Bezos Accepts Trump

![]() Bezos Makes His Peace With Trump

Bezos Makes His Peace With Trump

Three days ago, Amazon founder Jeff Bezos sent a subtle but unmistakable signal to his fellow billionaires: Life will go on even if Donald Trump wins another term.

Three days ago, Amazon founder Jeff Bezos sent a subtle but unmistakable signal to his fellow billionaires: Life will go on even if Donald Trump wins another term.

Not that it was reported that way anywhere: The news was that The Washington Post editorial board won’t endorse a presidential candidate this year.

By most accounts, the orders came straight from Bezos, who bought the Post from the Graham family in 2013.

Perhaps you didn’t even hear about it. After all, no one outside America’s center-left intelligentsia cares about newspaper endorsements of candidates anymore.

But inside America’s center-left intelligentsia, the meltdown was epic…

To be sure, Bezos’ gambit is intriguing. The Post endorsed Hillary Clinton in 2016. When she lost, the paper flamboyantly took on the mission of undermining Trump.

It adopted the pretentious slogan “Democracy Dies in Darkness.” Along with The New York Times, it relentlessly peddled the narrative that Trump was somehow “colluding” with the government of Russia — a narrative for which even Special Counsel Robert Mueller found no supporting evidence. Bezos’ rag then endorsed Joe Biden in 2020.

Our favorite political reporter Michael Tracey sees which way the winds are blowing now…

And Bezos is hardly alone…

The first clue that the power elite was making its peace with Trump came early this year at the World Economic Forum’s annual shindig in Davos, Switzerland.

The first clue that the power elite was making its peace with Trump came early this year at the World Economic Forum’s annual shindig in Davos, Switzerland.

We chronicled it at the time: Blackstone Group founder Stephen Schwarzman signaled lukewarm support for Trump at a time Trump still had competition for the Republican nomination.

But the real bombshell came from JPMorgan Chase CEO Jamie Dimon — veteran Democratic donor, once rumored a top candidate for Barack Obama’s Treasury secretary.

“Take a step back, be honest,” he told CNBC at Davos. “He was kind of right about NATO, kind of right on immigration. He grew the economy quite well. Trade tax reform worked. He was right about some of China.”

We can’t underscore the contrast strongly enough compared with eight years ago.

We can’t underscore the contrast strongly enough compared with eight years ago.

As we’ve chronicled before, there was almost no billionaire support for Donald Trump in 2016. The Wall Street Journal reported that nine of the 10 biggest donors gave to Hillary Clinton. (Home Depot’s Bernie Marcus was the 10th.) Among donations of $1 million or more, Clinton collected $180 million, compared with Trump’s $33 million.

Eight years later, Trump’s elite backers include Elon Musk… the venture capitalist Marc Andreessen… and hedge fund operators Bill Ackman and Paul Singer. Andreessen was a Clinton supporter eight years ago. Ackman, too, has a history of backing Democrats and he supported Nikki Haley in the 2024 GOP primaries. Eight years ago, Singer was a Never-Trump Republican.

The landscape has shifted: Musk and Ackman on the Trump train.

Bill Gates and Steve Jobs’ widow Laurene Powell Jobs backing Harris, either openly or quietly.

While Bezos and Jamie Dimon bide their time and hedge their bets…

![]() The “Whoosh” in Oil

The “Whoosh” in Oil

The price of oil has cratered 5.7% this morning because Iran’s oil production and distribution is still up and running.

The price of oil has cratered 5.7% this morning because Iran’s oil production and distribution is still up and running.

The first clue that Israel was about to carry out long-awaited airstrikes against Iran came on Friday afternoon — when U.S. aircraft began scrambling from Europe toward the Middle East…

It’s become so predictable in recent years — major U.S. military action coming after U.S. markets close on Friday afternoon. On Friday Feb. 2 this year, U.S. airstrikes in Iraq and Syria came the moment the market closed at 4:00 p.m. Eastern.

In this instance, the Israeli military waited a few hours after Friday’s close… and by most accounts U.S. forces had no direct involvement. According to Israel’s Army Radio outlet, the U.S. jets were on standby to rescue Israeli pilots if need be.

The mainstream spin is that the attack succeeded in its objectives. “The Israeli strikes on Iran hit several of Tehran’s most advanced air defenses,” says this morning’s Wall Street Journal, “exposing Iran’s vulnerability to future attacks.”

Gee, if it was such a smashing success, why are Israeli media reporting that Prime Minister Benjamin Netanyahu is about to give Defense Minister Yoav Gallant the heave-ho?

It’s all “fog of war” for the time being, but informed skeptics speculate that Israeli pilots encountered something unexpected on their way toward Iranian airspace and turned back. Whatever damage occurred was inflicted by missiles and drones.

“This attack was extremely underwhelming,” says the Armchair Warlord account on X — “particularly given that the Israeli military has announced that (1) this was in fact the big retaliatory stroke; and (2) they’ve finished the operation.”

In any event, Iran’s nuclear-power and oil-industry infrastructure remains intact this morning. With that, a barrel of West Texas intermediate trades for $67.68 — the lowest in four weeks.

![]() It’s Mag 7 Week

It’s Mag 7 Week

As Tesla goes, so goes the rest of the Magnificent 7?

As Tesla goes, so goes the rest of the Magnificent 7?

Five of the seven Big Tech-adjacent companies report their numbers this week…

- Alphabet (GOOG) after the close tomorrow

- Meta (META) and Microsoft (MSFT) after the close Wednesday

- Apple (AAPL) and Amazon (AMZN) after the close Thursday.

The broad stock market as measured by the S&P 500 has been moving sideways the last couple of weeks.

Given that the Mag 7 makes up 30% of the index’s market cap… this week will prove decisive for the market’s direction beyond October.

As we mentioned last week, Tesla was the first of the Mag 7 companies to report — and its upside surprise was so huge that TSLA posted a one-day gain of 22%, the biggest in over a decade.

“Did TSLA just give us a preview of the big beats we’re about to witness?” wonders Paradigm chart hound Greg Guenthner.

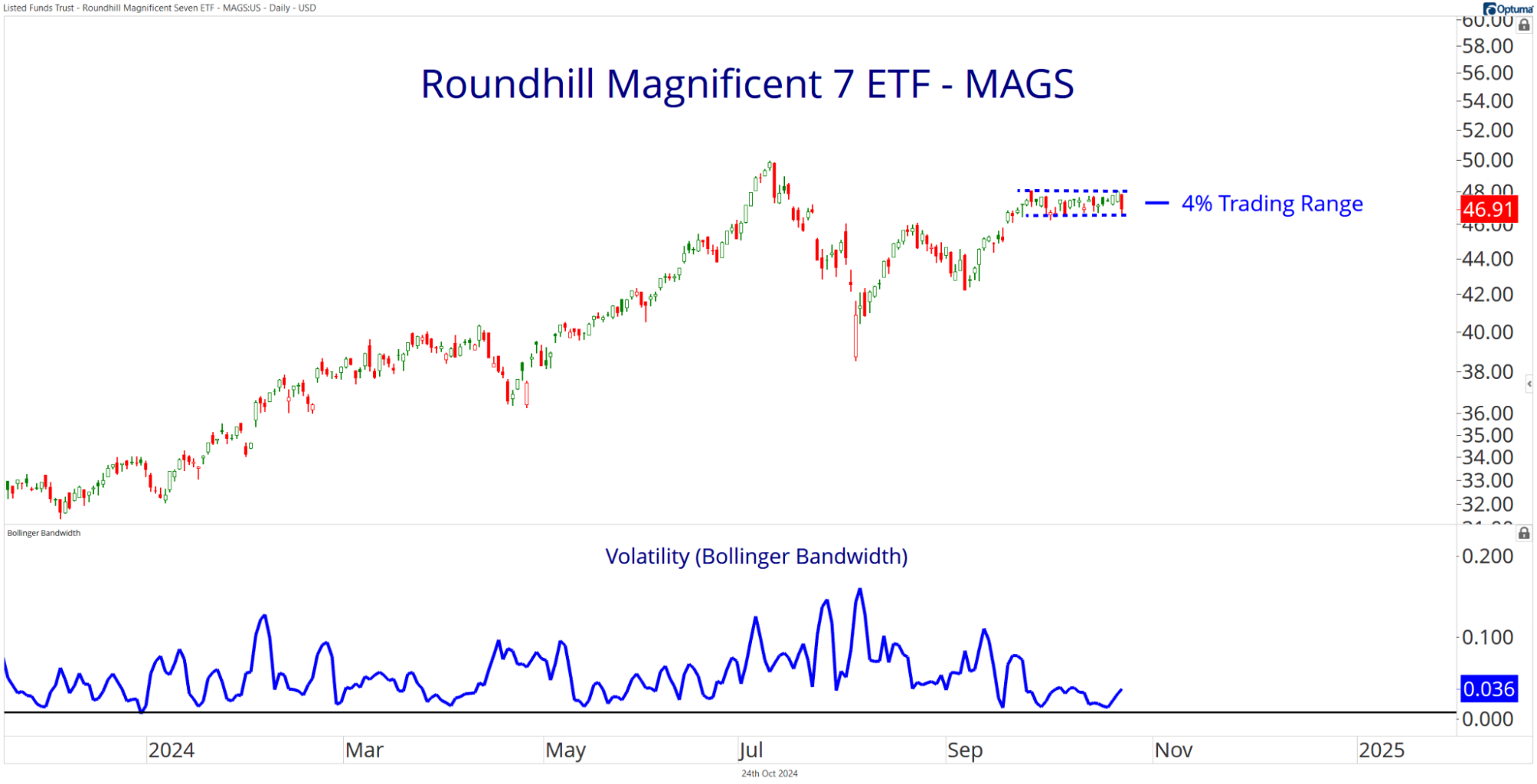

He’s keeping a close eye on a chart of the Roundhill Magnificent 7 ETF (MAGS) — which, as you might deduce, consists of nothing but the Mag 7 names.

On the heels of Tesla’s report, “many of these other mega-caps are looking coiled and ready for action,” says Greg. “We’ll see if they deliver.”

(In case you’re wondering, the last and most buzzy of the Mag 7 names — Nvidia — doesn’t report its numbers till the second half of November.)

After a string of earnings reports like these… Friday’s release of the October job numbers could prove anticlimactic.

Also this week we get the Commerce Department’s first read on third-quarter GDP Wednesday and the Federal Reserve’s preferred inflation measure on Thursday.

In the meantime, the major U.S. stock indexes are starting the new week in the green.

In the meantime, the major U.S. stock indexes are starting the new week in the green.

The S&P 500 is registering the weakest gain — up about a half percent to 5,835 at last check. The Nasdaq’s gain is stronger and the Dow’s the strongest.

Gold is inching down to $2,741; silver is creeping higher at $33.81. Bitcoin is knocking on the door of $69,000 after a failed breakout above that level a week ago today.

![]() The “Data Disconnect” Is Baaaack

The “Data Disconnect” Is Baaaack

Oh no, not this again: “A widespread, self-reported sense of financial strain suggests Americans think their financial lives are more precarious than economic data appears to indicate,” reports the Axios news site.

Oh no, not this again: “A widespread, self-reported sense of financial strain suggests Americans think their financial lives are more precarious than economic data appears to indicate,” reports the Axios news site.

According to a survey by Bank of America, nearly half of U.S. households report living paycheck to paycheck. But a separate analysis of customer behavior by Bank of America Institute finds that “the share who are genuinely spending nearly all the income they take in on essentials is lower than survey data suggests,” says Axios.

The discrepancy appears to hinge on how people define “essentials.” We’ll spare you the details. If you’re really interested, have at it.

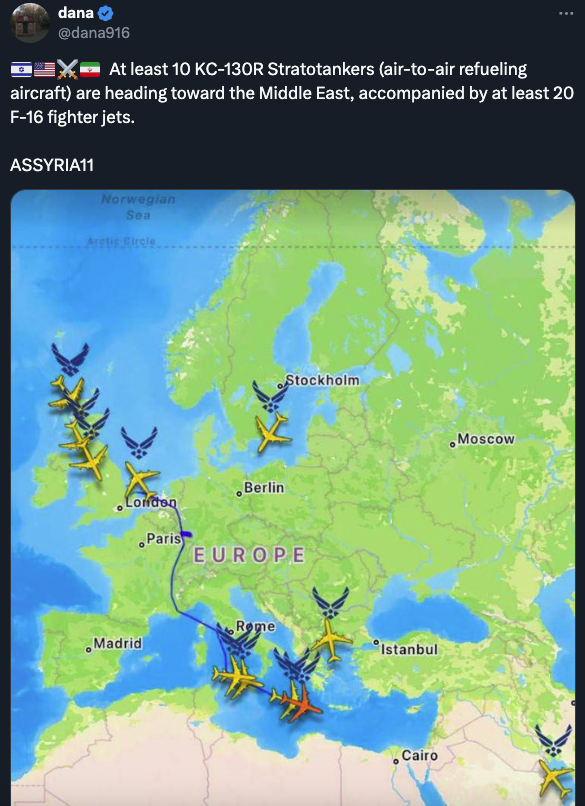

Anyway, it’s the latest entry in a long list of articles that implicitly chide everyday Americans for feeling economically strapped even though many statistical measures of the economy are superficially healthy.

The first we noticed was way back in March 2022, and a tweet from MSNBC: “President Biden’s approval rating has fallen to lowest level of his presidency despite booming economy.”

It’s become so tired and predictable by now, it’s the stuff of memes…

![]() “Intellectually Lazy and a Coward”

“Intellectually Lazy and a Coward”

To the mailbag, where the withering criticism by Trump supporters targeting third-party voters (or write-in voters or nonvoters) was too much for one of our semi-regulars…

To the mailbag, where the withering criticism by Trump supporters targeting third-party voters (or write-in voters or nonvoters) was too much for one of our semi-regulars…

“Sadly I write this to you. I have just learned that I am apparently intellectually lazy and a coward because I refuse to vote for either of the candidates that the two major parties have blessed us with.

“I think I began suffering these maladies living through the four years of our previous president. You know, the guy who would lash out at numerous people HE brought into his administration and then drove out and totally belittled. The guy who told us how tariffs wouldn't cost us minions anything. You know, the narcissist guy. (Wonder when he will turn on RFK and Tulsi?)

“I believe that the other cause of my malady may be caused by this most recent replacement candidate. I don't remember her participating in the primaries. You know the one that tells us how bad that other guy is and tells us that we need the government to protect us from the evil corporations that are price gouging. She's that assistant in the current administration that just finished adding $1.8 trillion to the country's $35-plus trillion debt.

“On a somewhat positive note, I have heard of a possible cure… a candidate that would stop our meddling in other countries’ affairs. A candidate that would actually cut spending and balance the budget. It sounds promising — however, I am not too hopeful.

“I am feeling a little weak right now, so I better get some rest the next two–three weeks. Appreciate your help and understanding. Thanks Dave.”

Dave responds: Who is this non-meddling, budget-balancing candidate of which you speak?

Which reminds me: Back in 2008, after the GOP establishment sandbagged Ron Paul’s candidacy (the first time)... Paul accomplished the extraordinary feat of getting four minor-party presidential candidates to agree on four platform planks including an end to the Iraq War, cutting the national debt and auditing the Federal Reserve.

He got everyone from Ralph Nader to one-time Moral Majority bigwig Chuck Baldwin to agree to these things.

It was an extraordinary moment. Alas, it took place less than a week before the collapse of Lehman Bros., followed by a series of bailouts that blew up the national debt by (what was then) an unprecedented degree.

We give the last word today to the meme-o-sphere — where Mr. Older Coffee-Cup Stock Photo Guy is weighing in…