.

Last week, we alerted you to Venezuela’s designs on a sizable chunk of Guyana, the country just to its east. The dispute goes back to the 19th century — but it just happens to be heating up at a time that a huge oil discovery from 2015 turns out to be even bigger than first thought.

On Sunday, Venezuelans went to the polls to vote in a referendum about annexing the territory: supposedly 95% said yes.

On Tuesday, Venezuelan President Nicolas Maduro declared the annexation of the territory and mobilized the army.

Today, Bloomberg reports that “Guyana said it’s intensifying security measures and engaging the U.S. military to help it protect the oil-rich region of Essequibo, describing Venezuela’s intentions to grant oil exploration licenses in the area as a threat to its territorial integrity.”

“Washington is increasingly concerned over how far Nicolas Maduro may be willing to go,” reports the U.S. newspaper with the most thorough Latin American coverage, the Miami Herald.

“Washington is increasingly concerned over how far Nicolas Maduro may be willing to go,” reports the U.S. newspaper with the most thorough Latin American coverage, the Miami Herald.

On the one hand, Maduro might simply be looking for an excuse to impose martial law and guarantee election to another term next year. On the other hand, per the Herald, U.S. diplomats believe he’s “seeking leverage against the United States at the negotiating table by threatening an invasion of western Guyana.”

Madruo’s regime has been the target of stiff U.S. sanctions going back to the Trump administration — which tried and failed to engineer a coup in 2019. Team Trump formally recognized an “interim president” literally no one voted for — a pretense Team Biden kept up until 2022.

Amid sky-high gasoline prices last year, the Biden administration reached out to Maduro — offering sanctions relief in exchange for Maduro resuming talks with the opposition.

Sanctions relief would mean a resumption of Venezuelan crude exports to America — crude that would be pumped by the U.S. giant Chevron, the sticky, sulfury kind of crude that’s perfect for U.S. refineries.

But the talks have bogged down — in part because Venezuela continues to hold American citizens that Washington considers to be “wrongfully detained.”

In the context of stalled negotiations, a threatened invasion of Guyana amounts to a big bargaining chip.

But what would happen if Maduro actually invaded?

But what would happen if Maduro actually invaded?

“This is one of those snake pits to which U.S. and Royal Marines would go,” Paradigm’s energy and military expert Byron King said on our weekly conference call yesterday. “Except all U.S./U.K. forces are tied up elsewhere.” Imperial overstretch and all that.

Also, it would be a uniquely bad look for the anti-fossil fuel Biden administration to send in the troops. Sure, they could drone on about “territorial integrity” and “the rules-based international order.” But everyone outside the United States and Guyana would conclude that Biden was acting in service to Exxon Mobil — the lead developer of Guyana’s big oil find.

Seriously, it would be the subject of one of those resolutions at the United Nations General Assembly where 185 nations would vote to condemn and the only dissent would come from the United States, Israel and some flyspeck island in the Pacific.

Anyway, U.S. intervention or no, an invasion would not be good for Exxon Mobil’s share price.

It’s not a high risk, not yet — but it’s one we’ll continue to keep an eye on…

![]() Jamie Dimon’s Totally Objective Anti-Crypto Rant

Jamie Dimon’s Totally Objective Anti-Crypto Rant

Ugh, this guy…

Ugh, this guy…

“I’ve always been deeply opposed to crypto, Bitcoin, etc.,” JPMorgan Chase CEO Jamie Dimon said yesterday on Capitol Hill, after he was lobbed a softball question from Sen. Elizabeth Warren (D-Massachusetts). “The only true use case for it is criminals, drug traffickers… money laundering, tax avoidance.

“If I was the government, I’d close it down.”

Talk about a classic case of entrenched incumbents trying to use Big Government to throttle their competition. Crypto’s cousin, decentralized finance or DeFi, promises a world of banking without banks — and without banksters like Dimon. And yet, the assembled senators lapped it up like a hungry kitten.

Sorry if you’ve seen this rant before — but on Dimon’s watch, JPM did business for years with both Bernie Madoff and Jeffrey Epstein — and admitted to an unprecedented five criminal counts between 2014–2020.

Yet JPM’s board continues to keep him in its employ… CNBC interviews him almost as reverentially as they interviewed the late Jack Welch… and congresscritters give him a platform to libel innovative new competitors.

What was it I said a few days ago about a system that’s not worth preserving and not worth fighting for? Oh, yeah…

![]() Mailbag: Terror Trades, Refilling the SPR, the Tyrant I Forgot

Mailbag: Terror Trades, Refilling the SPR, the Tyrant I Forgot

On the subject of hinky market activity in the run-up to both the 9/11 attacks in America and the 10/7 attacks in Israel, we heard from a member of our Omega Wealth Circle…

On the subject of hinky market activity in the run-up to both the 9/11 attacks in America and the 10/7 attacks in Israel, we heard from a member of our Omega Wealth Circle…

“With regard to the 9/11 Commission, as I recall their wording was that there is no evidence of unusual trading by foreign entities — neatly ignoring the obvious answer that if it wasn't foreign traders, then it must have been U.S. ones. Because that would open a can of worms that nobody in the government wanted anyone to even consider.

“In Israel, there has been suspicion from the night of the attack that there must have been awareness in some circles of Israeli intelligence that an attack was planned, but that for whatever reason they elected to allow it to happen.

“It's all just more evidence for why the authorities are so determined to censor communications. They are not competent to hide all the loose ends of their dirty deeds, so they need censorship to cover them up after the fact.”

“So the Strategic Petroleum Reserve will now be refilled, correct?” a reader snarks at the news that oil is back below $70 a barrel.

“So the Strategic Petroleum Reserve will now be refilled, correct?” a reader snarks at the news that oil is back below $70 a barrel.

Dave responds: It appears the Biden administration is just now discovering that it’s emptied the SPR to such an extent that refilling it too quickly would damage the salt caverns in Louisiana and Texas where all that oil is held.

“We hope we can bring more capacity online at these price levels to buy as much as we can to refill,” Deputy Energy Secretary David Turk told Bloomberg TV this week.”We will buy back as much as we possibly can, but there are some physical constraints.”

In practical terms, that means the SPR level bottomed in July at 347 million barrels — and has risen to a mere 352 million in the week ended last Friday. At this time two years ago, it was still 601 million.

After I called out a couple of governors for ignoring their own COVID restrictions, a reader called me out, however gently…

After I called out a couple of governors for ignoring their own COVID restrictions, a reader called me out, however gently…

“In Bullet No. 5 on Tuesday, you missed Gov. J.B. Pritzker — Illinois’ next presidential hopeful.

“He used a private jet to go to Florida during COVID while Illinois was under lockdowns and even did some briefings from there trying to disguise his location.

“Plus he limited boaters to two people (who travel six in a minivan) since his boat is in Lake Geneva, Wisconsin, where there were no restrictions. Forgot that while nobody was supposed to work in Illinois, he had workers travel from Illinois to Wisconsin to work on building a house there.

“Don’t slight Illinoisans for our ability to develop corrupt leaders ever since someone took out Honest Abe.”

Dave responds: Mea culpa! I grew up in Illinois, still have family there and worked in a Chicago newsroom for eight years. How could I forget your fatass tyrant along with Prince Gavin and Big Gretch? I promise to do better!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets