Dollar Death Knell

![]() The “Doomsday Deal,” Revisited

The “Doomsday Deal,” Revisited

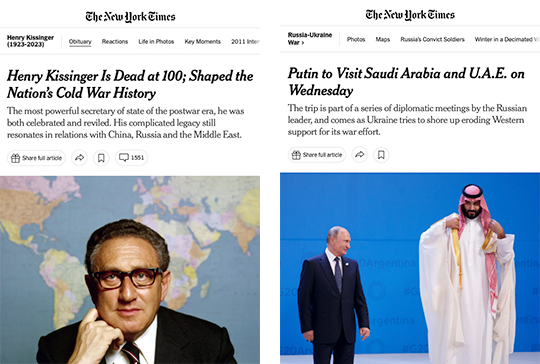

There’s a certain poetry to the juxtaposition of these two headlines in recent days…

There’s a certain poetry to the juxtaposition of these two headlines in recent days…

Presumably you’ve heard by now about Henry the K’s passing — if only because we shared a few choice memes about it last week.

The other, however, is probably news to you: Russian President Vladimir Putin will pay a call on the two big Gulf sheikdoms tomorrow — “saying he would discuss bilateral relations, oil and international affairs in Saudi Arabia and the United Arab Emirates,” per The New York Times.

Putin doesn’t get around much these days; since the invasion of Ukraine, he’s faced an international arrest warrant. He takes a risk traveling to any country that’s signed onto the International Criminal Court. That’s why he didn’t travel to the BRICS summit in South Africa earlier this year, attending virtually instead.

But there’s no such obstacle in Saudi Arabia and the UAE. What’s more, both countries will join the BRICS grouping come Jan. 1. Ditto for Saudi Arabia’s erstwhile arch-enemy Iran — whose president Putin will host in Moscow on Thursday, by the way.

The BRICS might be slow-walking a new gold-backed joint currency — but it’s obvious to all by now that they have an end-goal of “de-dollarization.”

How things have changed in 50 years — when Henry Kissinger cemented the so-called “petrodollar” arrangement between the United States and Saudi Arabia.

How things have changed in 50 years — when Henry Kissinger cemented the so-called “petrodollar” arrangement between the United States and Saudi Arabia.

This scheme emerged in the aftermath of the Arab oil embargo in late 1973 — a response to U.S. support for Israel in the Yom Kippur War. Oil prices quadrupled in a matter of weeks.

The following year, Kissinger midwifed a system under which Saudi Arabia agreed to price its oil in U.S. dollars and use its clout to get other OPEC nations to do likewise. In return, the U.S. government protected Saudi Arabia and its allies against foreign invaders and domestic rebellions.

In between the boycott and the advent of the petrodollar arrangement… Kissinger and crew briefly contemplated a U.S. invasion of Saudi Arabia.

In between the boycott and the advent of the petrodollar arrangement… Kissinger and crew briefly contemplated a U.S. invasion of Saudi Arabia.

As a much younger man, Paradigm’s macroeconomics authority Jim Rickards witnessed the hatching of this plan. If you’re familiar with Jim’s “Doomsday Deal” thesis, you already know the story — but it’s worth a revisit in light of recent headlines.

“In February 1974,” he recalls, “I was asked by Professor Robert W. Tucker of the Johns Hopkins School of Advanced International Studies to join him and four other foreign policy experts for a meeting at the White House.

“We were ushered through the security gate on Pennsylvania Avenue near West Executive Avenue, closest to the West Wing. We were then escorted to the office of Dr. Helmut Sonnenfeldt, Secretary of State Henry Kissinger’s deputy on the National Security Council.

“There, we engaged in a strategy discussion. Our focus that night was debating a full-scale military invasion of Saudi Arabia.

“The idea was we’d then secure their oil fields, pump enough oil to supply Western and Japanese needs and price it however we wanted. We debated the pros and cons of this plan, including potential supply disruptions and international reactions until well into the evening.”

Thank God it never came to that, right?

![]() The Rise… and Fall… of the Petrodollar Scheme

The Rise… and Fall… of the Petrodollar Scheme

Instead, Kissinger hit upon the petrodollar scheme — which President Nixon sealed in Saudi Arabia during a meeting with King Faisal that summer (only weeks before Nixon resigned in disgrace).

Instead, Kissinger hit upon the petrodollar scheme — which President Nixon sealed in Saudi Arabia during a meeting with King Faisal that summer (only weeks before Nixon resigned in disgrace).

As Jim explains it, it was more than just a straight-up deal of “you price oil in dollars and we’ll protect your regime.”

The dollars that the kingdom would collect in exchange for its oil? They’d be reinvested in U.S. Treasuries — and deposits in U.S. banks.

“U.S. banks would then ‘recycle’ the petrodollars deposited by Saudi Arabia as loans to emerging markets in Latin America, South Asia and Africa,” says Jim.

“In turn, those developing countries would purchase U.S., European and Japanese exports. That would ignite global growth. And, of course, to do that they’d need lots of oil. That meant oil demand would grow endlessly as would demand for dollars.”

The petrodollar deal restored global faith in the U.S. dollar after Nixon cut the dollar’s last tie to gold in 1971. It helped preserve America’s post-WWII prosperity into the 21st century.

“Now, almost 50 years later, the wheels are coming off,” says Jim. “The world is losing confidence in the dollar again, and the cracks in the dollar are already getting larger.”

“Now, almost 50 years later, the wheels are coming off,” says Jim. “The world is losing confidence in the dollar again, and the cracks in the dollar are already getting larger.”

As we’ve said from the beginning, U.S. sanctions in response to Russia’s invasion of Ukraine in February 2022 were a watershed. Freezing the dollar assets of Russia’s central bank prompted the leaders of dozens of other countries to wonder if the same thing could happen to them. And they didn’t want to wait around to find out.

Just in the first quarter of this year, for instance, they’ve undertaken the following de-dollarization steps. Take note especially of the first one…

- Jan. 17: Saudi Arabia declares it might accept currencies other than dollars in exchange for oil

- March 8: India and Russia agree to trade oil in non-dollar currencies

- March 28: Brazil and China agree to conduct all future trade in reais and yuan

- Also March 28: Total, the French oil giant, announces it bought liquefied natural gas from a Chinese firm using yuan. “Even our so-called allies saw the writing on the wall,” says Jim.

“Now, other U.S. allies like India, Pakistan and the United Arab Emirates have made deals with Russia or China to buy oil or other commodities in their own currencies.”

Oh, and Iraq — the oil-rich country Washington invaded 20 years ago.

“In a global political economy long dominated by the petrodollar, this could be the beginning of a seismic shift. Eventually a tipping point will be reached where the dollar collapse suddenly accelerates as happened to the British pound sterling last century.

“One of the best ways investors can anticipate this monetary earthquake is by buying gold.”

About which more in Bullet No. 3…

[Editor’s note: This week only, Jim is inviting you into his private meeting room — where he’ll introduce you to one of his most trusted financial contacts, a former hedge fund manager. “He’s one of the only investors in America that put together a winning investment portfolio in 2022,” says Jim.

“And today he wants to teach YOU how to conquer the next wave of economic volatility.” For access to Jim’s private meeting room, follow this link.]

![]() Gold’s Big Smash — and the Next Upside Target

Gold’s Big Smash — and the Next Upside Target

The good news is that for the moment, gold is still holding the line on $2,000 an ounce.

The good news is that for the moment, gold is still holding the line on $2,000 an ounce.

The bad news Emily told you about yesterday — or as veteran gold observer Ed Steer writes, “one of the most horrific, coordinated and collusive attacks in memory” on the gold price.

The all-time high — nearly $2,150 on Sunday night — is back to a much more modest $2,016. That’s another $13 loss today. Meanwhile, silver is only a penny away from breaking back below $24.

Volatility notwithstanding, Alan Knuckman — Paradigm’s eyes and ears at the Chicago options and futures exchanges — says the bounce off the September lows ultimately signals a rise to $2,440. Hold on tight…

Not much movement in the U.S. stock market today; the major averages are still digesting their big November gains.

Not much movement in the U.S. stock market today; the major averages are still digesting their big November gains.

At last check, the S&P 500 was nearly ruler-flat on the day at 4,568 — down 26 points from its year-to-date closing high of 4,594 set on Friday.

Crude is up a quarter to $73.29, but the reality is that oil continues to languish near lows last seen in early July.

Crypto keeps powering higher — Bitcoin over $42,000 for the first time since the big drop in the spring of last year. The next significant upside target would be the March 2022 peak over $47,000.

Treasury prices are rallying, pushing yields still lower. The yield on a 10-year T-note is now below 4.2% for the first time in three months — dramatically lower than the 5% peak in mid-October. Meanwhile, the yield on a 30-year bond is approaching 4.3%.

![]() T-Bonds: Window of Opportunity Starts Closing

T-Bonds: Window of Opportunity Starts Closing

It’s not too late to get into T-bonds — but the window of opportunity is starting to close, says Paradigm retirement specialist Zach Scheidt.

It’s not too late to get into T-bonds — but the window of opportunity is starting to close, says Paradigm retirement specialist Zach Scheidt.

Earlier this year, Zach went against the grain of conventional wisdom and said Treasuries were a buy. He’s since been vindicated: “The ETF that tracks the price of long-term bonds has gained 9% in November, and Treasurys just wrapped up their best month since the 1980s.”

Zach’s rationale was that the Federal Reserve was probably done with its cycle of interest-rate increases — which increasingly looks like the case. (The last one came in July; no one expects an increase at the next Fed meeting a week from tomorrow.)

“Inflation may still be a major problem for our economy and individuals alike,” Zach allows, “but it has slowed down. It’s also likely that we’ll see some political pressure to lower rates, considering high interest makes our country’s debt very expensive.

“So I think we’ll probably start to see rate cuts in the next year or two, especially if the economy shows signs of weakness.

“That means now is the time to buy long-term bonds. Not only will you lock in a high yield, but your bonds will also rise in value as investors begin to anticipate rate cuts,” says Zach.

“That means now is the time to buy long-term bonds. Not only will you lock in a high yield, but your bonds will also rise in value as investors begin to anticipate rate cuts,” says Zach.

Zach prefers you buy real bonds — they come with a face value of $1,000 each — as opposed to an ETF. “That way you'll know exactly what your coupon payments will be and when your bonds will mature, paying you $1,000 per bond.” In contrast, the price of an ETF fluctuates as interest rates rise and fall.

“With interest rates now above the rate of inflation, you're getting a great deal on the investment.

“And the potential for lower interest rates means that your bond could quickly surge higher once rates start falling.

“This would give you a chance to sell early at a higher price,” Zach concludes — “and reinvest the money into other opportunities that the market gives us.”

![]() Postscript: Rules for Thee, but Not for Me…

Postscript: Rules for Thee, but Not for Me…

Now for some unfinished business from the collapse of Credit Suisse…

Now for some unfinished business from the collapse of Credit Suisse…

Antonio Horta-Osorio lasted only nine months as chairman of the lumbering Swiss banking giant. He was forced out in January 2022 when it emerged he violated COVID quarantines — more than once.

Turns out he flew to London in July 2021 to take in the Wimbledon finals — and then to the European soccer championship at Wembley Stadium the same day. Once that jaunt became public, it also was revealed he broke Swiss quarantine rules with another trip on the jet to Spain.

When Credit Suisse failed in March of this year under the watch of Horta-Osorio’s successor, it was taken over by Swiss rival UBS.

Now comes word that UBS is unloading the jet Horta-Osorio used for his illicit excursions: “The Dassault Falcon 7X was sold in recent weeks to a German subsidiary of French bank Societe Generale that specializes in aircraft leasing,” says a Financial Times scoop. “The sale price was not disclosed.

“People with knowledge of the decision said the sale had been planned by Credit Suisse’s management team before its rescue by UBS this year. UBS executives have pushed through the sale after criticizing Credit Suisse’s high risk-taking and high-reward culture.”

Yeah, OK, whatever they want to say to feel better about themselves.

To be sure, the COVID restrictions were a joke. But Horta-Osorio’s use of a corporate jet to skirt the restrictions while everyday folks had their freedom of movement limited? It speaks volumes about the power elite and its culture of impunity. (Lookin’ at you, Govs. Newsom and Whitmer…)

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets