Biden Whistleblower in Hiding

- De-dollarization expert/Biden whistleblower flees custody

- OPEC’s logical response to “Western money-printing”

- Retail theft hits corporate earnings, consumers’ wallets

- We hate to take the side of Google and Facebook, but…

- Mailbag: Yes, humans can (and do) ingest sawdust

![]() Biden Whistleblower on the Lam

Biden Whistleblower on the Lam

There’s been a Gal Luft sighting. Well, sort of. He’s a fugitive now.

There’s been a Gal Luft sighting. Well, sort of. He’s a fugitive now.

As we’ve chronicled in the past, Luft is the fellow who literally wrote the book on de-dollarization — 2019’s De-Dollarization: The Revolt Against the Dollar and the Rise of a New Financial World Order.

Along with a handful of other luminaries like Paradigm’s own Jim Rickards, Luft was years ahead of the curve in noticing how the governments of Russia, China, Iran, etc., were taking countermeasures against Washington’s increasing weaponization of the U.S. dollar.

Three months ago, we told you how Luft had been picked up in Cyprus on U.S. charges of arms trafficking. In a tweet, he said it was all a pretext to shut him up because he’s got the dirt on Joe Biden’s son Hunter.

At that time, the details were paper-thin as Luft awaited his first court date in Cyprus.

Last week, Luft granted an interview from an “undisclosed location” to the New York Post — after skipping bail.

Last week, Luft granted an interview from an “undisclosed location” to the New York Post — after skipping bail.

“The chances of me getting a fair trial in Washington are virtually zero,” he says. “I had to do what I had to do.” Exactly how he made his escape from house arrest in Cyprus, he won’t say. “I don’t want to get people in trouble.”

Luft denies the U.S. allegations, which the Post sums up as “five charges relating to the Arms Export Control Act of conspiring to sell Chinese products to the United Arab Emirates, Kenya and Libya, as well as a violation of the Foreign Agents Registration Act, and of making a false statement.”

It’s all bogus, Luft says: “I was asked by a bona fide arms dealer, an Israeli friend, to inquire with a company I knew if they had an item and what would be the price of an item. This is where the conspiracy ended. No follow-up, no money, no brokering activity.”

Luft says the timing of his extradition order makes the political motives obvious.

Luft says the timing of his extradition order makes the political motives obvious.

The order is dated Nov. 1, 2022 — seven days before the U.S. midterm elections. Recall that it was nearly certain Republicans would win control of the House and launch investigations into allegations of foreign influence-peddling by the Biden family.

“When it was clear the Republicans are going to win the House or the Senate, all of a sudden comes [GOP Rep. James] Comer and [GOP Rep. Jim] Jordan and the game is changing. There will be questions and subpoenas and investigations [so] they [the administration] have to discredit me,” Luft tells the Post.

“I never thought of coming forward. Through 2020 I sat quiet like a fish…”

Indeed, Luft thought he’d put the whole thing behind him in 2019.

Indeed, Luft thought he’d put the whole thing behind him in 2019.

As we mentioned in March, Luft flew to Belgium that year to talk to the feds about the Biden family’s dealings.

Per the Post, we now know a few more details about what he told them — specifically “that Chinese state-controlled energy company CEFC had paid $100,000 a month to Hunter Biden and $65,000 to his uncle Jim, in exchange for their FBI connections and use of the Biden name to promote China’s Belt and Road Initiative around the world.”

Luft had served as an adviser to CEFC, and CEFC had donated at least $350,000 to Luft’s Washington-based think tank, the Institute for the Analysis of Global Security. A CNN article in 2018 said CEFC had “aligned itself so closely with the Chinese government that it was often hard to distinguish between the two.”

We’ll leave it there for today. The Post article has many more details — many of which might make your eyes glaze over, and none of them about his de-dollarization research. But the saga is intriguing for sure, so we’d have been derelict in our duty not to do an update.

![]() OPEC Strikes Back Against “Western Money-Printing”

OPEC Strikes Back Against “Western Money-Printing”

As it happens, there’s a de-dollarization subtext to the big market-moving story today.

As it happens, there’s a de-dollarization subtext to the big market-moving story today.

Crude prices popped big-time last night as trading opened for a new week — a barrel of West Texas Intermediate fetching over $74. At last check it’s pulled back, but not much, to $72.91.

The catalyst was the conclusion of a meeting among OPEC+ oil ministers. Saudi Arabia will cut production by 1 million barrels a day starting next month. Other member states will stick to the production cuts they’d already committed to. “Gas is not going to become cheaper,” Rystad Energy’s Jorge Leon tells The Associated Press.

A Reuters story previewing the meeting on Friday had two eyebrow-raising background sentences…

Western nations have accused OPEC of manipulating oil prices and undermining the global economy through high energy costs.

In return, OPEC officials and insiders have said the West's money-printing over the last decade has driven inflation and forced oil-producing nations to act to maintain the value of their main export.

Recall that oil is (still, for the most part) priced globally in dollars. That OPEC zinger wasn’t directed at “the West,” it was directed at Washington, D.C.

Elsewhere, the major U.S. stock indexes are a mixed bag.

Elsewhere, the major U.S. stock indexes are a mixed bag.

The Dow is down a quarter percent to 33,680. But the S&P 500 is up a quarter percent to 4,293, and the Nasdaq is up a half percent to 13,310.

Federal Reserve officials have entered their “quiet period” in which they don’t give speeches or interviews ahead of their next policy-setting meeting a week from Wednesday. “If the Fed pauses this month, the next stop for the S&P is 4,450,” says Rude Awakening editor Sean Ring in his Monthly Asset Class Report.

Gold is trying to stage a rally, up 11 bucks to $1,958. Silver has shed 4 cents to $23.55.

Crypto looks a little shaken by the news that the SEC is suing Binance — accusing it of operating an illegal stock exchange in the United States. That’s not an altogether surprising development, but Bitcoin has sold off over 3% to $26,142 — a level last seen in mid-March. Ethereum is down 2.6% at $1,834.

➢ One economic number of note, and it’s a stinker: The ISM services index for May clocks in at a five-month low of 50.3 — barely above the 50 dividing line between a growing services sector and a shrinking one. No one among dozens of Wall Street economists polled by Econoday anticipated a number this weak.

Confessions from Jekyll Island

Doug Hill helps oversee day-to-day operations at Paradigm Press — ensuring that our publications promote our core beliefs of financial freedom and self-reliance.

As one of Paradigm’s lead publishers, Doug continues to seek out fresh perspectives and revolutionary ideas. He’s committed to bringing you opportunities you won’t learn about from the mainstream press.

In this 7-minute confessional interview, filmed at the birthplace of the Federal Reserve, Doug explains what’s happening in the markets today… and how he’s still excited about the future.

![]() Shrinkage… and Inflation

Shrinkage… and Inflation

To you, “shrinkage” might be a memorable gag from Seinfeld. To retailers, shrinkage is an industry term for theft. “And it’s becoming a big problem across our country,” says Paradigm retirement authority Zach Scheidt.

To you, “shrinkage” might be a memorable gag from Seinfeld. To retailers, shrinkage is an industry term for theft. “And it’s becoming a big problem across our country,” says Paradigm retirement authority Zach Scheidt.

“Last year, retailers lost nearly $100 billion worth of inventory that simply disappeared from shelves and warehouses.”

The topic came up in the quarterly earnings reports from a host of retailers late last month: “Kohl's said that shrinkage was high during the first quarter and told investors to expect even more theft throughout the year. This echoes warnings from Home Depot, Target and several other high-profile retail companies.”

For Zach, the issue hits close to home: “My college-age daughter quit a part-time job with Target, frustrated with her managers for allowing theft to continue because it was easier than confronting the scammers who were removing items from shelves and then returning them for cash refunds.”

Point being, “When someone steals from Walmart or Target, the company still has to pay for the merchandise that disappeared,” Zach continues.

Point being, “When someone steals from Walmart or Target, the company still has to pay for the merchandise that disappeared,” Zach continues.

“These companies still have to cover all their expenses like payroll, transportation, warehousing and storefront space. And these retail companies still need to turn a profit for shareholders. (You're an investor, right? You want the companies you invest in to be profitable and pay you dividends over time.)

“With shrinkage picking up, these retail companies have no choice but to raise prices for customers who are actually paying for merchandise. And those higher prices help to keep inflation higher, which affects our economy, the Fed's interest rate targets, the broad stock market and more.

“As long as these retailers turn a blind eye to theft, ethical shoppers will continue to face higher inflation, which drags down our entire economy.”

![]() Awful Ideas, California Edition

Awful Ideas, California Edition

The lower house of California’s legislature has just passed a bill effectively subsidizing a favored industry — the news media.

The lower house of California’s legislature has just passed a bill effectively subsidizing a favored industry — the news media.

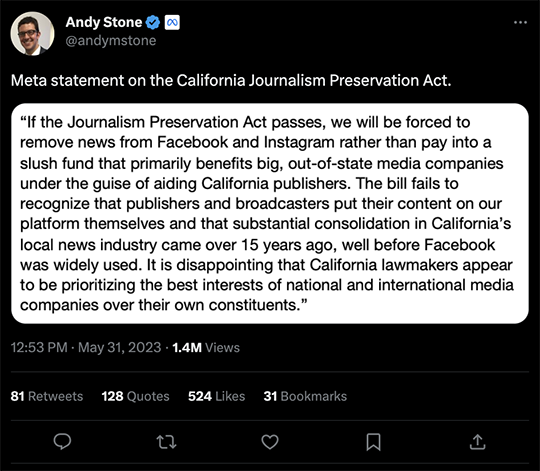

The California Journalism Preservation Act would, for all intents and purposes, require outfits like Google and Facebook to fork over a “journalism usage fee payment” if they link to media websites. It passed by a 46-6 vote on Friday.

Look, it’s hard to take the side of Google and Facebook after all the censorship of the last few years… but this concept is utterly bass-ackwards. In what universe does it make sense for media websites to get traffic from Google or Facebook — and get paid for it to boot?

And it’s even worse than that, writes Mike Masnick at Techdirt…

It also breaks the most fundamental concept of the open web — the link — by saying that the government can force some websites to pay for linking to other websites (and, on top of that, force the paying websites to have to host those links, even if they don't want to).

Everything about this is filthy and corrupt. It's literally Rep. Buffy Wicks [the bill’s sponsor] and others in the California legislature saying "we're forcing companies we dislike to give money to companies we like."

For its part, Facebook parent Meta says it will stop letting news sites post to both Facebook and Instagram in California if this bill becomes law. Meta communications exec Andy Stone is an undeniably bad actor — he’s the guy who suppressed the Hunter Biden laptop story in 2020 — but there’s nothing to argue with here…

If you’re curious, yes, there’s been a proposal to do something similar on the federal level — courtesy of Sen. Amy Klobuchar (D-Minnesota). Last year she lined up bipartisan support from 14 of her colleagues.

As someone who committed journalism daily for 20 years, I’ll tell you there’s an even deeper problem with these bills: They fatally compromise any notion of impartiality. Think about it: Journalists will inevitably feel beholden to the lawmakers who pass such a bill, and the bureaucrats who enforce it, if they feel their livelihoods depend on it.

As if the media aren’t already totally in bed with the government, right?

![]() Debt Ceiling Posturing? Say It Ain’t So!

Debt Ceiling Posturing? Say It Ain’t So!

“I think critics on both sides of the debt ceiling ‘deal’ are merely posturing for attention,” a reader writes.

“I think critics on both sides of the debt ceiling ‘deal’ are merely posturing for attention,” a reader writes.

“Even author David Horowitz in criticizing the deal seemed to make contradicting statements.

He asserted that the House majority has the ‘power of the purse,’ and thus controls the spending, which aligns with my understanding. Then he says lifting the cap on the debt ceiling gives the president unlimited room to spend to his delight.

“Now, wait a minute! This doesn't add up. The president can't spend what the Congress hasn't approved, no?

“So who is to blame for runaway spending? I get a kick out of the vitriolic debate, or am I missing something? I am just an immigrant, who passed a citizenship test.

“The debt ceiling would have meaning only if Congress would curb their spending accordingly.

It needs raising now to accommodate spending approved by the previous Congress.

“What happens going forward depends on the current majority, which is the GOP? Their record isn't exactly pristine either.”

Speaking of which, another reader reacts to last Thursday’s edition: “Proud you called it with Paul Ryan way back in 2012.

“We need more Americans able to see a bad one before they receive too much power, which RINOs like Ryan always abuse. He was an arrogant leader.”

“I gleefully ‘busted a gut’ on Friday’s edition,” says one of our long-timers — after we acknowledged it wasn’t exactly a knee-slapper.

“I gleefully ‘busted a gut’ on Friday’s edition,” says one of our long-timers — after we acknowledged it wasn’t exactly a knee-slapper.

“To the ‘Wood Milk’ item (I'd call it a parody, but I'm being polite), I would add the small factoid — which I'd suggest you verify independently since I don't remember where I got it — about a quality we humans share with rats, that being the ability to digest small amounts of sawdust on occasion. Made the whole thing even funnier!

“P.S. About your new name — for me it conjures up images of primer and powder and being on the wrong end of same. But that's OK, I'll live with it, just keep up your style.”

Dave responds: Sawdust, cellulose, wood pulp… whatever you want to call it, “cellulose has been a safe, FDA-approved food additive since 1973,” according to a 2016 Men’s Health article.

Your body can’t break it down, so it gets passed on out. “Many packaged foods like cereals and granola bars use cellulose as a way to bump up a product’s fiber content, which can help keep you full and quell subsequent cravings.” (Or you can just avoid the carbs in the first place, right?)

The article includes a list of 31 items where it’s a common ingredient. Most of them would fall under the category of “processed foods”... so if you avoid the interior aisles of the grocery store, you’ll keep your sawdust intake to a minimum.

Now you know!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets