Gold’s Next Catalyst: Happening Now

![]() Follow the Yellow BRICS Road

Follow the Yellow BRICS Road

Even if the BRICS nations don’t announce a new currency with partial gold backing this week… they’ll light a fire under the gold price nonetheless.

Even if the BRICS nations don’t announce a new currency with partial gold backing this week… they’ll light a fire under the gold price nonetheless.

Not bad considering gold hit $2,700 for the first time last week and is still holding the line on that level this morning.

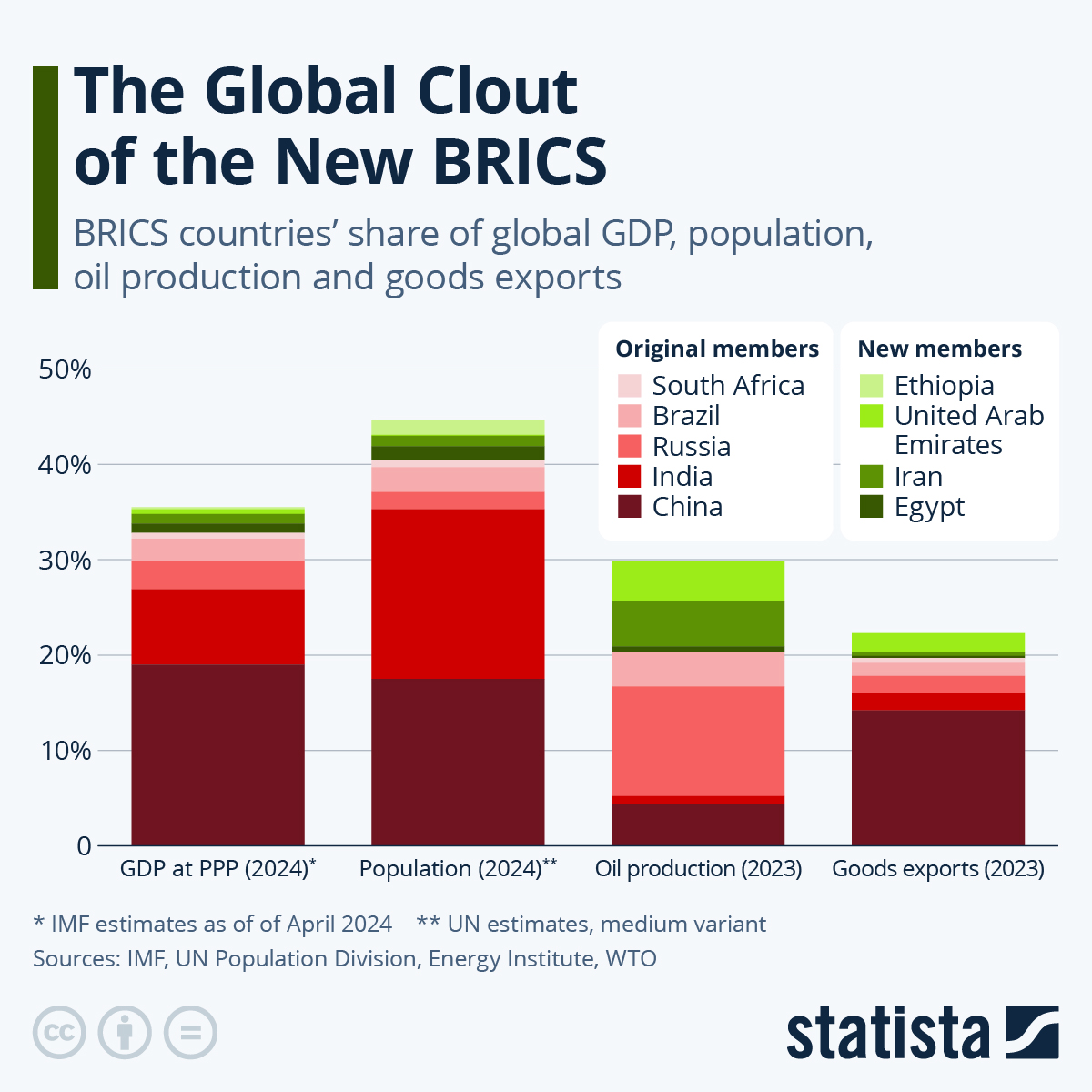

Leaders of the BRICS countries are gathered this week in Kazan, Russia. As a reminder, the core membership of Brazil, Russia, India, China and South Africa expanded this year to include four more countries headlined by Iran.

Together, they make up a powerful economic bloc — as the folks from Statista illustrate in this infographic…

The rumors in the run-up to this week were that the BRICS would announce some sort of payment currency for use in member countries, likely with a 40% gold backing.

And that might yet happen at the conclusion of the meeting tomorrow — but don’t count on it.

That said, the more likely announcement is still enormously gold-positive.

Before we go any further, let’s explore an interesting thing about the psychology of gold prices.

Before we go any further, let’s explore an interesting thing about the psychology of gold prices.

Paradigm macro maven Jim Rickards likes to emphasize this point to his readers often: “Investors tend to focus on the dollar price of gold and to analyze the price in round numbers.

“That makes sense. If gold goes up $100 per ounce and you own 500 ounces, that’s a $50,000 profit. Another $100 per ounce gain means another $50,000 profit. That’s real money for you.

“What investors may not realize at first is that each $100 gain (and $50,000 profit) is easier than the one before. That’s because each gain is measured in constant $100 increments, but the measurement begins from a higher base. A constant dollar gain is a smaller percentage of an expanding base so it’s easier to achieve in percentage terms.

“For example, if the price goes from $2,500 to $2,600 per ounce, that’s a 4.0% gain. But if the price goes from $2,900 to $3,000 per ounce (same $100 gain), that’s a 3.5% gain. Obviously, a 3.5% gain is easier to pick up than a 4.0% gain, but it’s the same $100 gain and $50,000 profit in your pocket.”

Meanwhile, let’s not overlook the relentless gold accumulation by central banks around the world.

Meanwhile, let’s not overlook the relentless gold accumulation by central banks around the world.

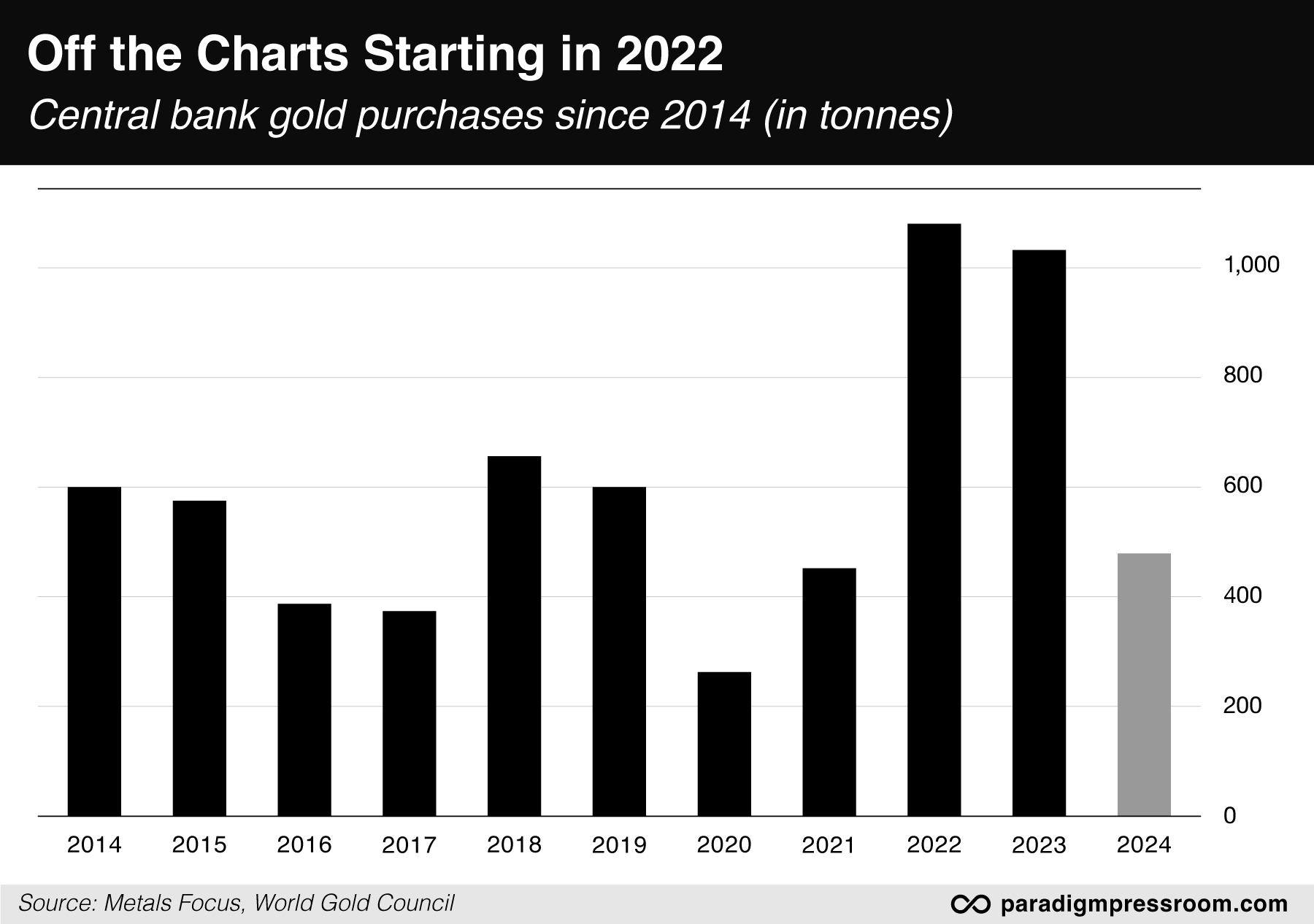

We’ve hammered away at this theme in recent months: Central banks have been net buyers of gold since 2009 — but the buying went off the charts in 2022.

When Russia invaded Ukraine, Washington reacted by applying unprecedented sanctions — freezing the dollar-based assets of the Russian central bank. Other governments immediately realized: If it can happen to Russia, it can happen to us.

We ran this chart only last week, but it’s worth another look…

Here’s the point today: “Central bank net buying is equivalent to about 20% of annual gold mining output,” says Jim.

“That does not indicate a gold shortage, but it does put a firm floor under the dollar price of gold. That creates what we call an asymmetric trade. On the upside, the sky’s the limit, but on the downside, the central banks have your back to some extent because they will definitely buy the dips to increase their gold hoards. That’s the best type of trade to be in.

“So the stage is set. The simple math of easier percentage gains for constant dollar gains is the dynamic that can set off a buying frenzy and lead to super-spikes in the dollar price of gold. Central bank buying causes a relentless increase in the dollar price of gold and offers limited downside because they will buy the dips.

“All that is needed to set off the super-spike is an unexpected development that is not already priced in.”

Which brings us back to the BRICS. Read on…

![]() Unexpected Developments From Russia

Unexpected Developments From Russia

Here’s the most likely announcement to emerge at the end of the BRICS meeting in Russia tomorrow.

Here’s the most likely announcement to emerge at the end of the BRICS meeting in Russia tomorrow.

As Jim Rickards wrote his Situation Report readers yesterday: “The BRICS will announce a new blockchain-based digital ledger to record trade payments using existing currencies of the BRICS members.

“The significance of this system (tentatively named ‘BRICS Clear’) is that there are no dollars involved and the secure payment channels are relatively safe from U.S. and EU sanctions.

“Russia will sell oil to China for rubles, Brazil will sell aircraft to China for reais and India will sell technology to China for rupees and so on. (Alternatively, any BRICS member can elect to take the currency of any other BRICS member, all to be recorded on BRICS Clear).”

Just a couple of hitches, though: Not all transactions would be settled immediately. What if the exchange rates between one currency and another fluctuate in the interim?

Even more important: What happens when, say, a company in Brazil sells its wares to India, taking rupees in return — but the company has little it wants to buy from India? That’s a lot of useless rupees that would accumulate in a hurry.

Gold solves both of those problems.

Gold solves both of those problems.

“If you don’t want to take exchange rate risk,” says Jim, “you can take your counterparty currency balances and buy gold. And if you have too much of a certain currency standing on your accounts, you can reduce the balance by buying gold.”

To some extent, countries trading with China are already doing this. That’s why the People’s Bank of China has been loading up on gold.

“The implications of this have not yet sunk into market pricing,” Jim goes on.

“It’s tantamount to an informal gold standard without fixed exchange rates. It relies on market forces (mostly denominated in U.S. dollars for now) and does not rely on huge hoards of freely convertible gold in central banks. Still, it works. It positions gold as an anchor in a new international monetary system without the strictures of the classical gold standard.

“The picture is now complete. Gold is on an upward path driven by central bank buying. Gold is poised to go much higher because the BRICS will use physical gold as their anchor instead of U.S. dollars. And investor psychology will cause a super-spike once the big dollar gains become a daily occurrence.

“It’s a powder keg and the BRICS have just struck a match. The smartest move for everyday investors is to buy gold now before the fun really begins.”

![]() Housing Market Still Seized Up

Housing Market Still Seized Up

The big economic number of the day affirms that the housing market is still frozen in amber.

The big economic number of the day affirms that the housing market is still frozen in amber.

The National Association of Realtors says existing home sales fell 1% from August to September. The year-over-year change works out to minus 3.5%.

At the current pace, existing home sales are on track for their worst year since 1995 — when, of course, the population of the United States was much smaller.

It doesn’t help that the median price of an existing home is $404,500 — up 3% over the last year. But the killer is mortgage rates.

As noted here yesterday, the Federal Reserve’s cuts to short-term interest rates are not feeding through to longer-term rates. In fact, longer-term rates like mortgages are rising, for reasons colleague Sean Ring explores in-depth in today’s edition of our sister e-letter The Rude Awakening.

Whether it’s rising rates or some other factor, the major U.S. stock indexes are stuck in the red today — the S&P 500 down two-thirds of a percent to 5,813. The yield on a 10-year Treasury note is up to 4.23%, another three-month high.

Whether it’s rising rates or some other factor, the major U.S. stock indexes are stuck in the red today — the S&P 500 down two-thirds of a percent to 5,813. The yield on a 10-year Treasury note is up to 4.23%, another three-month high.

As noted above, gold is holding the line on $2,700 an ounce — but it’s down nearly $30 on the day. No surprise, silver’s getting slammed worse — down more than a buck to $33.74.

With the release of the Energy Department’s weekly inventory numbers, crude has erased a big chunk of yesterday’s big gain — down almost a buck to $70.81.

Bitcoin is poised for a year-end rally, as we mentioned on Monday but at the moment it’s in danger of cracking below $66,000.

![]() AI’s Broken Promises

AI’s Broken Promises

Yeah, so about AI being this big productivity enhancer…

Yeah, so about AI being this big productivity enhancer…

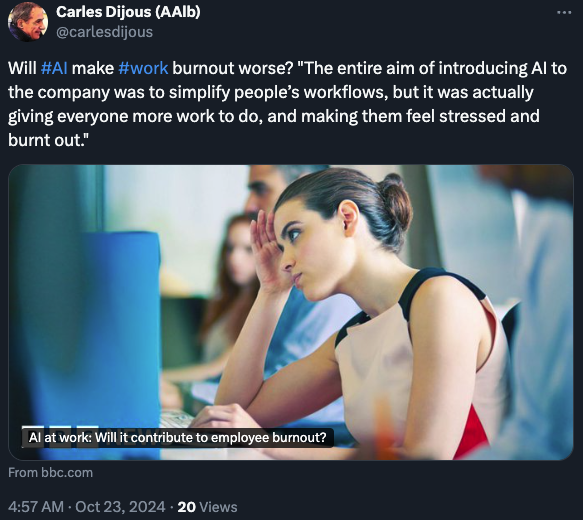

There’ve been a couple of eye-opening surveys of white-collar workers recently. The freelancer platform Upwork surveyed 2,500 “knowledge workers” in the United States, Canada, Australia and the United Kingdom. In addition, the resume-writing company Resume Now surveyed 1,150 Americans.

The highlights…

- 77% say AI tools have decreased their productivity and added to their workload

- 47% of employees using AI say they have no idea how to pull off the productivity gains their employers expect

- 61% believe the use of AI at work will put them at greater risk of burnout. (Among the under-25 set, that rises to 87%)

- 43% believe AI will have a negative effect on work-life balance.

A BBC article profiles Anurag Garg, the head of a public-relations agency operating in both the United States and India.

When ChatGPT became a phenomenon in late 2022, he encouraged his team of 11 to go all in — “coming up with story ideas for clients, pitches to offer the media and transcribing meeting and interview notes.

“But rather than increase the team’s productivity, it created stress and tension,” the BBC continues.

“But rather than increase the team’s productivity, it created stress and tension,” the BBC continues.

“Staff reported that tasks were in fact taking longer as they had to create a brief and prompts for ChatGPT, while also having to double-check its output for inaccuracies” — and there were a lot of those.

“The team complained that their tasks were taking twice the amount of time because we were now expecting them to use AI tools,” Garg tells the Beeb.

And keeping up with new AI tools? That makes the task nearly insurmountable.

In the end, “Garg backtracked on the mandate that the team should use AI in all their work,” says the BBC, “and now they use it primarily for research purposes - and everyone is much happier.”

That’s certainly been your editor’s own experience with AI. Research and writing takes up all my available time. I can’t put that on hold so I can figure out how to trick an AI into doing what I want it to do.

As I’ve chronicled recently, I do use the Perplexity AI search engine — but that’s mostly because Google has become so useless over the last five years.

To be sure, AI has enormous potential to make life better and easier, as our own James Altucher emphasizes all the time — just not the way it was touted when ChatGPT burst onto the scene two years ago.

![]() Mailbag: Third Parties

Mailbag: Third Parties

Time to return to the topic of voting third-party (or just not voting, or leaving the presidential portion of one’s ballot blank) — a topic that seems to have raised the ire of people who intend to vote for Donald Trump…

Time to return to the topic of voting third-party (or just not voting, or leaving the presidential portion of one’s ballot blank) — a topic that seems to have raised the ire of people who intend to vote for Donald Trump…

“Not voting for either candidate because you don’t like both of them is lunacy,” writes one. “First, voting is a great American right that some countries do not have. Second, if you don’t like either candidate, then you must look at it as voting for the lesser of two evils because you are going to get one of them. And voting for the candidate that you think benefits this country the most should be your choice.

“Think of it like this: Do you want more of the same over the last four years or do you want the much better economy we had previously? Most people can’t afford to pay for the general necessities at the moment and it will continue under the current administration.

“Do you believe what occurred under the previous administration or do you believe the person that believes that the current administration’s policies are working for you? The previous administration uses a majority of President Reagan’s policies. The other will use the current administration’s policies, but has been caught lying about it. Which one do you think will help Americans more? Or do you not care about your fellow Americans?”

Says another: “We are not electing a pope. The free world is on the line — I expect a more realistic take on current as well as financial issues from sources I want to trust. Can you honestly describe an upside to a harris walz (intentional) regime?”

“Dave, it really bugs me when people say that they won't vote for either candidate because they don't like either of them,” adds a third.

“Dave, it really bugs me when people say that they won't vote for either candidate because they don't like either of them,” adds a third.

“They are intellectually lazy and cowards and are looking for an excuse to be so. As an American, we have a duty to make our voices heard on Election Day. Those that don't exercise that duty or don’t become informed before doing that duty do a disservice to themselves, to their families and to the country that enabled them to have the means to subscribe to a financial newsletter and likely follow some of the advice.

“It is quite clear that neither candidate is ideal and are probably far from ideal, but that doesn't matter. In a case such as this, one must vote for the lesser of two evils, the person that is less bad for this country than the other. This is a matter of civic duty. If one cannot determine, in this case, who that is, the person is intellectually lazy and/or a coward that has zero ability of discernment or logic. Full stop.

“This election literally is the election that will matter whether we become Europe, a cesspool of economic mediocrity, where your typical reader is much less likely to have achieved his current financial wherewithal, or worse. I know some ‘independents’ like to say that ‘people have always said this election is the make-or-break.’ But it is true in this case.

“Look at how much damage Biden has done to our freedoms, our freedom of speech, our freedom to be armed, making our own medical decisions, on and on — to owning a gas stove for gosh's sake. Anyone that thinks this isn't the most important election of our lifetimes is delusional and asleep at the wheel.”

Dave responds: I’ve let these comments simmer since last week. Much to unpack here, and it can’t be done in a single day.

For today, we’ll leave aside the lesser-of-two-evils question and focus on something that both Trump detractors and Trump fans ignore — the fact that the guy has a track record in office on which he can be evaluated.

And the record is — pretty much what you would have gotten from a more conventional Republican. A ginormous tax cut with no spending cuts to offset it… a mixed bag of Supreme Court justices… COVID lockdowns and a jab that failed to deliver on its major promises (and for which he still takes credit!).

How would any of this have been different if the GOP donor class got their wish in 2016 and Jeb Bush became president?

Oh, but he stood up to the deep state, comes the response.

Really? Our favorite political reporter Michael Tracey offers the following laundry list of all the ways he “fought” the deep state…

The lesser-of-two-evils argument notwithstanding, giddy expectations for a second Trump term hark back to Samuel Johnson’s description of second marriages, popularized by Oscar Wilde — “the triumph of hope over experience.”