Dollar Death Spiral Accelerates

- BRICS: Who says it was a nothingburger?

- What’s next for BRICS currency (and the USD)?

- Who will be “the Bud Light of masks”?

- Powell: Put this in your Jackson Hole

- Comic relief.

![]() BRICS: Who Says It Was a Nothingburger?

BRICS: Who Says It Was a Nothingburger?

“What happened?!? You know, Biden’s 9/11 moment??? What a dud,” a reader writes. “Methinks Jim Rickards needs to make some adjustments to his fabulous financial computer program and forecasting.”

“What happened?!? You know, Biden’s 9/11 moment??? What a dud,” a reader writes. “Methinks Jim Rickards needs to make some adjustments to his fabulous financial computer program and forecasting.”

You don’t think what happened yesterday was an earthquake, sir? Saudi Arabia turning its back on Washington, D.C.? The formation of an economic bloc comprising 35% of global GDP and 46% of the world’s population?

This expert in the metals-and-mining space would beg to differ…

He might have a point. Nvidia delivered blowout quarterly numbers Wednesday afternoon — a development that by all rights should have powered the U.S. stock market higher yesterday, in the same way NVDA’s blowout numbers in May powered the market higher throughout June and July.

Instead, in the shadow of the BRICS+ Six and no other news to speak of… the S&P 500 fell 1.3%, the Nasdaq tumbled 1.9% and NVDA itself could only eke out a 0.1% gain.

As for the IMPACT trades that Jim and his team laid on in The Situation Report… there was no promise they’d rocket higher the instant the announcement was made. That’s why Jim said “the next 30 days” would be “the best time to trade currencies that we’ve seen in decades.” Plenty of time for events to play out.

Meanwhile, still more experts are affirming Jim’s outlook…

“The Biden administration’s and other Western alliance powers’ policies are a recipe for slow economic suicide. This expanding alliance should be a loud wake-up call,” writes Carol Roth.

“The Biden administration’s and other Western alliance powers’ policies are a recipe for slow economic suicide. This expanding alliance should be a loud wake-up call,” writes Carol Roth.

Ms. Roth is a former investment banker and author of the just-published You Will Own Nothing: Your War with a New Financial World Order and How to Fight Back.

In a column at The Blaze, she succinctly sums up the state of play: “After the U.S. went off the gold standard, with the dollar as the pre-eminent global currency, oil around the world was priced in dollars.

“In 1974, Saudi Arabia was the largest producer of oil and de facto head of the Arab oil-exporting countries. The U.S. and Saudi Arabia made what was heralded as a ‘milestone pact.’ Among the points was that the U.S. would support the Saudis militarily and the Saudis would plow their excess U.S. dollars from oil exporting (‘petrodollars’) back into U.S. Treasury bonds.

“With oil priced in U.S. dollars and substantial demand for oil, as well as the excess U.S. dollars being plowed back into Treasurys by pact, there was naturally massive demand for dollars that ultimately provided cheap financing to the U.S., including to the U.S. government for its massive expansion.”

Now it’s all coming apart. It was inevitable — but that makes it no less significant.

![]() What Next for the BRICS Currency — and the Dollar?

What Next for the BRICS Currency — and the Dollar?

“As a result of this expanded membership, the new BRICS currency will emerge in the year ahead,” Jim Rickards wrote to his Strategic Intelligence subscribers yesterday…

“As a result of this expanded membership, the new BRICS currency will emerge in the year ahead,” Jim Rickards wrote to his Strategic Intelligence subscribers yesterday…

It is true there was no Big Announcement about a common currency that would further undermine the dollar’s role as the globe’s reserve currency.

But that’s still undeniably the trajectory. In a speech, Brazil’s President Luiz Inacio Lula da Silva said a common trading currency is the only way the bloc can achieve more “payment options and reduce our vulnerability” to a weaponized dollar.

In a final statement, South African President Cyril Ramaphosa said, “The summit agreed to task the BRICS finance ministers and/or central bank governors, as appropriate, to consider the issue of local currencies, payment instruments and platforms and report back to the BRICS leaders by the next summit."

By the way, next year’s summit will be held in… Russia. Who’s the “pariah state” now?

The BRICS+ Six want out from under the dollar’s thumb. Simple as that. As we’ve said for years, it’s a story with a long arc — but it will gather speed over the next 12 months.

The BRICS+ Six want out from under the dollar’s thumb. Simple as that. As we’ve said for years, it’s a story with a long arc — but it will gather speed over the next 12 months.

Jim Rickards again: “All current and prospective BRICS members and the entire Global South including members of the Shanghai Cooperation Organization and the Eurasian Economic Union are suffering from the weaponization of the U.S. dollar and the threat that their dollar-denominated reserves may be frozen by the U.S. as recently happened to Russia.

“Also, the expanded BRICS membership marks the beginning of the end of the petrodollar era. Membership of Saudi Arabia in the BRICS is a large step in that direction. This is why the admission of new members and the launch of a new currency cannot be viewed in isolation. They are two parts of a common project. The expanded membership is precisely what makes the new currency more feasible.”

Jim will have expanded commentary for his subscribers later today; look for highlights here on Monday.

Before we move on, we should be careful to place the blame where it belongs: It’s not on Biden alone.

Before we move on, we should be careful to place the blame where it belongs: It’s not on Biden alone.

“There is a global alliance forming against the United States of America because of the absolutely weak, pathetic and the most corrupt president we have ever had in U.S. history,” complains retired Gen. Michael Flynn, who was Donald Trump’s first national security adviser.

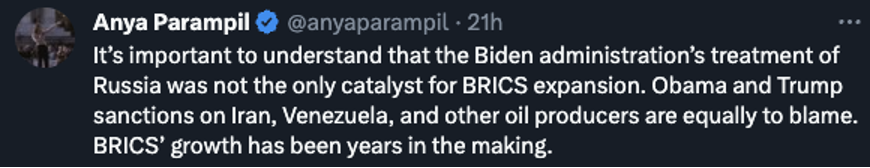

Anya Parampil, one of the few American reporters covering the BRICS summit in Johannesburg, issued a necessary corrective…

Looking forward, “a movement away from the dollar — even in slow motion — will mean a rising cost of living for Americans,” writes Ryan McMaken of the Mises Institute.

Looking forward, “a movement away from the dollar — even in slow motion — will mean a rising cost of living for Americans,” writes Ryan McMaken of the Mises Institute.

“With fewer foreigners holding on to dollars, the U.S. regime’s current runaway monetary inflation will create more domestic price inflation. In other words, movement away from the dollar will mean the U.S. regime must engage in less monetization of the nation’s debt if it wishes to avoid runaway inflation.

“It also likely will lead to a need to pay higher interest rates on U.S. government bonds, and that will mean a need for more taxpayer money to service the debt. It will mean that it will become more difficult for the U.S. regime to finance every new war, program and pet project that Washington can think up.”

It’s our new reality. Get used to it.

![]() Who Will Be “the Bud Light of Masks”?

Who Will Be “the Bud Light of Masks”?

We’ll have more about inflation shortly, but first… this new lockdown thing is getting serious.

We’ll have more about inflation shortly, but first… this new lockdown thing is getting serious.

We dropped an initial warning on Tuesday. Today we’re seeing scattered reports of school reopenings postponed in Kentucky and Texas — even though COVID never posed a meaningful threat to children, even during the initial outbreak.

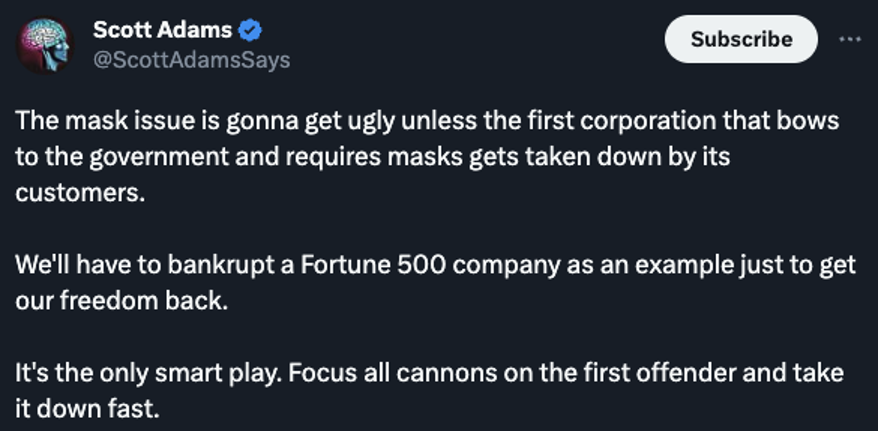

Also on Tuesday, former Surgeon General Jerome Adams tweeted from an airport — masked up. Which brought the following response from Dilbert creator Scott Adams.

Your editor is no Scott Adams fan, but I’ve got nothing to quibble with here.

Meanwhile, Tucker Carlson whiffed on the chance to hold Donald Trump’s feet to the fire about the initial round of COVID tyranny.

Meanwhile, Tucker Carlson whiffed on the chance to hold Donald Trump’s feet to the fire about the initial round of COVID tyranny.

The subject did not come up during what nearly everyone agrees was a softball interview Wednesday, conducted as “counterprogramming” to the Fox GOP debate that Trump sat out.

(Nor, for that matter, was there anything about the insane ramp-up of federal spending on his watch, both before and after the virus arrived. We’re still living with the inflationary consequences.)

It is especially disappointing in light of the interactions Carlson and Trump had at a crucial moment during the original outbreak. According to a recent biography, Tucker, by Chadwick Moore, Carlson ventured to Mar-a-Lago on March 7, 2020 — telling Trump not to minimize the threat.

A couple of days later, he went on Fox to say, “It’s definitely not just like the flu… The Chinese coronavirus will get worse; its effects will be far more disruptive than they are right now. That is not a guess; it is inevitable no matter what they’re telling you. Let’s hope everyone stops lying about that, and soon.”

According to biographer Moore, Carlson now regards his role in this debacle as the “greatest public mistake he ever made.”

As Jeffrey Tucker wrote recently for our sister e-letter The Daily Reckoning, “We should not underestimate Tucker’s influence on all of this. The lockdowns — the wrecking of American liberty — certainly needed bipartisan and broad ideological support. If this became a left-right issue, it simply could not work.”

The Trump interview with Carlson this week could have been an opportunity for the two men to publicly come to terms about what Trump allowed to happen on March 16, 2020 — and Carlson’s role in facilitating it. It would have been a moment of accountability, of resolution, of healing.

But it wasn’t to be. Now comes the whirlwind.

At least we can try to squeeze a grim chuckle or two out of it.

![]() Powell: Put This in Your Jackson Hole

Powell: Put This in Your Jackson Hole

If Mr. Market was hoping Federal Reserve Chair Jerome Powell would start to ease up on the Fed’s inflation-fighting efforts… he’s mighty disappointed today.

If Mr. Market was hoping Federal Reserve Chair Jerome Powell would start to ease up on the Fed’s inflation-fighting efforts… he’s mighty disappointed today.

This morning Powell delivered the customary Friday speech during the Kansas City Fed’s annual confab of central bankers in Jackson Hole, Wyoming. In what should have surprised no one, he said inflation “remains too high” and “we are prepared to raise rates further.”

The Fed has an inflation target of 2% and the Fed’s preferred measure of inflation is still at 4.1%. Throughout the Fed’s rate-raising cycle the last year and a half, Powell has become fond of saying, “Without price stability, the economy doesn’t work for anyone.”

Then again, if Mr. Market is indeed disappointed, he’s doing a reasonably good job of hiding it.

Then again, if Mr. Market is indeed disappointed, he’s doing a reasonably good job of hiding it.

At last check, the Dow is marginally in the green at 34,145… the S&P 500 is down a skootch to 4,372… and the Nasdaq is down a third of a percent to 13,421. If these numbers hold by day’s end, the S&P will end the week no better off than it was in mid-June.

Precious metals are losing ground but for the moment gold is still above $1,900; silver’s grip on $24 is looking more tenuous. Crude has rallied nearly a buck to $79.89.

Futures traders are pricing in a nearly 50-50 probability the Fed will raise rates one more time between now and the end of the year.

Three more meetings are scheduled, the next on Sept. 19–20. As a practical matter, there’s no telling what the Fed will do then until we see the next job numbers a week from today and the next inflation numbers on Sept. 13. Anyone who says otherwise, run the other way.

![]() Comic Relief

Comic Relief

It’s been a heavy week. Let’s try to end things with some one-liners, aided by our readership…

It’s been a heavy week. Let’s try to end things with some one-liners, aided by our readership…

Reacting to our item on Monday about how there’s only one remaining new car you can buy for under $20,000, a reader writes: “It's not an automobile; it's just a Mirage!”

On the subject of “AI drift,” in which ChatGPT appears to be getting dumber with time: “Wow, I can hear the excuses (and T-shirts) coming in the future younger generation: ‘I can't come into work today — I have a severe case of AI drift.’”

Finally, one more courtesy of the Fark website — where submitters of links try to one-up each other with snarky headlines.

Upon the news that the founding families who own the sandwich chain Subway are selling out to private equity player Roark Capital, the reaction is:

“Subway to be sold to Roark, which is also the sound you make after you eat Subway.”

Have a good weekend!

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets