Battle Lines in the Trade War

![]() Battle Lines in the Trade War

Battle Lines in the Trade War

OK, with the benefit of a few days’ hindsight, we can take stock of where things stand with the trade wars.

OK, with the benefit of a few days’ hindsight, we can take stock of where things stand with the trade wars.

That is, apart from angry Canadian sports fans…

As perhaps you’re aware, the 25% tariffs Donald Trump declared on Canada and Mexico got last-minute reprieves. But the drama is sure to ramp up again ahead of a new deadline early next month.

“The extent of Canadian and Mexican trade with the United States is difficult to overstate,” says Paradigm’s macro authority Jim Rickards.

“The extent of Canadian and Mexican trade with the United States is difficult to overstate,” says Paradigm’s macro authority Jim Rickards.

“Twenty-three of the 50 states rank Canada as their No. 1 trading partner measured by imports. That includes the entire northern tier of U.S. states from Washington to Maine (with the exceptions of Idaho and Michigan) and most of the Midwest.

“Ten of the 50 states rank Mexico as their No. 1 trading partner measured by imports. That includes the entire southern tier of U.S. states (with the exceptions of California and Florida) plus Missouri, Kentucky and Michigan.

“From automobiles to avocados, Canadian and Mexican imports are everywhere.”

While Trump’s stated grievances with our North American neighbors are fentanyl and migrants, Jim says there’s a bigger issue looming with Mexico.

While Trump’s stated grievances with our North American neighbors are fentanyl and migrants, Jim says there’s a bigger issue looming with Mexico.

In recent years, “Chinese companies have taken over Mexican companies or built their own factories in Mexico to do an end-run around direct tariffs on China. The Chinese are putting automobile assembly plants in Mexico and exporting the cars to the U.S. free of tariffs under the U.S.-Mexico-Canada Agreement on trade (USMCA, the successor treaty to NAFTA).”

By the same token, U.S. tariffs on Mexico could become a major issue for European automakers with Mexican factories.

“I spoke to a well-informed source at Audi recently,” Jim says. “They're frantic. They just built a multibillion-dollar plant in Mexico to do final assembly on the Q5 SUV (their most popular model). They expect that new Mexican tariffs will price it out of the market (compared to Toyotas and Nissans that are built in the USA).” Bad news for Audi parent Volksawagen.

“The trade situation with Canada is more problematic,” Jim says.

“The trade situation with Canada is more problematic,” Jim says.

For one thing, Justin Trudeau is only a caretaker prime minister until elections later this year — no later than October. He doesn’t have much authority to strike permanent deals.

If Trudeau’s Liberal Party hangs onto power, Jim says you can expect “dollar-for-dollar tariff retaliation, an international anti-Trump trade coalition including Mexico, Denmark, Panama and the EU, a ban on purchases of U.S. goods by all Canadian federal government agencies, a ban on American companies bidding on Canadian government contracts, a ban on American firms participating in projects funded by Canada and support for Canada’s cultural sector against ‘Donald Trump’s billionaire buddies.’

“Canadian exports to the U.S. are dominated by energy products (about $165 billion) followed by automobiles and parts (about $83 billion) and consumer goods (about $70 billion). Electronics, food, fish and aircraft make up a relatively small part of the total.”

And then there’s China — where there’s been no 30-day pause. A new 10% tariff took effect on Tuesday.

And then there’s China — where there’s been no 30-day pause. A new 10% tariff took effect on Tuesday.

China responded immediately with a 15% tariff on U.S. coal and liquefied natural gas and a 10% tariff on oil, farm equipment and “large-engine cars,” effective next Monday.

The Middle Kingdom has little room to maneuver, as Jim sees it: “China is in the opposite position of the U.S. It produces too much and does not consume enough.

“China’s best approach would be to lower its tariffs, encourage consumption by its citizens and attempt to strengthen its currency so that its consumers can afford more imported goods.

“In fact, we expect China to do the opposite and hunker down in its neo-mercantilist approach by cheapening its currency and attempting to flood the world with more exports.

“If China takes the latter approach, it will fail.”

Last night in an exclusive webcast from Pentagon City, Jim explained why an announcement from Beijing coming as early as this Monday could turn global markets inside-out.

He also laid out a comprehensive strategy you can put to work in your own portfolio to transform the turmoil of a global trade war into a major personal windfall.

We’re talking the potential for returns 50–100 times higher than traditional approaches. In fact, looking back investors could have walked away with gains as high as 1,394%...1,560%...and even 1,755% in a matter of weeks or months as this all played out.

We urge you to give Jim’s urgent trade-war update a look right away.]

![]() “Meh” Jobs, Rising Wages

“Meh” Jobs, Rising Wages

There’s nothing in the January job numbers to spur the Federal Reserve to resume its rate-cutting cycle next month.

There’s nothing in the January job numbers to spur the Federal Reserve to resume its rate-cutting cycle next month.

The numbers came out this morning. The wonks at the Bureau of Labor Statistics conjured only 143,000 jobs for January. That’s a bit less than needed to keep up with population growth. On the other hand, December’s blockbuster number was revised even higher.

The official unemployment rate ticked down to 4.0%.

As mentioned yesterday, today’s release includes extensive revisions to prior years’ numbers to reflect new incoming data. (The response rate from businesses to BLS surveys has dropped like a rock since the pandemic.)

It turns out that in the 12 months ending March 2024, there were 589,000 fewer jobs created than the BLS first estimated. Which sounds bad except for the fact that the BLS issued a worse estimate last summer of 818,000. Less bad is good — or something like that.

Perhaps the biggest bummer as far as Wall Street is concerned is that wages are up 4.1% year-over-year in January — up from 3.8% in December.

All else being equal, rising labor costs translate to rising prices — which prompt workers to demand even bigger pay increases, and so on and so on. This is the dreaded “wage-price spiral” that made inflation so tough to tame in the 1970s.

These wage numbers will make the Fed even less inclined to cut interest rates next month than it was already.

Whether it’s Fed policy or tariff jitters or another subpar earnings report from a “Magnificent 7” name… the major U.S. stock indexes are in the red today.

Whether it’s Fed policy or tariff jitters or another subpar earnings report from a “Magnificent 7” name… the major U.S. stock indexes are in the red today.

At last check, the S&P 500 is down just over a half-percent to 6,050. The index has been range-bound since mid-January. If it’s going to break out, either the Mag 7 have to get back on track or the other 493 stocks in the index have to pick up the slack.

Another Mag 7 name — Amazon — delivered an earnings disappointment after the closing bell yesterday. The numbers were fine, but Mr. Market doesn’t like AMZN’s outlook for the year. And he especially doesn’t like the company’s plans for a record amount of AI spending.

(Remember when the Street saw “record AI spending” as a plus? That’s the DeepSeek effect for you…)

![]() Precious Metals on the Precipice

Precious Metals on the Precipice

Something is starting to crack in the precious metals space.

Something is starting to crack in the precious metals space.

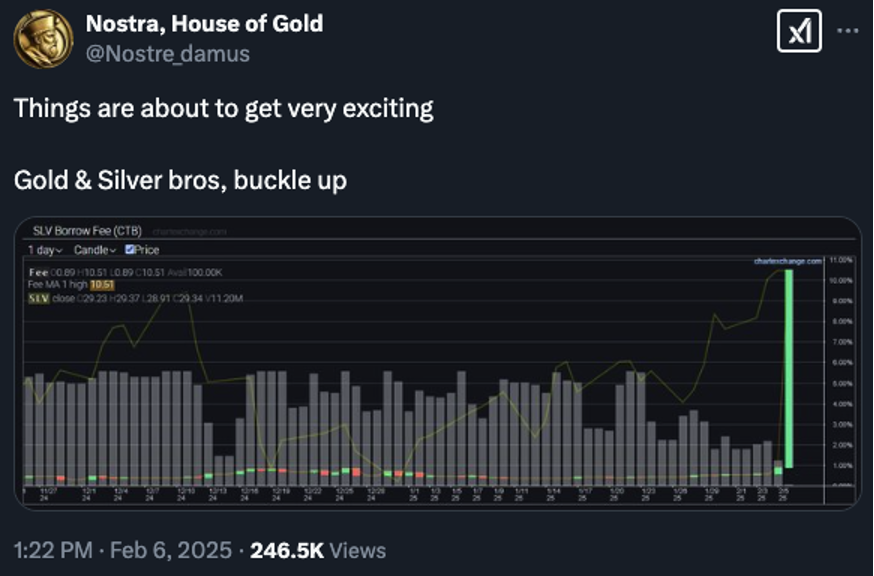

So that’s a chart of what it costs to borrow shares of the iShares Silver Trust (SLV) — the big silver ETF. And yes, that cost just exploded higher.

Reminder: People borrow shares of a stock or ETF when they’re engaged in short selling — betting the share price will fall. You borrow shares from a broker and sell them immediately in hopes of buying them back later at a lower price. Once you do that, you return the shares to the broker and pocket the difference. Lather, rinse, repeat.

If the fee to borrow shares of SLV has exploded higher, that means almost no one holding SLV is willing to lend those shares to short sellers. “The stress in the silver market appears to be in the process of going parabolic,” says Ed Steer, independent newsletter operator and a veteran of the precious metals markets.

Similar, if less extreme, activity is showing up in the big gold ETF, GLD.

This evident “short squeeze” coincides with a widening gap between the spot price of gold and the price of gold futures.

This evident “short squeeze” coincides with a widening gap between the spot price of gold and the price of gold futures.

As we check our screens, the bid on spot gold this morning is near record territory at $2,868. The front-month futures contract is also near record territory, but $22 higher at $2,890.

This “spread” is one of the widest to emerge since the market dislocations brought about by the COVID pandemic nearly five years ago.

This time, the mainstream has settled on tariff jitters as the reason. Large amounts of physical gold are fleeing vaults in London for vaults in New York — in case the Trump administration slaps tariffs on the U.K. and the European Union.

We’re always skeptical of facile mainstream explanations. What matters more is this: The 2020 dislocation resulted in gold leaping from under $1,600 to over $2,000 in only six months.

No guarantees of a repeat this time — but the setup is there.

In the meantime, silver is struggling to keep up with gold, back below $32. The mining stocks as a group are flat on the day.

Elsewhere in the commodity complex, crude is at the low end of its recent trading range at $70.67.

For once, crypto is like watching paint dry — Bitcoin stuck a little under $98,000, Ethereum just over $2,700.

![]() Priorities

Priorities

In case you’re wondering… the IRS will not get a going-over from DOGE until tax season is over.

In case you’re wondering… the IRS will not get a going-over from DOGE until tax season is over.

Elon Musk’s Department of Government Efficiency might be putting a torch to the U.S Agency for International Development… but Treasury Secretary Scott Bessent tells Bloomberg the IRS is off-limits for the time being.

For one thing, “customer-facing employees” at the IRS aren’t even being offered the buyout that many other federal employees are. At least not until after the April 15 filing deadline. And thus, the agency as a whole won’t get any DOGE scrutiny until that time, either.

Priorities, right?

Speaking of which… when is Musk’s DOGE crew going to show up at the Pentagon — which as we’ve pointed out for more than a decade is incapable of passing an audit?

Speaking of which… when is Musk’s DOGE crew going to show up at the Pentagon — which as we’ve pointed out for more than a decade is incapable of passing an audit?

Or would that be getting too close to Musk’s own gravy train at SpaceX?

As independent journalist Max Blumenthal tweets, the Defense department is “the most corrupt, bloated arm of the U.S. government, which makes USAID look like a lemonade stand. But I doubt Elon will bite the hand that’s fed him so much.”

![]() Prohibition, Continued…

Prohibition, Continued…

“I am responding to the reader who made a comment regarding the role they believe government should have in the war on drugs,” begins today’s mailbag.

“I am responding to the reader who made a comment regarding the role they believe government should have in the war on drugs,” begins today’s mailbag.

(If you’re late to the party, somehow a discussion over fentanyl and tariffs earlier this week morphed into a thoughtful dialogue about drug prohibition.)

“Putting aside their confidence in government’s abilities these types of arguments always have a do-gooder undertone to them. There’s this underlying assumption that the collective ‘we’ have to do something.

“What this reader and those who believe in the power of ‘society’ do not acknowledge is that there is a proper role for government and just as it has its role so too do family and the church. I just read this morning the Morning Reckoning and Mr. Ring had an excellent point in his describing ordo amoris. There are proper roles for all parts of society - God, self, family, society, country.

“People today dismiss God outright and elevate country and society as the cure for everything. The order is all messed up. People think government is the cure for all our ills. The problem is that there is a spiritual world whether you agree or not. The government is incapable of addressing spiritual issues, of which drug abuse is one.

“While there is a need for personal responsibility and perhaps government can make it harder to acquire the drugs, the desire that is spiritual can’t be stopped by society or government. That is where the church comes in as only they are equipped to address the heart by pointing that person to God, who can change their desires and heal their spirit. Until society/government and people acknowledge this the ‘war on drugs’ will ALWAYS be a failure. Thanks again for always having great content and thought-provoking comments!”

“As someone that works with addicts, I can tell you that if an addict wants their substance of choice, it doesn't matter who is there or how difficult it is to obtain, they will find a way to get it,” says our final correspondent.

“As someone that works with addicts, I can tell you that if an addict wants their substance of choice, it doesn't matter who is there or how difficult it is to obtain, they will find a way to get it,” says our final correspondent.

“With ‘providers’ of said substance, if there's a market they will work to fulfill that opening no matter the difficulty.

“This is something that this country witnessed during Prohibition. Vocal society didn't like the generally male individuals who would drink away the weekly paycheck and then go home and mistreat the others in the household. They worked tirelessly at getting the Eighteenth Amendment passed, in 1919 (effected Jan. 17, 1920), as an act of reducing poverty and improving society.

“Society didn't want to stop drinking so enterprising individuals began producing ‘homebrew’ in much greater quantities and bootlegging began filling the void. Speakeasies began appearing (although most were nothing like in the movies, with passwords at doors and secret passages). Most were out in the open along roads or in restaurants.

“Organized crime saw an opportunity and stepped in. They created a lot of wealth through their bootlegging and speakeasy operations. There were also several parties who weren't concerned with the quality of the end product and didn't utilize appropriate equipment, causing blindness in several of their consumers.

“The government finally saw that they were fighting a losing battle and repealed the Eighteenth Amendment with the Twenty-First Amendment in 1933.”

Dave responds: The 21st Amendment is the only one adopted via state ratifying conventions — as opposed to state legislatures. Perhaps that’s a measure of how unpopular Prohibition had become after 14 years.

As for family, church, etc. I penned a few thoughts in 2023 that you might wish to set aside for a little weekend reading.

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets