An Inflation Carol

![]() The Inflationary Grinch

The Inflationary Grinch

Not to be a downer or anything on Christmas Day, but was your holiday spending this year a little on the thrifty side?

Not to be a downer or anything on Christmas Day, but was your holiday spending this year a little on the thrifty side?

One or two fewer presents under the tree? A less fancy cut of meat for the entree? It’s what you had to do to cope with the cost of living, right?

And others might be worse off than you. “As of November, 62% of adults said they are living paycheck to paycheck,” according to CNBC, citing a LendingClub survey. That’s no better than a year ago.

I don’t mean to depress you. The whole point of this holiday edition of our 5 Bullets is to empower you against the inflationary Grinch who’s out to steal your Christmas — as well as your Thanksgiving, Fourth of July and every other day of the year.

Before anything else, please wrap your mind around this: The inflation rate is climbing down, but inflation will likely persist for the rest of the 2020s. In economist-speak, inflation will be “sticky.”

Before anything else, please wrap your mind around this: The inflation rate is climbing down, but inflation will likely persist for the rest of the 2020s. In economist-speak, inflation will be “sticky.”

The official U.S. inflation rate topped out in June 2022 at 9.0%. It’s since retreated to 3.1%. Surely you’re still feeling the impact.

The Federal Reserve has an official inflation target of 2%. We can forecast confidently that the Fed won’t get there for several more years.

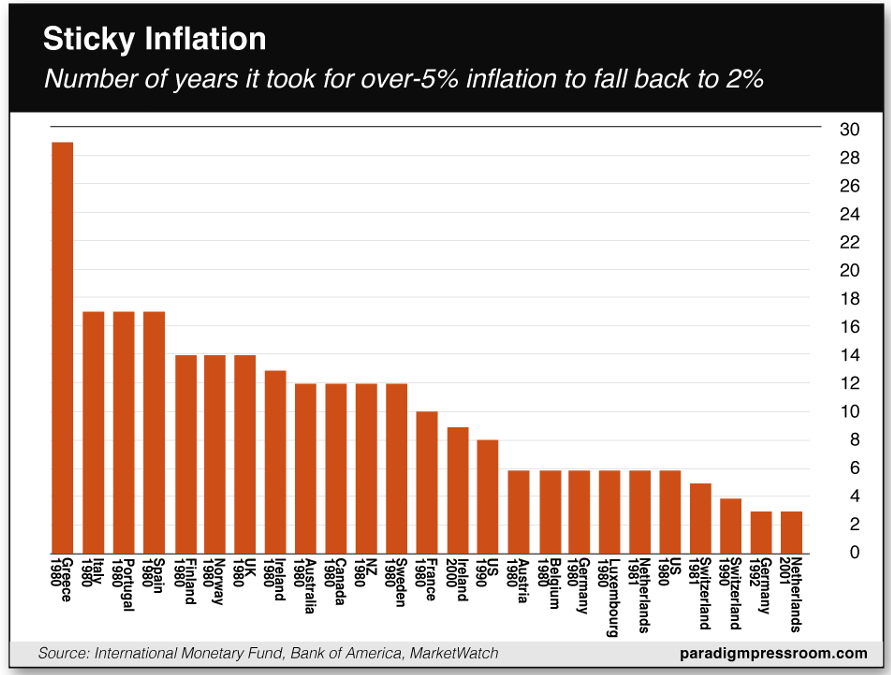

Last year, researchers from Bank of America’s U.K. division combed through extensive data going back decades from most of the globe’s developed economies.

They found that once inflation pokes its nose over 5%, getting back to 2% takes an average of 10 years. Click the chart to enlarge…

A separate study conducted last year by the firm Research Affiliates arrived at the same broad conclusion: “Above 8%, reverting to 3% usually takes six–20 years, with a median of over 10 years.”

OK, we’re going to get weird now: Want to know an asset class that’s almost a surefire winner for the next five years? It’s razor blades.

OK, we’re going to get weird now: Want to know an asset class that’s almost a surefire winner for the next five years? It’s razor blades.

We’re deadly serious. Figure out how many blades you go through in a year, and then go to Costco or Sam’s Club or BJ’s and buy five times that amount. We can nearly guarantee a return on your investment at the end of the first year because by that time the price will be higher. And the returns will only get better as time goes by.

Our modest suggestion is a good starting point to explore a “lost” inflation survival manual — now over 40 years old, and more relevant than ever.

Most of what follows is a reprise of a collaboration between myself and veteran financial publisher Addison Wiggin a decade ago, circulated to a limited audience. It deserves a wider hearing — especially now.

![]() Before You Buy Another Ounce of Gold or Silver, Do This

Before You Buy Another Ounce of Gold or Silver, Do This

The usual guidance to fight a rising cost of living is to buy precious metals. Which the late John Pugsley thought was a fine idea… but he preferred to attack the problem at the source.

The usual guidance to fight a rising cost of living is to buy precious metals. Which the late John Pugsley thought was a fine idea… but he preferred to attack the problem at the source.

Mr. Pugsley belonged to the first generation of “hard money” newsletter editors who made a splash during gold’s epic run-up in the 1970s, along with other legends like Howard Ruff and Harry Browne.

But by 1980, gold was climbing down from an $800 high that wouldn’t be seen again for 27 years. Pugsley refined his guidance in a pathbreaking book called The Alpha Strategy: The Ultimate Plan of Financial Self-Defense. Alpha is the first letter of the Greek alphabet, and Pugsley defined the Alpha Strategy as “the first plan for any individual to protect his wealth.”

“Wealth,” he wrote, “is made up of real things. It is hammers, lathes, shovels, typewriters, windows, doors, walls, pencils, shirts, shoes, rugs, apples, automobiles and bread. Wealth comprises all those things we use, enjoy and benefit from.”

He urged readers to rethink the entire process of working for a living and preserving purchasing power: “Instead of converting labor into money, money into investments, investments back into money and money into real goods once again, convert your surplus earnings directly into real goods. Simply stated, invest your savings in those real things that you will be consuming in the future. Save only real wealth.”

The Alpha Strategy entailed three levels…

The Alpha Strategy entailed three levels…

- Invest in production. If it’s something you need to make a living — education, a skill set, tools — this takes priority over anything else.

- Save consumables. This is the stuff you use on a day-to-day basis — razor blades, pasta, tires — if you use it up and it has a decent shelf life, it falls under Level 2.

- Save real money. If after Level 2 you still have savings left, then you can put it into precious metals and other tangible assets.

Note well: The Alpha Strategy is not a “prepper” or “survivalist” plan for the end of civilization as we know it. You will not — indeed, should not — load up on No. 10 cans of Mountain House freeze-dried meals.

“While you may choose to put away freeze-dried foods,” Pugsley wrote, “remember that they do not fall within the definition of good savings assets… The Alpha Strategy is a means to protect purchasing power, and is not intended to be a means to defend against social collapse.”

Although under present circumstances going into 2024, it can’t hurt. Heh…

The best part about the Alpha Strategy is you can start with any amount of capital. “If you have only $100, you can protect it completely against inflation and all investment risks by simply buying things now that you know you will have to buy next week, next month or next year. If you have $1,000 or $10,000, the same thing holds true.”

Better yet, all your “gains” are tax-free.

![]() Level 1: Invest in Production

Level 1: Invest in Production

“The greater the investment you make in education and tools, the more you will produce and the higher your income and standard of living will be,” Pugsley wrote in The Alpha Strategy.

“The greater the investment you make in education and tools, the more you will produce and the higher your income and standard of living will be,” Pugsley wrote in The Alpha Strategy.

By education, he was careful not to specify a college degree. For purposes of the Alpha Strategy, education means “the acquisition of knowledge that will enable you to produce a product or service that will be in demand by others.” Or it might entail learning a second trade, in case your current skill set becomes obsolete.

Meanwhile, think of the tools you use to earn your living. “Whether you are an accountant whose only tools are a calculator, an accounting pad and a pencil; a mechanic who uses wrenches, drills and hammers; or a manufacturer who needs warehouses, lathes, presses and automatic screw machines, the principle is the same.”

OK, the accountant of 1980 undoubtedly had to spend money on ever-increasing amounts of computer power in the decades since, but you get the idea: If it’s something that won’t go out of date quickly, stock up before prices rise any further.

![]() Level 2: Save Consumables

Level 2: Save Consumables

On to Level 2: “Once you have invested as much of your available capital as you can in education, tools, supplies and facilities for production, the next logical place to put your savings is into those goods that you and your family will consume in future years,” Pugsley wrote.

On to Level 2: “Once you have invested as much of your available capital as you can in education, tools, supplies and facilities for production, the next logical place to put your savings is into those goods that you and your family will consume in future years,” Pugsley wrote.

Whether it’s toothpaste, light bulbs or antifreeze, goods that have a long shelf life and won’t become obsolete before you use them are all fair game for the Alpha Strategy.

It might sound daunting at first. But it’s much easier to accomplish now than when The Alpha Strategy was published. Then, Pugsley had several pages of advice about how to dicker with retailers to get bulk discounts and how to seek out wholesale suppliers. In the age of the internet and wholesale clubs like Costco and Sam’s, you don’t need to resort to such measures.

So… let’s run down a shopping list.

Food: “Foods are the No. 1 consumption item for most of us,” Pugsley wrote, “but because of their perishable nature, they must be carefully selected.” So forget about meat and produce. Even with a freezer, “the storage cost is high relative to other goods.” Consider instead…

Canned goods: Shelf life varies, but figure on using them up within 18 months. Even a one-year supply will insulate you against rising prices

Sugars: The shelf life of sugar is just on this side of forever. “Jams, jellies and other preserves will last indefinitely, as will most fruits that are packed in sugar syrups.” Honey and molasses will keep for years; even if they harden, just heat and stir

Grains and legumes: Wheat, rice, peas and beans will all last for 10 years or longer. Beware: If you grind the wheat into flour, that shelf life turns into mere months

Tea: A “near perfect” savings asset, Pugsley said. Bulk buying gives you significant savings, and tea takes up little space and suffers little if any loss of quality over time

Pasta: It can keep for five years or longer.

Coffee? At the time Pugsley wrote the book, debate raged over its shelf life. A casual search of the internet today reveals that’s still the case. You might want to experiment.

Health and beauty aids: “Items such as deodorant, shampoo and toothpaste will keep indefinitely when stored in a cool, dry place, and mouthwash will keep up to three years under these same conditions… Don’t forget razor blades, toothbrushes, sanitary napkins, combs, brushes and first-aid supplies.”

Cleaning supplies: Depending on their chemical makeup, not all detergents will last indefinitely. “The best Alpha items in the cleaning equipment category are brushes, brooms, mops, vacuum bags, pot scrubbers, trash bags, compactor bags, sponges and scouring pads.”

Paper products: Yes, they last forever as long as they’re not exposed to light, bugs or mice. But there’s a catch: “The biggest drawback to some of these goods is their low cost per cubic foot, as this makes them costly to store.” More about this shortly…

Clothing: Yes, fashions change. But men in particular could easily load up on 10 or 20 years’ worth of socks, underwear and T-shirts.

Automotive: “Storage space and styling taken into account,” Pugsley wrote, “you may decide to buy an extra new car this year and put it up on blocks.” Five years on, you might be very satisfied with the purchase. If that’s too out there, consider stockpiling replacement parts, motor oil and tires.

Around the house: Here too, spare parts for furnaces, water heaters and such might be useful. At the very least, consider small hardware items and garden supplies.

Wine: Pugsley was an oenophile, and he waxed eloquent about wine storage for four pages. “The investment in a substantial personal wine cellar,” he wrote, “offers the best of everything: low risk, protection against inflation, no taxes on the gain and an interesting and pleasurable avocation — in other words, it is the perfect asset for saving.”

Don’t take this up without some basic knowledge about which wines store well and which don’t.

Also beware the temptation to deplete your stash faster than you expect: “My first adventure into stockpiling,” Pugsley wrote, “came when I bought what I thought would be a two–three-year supply of wine. The convenience of having it on hand each time we had a nice meal turned it into a one-year supply.” Which defeats the purpose of keeping your cost of living low…

Most hard liquor, by the way, can last 10 years or more if you store it properly. Beer? Forget it.

Ah, but where do you keep everything? And how much room do you need in the first place?

Ah, but where do you keep everything? And how much room do you need in the first place?

“The amount of room you need,” Pugsley wrote, “will depend on the amount of money you have to invest and the type of goods you decide to stockpile.”

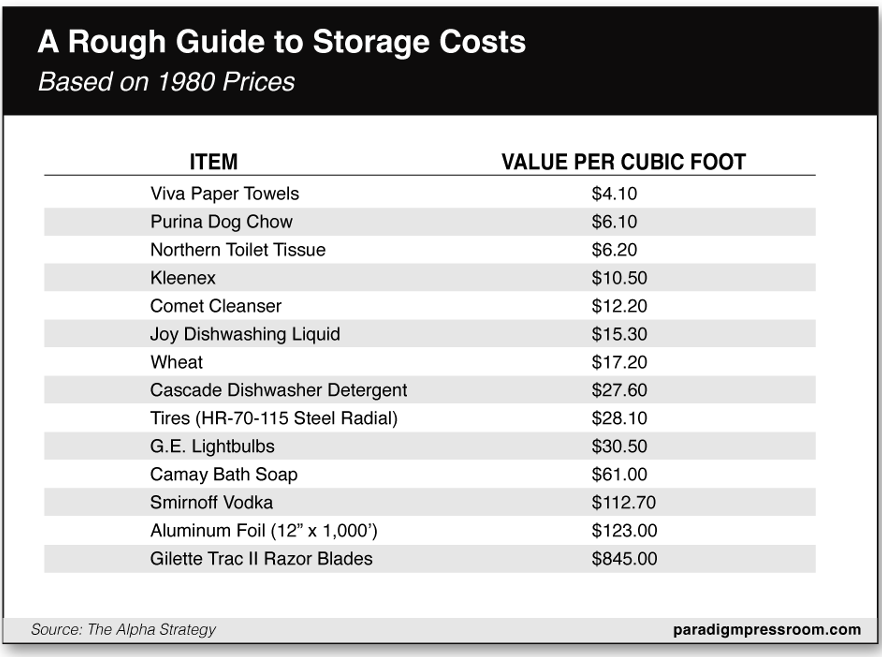

A helpful tool is to figure the cost of an item relative to the amount of space it takes up, the value per cubic foot. This is why we encouraged you at the start of today’s 5 Bullets to stock up on razor blades — a large supply takes up little space — so you wouldn’t find the idea intimidating!

Here’s a table taken straight from The Alpha Strategy. The dollar amounts are vastly out of date, but they’ll get you thinking about which items give you the most bang for your buck if you have limited space.

At 1980 prices, Pugsley reckoned the average value per cubic foot of the goods you’d store would be $25. Thus, a $10,000 stockpile would require 400 cubic feet of space. “It could be kept in a space 4 feet deep by 7 feet high by 14 feet long, or roughly a 4-foot-deep storage area built along the wall of your garage.” That said, a garage might not be the ideal choice, he said: You want a space that’s cool, dark and dry.

Don’t forget to think about insurance if loss of the goods would affect your standard of living for the worse.

![]() Level 3 (Save Real Money)... and Beyond

Level 3 (Save Real Money)... and Beyond

Then you get to Level 3 — saving real money.

Then you get to Level 3 — saving real money.

Still have some cash left after building up your stash? “You are ready to explore the third level of the strategy: the accumulation of real goods that you can eventually sell or exchange.”

Pugsley’s preferred vehicles were raw commodities. Granted, pork bellies and barrels of oil are problematic… so he leaned mostly toward metals, and not only the precious variety. “Copper, zinc, lead, tin, nickel and aluminum are all metals that can be stockpiled, are universally used and can be expected to be in demand for centuries to come.”

Forty-plus years later, his words take on new relevance as copper and nickel will be cornerstones to a “greener” economy — one that will surely be more expensive to live in.

Eager to explore more? It’s easy.

Eager to explore more? It’s easy.

Late in his life — he died in 2011 at age 77 — Mr. Pugsley posted a free PDF file of The Alpha Strategy on his website. And while his site is long gone, fans dutifully reposted the PDF. Here’s a link.

If you prefer a real book in your hands, used copies abound on Amazon and AbeBooks. But they’re less plentiful than when we last looked a few months ago. Thus, expect to shell out about $20. Note well: Only the real book contains an appendix listing the shelf lives of literally hundreds of consumer goods.

The sooner you start, the sooner the strategy will begin paying off. No better place to start, either, than those razor blades.

Merry Christmas,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets