Sunspots and Markets

![]() Sunspots and Markets

Sunspots and Markets

“Are You Prepared for the Next Solar Storm?” reads a warning from the Michigan Farm Bureau.

“Are You Prepared for the Next Solar Storm?” reads a warning from the Michigan Farm Bureau.

“Solar storms can disrupt GPS signals causing temporary delays in field work as well as inaccurate application of inputs, potentially impacting yield.”

A few days ago we mentioned that’s exactly what happened to farmers across the United States last May. The biggest geomagnetic storm since 2003 fouled up the satellite navigation that farmers rely on to guide their tractors, planting seed and fertilizer with pinpoint precision.

Conservative estimate of the resulting crop losses? $500 million.

But it’s not just satellites or avionics or the power grid that can get messed up when the sun gets angry and starts shooting solar flares earthward.

A large body of research shows that solar flares affect everything from societal moods to, yes, financial markets.

A large body of research shows that solar flares affect everything from societal moods to, yes, financial markets.

In the 1920s, the Russian researcher Alexander Chizhevsky uncovered a link between sunspots and “mass excitability.”

“Chizhevsky,” says a thumbnail sketch at Wikipedia, “proposed that not only did geomagnetic storms resulting from sunspot-related solar flares affect electrical usage, plane crashes, epidemics and grasshopper infestations, but human mental life and activity.”

He studied sunspot records and compared them with riots, revolutions and wars in Russia and 71 other countries going back nearly 2,500 years. “He found that a significant percent of what he classified as the most important historical events involving large numbers of people occurred around sunspot maximum.”

OK, we know: Correlation does not equal causation. Wet sidewalks don’t cause rain. And Chizhevsky didn’t try to explain a mechanism by which sunspots, and the geomagnetic storms they trigger, made people go more berserk than usual. (His fiercest critic was Stalin, who disliked what Chizhevsky’s research implied about the Russian revolutions of 1905 and 1917; Chizhevsky spent eight years in the gulag.)

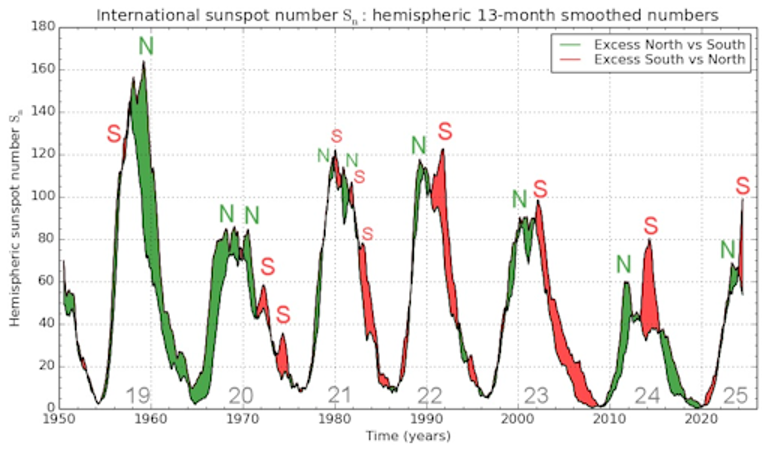

Key point: Sunspots don’t occur at random. There’s an 11-year sunspot cycle — and the current cycle is near or at its peak.

Key point: Sunspots don’t occur at random. There’s an 11-year sunspot cycle — and the current cycle is near or at its peak.

Here’s a chart of the cycles going back several decades, courtesy of the Royal Observatory of Belgium…

Fortunately, from a “mass excitability” standpoint, the peak of the previous cycle in 2012–13 was a weak one — by some measures the weakest in a century.

But the previous peak coincided neatly with the 9/11 attacks in 2001. The peak before that coincided with Iraq’s invasion of Kuwait in 1990.

You can go back further: 1979 marked the starts of both the Iran hostage crisis and the Soviets’ war in Afghanistan. 1968 was an epic year of conflict — the Tet Offensive, the Prague Spring, the MLK and RFK assassinations, the Democratic convention meltdown in Chicago, the start of the Troubles in Northern Ireland.

For decades, there’s been a niche of analysts who see a link between sunspots and events in the economy and markets.

For decades, there’s been a niche of analysts who see a link between sunspots and events in the economy and markets.

In the 1940s and ’50s, the American economist Edward Dewey latched onto Chizhevsky’s work and gave it a Western audience — publishing it through his Foundation for the Study of Cycles.

In more recent years a handful of finance bigwigs like Paul McCulley — who helped run the bond trading giant Pimco in its heyday — have also latched onto sunspot study, suggesting that peaks in the solar cycle coincide with peaks in the stock market.

That might have proven true with dot-com mania peaking shortly before the sunspot max of 2001… but otherwise the linkage is more shaky.

Likewise, certain stock market bottoms have coincided with solar minimums — i.e., 2009 and 1932 — but it doesn’t occur in a reliable 11-year pattern.

Your editor has written about this phenomenon periodically since 2012 — with mild interest but also little hope that the solar cycle can translate to actionable investment advice.

But as it happens, one expert has cracked the sun’s code.

But as it happens, one expert has cracked the sun’s code.

“The consequences of solar flares are well understood,” says Mason Sexton — the newest addition to the Paradigm team.

As he writes in his welcome package for readers of his trading service The Map, “These intense bursts of electromagnetic radiation generated in the sun’s atmosphere can interrupt radio broadcasts, knock out electric grids and even force satellites to fall from the sky.

“Is it really so hard to believe that these massive forces could impact the moods, feelings and temperaments of human beings?”

Or, I might add, their actions in the markets?

It’s little wonder I was unaware of Mr. Sexton until recently. He was a media star in the 1980s — making spooky-accurate calls such as the start of an epic market in 1982. He also nailed the crash of 1987, still the biggest one-day percentage drop in market history.

Then he dropped out of sight. His prescient forecasts were limited to well-heeled private clients.

But his track record remained unblemished. Among other calls, he nailed the 2008 financial crisis and the COVID crash of 2020 — and the recoveries that followed.

Now he’s stepping back into the public eye — and not a moment too soon with the current sunspot cycle approaching its peak.

Thing is, it’s not just sunspots that Mason Sexton uses to make these calls. That’s unusual enough — but there’s another aspect to his methodology that, frankly, we’ve been told “smacks of the occult.”

No doubt, Paradigm Press publisher Matt Insley put his rear end on the line when he brought Mason aboard.

Was it the right decision?

Click here to watch a short message from Matt and decide for yourself. Give it a look now — because with the solar cycle approaching its peak, Mason says something big could be coming three weeks from today.

![]() NVDA: No Worries

NVDA: No Worries

A funny thing happened after we went to virtual press yesterday.

A funny thing happened after we went to virtual press yesterday.

Nvidia’s post-earnings sell-off of 3.5% suddenly swelled to an 8% drop by the closing bell. That was a serious drag on the major averages — with the S&P 500 ending the day down 1.6% and the Nasdaq 2.8%.

What changed in those final couple hours of trading? Nothing. Just one of those “selling begets more selling” things.

“Nvidia has been such a dominant force that anything short of absolute perfection leaves traders looking for an excuse to take profits,” writes Davis Wilson of our sister e-letter The Million Mission.

“And after the stock’s monster run over the past year, there was bound to be some selling pressure from funds looking to rebalance.”

As far as Davis is concerned, “Nvidia remains at the center of the AI revolution. Hyperscaler spending is still increasing, every major AI model being built today relies on Nvidia’s hardware and the AI revolution is just getting started.

“When a world-class company posts stellar earnings and the stock dips anyway, it often sets up a buying opportunity. That’s why I’m watching Nvidia closely in the coming days.

“If the stock continues to slide, I may look to add to my position.”

Checking our screens this morning, NVDA is staging a modest recovery of 1.3%. All the major U.S. indexes are up between a third and a half of a percent. Still, at 5,881 the S&P 500 is on track for its worst week of 2025.

If it’s real carnage you’re looking for today, it’s in the precious metals.

If it’s real carnage you’re looking for today, it’s in the precious metals.

Gold is down another 30 bucks at last check, the bid now $2,847. The good news is that just like in January, the Midas metal will post a weekly and monthly close over $2,800. The bad news is that gold has slid over $100 in the space of a week. Yes, gold was seriously “overbought,” but that doesn’t make the sea of red any easier to look at.

Silver is set to end the week a hair below $31. It wasn’t a good sign for the precious metals complex that silver couldn’t hold the $33 handle for more than a nanosecond earlier this month.

Elsewhere, crude is set to end the week back under $70. And the damage to crypto will take some time to repair; as we write Bitcoin is just over $84,000.

The Federal Reserve’s preferred measure of inflation is backing down.

The Federal Reserve’s preferred measure of inflation is backing down.

“Core PCE” this indicator is called. When Fed officials talk about their 2% inflation target, this is the number they have in mind.

For January, core PCE registered a 2.6% year-over-year increase — down meaningfully from December’s 2.9%. That said, the number’s been stuck in a range between those two figures for the last nine months.

At this point, the activity in the futures market suggests a 94% probability the Fed will leave short-term interest rates alone at its next meeting on March 19. The next major economic data point that could alter that calculus is the February job numbers — due a week from today.

![]() Apple Caves on Privacy

Apple Caves on Privacy

Presumably, the topic of online privacy and security did not come up yesterday when British Prime Minister Keir Starmer met with President Trump. But it should have.

Presumably, the topic of online privacy and security did not come up yesterday when British Prime Minister Keir Starmer met with President Trump. But it should have.

A week ago, Apple took the extraordinary step of disabling its “end-to-end encryption” of digital data for customers in the United Kingdom.

It was the only way Apple could comply with the U.K.’s Investigatory Powers Act. Simply put, the British authorities want easy access to Apple customers’ encrypted data.

For her part, U.S. Director of National Intelligence Tulsi Gabbard says the Brits didn’t bother to tell her it was demanding this access. She says given the way online data zips back and forth across international borders, London is effectively committing an “egregious violation” of Americans’ privacy.

A bipartisan bevy of congress members agrees — everyone from liberal icon Sen. Ron Wyden (D-Oregon) to constitutional conservative Rep. Andy Biggs (R-Arizona).

Essential background: Time was when the American authorities sought this unprecedented access from Apple.

Essential background: Time was when the American authorities sought this unprecedented access from Apple.

Going back more than a decade, your editor has chronicled how the FBI and the Justice Department were miffed at Apple’s use of end-to-end encryption. Even with a court order, the feds are frequently unable to crack messages between two Apple devices.

Everyone from James Comey (Barack Obama’s FBI director) to William Barr (Trump 45’s attorney general) complained about it. They demanded Apple build “back doors” into their hardware and software so the feds could obtain easier access to sensitive data.

The problem, as I pointed out all along, is that there’s no such thing as a back door that only “good guys” can pass through. If the feds can get in, so can hackers, foreign governments and so on.

The feds turned out to be less insistent than the Brits — and so Apple caved last week. The back door is wide open and so is the front.

Gabbard says she’s seeking legal advice about whether London has breached an agreement with Washington not to demand data belonging to each other’s citizens.

Again, it would have been nice if this topic had come up yesterday between Trump and Starmer — but I see nothing to suggest it did.

To be continued…

![]() Beelzebezos Likes “Personal Liberties and Free Markets” Now<

Beelzebezos Likes “Personal Liberties and Free Markets” Now<

We shouldn’t let the week go by without acknowledging Jeff Bezos’ latest pivot at The Washington Post.

We shouldn’t let the week go by without acknowledging Jeff Bezos’ latest pivot at The Washington Post.

It was a big deal last October when Bezos forbade his editorial board from endorsing a presidential candidate.

Under his ownership it endorsed the Democrat in both 2020 and 2016. And during the Trump 45 years, the paper adopted the pretentious slogan “Democracy Dies in Darkness.”

On Tuesday, he told the staff about “a change coming to our opinion pages.

“We are going to be writing every day in support and defense of two pillars: personal liberties and free markets. We’ll cover other topics too of course, but viewpoints opposing those pillars will be left to be published by others.”

Given a choice to resign if he wouldn’t get with the program, the editorial page editor quit.

“I’m confident that free markets and personal liberties are right for America,” Bezos continued. “I also believe these viewpoints are underserved in the current market of ideas and news opinion. I’m excited for us together to fill that void.”

Of course, liberal consumers of legacy media are aghast about the lack of “balance.” Whatever.

(As Glenn Greenwald tweets, “How many Trump supporters has the Sulzberger family hired as NYT columnists?”)

The more important thing is that Bezos’ heel turn is now complete. He now belongs in the same bucket as Sam Altman and Alex Karp.

It would have been nice for Mr. Bezos’ rag to stand up for “personal liberties and free markets” when it counted — right around this time five years ago when COVID lockdowns were looming.

But of course, Bezos was one of the biggest beneficiaries of lockdowns — as thousands upon thousands of small retailers were devastated while Amazon booked a 44% increase in revenue and a 70% jump in profit.

Oh, but this isn’t even the biggest outrage in media this week. Stand by for the mailbag…

![]() Mailbag: From JFK to Jeffrey Epstein

Mailbag: From JFK to Jeffrey Epstein

“I have appreciated your thoughts about the release of JFK assassination documents over the years,” a reader writes

“I have appreciated your thoughts about the release of JFK assassination documents over the years,” a reader writes

“Any thoughts about what has been revealed so far with the latest document releases?”

Dave responds: I defer to the heroic Jefferson Morley, who’s been suing the CIA for over 20 years to get full access to the relevant documents.

In a post last Saturday at his JFK Facts Substack site, he assigns the Trump administration a D-plus for its efforts since Trump’s executive order of Jan. 23.

The only genuinely positive development is the FBI coming clean with 2,400 “new” documents the agency previously withheld from the Assassination Records Review Board. The National Archives is now preparing them for release.

Otherwise, there’s been bupkis for transparency. After all these years, we’re still waiting for the complete and unredacted versions of three essential documents…

- The testimony of CIA spymaster James Angleton, who kept Oswald under surveillance from 1959–1963

- The personnel file of undercover CIA officer George Joannides, who likewise kept tabs on Oswald

- The 1961 memo of JFK aide Arthur Schlesinger proposing an overhaul of the CIA.

In sum, “The president has a long way to go to make good on the laudable goals of EO 14176,” says Morley.

While we’re at it, we should address yesterday’s fiasco with the Jeffrey Epstein files — seeing as I’ve observed many commonalities between the two cases.

While we’re at it, we should address yesterday’s fiasco with the Jeffrey Epstein files — seeing as I’ve observed many commonalities between the two cases.

As you might be aware, Attorney General Pam Bondi delivered Epstein dossiers to a handful of MAGA “influencers” visiting the White House — who proceeded to wave them around as if they’d performed a daring feat of investigative journalism.

As one comment on X put it, “Making such a goofy, WWE-style hypertrain spectacle of demonic child abuse documents comes off as super tone-deaf and weird.”

[Photo posted extensively on X]

Worse, it turns out there was nothing in the “dossiers” that wasn’t already public. Certainly there were no names of wealthy and powerful people to whom underage girls were trafficked.

Thus, Bondi wrote the proverbial strongly worded letter to the FBI. She accused the agency’s New York field office of holding back the important stuff — as if she didn’t know where that important stuff is housed and who’s in charge of it.

Snarks a writer who goes by the pseudonym “Sundance” at The Conservative Treehouse:

“Apparently the attorney general was unaware that Ghislaine Maxwell was prosecuted in New York and all the Epstein evidence was co-located with the trial venue as some of the post-conviction legal arguments and appeals are taking place.”

(The writer calls Bondi “the Sean Hannity of U.S. attorneys general.” Heh…)

According to a report from The National Pulse, the “influencers” were supposed to keep the “dossiers” hush-hush until a later time — but someone forgot to tell them and by the time they did their little impromptu photo-op it was too late.

Whether it all went down that way or not, it’s a horrible look for the much-ballyhooed “new media.”

The LibsofTikTok lady and the rest of them performed a shameful act of “access journalism” with Trump World — as shameful as anything the legacy media used to with the Clintons, Bushes and Obamas.

And it’s just as much of a disservice to the citizens they purport to speak for.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets