Clueless In Canada

- Stupid lawmaker tricks, Canadian edition

- Crypto chaos

- From the follow-up file

- ChatGPT is having brain fog

- Alexa, when will World War III start?

![]() Stupid Lawmaker Tricks, Canadian Edition

Stupid Lawmaker Tricks, Canadian Edition

Every new law and regulation runs up against the law of unintended consequences — as Canadian fire victims are learning the hard way.

Every new law and regulation runs up against the law of unintended consequences — as Canadian fire victims are learning the hard way.

As the weekend approaches, we’ll avert our gaze from next week’s BRICS summit just long enough to take stock of some other items that have caught our eye.

Up first: Maybe you’ve heard, or maybe you’ve not, but the latest wildfire outbreak in Canada this summer is in the remote Northwest Territories. The capital Yellowknife, population 20,000, is under evacuation orders — with a deadline of noon Mountain Time today.

But for many folks in harm’s way, information is sparse — because in Canada, news websites can’t post on Facebook or Instagram.

Earlier this summer, Canada’s parliament passed a bill requiring giant platforms like Meta and Google to pay news publishers for content — a ham-fisted attempt to shore up the revenues of print newspapers and broadcasters.

Meta called the law "fundamentally flawed legislation that ignores the realities of how our platforms work.” The company complied with the law in the simplest, most direct way possible: As of Aug. 1, news sites could no longer post links to their articles on Facebook or Instagram.

Result? “We have to screenshot parts of a news story and post that as a picture,” says Poul Osted. Osted lives in tiny Fort Resolution, and he’s trying to keep up with family members who fled two hours down the road to Hay River — which is now also under threat.

"Oftentimes this means you don't get the whole story,” he tells the BBC, “or have to go searching the web for verification” — for instance, whether one or another highway is blocked.

If this all sounds weird and familiar, it’s because back in June we told you about very similar legislation pending in California.

If this all sounds weird and familiar, it’s because back in June we told you about very similar legislation pending in California.

Gee, they never have wildfires or other natural disasters there, do they?

The California Journalism Preservation Act is very much like the Canadian law. And it makes no more sense than the Canadian law.

Much as it pains us to take the side of censorship-happy Big Tech, fairness and common sense demands we do so in this instance. It’s ludicrous to suggest that media websites should pick up traffic from Google or Facebook that they wouldn’t get otherwise — and expect to be paid for it too!

As we mentioned at the time, the Golden State legislation passed the Assembly overwhelmingly. But as we understand it, it’s not on the Senate docket until 2024.

Maybe between now and then the Canadian experience will give a lawmaker or two second thoughts…

![]() Crypto Chaos

Crypto Chaos

The most dramatic market story of the last 24 hours is with Bitcoin…

The most dramatic market story of the last 24 hours is with Bitcoin…

Bitcoin took a sharp drop shortly before lunchtime on the East Coast yesterday — and a much sharper drop closer to dinnertime. It’s since recovered above $26,000 but the damage is done; BTC still sits near two-month lows and $30,000 is a distant memory.

The proximate event was news linked to the mercurial Elon Musk: The Wall Street Journal published a deep dive into the financials of SpaceX — which are mostly a black box, seeing as it’s not publicly traded. Tucked within the story was the tidbit that SpaceX had sold off its Bitcoin holdings — after writing down the value of those holdings by $373 million over the last two years.

But that’s not the only wild card in play for Bitcoin at this instant.

But that’s not the only wild card in play for Bitcoin at this instant.

Sometime today or perhaps next week a federal court is set to rule on whether Grayscale Investments can launch the first Bitcoin ETF.

The Securities and Exchange Commission has been dead set against the idea for more than five years… but more than a year ago, Grayscale sued the SEC.

“If Grayscale is successful in their case,” says Paradigm crypto evangelist James Altucher, “it would open the door to the launch of the first of many crypto ETFs in U.S. markets. I would not be surprised to see a big jump in the price of Bitcoin and other cryptocurrencies if Grayscale wins the case. A loss for Grayscale could have the opposite effect.

“For investors looking to trade a high-volatility scenario, the upcoming Grayscale decision could provide the rapid price change that adrenaline junkie traders love.”

Longer term, James is still bullish on Bitcoin… but much more bullish on Ethereum.

OK, we almost have our 5% pullback in the stock market now.

OK, we almost have our 5% pullback in the stock market now.

As a reminder, the S&P 500’s year-to-date peak came on July 31 at 4,589. Checking our screens this morning, the S&P sits at 4,360. That’s a drop of 4.99%

Pullbacks of 5% are not uncommon; Paradigm chart hound Greg Guenthner says we get them three or four times a year. The last one? Back in February and March.

Nothing about this pullback should be cause for hand-wringing, but of course the financial media are having hair-on-fire reactions this week to every little thing — rising interest rates, trouble in the Chinese financial system, the Britney Spears divorce.

“We're coming off a red-hot first six months,” Greg writes to his Trading Desk readers this morning. “Stocks (especially tech) were very overextended coming into August, where we should be seeing some seasonal weakness.”

Amid continued dollar strength, gold is likely to end the week below $1,900 and silver below $23. Crude, for the moment, is hanging in there over $80.

![]() The Follow-Up File

The Follow-Up File

OK, maybe “solid state” battery technology is further along than we thought.

OK, maybe “solid state” battery technology is further along than we thought.

Last month we took note when Toyota pushed back its timeline for fast-charging next-generation electric vehicle batteries — from 2025 to 2027. Only then would the company offer EVs with a range of 750 miles and a charging time of 10 minutes or less. And some experts said even that goal looked ambitious.

Still, solid-state batteries might make up 10% of the global market by 2030, according to Mathias Miedreich, CEO at Umicore. Umicore is one of the world’s biggest producers of battery metals. Commercial development “has really accelerated in the last six to nine months,” he tells the Financial Times. “The first phase of industrialization will start somewhere in 2025–27.”

Granted, Miedreich is “talking his book.” But here’s the thing: According to a Motor Trend article earlier this year, solid-state batteries might require even more lithium than conventional EV batteries — possibly by a factor of as much as 10X.

We spotlighted the growing demand for EV battery materials yesterday: Today’s development is just reinforcement that the story’s not going away.

The Biden administration is going ahead with new tariffs on metals used in food cans.

The Biden administration is going ahead with new tariffs on metals used in food cans.

We gave you a heads-up about this in our Saturday edition toward the end of last month. Now comes word that the Commerce Department has concluded that steelmakers from China, Germany and Canada sold their tinplate steel at “unfairly” low prices.

The final level of the tariff won’t be set until January… but right now the levy on Chinese products could be more than double their import value — 122.52%. Much lower tariffs are likely for German and Canadian products.

The administration is acting at the behest of Cleveland-Cliffs Inc. — owner of one of the few remaining tinplate factories in the United States. (This is the same Cleveland-Cliffs that offered to buy U.S. Steel earlier this week; U.S. Steel rejected the bid.)

Seeing as China makes up 14% of U.S. tinplate imports… while Germany and Canada comprise another 30%... you can expect the price of canned goods to rise. Food manufacturers are already warning as much; might want to stock up on tuna, soup and whatnot.

![]() ChatGPT Is Having Brain Fog

ChatGPT Is Having Brain Fog

“OpenAI has consistently denied any claims that GPT-4 has decreased in capability,” says an article at Ars Technica. This was in response to a Stanford-UC Berkeley study with some eye-opening findings.

“OpenAI has consistently denied any claims that GPT-4 has decreased in capability,” says an article at Ars Technica. This was in response to a Stanford-UC Berkeley study with some eye-opening findings.

As Paradigm science-and-technology authority Ray Blanco explains, “[Researchers] asked ChatGPT to identify prime numbers as well as happy numbers, which in number theory are numbers that eventually reach one when replaced by the square of each digit,” he explains.

“They performed similar tests in March and June of this year with both the current version, Chat GPT-4, and the previous version, Chat GPT-3.5.

“In many cases 3.5 improved while GPT-4 got worse,” says Ray.

“When testing ChatGPT’s math capabilities in June, ChatGPT was asked, ‘Is 17,077 a prime number? Think step by step.’ When asked for step-by-step reasoning, it is supposed to provide its ‘Chain-of-Thought.’

“Not only did the chatbot provide the incorrect answer,” he notes, “it also failed to provide its reasoning.”

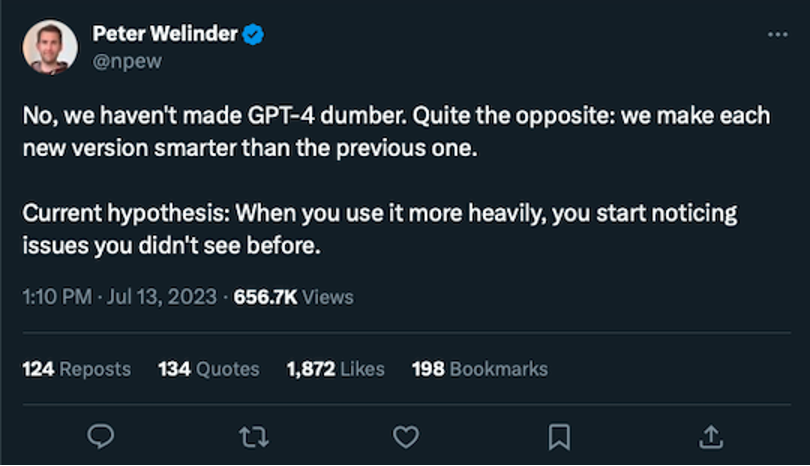

OpenAI’s VP of Product Peter Welinder took exception to the Stanford-UC Berkeley study via Twitter (or “X”)...

Ray, however, posits: “An AI system performing worse over time is part of something known as AI Drift.

Ray, however, posits: “An AI system performing worse over time is part of something known as AI Drift.

“Specifically, AI Drift refers to a system straying from its original purpose through self-teaching. This doesn’t always mean it performs worse, or gets dumber, but it seems to develop different priorities.

“So what went wrong?” Ray asks. “Did we break ChatGPT, or did it do a bad job of teaching itself?

“The exact details of the large language model (LLM) that powers ChatGPT isn’t public, so experts are forced to theorize,” he says.

On Wednesday, we highlighted OpenAI’s monetization woes. Now? Ray concludes: “A new obstacle the AI pioneers are facing is that, contrary to expectations, ChatGPT may actually be getting… dumber.”

![]() Readers Write: When Will World War III Start?

Readers Write: When Will World War III Start?

“Please address this,” a reader implores: “Ask Alexa when World War III will start and how.

“Please address this,” a reader implores: “Ask Alexa when World War III will start and how.

“The powers that be always tell us what is coming however it seems no one cares or is not paying attention.”

Dave responds: Are you asking specifically what Alexa would say? Because I’m one of those paranoid oldsters who doesn’t use voice-activated technology for anything.

If you’re making a more general inquiry about World War III… Jim Rickards offered up some interesting thoughts this week to Insider Intel readers on the topic of when the previous world war began.

Of course, American involvement began in December 1941 with the attack on Pearl Harbor. And history books typically date the start of the conflict with Germany’s invasion of Poland in September 1939.

“The Chinese can be forgiven for saying both dates are wrong,” Jim wrote. “The Chinese look to the invasion of Manchuria by Japan on Sept. 18, 1931 as the real start of World War II. Closer to the German invasion of Poland, one might cite the Nanjing Massacre, also called the Rape of Nanjing, on Dec. 13, 1937, involving 200,000 innocent civilians killed and over 20,000 rapes condoned by the Japanese military.”

Further back in history, the Balkan Wars of 1912–13 presaged World War I.

Jim avers that we might well be in another one of these periods that historians will look upon as precursors to a global conflict. Of course there’s Ukraine, but there’s also the incipient conflict shaping up in West Africa — to say nothing of Washington and Beijing rattling sabers over Taiwan.

And Jim says keep an eye on Pakistan — where the current regime has imprisoned the popular former Prime Minister Imran Khan. “Chaos in Pakistan is inherently threatening at a global level because it is a nuclear armed power in a continual standoff with the nuclear armed India.

“Perhaps these conflicts will resolve themselves in the fullness of time. Perhaps not. For now, they are individually threatening (because of escalation) and bear an eerie resemblance to the confluence of conflicts that presaged the two greatest wars in history.”

On the heels of our item in yesterday’s edition about restaurants tacking on surcharges for employee health insurance, a reader writes…

On the heels of our item in yesterday’s edition about restaurants tacking on surcharges for employee health insurance, a reader writes…

“Around our locale, restaurants have begun to add surcharges to a bill if you pay with a credit card. Health insurance? Credit card? Soliciting tips for counter service? What's next?”

Dave responds: Well, don’t forget every merchant — large or small — has to pay “interchange fees” of 2–3% every time you swipe your card.

In general, when I transact with nearby businesses, I try to use cash. The one exception I usually make is for restaurants where you pay the server at the table.

Even at restaurants where you pay at the counter, I tend to pull out cash. Helping small business owners avoid interchange fees is one small way I feel as if I’m cultivating the ecosystem of the local economy.

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. Moments ago, Jim Rickards added a brand-new currency trading alert to his model portfolio.

That’s in addition to the three that he described to viewers on Tuesday night.

“I believe the next 30 days could be the best time to trade currencies that we’ve seen in decades,” says Jim – and it’s all because of what’s going down at the BRICS summit starting next Tuesday.

Similar opportunities in the past have generated gains as high as 471% in three weeks… 500% in just over a week… even 3,200% in only eight days.

But you’ll want to be positioned before the BRICS summit convenes on Tuesday. Follow this link to learn how to access Jim’s brand-new currency trade alerts.