Saudi Stab in the Back

- BRICS+ Six: Saudi Arabia’s slow-motion dollar dis

- But what about the BRICS currency?

- The muted reaction to NVDA’s blowout

- Team Biden’s 2024 oil play

- Long Cramer, we hardly knew ye.

![]() BRICS+ Six: Saudi Arabia’s Slow-Motion Dollar Dis

BRICS+ Six: Saudi Arabia’s Slow-Motion Dollar Dis

We’re going to start out with something a little out of the ordinary today.

We’re going to start out with something a little out of the ordinary today.

Do me a favor and read the following 10 lines, OK? Here goes…

Nvidia Earnings Blowout.

Nvidia Earnings Blowout.

Nvidia Earnings Blowout.

Nvidia Earnings Blowout.

Nvidia Earnings Blowout.

Nvidia Earnings Blowout.

Saudi Arabia Joins BRICS.

Nvidia Earnings Blowout.

Nvidia Earnings Blowout.

Nvidia Earnings Blowout.

Now for a two-part quiz…

- One of those 10 lines above is a bombshell that stands to alter the global monetary order we’ve known for the last 50 years. Which one is it?

- One of those 10 lines above is being sorely underplayed by the corporate media today at the expense of the other nine. Which one is it?

OK, enough snark.

While Wall Street types were wiping the sleep from their eyes this morning, the BRICS configuration of Brazil, Russia, India, China and South Africa welcomed six new members — led by none other than Saudi Arabia, the country that’s propped up the U.S. dollar’s role as the world’s reserve currency since 1974.

While Wall Street types were wiping the sleep from their eyes this morning, the BRICS configuration of Brazil, Russia, India, China and South Africa welcomed six new members — led by none other than Saudi Arabia, the country that’s propped up the U.S. dollar’s role as the world’s reserve currency since 1974.

Independent journalist Michael Tracey — one of the few Americans on hand at the BRICS conference in Johannesburg, South Africa, this week — immediately grasped the significance…

But of course, it’s much more than that. Saudi Arabia is — was — the linchpin of the so-called “petrodollar” arrangement forged by the Nixon administration nearly 50 years ago.

The Saudi princes agreed to price their oil in dollars — and they used their clout to get other OPEC nations to do the same. In return, Washington agreed to protect Saudi Arabia and its allies against foreign invaders and domestic rebellions.

From 1974 until last year, anyone who wanted to buy oil needed dollars to do so. The petrodollar greased the wheels of world commerce and allowed Americans to live in the debt-soaked style to which they became accustomed.

Last year, the arrangement started to come unglued after Russia invaded Ukraine and Washington responded with a raft of sanctions aimed at curbing Russia’s energy revenue.

Russia soon began selling oil to China and India in exchange for yuan and rupees. Soon, Saudi Arabian leaders started talking publicly about selling oil to China for yuan.

Dollars? Who needs ’em?

Now the BRICS grouping encompasses two of the world’s top three oil producers — Russia and Saudi Arabia. (America is the odd man out.)

Now the BRICS grouping encompasses two of the world’s top three oil producers — Russia and Saudi Arabia. (America is the odd man out.)

For that matter, the expanded BRICS includes six of the top 10 oil producers — comprising 43% of global oil production. In addition to Russia and Saudi Arabia, there’s China and Brazil. And then there are two more BRICS arrivals: Saudi Arabia’s arch-enemy Iran is joining the BRICS configuration, and so are the United Arab Emirates.

Another wrinkle: As Jim Rickards said here on Tuesday, “China is the largest purchaser of Saudi Arabian oil, so a formal alliance including both countries makes sense, especially as they and others move forward on a common currency other than the U.S. dollar.”

Anyone want to open a betting pool on how soon the House of Saud starts taking yuan in exchange for oil now?

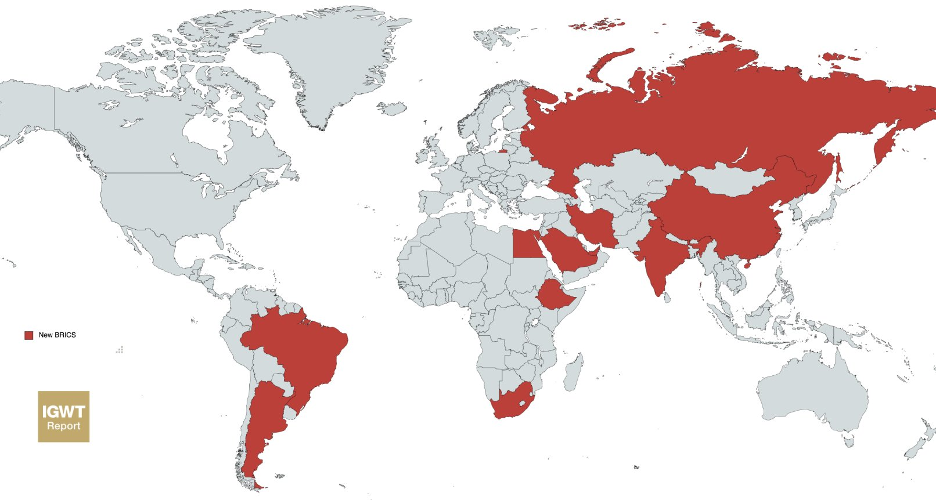

Then there’s the matter of how this expanded 11-member BRICS grouping looks on a map.

Then there’s the matter of how this expanded 11-member BRICS grouping looks on a map.

The good folks at the European asset manager Incrementum AG — the ones who put out the annual In Gold We Trust report — have already put one together…

Paradigm energy expert Byron King draws our attention to a few things…

- The oil-rich Persian Gulf will be encircled by BRICS powers — Saudi Arabia, Iran, UAE

- The Suez Canal, one of the major “choke points” for global ship traffic, will be surrounded by BRICS powers — Saudi Arabia as well as two new arrivals, Egypt and Ethiopia

- Meanwhile, Argentina will join Brazil as a member of the Latin American BRICS contingent — packed with “green energy” components like lithium and copper.

Energy and shipping lanes. So this is a bigger story even beyond Saudi Arabia turning its back on Washington and the petrodollar.

![]() But What About the BRICS Currency?

But What About the BRICS Currency?

Now that the question of new membership has been settled, there’s still unfinished business on this final day of the conference — a new joint currency.

Now that the question of new membership has been settled, there’s still unfinished business on this final day of the conference — a new joint currency.

Of course, this is a tougher climb than welcoming new members — as Jim Rickards has been telling us all summer.

“There is currently no alternative to the dollar in terms of its reserve currency status because of the absence of a sovereign bond market of sufficient size and operational capacity,” he says. “That role will be very difficult to dislodge, perhaps taking 10 to 20 years to establish the necessary infrastructure and gain the trust of market participants.”

Then again, why go through all that trouble?

“If no other currency can easily replace the reserve currency role of the dollar, is there any alternative at all? Yes, gold is ready and waiting in the wings,” Jim goes on.

“If no other currency can easily replace the reserve currency role of the dollar, is there any alternative at all? Yes, gold is ready and waiting in the wings,” Jim goes on.

“That’s the real danger to the U.S. Treasury market — that sovereign nations turn to gold to escape the dollar. The impediment to another currency as a reserve currency is the absence of a bond market where reserves are actually invested.

“With gold, there’s no need for a bond market to absorb reserves because you have the physical gold as the resulting asset. If this came to fruition, the dollar would become another regional currency, such as pesos are to Mexico or the pound is to the U.K.”

Over time, that translates to “higher inflation and a much higher dollar price for gold,” says Jim. “That means other commodity prices will rise in lockstep. A commodity boom favors BRICS and emerging markets generally (as it did in the late 1970s and early 1980s).” Invest accordingly.

➢ Case in point: Argentina’s economy is a basket case right now, with a severe shortage of dollars. Just yesterday, Brazil’s finance minister offered Argentina a lifeline — trade with each other using Chinese yuan. Already, Argentina pays for Chinese imports with yuan and Brazil finances exports to Argentina using Brazilian reais. Dollars? Who needs ’em?

![]() The Muted Reaction to NVDA’s Blowout

The Muted Reaction to NVDA’s Blowout

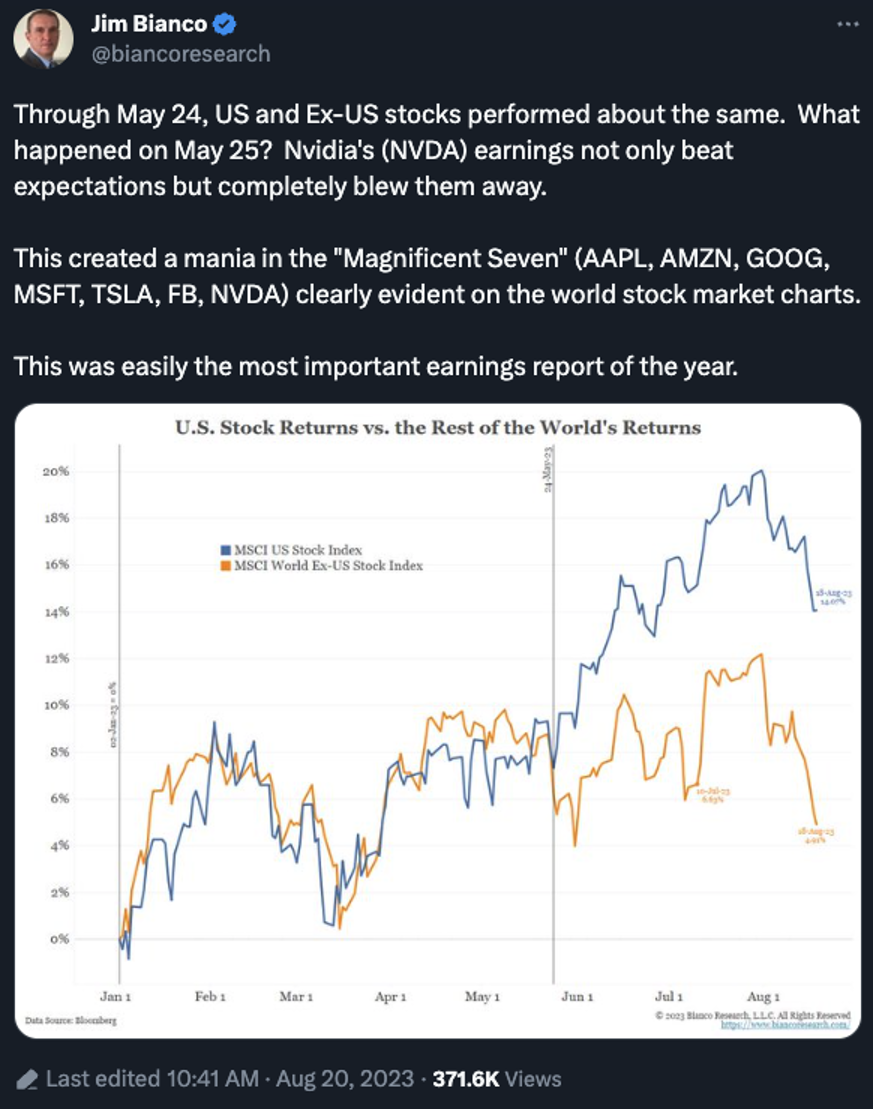

OK, now we’ll talk about Nvidia’s earnings blowout. But we’ll start with a peculiar statistic that raised some eyebrows a few days ago on the website formerly known as Twitter…

OK, now we’ll talk about Nvidia’s earnings blowout. But we’ll start with a peculiar statistic that raised some eyebrows a few days ago on the website formerly known as Twitter…

For the first five months of this year, the U.S. stock market traded in tandem with the rest of the world — right up until Nvidia reported its quarterly numbers in late May.

Then the U.S. stock market went on a tear, leaving the rest of the world in the dust.

As Bianco Research founder Jim Bianco put it, Nvidia’s earnings “are becoming a macro event” for the markets — something as closely followed as the monthly unemployment and inflation numbers.

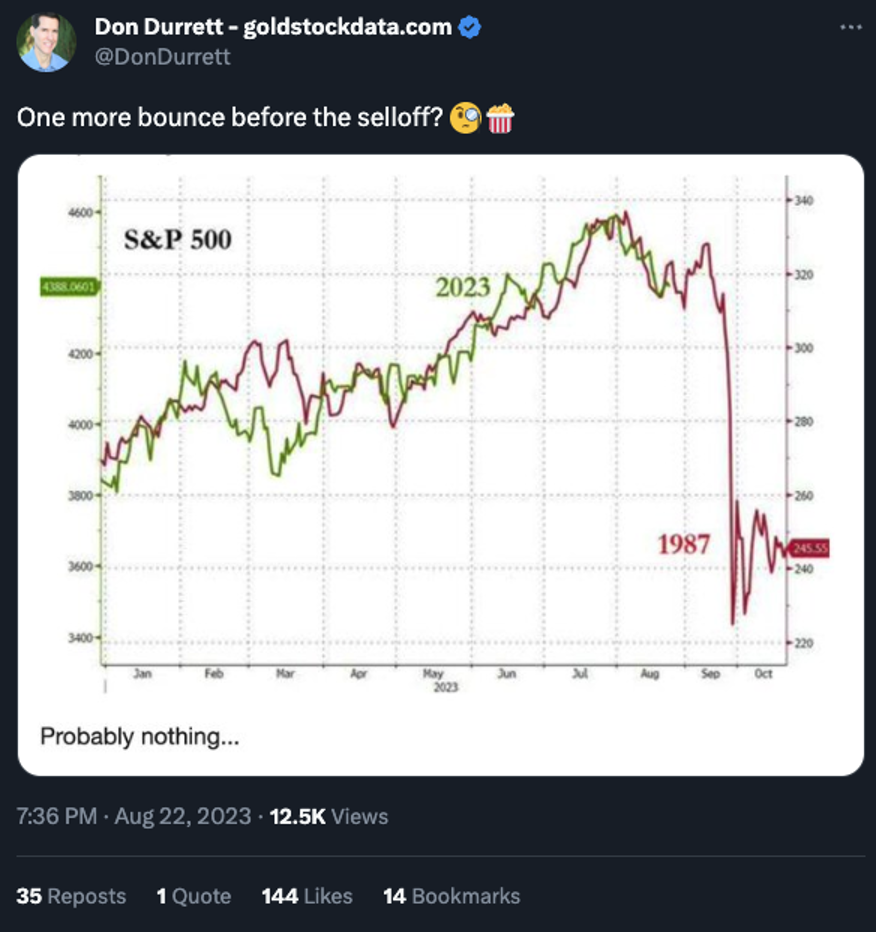

Which brings us to the new “most important earnings report of the year” — or would that be the second-most?

Which brings us to the new “most important earnings report of the year” — or would that be the second-most?

Nvdia released its numbers after the closing bell yesterday: Revenue doubled to record levels. Profits surpassed the consensus guess among Wall Street analysts. And the company “guided higher” for the rest of the year.

“The race is on to adopt generative AI,” said CEO Jensen Huang — and Nvidia’s chips are the industry standard for AI applications.

Funny thing, though: While NVDA was bid up big time in after-hours trading yesterday — as much as 7% — shares are up barely 1.2% as we write.

And that’s no help at all for the major U.S. stock indexes: The S&P 500 is down a half-percent on the day to 4,413. The Nasdaq is down more than three-quarters of a percent to 13,601. And the Dow is down a third of a percent at 34,358.

Hmmm…

➢The day’s big economic number is durable goods orders — down 5.2% in July, even more than expected. But that number is skewed by a drop in aircraft orders, which are notoriously noisy month to month. If you exclude aircraft and military hardware, orders for “core capital goods” inched up 0.1%.

Maybe, just maybe, it’s dawning on traders that going forward… Nvidia has a tougher row to hoe.

Maybe, just maybe, it’s dawning on traders that going forward… Nvidia has a tougher row to hoe.

In a recent Yahoo Finance interview, Bernstein analyst Stacy Ragson said shortages of NVDA’s flagship H100 chips have had the effect of pulling demand forward from the future. “When people can’t get what they want, they order more… At some point, what is the chance that Nvidia will see an air pocket? It’s probably 100%.”

Meanwhile Paradigm’s own tech specialist Ray Blanco points out that Nvidia’s lead in AI chips might be huge — but it’s not insurmountable. Distant No. 2 AMD plans to release a “superchip” that’s touted as outperforming the H100.

“This chip will combine a central processor, a graphics processor and memory all in the same chip package,” Ray tells us. “It’s being designed and marketed for use in data centers for companies running advanced AI applications.”

Nor is AMD the only player that might give Nvidia a run for the money: “While giants such as Google, Amazon and Microsoft are deep into development of their own chips, there are also billions of dollars pouring into semi startups like Mythic and Tachyum.”

Looking forward, “Nvidia’s early lead may seem significant,” says Ray, “but in the total technological upheaval that artificial intelligence seems to be causing, its ‘meager’ trillion dollars market cap may end up just being a drop in the bucket.”

![]() Team Biden’s 2024 Oil Play

Team Biden’s 2024 Oil Play

Seeing how the Biden administration already drained the Strategic Petroleum Reserve to keep a lid on gas prices for the 2022 midterm elections, what’s the plan for 2024?

Seeing how the Biden administration already drained the Strategic Petroleum Reserve to keep a lid on gas prices for the 2022 midterm elections, what’s the plan for 2024?

As a reminder, the SPR has shrunk from 638 million barrels less than 18 months ago… to 349 million barrels now. That’s a 45% drop. The SPR hasn’t been this low since 1983.

If it’s drained much more, the structural integrity of the salt caverns in Texas and Louisiana where the crude is stored will be in danger.

What can the administration do now?

“U.S. officials are drafting a proposal that would ease sanctions on Venezuela’s oil sector, allowing more companies and countries to import its crude oil,” says a Reuters report citing five anonymous sources.

“U.S. officials are drafting a proposal that would ease sanctions on Venezuela’s oil sector, allowing more companies and countries to import its crude oil,” says a Reuters report citing five anonymous sources.

Venezuela is home to bountiful reserves of heavy, sour crude — the sort that U.S. refineries are well equipped to handle. The Trump administration imposed sanctions on Venezuela between 2017–19, and the Biden administration hasn’t let up.

So the outlines of a deal are coming into view: The United States eases up on the sanctions as long as Nicolas Maduro’s regime holds an election next year that Washington deems “free and fair.”

To be sure, this is nowhere near a done deal. More to the point, even if Washington and Caracas come to terms, the Venezuelan regime’s mismanagement has left the country’s oil industry in shambles.

As the aforementioned Byron King said during a previous round of U.S.-Venezuela talks last year, “As if Venezuela can just turn a few valves? Hey, what valves? They’re either rusted shut or stolen and sold for scrap.

“Venezuela’s oil industry has been decapitalizing for 15 years. It will take hundreds of billions of dollars to get it back up to speed, and likely a decade if it all begins today. (Which it won’t.)”

Gee, that doesn’t sound as if it’ll be helpful for 2024, will it?

![]() Long Cramer, We Hardly Knew Ye

Long Cramer, We Hardly Knew Ye

Appropriately enough — on Sept. 11 — the Long Cramer Tracker ETF (LJIM) will close and be liquidated.

Appropriately enough — on Sept. 11 — the Long Cramer Tracker ETF (LJIM) will close and be liquidated.

The ETF’s lifespan has been exceptionally brief: Tuttle Capital Management launched the fund less than six months ago to invest in the stock picks of former hedge fund manager and CNBC blowhard Jim Cramer.

But the ETF had a miserable time drawing investors, attracting a pitiful $1.3 million while eking out an equally pitiful 3.3% return — versus the near 12% the S&P 500 gained over the same time period.

“We started LJIM in order to facilitate a conversation with Jim Cramer around his stock picks,” says the fund’s manager Matthew Tuttle.

“Unfortunately, Mr. Cramer and CNBC have been unwilling to engage in dialogue and instead have chosen to ignore the funds, therefore there is no reason to keep the long side going,” Tuttle said in a new release Monday. “Going forward we will just focus on the short side.”

Thing is, the Inverse Cramer ETF (SJIM), which invests “approximately the opposite… of the investments recommended” by Cramer, according to Crameretfs.com, has performed even worse — down over 4% since its March 2 launch and eliciting just $3.4 million in investments.

What else can we say about Jim Cramer? At this point, he’s a human punching bag — but a fortunate one, at that, with an estimated net worth of $170 million. He’s sure laughing all the way to the bank.

Here’s hoping — for his sake, anyway — that Cramer didn’t bank at one of his legendarily disastrous stock recommendations, the ill-fated Silicon Valley Bank.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets