Follow-up: China’s Tariff WMD

![]() Follow-up: China’s Tariff WMD

Follow-up: China’s Tariff WMD

“If war is what the U.S. wants, be it a tariff war, a trade war or any other type of war, we’re ready to fight till the end."

“If war is what the U.S. wants, be it a tariff war, a trade war or any other type of war, we’re ready to fight till the end."

Yesterday we briefly touched on a brusque statement from the Chinese Foreign Ministry in response to the latest Trump tariffs. It deserves more attention today — not least because it’s getting overlooked by liberal legacy media and conservative “new media” alike.

In fact, the whole thing is worth a block quote, something we rarely do…

The fentanyl issue is a flimsy excuse to raise U.S. tariffs on Chinese imports. Our countermeasures to defend our rights and interests are fully legitimate and necessary.

The U.S., not anyone else, is responsible for the #FentanylCrisis inside the U.S. In the spirit of humanity and goodwill toward the American people, we have taken robust steps to assist the U.S. in dealing with the issue. Instead of recognizing our efforts, the U.S. has sought to smear and shift blame to China, and is seeking to pressure and blackmail China with tariff hikes. They’ve been PUNISHING us for helping them. This is not going to solve the U.S.’ problem and will undermine our counternarcotics dialogue and cooperation.

Intimidation does not scare us. Bullying does not work on us. Pressuring, coercion or threats are not the right way of dealing with China. Anyone using maximum pressure on China is picking the wrong guy and miscalculating. If the U.S. truly wants to solve the fentanyl issue, then the right thing to do is to consult with China by treating each other as equals.

If war is what the U.S. wants, be it a tariff war, a trade war or any other type of war, we’re ready to fight till the end.

“This leaves zero room for interpretation: China is clearly signaling they won’t be cowed by Trump,” tweets the internet entrepreneur Arnaud Bertrand.

“This leaves zero room for interpretation: China is clearly signaling they won’t be cowed by Trump,” tweets the internet entrepreneur Arnaud Bertrand.

In 2010, Bertrand co-founded HouseTrip — an online platform geared toward rental-house sharing in Europe. He sold it to TripAdvisor in 2016. Married to a Chinese woman, he has quite the global perspective; I don’t agree with everything he says but his feed on X is worth checking out.

As Bertrand sees it, China’s defiant stance contrasts with what we’ve seen from other governments since Trump’s inauguration — to wit, Colombia’s president folding like a lawn chair and agreeing to take back migrants expelled from the United States.

Ironically, “This will probably earn China even more respect from Trump (and the rest of the world) than a subservient approach,” Bertrand avers.

“As the Chinese saying goes, if you retreat one step they'll want to advance one step.”

Interesting. Brings to mind something Trump said on the campaign trail last June: "We have enemies on the outside — China, Russia, North Korea. But they're not really enemies if you have a smart president. They're not enemies, you’ll make them do great."

And something he said on Inauguration Day: “My proudest legacy will be that of a peacemaker and unifier.”

For the sake of our peace and prosperity, let’s hope that’s the case.

Of course, getting from here to there could be a hair-raising experience.

Which brings to mind a tariff-themed warning from Paradigm’s macroeconomics maven Jim Rickards that landed in your inbox yesterday.

In case you didn’t see it, he said, “While everyone has been focusing on Canada and Mexico,

China has been preparing a trade war WMD of its own.”

It’s set to launch in four more days — “and President Trump is prepared to fire back with a ‘kill shot’ of his own,” says Jim.

If you have money in the markets, you won’t want to pass up Jim’s urgent briefing from Pentagon City. Click here to watch immediately.

![]() Crypto Revival

Crypto Revival

Hmmm… Bitcoin has climbed back above $90,000.

Hmmm… Bitcoin has climbed back above $90,000.

$90K is the number that Paradigm chart hound Greg Guenthner told us on Tuesday was a line in the sand. A recovery to that level would bode well for the flagship crypto; otherwise a drop to $73K might be in the cards.

Checking our screens Bitcoin is up to $90,692 — perhaps in anticipation of concrete news emerging tomorrow from a crypto summit hosted by White House crypto-and-AI czar David Sacks.

Context: In January, Bank of America CEO Brian Moynihan told CNBC that the banking industry is ready to “come in hard” on crypto — once the new administration clarifies the rules of the road.

“JPMorgan, Goldman Sachs and Citigroup are already experimenting with blockchain technology,” Paradigm’s own crypto and AI authority James Altucher reminds us.

“JPMorgan, Goldman Sachs and Citigroup are already experimenting with blockchain technology,” Paradigm’s own crypto and AI authority James Altucher reminds us.

“And now, as Washington prepares to clarify cryptocurrency regulations, banks are getting ready to act.

“The biggest development? Banks might soon let you put your checking account on the blockchain. They're calling it ‘tokenized deposits.’ (Don't worry about the fancy name — it just means your money moves at internet speed.)

“This is a complete U-turn from just a year ago. Under the previous administration, banks were told to stay away from crypto. Now, they're being encouraged to dive in.

“Even the usually strict FDIC (the people who insure your bank deposits) is changing its tune. They're working on new rules to let banks offer crypto services without jumping through endless hoops.”

Three consequences: “First, cryptocurrency is about to become much easier to use,” says James.

Three consequences: “First, cryptocurrency is about to become much easier to use,” says James.

“Instead of dealing with complicated crypto exchanges, you might soon buy Bitcoin through your regular bank account.

“Second, sending money across borders could become as easy as sending an email.

“And third — this might be the biggest one — we're watching the birth of a new financial system. One that combines the safety of traditional banks with the speed of cryptocurrency.

“For investors, this is like watching the internet boom of the 1990s all over again. But this time, the banks aren't fighting the technology. They're embracing it. And they're bringing trillions of dollars with them.

“The crypto market is already worth over $2 trillion. Imagine what happens when JPMorgan's $3.9 trillion in assets starts flowing into the space. Or when Bank of America's 68 million customers can buy Bitcoin as easily as they check their balance.

“We're not just talking about price increases. We're talking about a complete transformation of how money moves around the world. And it's happening right now.”

On the heels of the White House crypto summit tomorrow, James will host an exclusive online event for Paradigm readers next Tuesday — live from the SXSW confab in Austin, Texas.

Of course, crypto is only a small part of an ambitious agenda. Among the topics James says he and his team will cover…

- “Are artificial intelligence stocks in a bubble that’s ready to pop?

- “How will Robert F. Kennedy Jr. shake up drugmakers and biotechs?

- “Can quantum computers become the next trillion dollar-industry, or are they just sci-fi hype?”

There will be no hard sell — no selling at all, matter of fact. It all gets going next Tuesday the 11th at 2:00 p.m. EDT.Here’s the full agenda; you’ll want to bookmark that website because that’s where the live event will be hosted.

![]() Actually, This Is Normal

Actually, This Is Normal

As lousy as the recent stock-market sell-off might feel, it’s shockingly normal by the standards of the last couple of years.

As lousy as the recent stock-market sell-off might feel, it’s shockingly normal by the standards of the last couple of years.

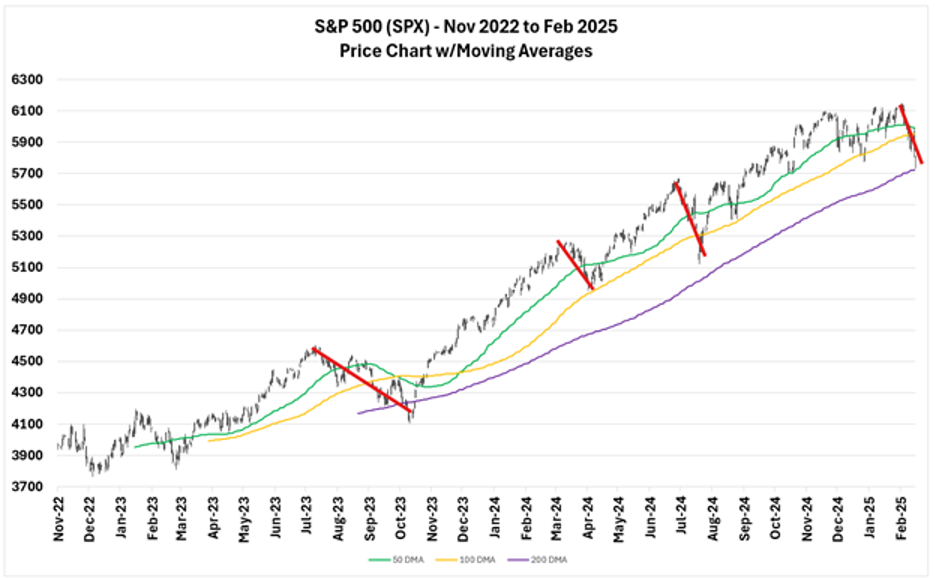

Going back to the start of the current bull market in late 2022, “there have been four major sell-offs in the S&P 500 between 5–10%,” says Paradigm trading pro Enrique Abeyta.

This chart is a little messy, but it’s the only way to illustrate his point.

“As painful as this pullback has been,” says Enrique, “you will see in the chart that it’s fairly ordinary compared with what we have seen so far. It’s also very typical of a normal bull market.”

In the meantime, the major U.S. stock averages are gyrating with every new tariff headline.

In the meantime, the major U.S. stock averages are gyrating with every new tariff headline.

After we hit “send” on yesterday’s edition, Donald Trump said automakers who comply with the U.S.-Canada-Mexico trade accord signed during his first term will be exempt from the new Canadian and Mexican tariffs for 30 days. Mr. Market rebounded, the S&P 500 ending the day up 1.1%.

Today, Commerce Secretary Howard Lutnick says additional one-month exemptions are in the cards. But with no additional clarity, the sell-off has resumed. At 5,794 the S&P 500 is down more than three-quarters of a percent on the day — but still higher than Tuesday’s close.

For the moment, watching precious metals is like watching paint dry — gold at $2,915 and silver at $32.66. Crude is rebounding slightly, but remains under $66.

![]() Republicans Back Financial Cancellation

Republicans Back Financial Cancellation

Go figure: Republicans are about to make “financial deplatforming” a thing again.

Go figure: Republicans are about to make “financial deplatforming” a thing again.

Over the years we’ve chronicled how payment platforms like PayPal and Venmo would cancel the accounts of people who expressed opinions online that the platforms deem “hate speech” or “misinformation.”

And it wasn’t just racism or COVID dissent that were causes for cancellation: For instance, PayPal stopped processing donations to the venerable alt-news website Consortium News because its writers expressed opinions about Ukraine that ran counter to official narratives.

Strangely, on its way out the door the Biden administration implemented a rule in December forbidding this sort of financial cancellation on ideological grounds.

It was part of a general overhaul of rules at the Consumer Financial Protection Bureau (CFPB) governing non-bank financial services like PayPal, Apple Pay and Zelle.

Yesterday, the Senate voted to kill this rule.

Yesterday, the Senate voted to kill this rule.

The vote was 50-47 — with every Republican on the floor voting “yea” except Missouri’s Josh Hawley.

“I don’t want to hear the GOP call themselves the free speech party ever again,” tweets the provocateur Laura Loomer.

Ms. Loomer is a garbage human — but she’s not wrong. And she knows the phenomenon firsthand, having been cancelled over the years by PayPal, GoFundMe and Uber.

“You can oppose the ideological bias of CFPB,” she says, “while also not voting to repeal consumer and free speech protections when we 100% have a monopoly in our country by Big Tech companies as it relates to payment services.”

A companion bill in the House is still in committee. As far as we know, the White House hasn’t taken a stand on the legislation.

Gee, that might be an interesting question to ask for one of the “new media” outlets who’ve been granted White House press passes.

No, I’m not holding my breath. And yes, on a lark I did apply for one. Heh…

![]() Mailbag: JFK Again

Mailbag: JFK Again

From a longtime reader who doesn’t write to us often…

From a longtime reader who doesn’t write to us often…

“I always enjoy reading your take on the news, and the frequent tongue-in-cheek humor (even if I don't agree with 100% of your assertions).

“Over the years, you have poked fun at Bezos' newspaper and its pretentious slogan ‘Democracy Dies in Darkness.’

“It occurred to me that a more accurate slogan would be ‘Democracy Died in Dallas.’

“You folks at Paradigm have written some excellent pieces over the years on how Nov. 22, 1963 was a true watershed moment. One can make a strong case that the Kennedy presidency represented the last time (perhaps until now, I say with skepticism) that the will of the American people had any meaningful influence in Washington.

“Kennedy's death paved the way for the unelected bureaucrats, three-letter agencies and the lobbyist/think tank cartel (through their pet politicians) to take control of our federal government and lead us down the war and deficit spending pathway that we've been on ever since.

“As one of the minority who thinks DJT is neither Hitler reborn nor the second coming of Christ, I remain optimistic yet highly skeptical that the course we've been on the last 60 years might be reversed. There's a lot to be done, and it all comes with some amount of short-term pain for the American people. But lifesaving surgery is never painless, nor is recovery and rehabilitation quick.”

Dave responds: And there’s so much that could go wrong on the operating table!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets