Dollar Denial

- Waking up to BRICS: Too little, too late

- End of an era (interest rates)

- The U.S. oil boom was fun while it lasted

- Green delusions: Metal shortages are inevitable

- Uhhh… Health insurance surcharges on your meal?

![]() Waking up to BRICS: Too Little, Too Late

Waking up to BRICS: Too Little, Too Late

With only five days to go before the BRICS summit, mainstream media and finance are starting to wake up to reality.

With only five days to go before the BRICS summit, mainstream media and finance are starting to wake up to reality.

“BRICS leaders meet in South Africa next week,” says the Reuters newswire, “to discuss how to turn a loose club of nations accounting for a quarter of the global economy into a geopolitical force that can challenge the West's dominance in world affairs…

“Few details have emerged about what they plan to discuss, but expansion is expected to be high on the agenda, as some 40 nations have shown interest in joining, either formally or informally, according to South Africa. They include Saudi Arabia, Argentina and Egypt.”

Meanwhile, “a plan by the BRICS group of emerging-market nations to look at a joint currency has got investment banks examining whether that’s any threat to the global dominance of the dollar,” reports Bloomberg.

Meanwhile, “a plan by the BRICS group of emerging-market nations to look at a joint currency has got investment banks examining whether that’s any threat to the global dominance of the dollar,” reports Bloomberg.

Bloomberg spotlights a report from ING, the Dutch financial-services giant. “We suspect,” says the report’s executive summary, “the subject of de-dollarization might gain some traction this summer when senior leaders of the BRICS nations meet in South Africa on Aug. 22–24.

“At the top of the summit’s agenda is the proposed expansion of this geopolitical grouping and perhaps some proposals relating to a common payment system in BRICS currencies.”

But ING concludes that the dollar has nothing to worry about. As Bloomberg sums up, “While the dollar’s demise has been mooted many times in recent years, so far other pretenders have been competing amongst themselves and there’s no conclusive evidence for a structural dollar decline, they say.”

So while the mainstream isn’t exactly clueless… they’re still fundamentally in denial.

So while the mainstream isn’t exactly clueless… they’re still fundamentally in denial.

As you know, Jim Rickards believes next Tuesday’s meeting could amount to “Biden’s 9/11 moment,” so great could be the shock factor. (And Joe Biden will own it because it’s the BRICS’ response to unprecedented Western sanctions slapped on Russia last year.)

“This August meeting is by far the most important BRICS meeting since the founding of the organization in 2006,” Jim wrote yesterday in an email from the Paradigm Pressroom.

“At this summit the BRICS are expected to accept Saudi Arabia into their alliance, and I believe the Saudis could announce a deathblow to the U.S. dollar.”

And that, Jim is convinced, will be the catalyst for a $7.5 trillion global economic shock wave. That’s how much money he believes will change hands in the hours after the announcement.

“I don’t know if there will be a better time to profit from currency wars this entire decade,” he says.

=

Which is why at his “Biden’s Final Deathblow to America” event on Tuesday night, Jim described three currency trades he believes are set to be the biggest winners of this new “currency contagion.”

You can see the fruits of Jim’s research right here. Give it a look now… because with the summit starting next Tuesday, Jim says we’re looking at the potential for “decades’ worth of gains in the coming weeks.”

![]() End of an Era (Interest Rates)

End of an Era (Interest Rates)

Get used to it: It’s finally safe to say we’ve embarked on a new decades-long cycle of rising interest rates.

Get used to it: It’s finally safe to say we’ve embarked on a new decades-long cycle of rising interest rates.

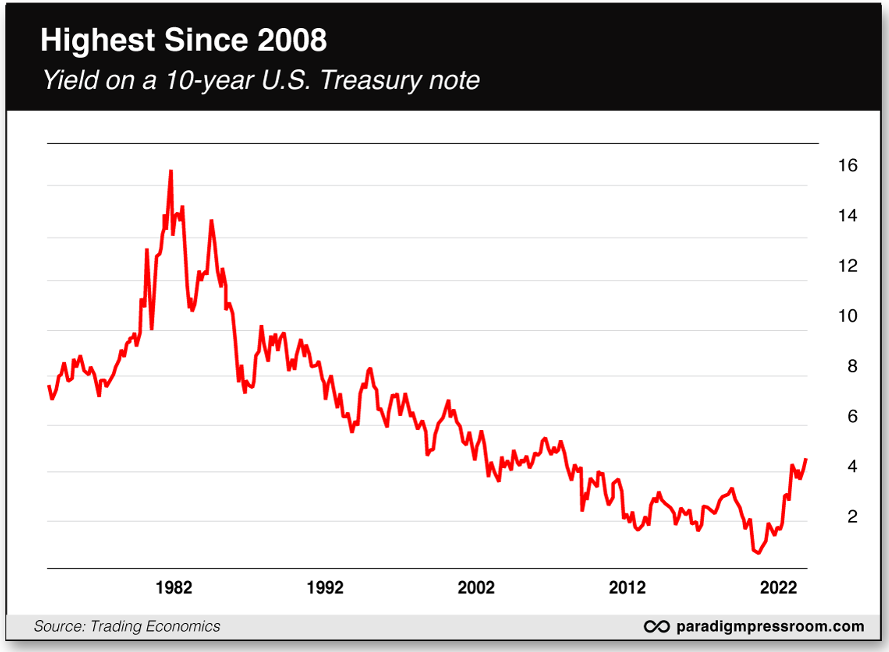

Yesterday, the yield on a 10-year U.S. Treasury note reached 4.26% — the highest since June 2008, two months before the global financial crisis went critical.

This morning, it’s even higher than that.

It’s not just that the ultralow interest rates of the last 15 years are now a thing of the past. Research by veteran market strategist Louise Yamada finds that interest rates move in long cycles of roughly 80 years. The peaks are short and sharp — you can see the peak near 16% in late 1981 — but the valleys can take as long as 14 years to become apparent.

Many “experts” were ready to say we hit bottom in 2012, when the 10-year yield dipped below 1.4%. And again in 2016, when it reached the same level.

In reality, absolute bottom didn’t come until three years ago amid the pandemic tumult — about 0.5%. From here, it’s up, up and away for at least the next 20–25 years. Not in a straight line, of course, but that’s the trend.

In the shorter term, this morning’s Wall Street Journal frets that “with the 10-year yield still well below the level of short-term interest rates set by the Fed, some analysts see ample room for it to keep climbing — a development that could lead to unexpected disruptions, as investors are forced to unwind wagers based on projections for lower yields.”

As a result, those rising rates are among several crosscurrents pulling down the U.S. stock market this month — although for the moment the sell-off is taking a rest.

As a result, those rising rates are among several crosscurrents pulling down the U.S. stock market this month — although for the moment the sell-off is taking a rest.

In fact, the Dow is marginally in the green this morning at 34,811. The S&P 500 is flat at 4,403 — now down 4% from its July 31 peak. The Nasdaq — packed with tech stocks that rely on low interest rates to fund their growth — is down another half-percent to 13,406.

Meanwhile, a strengthening dollar has been bearish for gold. The Midas metal slipped to a five-month low under $1,900 yesterday — and remains there today. Silver has rallied a bit to $22.67.

Crude dipped below $80 yesterday after the Energy Department’s weekly inventory numbers… but sure enough, it’s already rebounded past $81.

Bitcoin is looking ugly — slipping suddenly below $28,000 for the first time in eight weeks.

As for the day’s economic numbers…

- First-time unemployment claims: Down in the week gone by to 239,000. The labor market continues loosening, but not much

- Mid-Atlantic manufacturing: Back in positive territory for the first time in a year at plus 12, according to the Philadelphia Fed Manufacturing Index

- Leading economic indicators: From where we sit, this is the big one — posting a 16th straight month of decline. Thus the Conference Board, which crunches these numbers, projects a “mild contraction” in the economy late this year or early next.

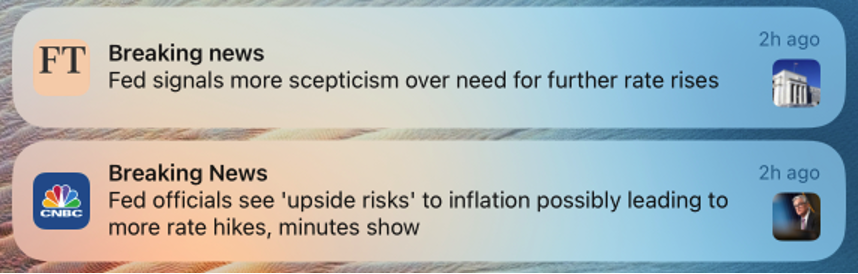

The Federal Reserve sure had fun jerking the media’s chain yesterday. Get a load of these two completely different takes on the minutes from the Fed’s July 26 meeting…

The Federal Reserve sure had fun jerking the media’s chain yesterday. Get a load of these two completely different takes on the minutes from the Fed’s July 26 meeting…

But as we always say, Fed “minutes” are not like the minutes from your local zoning commission. They’re not an objective record of who said what; they’re a document carefully crafted to generate a desired reaction from the media and the markets.

➢ Recovered history: Yesterday’s Fed minutes are reminiscent of the first-ever televised press conference by a U.S. president — Dwight Eisenhower in 1955. As the story goes, White House press secretary James Hagerty was apprehensive about one of the questions that was likely to come up. Ike assured his trusted aide, “Don’t worry, Jim, I’ll just confuse them.”

More clarity might come when Fed chair Jerome Powell speaks during the Fed’s annual confab in Jackson Hole, Wyoming — that’s a week from tomorrow.

But as we’ve said for a couple of weeks now, the real tell for the Fed’s intentions will be the next job number (Sept. 1) and the next inflation report (Sept. 13) ahead of the next Fed meeting on Sept. 19–20.

![]() The U.S. Oil Boom: Fun While It Lasted

The U.S. Oil Boom: Fun While It Lasted

The miracle of American shale oil has just about run its course.

The miracle of American shale oil has just about run its course.

Between 1999–2011, U.S. oil production was mired below 6 million barrels a day. Then the oil industry figured out how to profitably extract oil from “tight” shale formations with techniques like horizontal drilling and hydraulic fracturing — aka fracking.

U.S. oil production zoomed from 6 million barrels a day in 2012 to a peak of over 13 million just before lockdown in early 2020. As of last week, the figure hit a post-pandemic high of 12.7 million.

But this is as good as it gets, says a report from the energy research firm Enverus. Shale production is falling faster than expected, and anyone expecting a new production surge is dreaming.

“The industry’s treadmill is speeding up, and this will make production growth more difficult than it was in the past,” says Enverus managing director Dane Gregoris.

No one should be surprised by this development: As Paradigm energy authority Byron King has told us for years, shale wells deplete much faster than conventional wells. In many cases, maximum flow can be maintained only for a few months.

Thus, the rate of well production in the prolific Permian Basin of Texas and New Mexico has slipped 0.5% every year since 2014. And other shale plays like the Eagle Ford in Texas and the Bakken in North Dakota are in terminal decline.

Most of the Paradigm experts are in agreement that the recent jump in oil prices will have legs for the rest of this year. But judging from this report, oil plays stand to prosper for the rest of the decade.

![]() Green Delusions: Metal Shortages Inevitable

Green Delusions: Metal Shortages Inevitable

The Biden administration is so far off into cloud cuckoo land with its green-energy ambitions that shortages of critical minerals are inevitable.

The Biden administration is so far off into cloud cuckoo land with its green-energy ambitions that shortages of critical minerals are inevitable.

So concludes a comprehensive new report from S&P Global — examining the demand for cobalt, lithium, nickel and copper in light of the green energy subsidies in the so-called “Inflation Reduction Act” passed last year.

To be sure, the report doesn’t put it in the bald terms that I did at the start of this bullet.

Instead, the report is full of weasly language about how meeting demand will face “considerable challenges.”

➢ If you’re wondering, yes, that’s the same Daniel Yergin who wrote The Prize, the renowned history of the oil industry.

Specifically, the report finds that by 2035, the IRA will goose projected demand for lithium by 15%, cobalt by 14% and nickel by 13%.

But with or without the IRA, demand is unsustainable. “Energy-transition-related U.S. demand for the critical minerals lithium, nickel and cobalt, taken together, will be 23 times higher in 2035 than it was in 2021,” says the report.

Twenty-three times? How’s that going to work when it takes seven–10 years to put a new mine into production?

Answer: It won’t work. But it will be enormously profitable for the companies that can identify and exploit generous deposits of these minerals.

[Special announcement: Within the last 24 hours, we’ve firmed up one of the main events for this year’s Paradigm Shift Summit, set for Tuesday Oct. 3 at the Bellagio in Las Vegas.

Your editor will moderate a panel discussion featuring Jim Rickards, Byron King and one of the most renowned natural resource investors in all of North America.

The topic — investing in natural resources to hedge your inflation risk for the rest of the decade. I’ll make sure we cover the gamut — energy, industrial metals, precious metals, agriculture.

In addition, all three members of the panel will deliver individual talks. So will the other editors in the Paradigm stable — venture capital veteran James Altucher, tech-investing authority Ray Blanco and trading ace Alan Knuckman.

Out of 500 total seats, we’re now down to less than 200 available. If you’re interested in joining us for this one-of-a-kind in-person event, here’s your invitation direct from VP of Publishing Doug Hill.]

![]() Uhhh… Health Insurance Surcharges on Your Meal?

Uhhh… Health Insurance Surcharges on Your Meal?

Well here’s something novel, and not in a good way: A restaurant in Los Angeles is tacking on a surcharge for… employees’ health insurance.

Well here’s something novel, and not in a good way: A restaurant in Los Angeles is tacking on a surcharge for… employees’ health insurance.

The reaction on social media was — well, “hostile” doesn’t begin to describe it.

“This is absurd,” said someone on Reddit. “Just raise your prices by 4%,” said another. “They are either trying to make a political point or they’re basically committing price fraud.”

Restaurant owner Zach Pollack took to Instagram in his own defense: He said his business is being “singled out” and that “there are dozens if not hundreds of other restaurants in Los Angeles that implemented similar surcharges.”

This much is certain: Under the Affordable Care Act of 2010, small businesses with 50 or more full-time equivalent employees must offer health coverage.

According to a recent survey by the National Federation of Independent Business, “Almost half (49%) of small employers have taken a lower profit or suffered a loss to pay for health insurance premium increases over the last five years. Forty-six percent of small employers have raised prices and another 36% have become more productive and efficient.”

This story is one more not-so-gentle reminder that the U.S. health care system — a corrupt crony-capitalist cartel — is sucking out so much wealth from the productive sectors of the economy that in time the parasite might end up killing the host.

I know I’ve promised it before but sometime before the end of the year we’ll address this matter in depth. Of all the things that could go sideways for the rest of the Flaming Twenties — runaway inflation, a new energy crisis, a U.S.-China war — the collapse of the U.S. health care system is the thing that’s least talked about… and most inevitable.

Sorry to end today’s edition on a downer. We’ll try to do better tomorrow…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets