Piling on the BRICS

- BRICS author doth protest too much

- Stuck in the summer doldrums? Nah…

- An auto strike and spike

- OpenAI spends like Congress

- How to catch AI con artists

![]() BRICS Author Doth Protest Too Much

BRICS Author Doth Protest Too Much

The Goldman Sachs economist who, in 2001, coined the acronym BRICS now calls the idea of a BRICS currency “ridiculous.”

The Goldman Sachs economist who, in 2001, coined the acronym BRICS now calls the idea of a BRICS currency “ridiculous.”

In an interview at the Financial Times, Lord Jim O’Neill waves aside the idea that BRICS — including Brazil, Russia, India, China and South Africa — has the wherewithal to launch its own currency.

BRICS has “never achieved anything since they first started meeting,” O’Neill claims, and he scoffs: “They’re going to create a BRICS central bank? How would you do that? It’s embarrassing almost… What they attempt to achieve beyond powerful symbolism, I don’t know.”

Now a senior advisor at the U.K. think tank Chatham House, Lord O’Neill’s patently patronizing attitude is emblematic of “Western elites,” who, according to Paradigm’s macro expert Jim Rickards, have been “asleep at the switch for the past nine years as the BRICS prepare to do without them.”

Recall, nine years ago, Washington engineered regime change in Ukraine. So in 2014, the writing was on the wall that the U.S. — in lockstep with NATO — would stop at nothing to bring defiant nations (i.e. any country not slavishly cooperating) to heel.

Which is something journalist Afshin Rattansi, host of RT program Going Underground, underscored during his own interview with Lord O’Neill.

Throughout the interview, O’Neill seemed to be talking out of both sides of his mouth. “Eventually, as we saw in the United Kingdom, the world’s most… used currency, will ultimately be that of the world’s most important economies,” he says.

“So the idea that the dollar will remain king forever, I think, is probably unlikely,” concedes Lord O’Neill… Of course, Jim Rickards has been following the dollar’s slow demise since, at least, he published his book Currency Wars in 2011.

“So the idea that the dollar will remain king forever, I think, is probably unlikely,” concedes Lord O’Neill… Of course, Jim Rickards has been following the dollar’s slow demise since, at least, he published his book Currency Wars in 2011.

“This war is being fought behind the scenes deep inside governments across the globe,” Jim says today. “It’s a battle for global dominance among superpowers. I’m talking about China, Russia and the Middle East.”

The battle’s outcome? Equivalent to what Jim calls an economic “9/11 moment” for President Joe Biden. And all roads lead back to Ukraine — geographically speaking, a country slightly smaller than Texas with a population around 37 million, on par with Saudi Arabia and Angola.

“President Biden made a critical tactical mistake at the beginning of 2022,” Jim highlights.

And during last night’s live Paradigm event, Jim explained how Biden’s politically expedient decision to sanction Russia might well have been the catalyst for a BRICS super-currency. Simultaneously, Biden’s miscalculation launched an assault on Americans’ wealth… assets… retirements… You name it.

Although we’re up against a tight timeline — the BRICS summit is less than a week away — there’s still time to brace for impact. Watch the replay here… and decide how you should prepare.

![]() Stuck in the Summer Doldrums? Nah…

Stuck in the Summer Doldrums? Nah…

“Back in the day, junior traders and interns manned the turrets on Wall Street for the month of August,” says Paradigm’s chart hound Greg Guenthner. “The adults would return from the Hamptons after Labor Day weekend to clean up the mess… and the real trading would begin once again.

“Back in the day, junior traders and interns manned the turrets on Wall Street for the month of August,” says Paradigm’s chart hound Greg Guenthner. “The adults would return from the Hamptons after Labor Day weekend to clean up the mess… and the real trading would begin once again.

“I’m not so sure this is the case anymore in the modern era of 24/7 trading,” Greg observes. “August has been busy this year — mainly because of the abrupt market rotation we’re witnessing right now.”

Most notably, out of tech and into energy. Nevertheless, “the herd mostly ignored the quiet rallies in the energy sector in favor of explosive tech gains this summer.

“I get it,” Greg says, “Many of the big, recognizable names were stair-stepping higher every single week. If you wanted to make money, you’d bet on the tech leaders and snapback growth names.”

Greg’s takeaway? “The tech sector is taking its lumps, while energy stocks are breaking out to the upside,” he says. “The market is clearly changing.”

Indeed, the tech-heavy Nasdaq is getting hit hardest today; the index is down 0.45% to 13,570 while the staid Dow is up 0.15%, just a hair below 35,000. Meanwhile, the S&P 500 is stuck in the middle — slightly in the red at 4,435.

As for the commodities complex, oil is down 0.25% to $80.75 for a barrel of WTI. Precious metals? Gold is down 0.10%, according to Kitco, at $1,901.50 per ounce, but silver is up 0.15% above $22.50.

Last, the crypto market is struggling today: Bitcoin is down to $29,000 and Ethereum is priced at $1,815.

We have a noteworthy pair of economic numbers to report today…

We have a noteworthy pair of economic numbers to report today…

Housing starts were up 3.9% in July, in line with what Wall Street economists anticipated. Housing permits, however, an indicator of future activity, rose ever so slightly — up just 0.1% — falling below the consensus level.

Also, after two straight months in decline, overall industrial production jumped 1% last month, soundly beating the expected 0.3% increase. Within that number, manufacturing rose 0.5% while the utilities index — plus the production of vehicles and parts — rose 5.4% and 5.2% respectively.

![]() An Auto Strike and Spike

An Auto Strike and Spike

On Tuesday, United Auto Workers President Shawn Fain hosted a Facebook Live session for 150,000 union members who will vote this month on a strike.

On Tuesday, United Auto Workers President Shawn Fain hosted a Facebook Live session for 150,000 union members who will vote this month on a strike.

“Whether or not there’s a strike next month is entirely up to the Big Three automakers,” Fain said, calling out the “corporate greed” of Ford, GM and Stellantis.

According to an article at The Detroit Free Press: “Fain and other union leaders have been outspoken for months in calling for the automakers to share more of the billions of dollars in profits they’ve made over the past decade with autoworkers, to ensure a ‘just transition’ to electric vehicles and to resume benefits, such as cost-of-living adjustments, that were given up in past years.

“The auto companies contend they need to keep costs low in order to remain competitive during the expensive EV transition and against non-union operations, including Tesla and foreign companies.”

No one has a bigger stake in the not-so-smooth EV transition than Team Biden. “The contract talks between automakers and the UAW pose a delicate balance for Biden and Democrats between their priorities of transitioning the nation to electric vehicles and courting support of the UAW,” says Politico.

The date to watch? The UAW contract expires Sept. 14. (And here’s a cheery thought: An autoworker strike and partial government shutdown could hit simultaneously in late September.)

Also Tuesday, after its first day trading, Nasdaq-listed Vietnamese EV maker VinFast (VFS) now has a stock valuation higher than that of Ford or GM.

Also Tuesday, after its first day trading, Nasdaq-listed Vietnamese EV maker VinFast (VFS) now has a stock valuation higher than that of Ford or GM.

“Shares in the firm, which has yet to make a profit, closed above $37,” BBC reports, giving “VinFast a stock market valuation of $85 billion.” For comparison, Ford’s valuation is $48 billion and GM’s is $46 billion.

“Instead of a conventional share sale, VinFast went public using a shell company, or special purpose acquisition company (SPAC),” BBC says.

“They are primarily backed by Vingroup, which gives them access to funding from a business that has a proven track record of growth,” notes CEO Bill Russo of Shanghai-based Automobility.

Image courtesy: Vinfastauto.us

The VF9 model starts at $83,000

“Investors are continuing to believe that the future is in electric and that a low-cost East Asian country will emerge as a competitor in the U.S.,” Mr. Russo says. (Wait, did he say “low-cost”?!)

"The markets believe that given geopolitics… Vietnam, not China, will be that country,” he adds.

![]() OpenAI Spends Like Congress

OpenAI Spends Like Congress

“Why is the company that started the public’s fascination with artificial intelligence staring down the barrel of bankruptcy?” asks Paradigm’s science-and-technology authority Ray Blanco. “I thought AI was supposed to be a gold mine…

“Why is the company that started the public’s fascination with artificial intelligence staring down the barrel of bankruptcy?” asks Paradigm’s science-and-technology authority Ray Blanco. “I thought AI was supposed to be a gold mine…

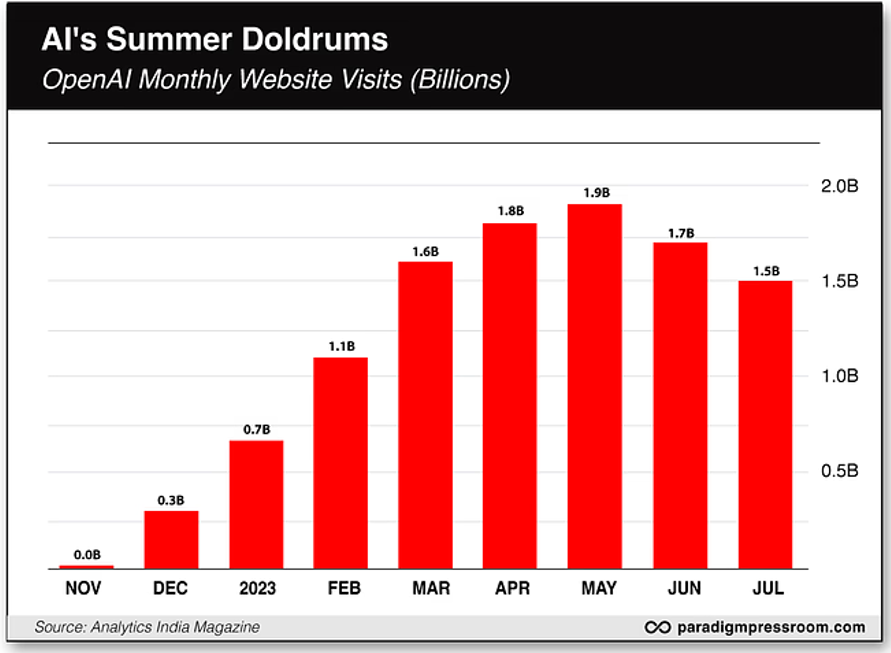

“OpenAI debuted their AI chatbot ChatGPT in November, attracting new users at a record pace. By February they topped 1 billion monthly visits and continued to increase their traffic until May.

“After topping out at an impressive 1.9 billion monthly visits, traffic has only declined,” says Ray.

“June and July each saw a drop of about 200 million visits. (This was explained away as students on summer vacation no longer needing ChatGPT to write papers for them.)”

“Whatever the reason, OpenAI is bleeding money.

“The company has yet to effectively monetize their extremely popular chatbot, and in May they saw their losses double to a brutal $540 million.

“The company has yet to effectively monetize their extremely popular chatbot, and in May they saw their losses double to a brutal $540 million.

“CEO Sam Altman said he expected OpenAI to earn $200 million in 2023 and $1 billion in 2024, but so far the losses are only piling up.”

In fact, citing a report at Analytics India Magazine, ChatGPT operates at a cost of $700,000 per day; at this rate, despite Microsoft’s $13 billion investment in OpenAI, the company might go bankrupt by 2024.

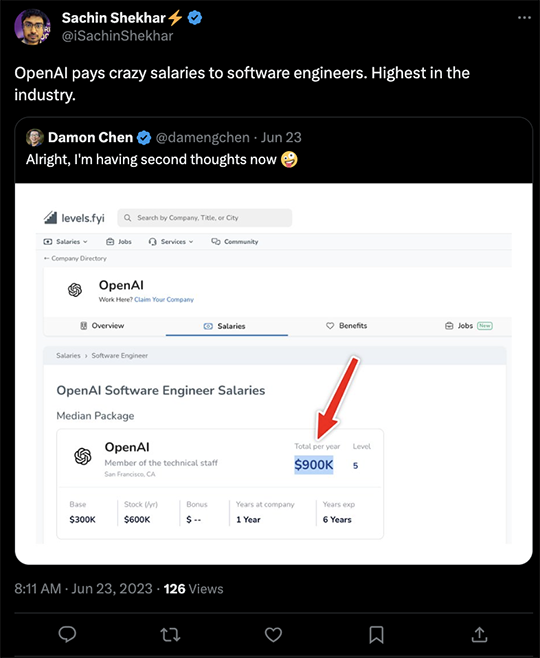

Of course, OpenAI’s outsized salaries might have something to do with that?

Ray adds: “With new competitors showing up every day — such as Anthropic’s surprisingly advanced ChatGPT-clone Claude 2 and Meta’s open-source large language model Llama 2 — OpenAI’s profitability is looking far from certain.

“While OpenAI might not have trouble keeping the lights on for the time being, there has to be growing concern that AI might not be the cash cow it was made out to be.”

Ray concludes: “There is clearly plenty of money in the picks-and-shovels of the AI gold rush — just ask the companies making microchips. Nvidia and Advanced Micro Devices have seen their stocks soar on the basis of high-powered hardware used to run artificial intelligence programs.

“Experts have also predicted that the value of AI could be measured in the trillions.”

All that to say OpenAI might be an artificial intelligence forerunner, but the company seems to be running a sprint instead of a marathon.

![]() How to Catch AI Con Artists

How to Catch AI Con Artists

“We’re in full-on crisis mode,” says writing professor Timothy Main of Conestoga College in Canada.

“We’re in full-on crisis mode,” says writing professor Timothy Main of Conestoga College in Canada.

“In his first-year required writing class last semester, Main logged 57 academic integrity issues, an explosion of academic dishonesty compared to about eight cases in each of the two prior semesters,” says an AP article. “AI cheating accounted for about half of them.”

So educators are going back to the drawing board. “Some professors will be requiring students to show editing history and drafts to prove their thought process.” Still others are trying to use AI detectors.

Turnitin, a popular plagiarism-detector program, however, has proven to be “best at confirming human work… but was spotty in identifying chatbot-generated text and least reliable with hybrid work,” the article says.

Here’s my two cents…

Remember these? I say educators go long on blue books… and short AI chatbots.

Have a great rest of your day, and we’ll be back with another round of 5 Bullets tomorrow.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets